Concept explainers

Standard-costing method, spoilage. Refer to the information in Exercise 18-29. Suppose LogicCo determines standard costs of $215 per equivalent unit for direct materials and $92 per equivalent unit for conversion costs for both beginning work in process and work done in the current period.

- 1. Do Exercise 18-29 using the standard-costing method.

Required

- 2. What issues should the manager focus on when reviewing the equivalent units calculation?

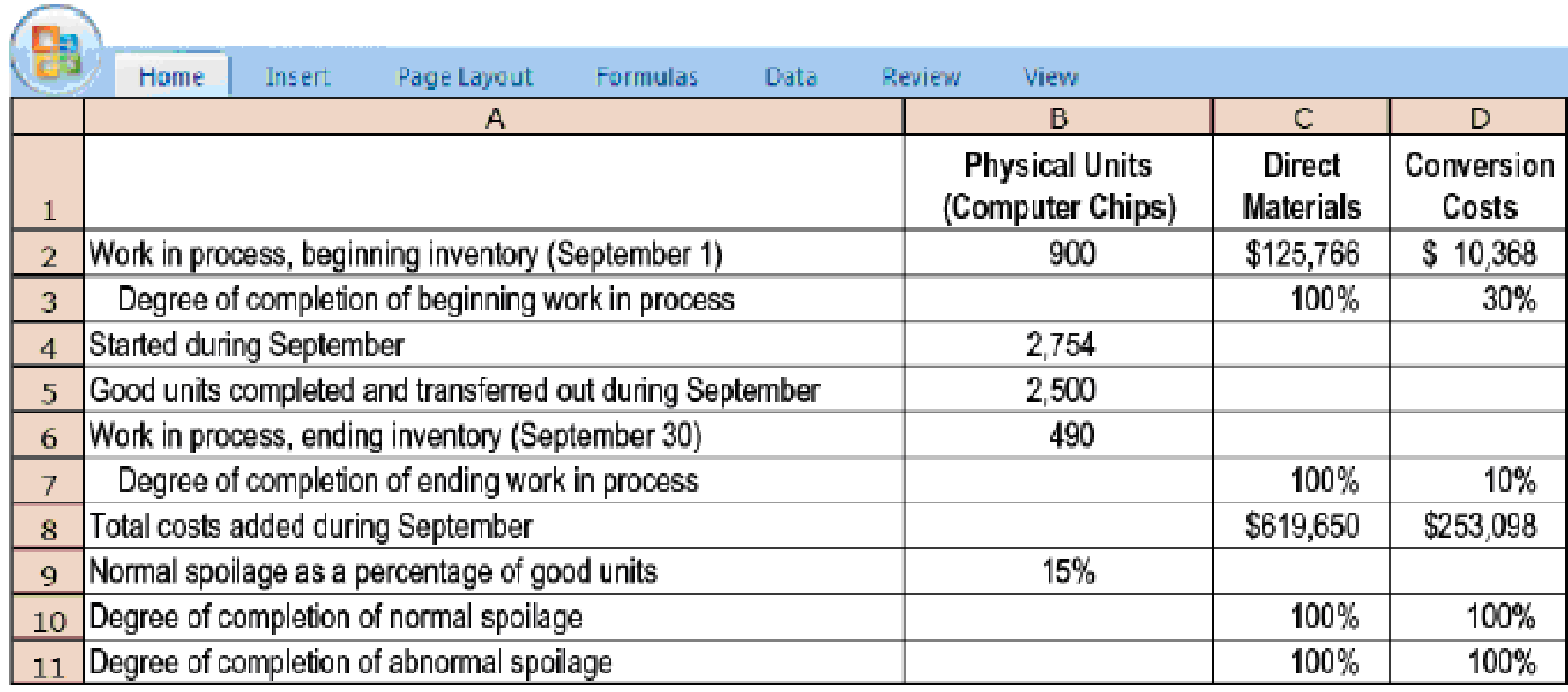

18-29 Weighted-average method, spoilage. LogicCo is a fast-growing manufacturer of computer chips. Direct materials are added at the start of the production process. Conversion costs are added evenly during the process. Some units of this product are spoiled as a result of defects not detectable before inspection of finished goods. Spoiled units are disposed of at zero net disposal value. LogicCo uses the weighted-average method of

Summary data for September 2017 are as follows:

Want to see the full answer?

