Concept explainers

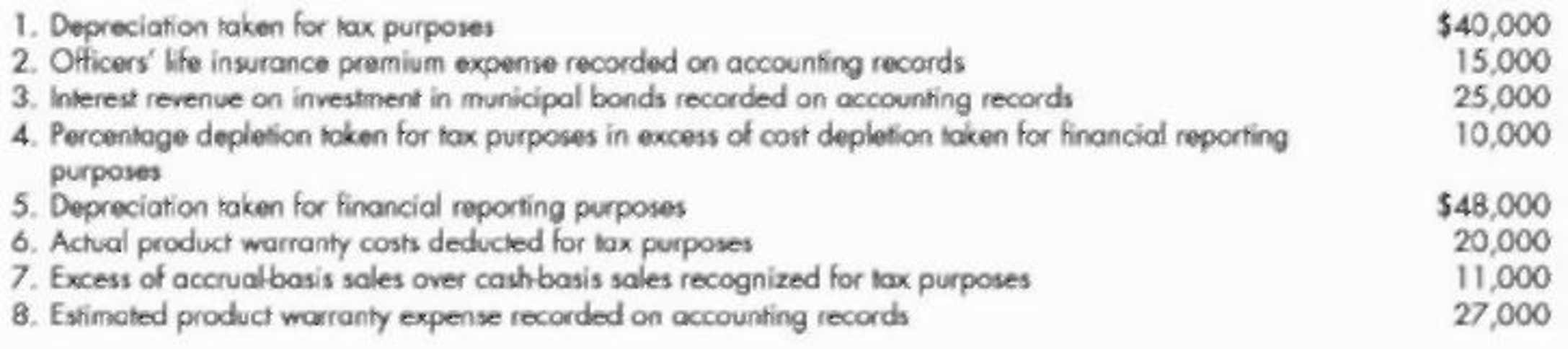

Interperiod Tax Allocation Peterson Company has computed its pretax financial income to be $66,000 in 2019 after including the effects of the appropriate items from the following information:

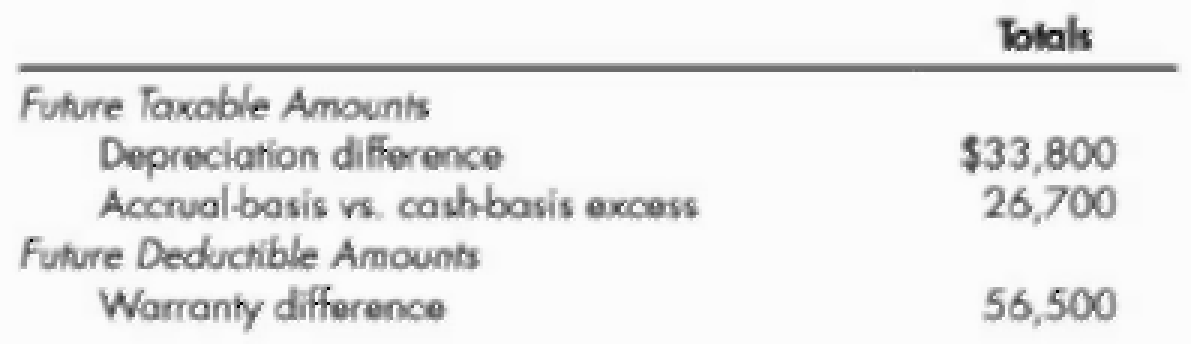

Peterson’s accountant has prepared the following schedule showing the future taxable and deductible amounts at the end of 2019 for its three temporary differences:

At the beginning of 2019, Peterson had a

Required:

- 1. Compute Peterson’s taxable income for 2019.

- 2. Prepare Peterson’s income tax

journal entry for 2019 (assume no valuation allowance is necessary). - 3. Next Level Identify the permanent differences in Items 1 through & and explain why you did or did not account for them as deferred tax items in Requirement 2.

1.

Determine the taxable income of Company P for 2019.

Explanation of Solution

Temporary Difference: Temporary difference refers to the difference of one income recognized by the tax rules and accounting rules of a company in different periods. Consequently the difference between the amount of assets and liabilities reported in the financial reports and the amount of assets and liabilities as per the company’s tax records is known as temporary difference.

Determine the taxable income of Company P for 2019:

| Computation of taxable income | |

| Particulars | Amount |

| Pre-tax financial income | $66,000 |

| Add: Excess of depreciation in financial reporting over tax income (1) | $8,000 |

| Excess of warranty expense in financial reporting over tax income (2) | $7,000 |

| Non-deductible officer's insurance premium for tax purpose | $15,000 |

| $96,000 | |

| Less: Non-taxable interest of Municipal bonds | ($25,000) |

| Excess of depletion percentage over cost depletion | ($10,000) |

| Excess of gross profit recognized for financial reporting over tax purpose (3) | ($11,000) |

| Taxable Income | $50,000 |

Table (1)

Thus, the taxable income of Company P is $50,000.

Working Note 1: Determine the Excess of depreciation in financial reporting over tax income:

Working Note 2: Determine the Excess of depreciation in financial reporting over tax income:

Working Note 3: Determine the Excess gross profit recognized for financial reporting over tax purpose:

2.

Record the income tax entry for Company P.

Explanation of Solution

Income Tax Expenses: The expenses which are related to the taxable income of the individuals and business entities for an accounting period, and are recognized by them for the purpose of federal government and state government tax are called as income tax expenses.

Record the income tax entry for Company P.

| Date | Accounts title and explanation | Post Ref. | Debit ($) | Credit ($) |

| 2019 | ||||

| December 31 | Income Tax Expense (Balancing figure) | 13,800 | ||

| Deferred Tax Asset- Warranty expense (4) | 2,100 | |||

| Deferred Tax Liability- Depreciation expense (5) | 2,400 | |||

| Income Tax Payable (6) | 15,000 | |||

| Deferred Tax Liability-Accrual basis sales (7) | 3,300 | |||

| (To record income tax expense with deferred tax asset and deferred tax liability) |

Table (2)

- Income Tax Expense is a component of stockholders’ equity and decreases, so debit it for $13,800.

- Deferred Tax Asset is an asset and increased, so debit it for $2,100.

- Deferred Tax Liability is a liability and decreases, so debit it for $2,400.

- Income Tax Payable is a liability and increases, so credit it for $15,000.

- Deferred Tax Liability is a liability and increases, so credit it for $3,300.

Working note 4: Determine the deferred tax asset – warranty expense:

Working note 5: Determine the deferred tax liability – depreciation expense:

Thus, there is a decrease of ($2,400) in deferred tax liability.

Working note 6: Compute the income tax payable:

Working note 7: Determine the deferred tax liability – accrual sales basis:

3.

Determine the permanent differences in Items 1 through 8 and elaborate the reasons for accounting the deferred tax items in requirement 2.

Explanation of Solution

The permanent differences in items 1 through 8 are as follows:

- Officer’s life insurance premium expense.

- Non-taxable interest revenue form municipal bonds.

- Percentage of depletion in excess of cost exhaustion.

These items are considered as permanent difference and would never be reversed in future (since the pre-tax financial income and taxable income are always different) and hence are not considered as deferred tax items for which the journal entries are recorded as per requirement 2.

Want to see more full solutions like this?

Chapter 18 Solutions

Intermediate Accounting: Reporting And Analysis

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning