Concept explainers

To calculate:

The dollar-weighted average return on monthly basis for a household saving account.

Introduction:

Dollar- weighted average return means rate of

Answer to Problem 1PS

Cash flows either positive or negative or vice versa is divided by the total of of investment,through this dollar weighted average return for a particular period can be calcualted.

Explanation of Solution

Given Information:

The saving-account of a household and entries are on the first day of each month:

| Month | Additions | Withdrawls | Value |

| January | |||

| February | |

||

| March | |

||

| April | |

||

| May | |

||

| June | |

||

| July | |

||

| August | |

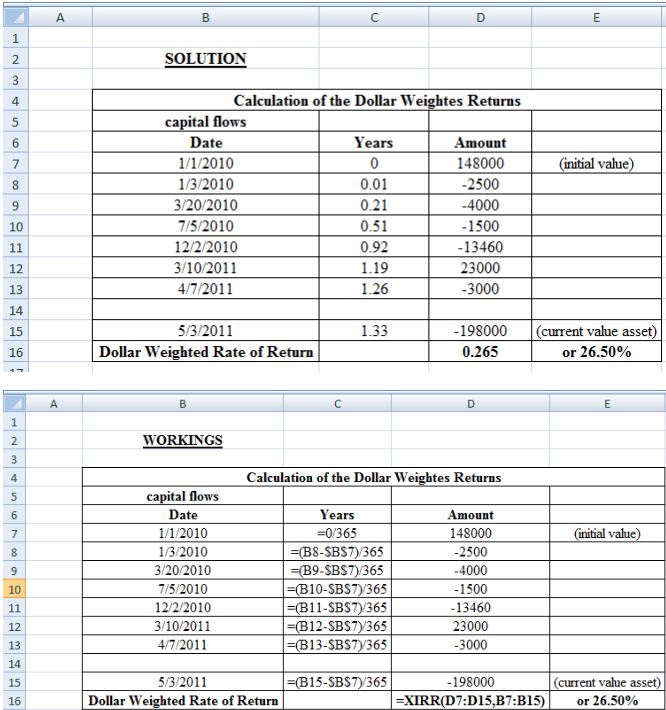

Household monthly Dollar Weighted Average Return can be calculated easily with the help of MS Office − Excel with the help of formulas. The calculations are shown under the snip of excel as attached below for reference:

The value of portfolio is calculated on monthly basis post taking the effects of with drawls and additions. The period of addition and with drawl in months is then converted into days to compute the weighted period and then the weighted average return is calculated.

Want to see more full solutions like this?

Chapter 18 Solutions

CONNECT WITH LEARNSMART FOR BODIE: ESSE

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education