(a)

To calculate:

The return of arithmetic average on the two stocks named ABC and XYZ.

Introduction:

Arithmetic average return is simple return which is calculated by adding the return for sub periods and then it is divided by total number of periods.

Answer to Problem 5PS

| ABC | XYZ | |

| Arithmetic average return on stock |

Explanation of Solution

Given:

The rate of returns of the two stocks:

| Year | rABC | Rxyz |

| 1 | 20% | 30% |

| 2 | 12 | 12 |

| 3 | 14 | 18 |

| 4 | 3 | 0 |

| 5 | 1 | -10 |

The formula for calculating arithmetic average return is:

The arithmetic return for stock ABC is:

The arithmetic return for stock XYZ is:

(b)

To determine:

The stock which has higer dispersion on the basis of the returns.

Introduction:

In grammatical terms, Dispersion means the size of the variety of value predictable for a particular stock.

Explanation of Solution

Dispersion is analyzing the about the variations of returns from a specific strategy or investment portfolio. It can be said that it is to measure the degree of uncertainty and risk associated with the security.

Both the stock gives equal average

Thus, stock XYZ is the stock with high dispersion as per the returns.

(c)

To calculate:

The return of geometric average of both the stocks.

Introduction:

Geometric return is explicitly used to calculate the average rate of return per period on an investment that can be compounded over multiple periods.

Answer to Problem 5PS

| ABC | XYZ | |

| Geometric average return on stock |

From the above analysis, it can be concluded that stock ABC has a higher geometric average return.

Explanation of Solution

Given:

The rate of returns of the two stocks:

| Year | rABC | Rxyz |

| 1 | 20% | 30% |

| 2 | 12 | 12 |

| 3 | 14 | 18 |

| 4 | 3 | 0 |

| 5 | 1 | -10 |

The formula for calculating geometric average return is:

The geometric return for stock ABC is:

The geometric return for stock XYZ is:

(d)

To calculate:

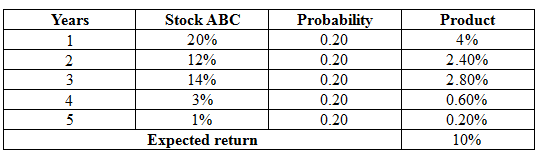

The expected return of stock ABC when the returns of this stock is likely to be earned equally in each year.

Introduction:

Expected return is expected value in terms of probability distribution of expected returns which can be providing to investors.

Answer to Problem 5PS

The expected return of stock ABC is

Explanation of Solution

Given:

The rate of returns of the two stocks:

| Year | rABC | Rxyz |

| 1 | 20% | 30% |

| 2 | 12 | 12 |

| 3 | 14 | 18 |

| 4 | 3 | 0 |

| 5 | 1 | -10 |

The probability is to be divided equally in each year i.e.

For computing the expected return, sum of product of probabilities and their respective returns is to be done.

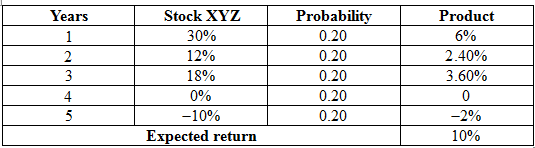

(e)

To calculate:

The expected return of stock XYZ when the returns of this stock is likely to be earned equally in each year.

Introduction:

Expected return is expected value in terms of probability distribution of expected returns which can be providing to investors.

Answer to Problem 5PS

The expected return of stock XYZ is

Explanation of Solution

Given:

The rate of returns of the two stocks:

| Year | rABC | Rxyz |

| 1 | 20% | 30% |

| 2 | 12 | 12 |

| 3 | 14 | 18 |

| 4 | 3 | 0 |

| 5 | 1 | -10 |

The probability is to be divided equally in each year i.e.

For computing the expected return, sum of product of probabilities and their respective returns is to be done.

(f)

To determine:

The best average return among arithmetic and geometric for predicting future performance of the two stocks .

Introduction:

Arithmetic average return is simple return which is calculated by adding the return for sub periods and then it is divided by total number of periods.

Geometric return is explicitly used to calculate the average rate of return per period on an investment that can be compounded over multiple periods.

Explanation of Solution

Given:

The rate of returns of the two stocks:

| Year | rABC | Rxyz |

| 1 | 20% | 30% |

| 2 | 12 | 12 |

| 3 | 14 | 18 |

| 4 | 3 | 0 |

| 5 | 1 | -10 |

As on the basis of computation of arithmetic and geometric average return of the stocks, it has been seen that the arithmetic average return of the both the stocks is equal i.e.

Thus, the arithmetic average return is more appropriate for the prediction of future performance.

Want to see more full solutions like this?

Chapter 18 Solutions

CONNECT WITH LEARNSMART FOR BODIE: ESSE

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education