Check out a sample textbook solution

Chapter 18 Solutions

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

- Shubelik Company is changing to an activity-based costing method. It has determined that it will use three cost pools: setups, inspections, and assembly. Which of the following would not be used as the activity base for any of these three activities? a.number of setups b.number of units to be produced c.number of inspections d.number of direct labor hoursarrow_forwardC) Standard Costing as a Management Tool. The C.E.O. then states that production reports have shown major differences between the actual costs and what was budgeted to be incurred. You suggest to him that a standard technique be used to identify and analyse the differences. The following information about the cost to produce one item is obtained Direct Materials - 6 pounds at $ 2.50 per pound Direct Labour -3.1 hours @ 12.00 per Hour Direct Materials Purchased for the month - 1,600 pounds $ 4,192 Direct Labour- 760 Hours 250 Units were produced. $ 15.00 $37.20 $ 8,740 You are asked to compute: 1) The total Material and Labour Variances. 2) The Material Price and Quantity Variance 3) The Labour Price and Quantity Variance.arrow_forwardShubelik Company is changing to an activity-based costing method. They have determined that they will use three cost pools: setups, inspections, and assembly. Which of the following would not be used as the activity base for any of these three activities? a.number of inspections b.number of setups c.number of direct labor hours d.number of units to be producedarrow_forward

- Which of the following is NOT true about a resource cost driver under Activity based costing? O a. Sales orders are used to assign the cost of machines O b. Resource cost driver is used to assign the cost of the resource to an activity OC. Number of purchased orders placed will determine the cost of purchasing the materials O d. Number of times machines are set up will determine their cost of setting uparrow_forwardThe following data have been extracted from the records of Puzzle Incorporated: Production level, in units Variable costs Fixed costs Mixed costs Total costs Required A Required B Required: a. Calculate the missing costs. b. Calculate the cost formula for mixed cost using the high-low method. c. Calculate the total cost that would be incurred for the production of 12,880 units. d. Identify the two key cost behavior assumptions made in the calculation of your answer to part c. Required C Production level, in units Variable costs Fixed costs Mixed costs Total costs Complete this question by entering your answers in the tabs below. Calculate the missing costs. Note: Do not round intermediate calculations. February 9,200 $ 19,320 ? 16,312 $ 71,532 February 9,200 $ 19,320 $ 2 X 16,312 $ 71,532 Required D August August 20, 240 $? 35,900 ? $ 106,970 Answer is not complete. 20,240 34,255 35,900 52,475 $ 106,970arrow_forwardTrue or False 1. Under weighted average method, the equivalent units used to compute the unit costs of ending inventories relate only to work done during the current period. 2. Process costing is used to account for products that needs further processing. 3. Using the weighted average, if materials are added at the start of the process, the EUP for materials is equal to the units completed and transferred.arrow_forward

- Time left Activity-based costing: O a. provides the same results as the departmental overhead costing O b. typically applies overhead costs using direct labor-hours O c. None of the given answer. O d. does not assign any non-manufacturing overhead costs to product costs. O e. uses a pool rate for all costs incurred by the same activity which can reduce the number of cost assignments required. CLEAR MY CHOICE In Al-Waha Water Bottling Company, costs incurred for research and developments would be classified as a: O a. none of the given answers. O b. Unit level activity. of O c. Batch level activity. O d. Organization- sustaining level activity. O e. Product- sustaining level activity. CLEAR MY CHOICE NEXT PAGE MacBook Air FB F7 吕口 F3 F5 F1 F2 * % $ 4 @ 7 8 A9 6 一 W E R Y *** ق DSF G K S ش X, C V BiN M %#3arrow_forwardNeed some help making a cheet sheet for an up coming test. please provide examples. The exam covers chapters 1 through 13. Here are some suggested study topics: Cost Classifications - variable, fixed and mixed, period and product, direct and indirect, opportunity, sunk, relevant, traceable, common, etc. Calculate the results of changes to cost assumptions (CVP) Calculate net income based on contribution margin values either dollars or % Application of Manufacturing Overhead - calculate predetermined overhead rate or activity rates applied to a product or job - job order using a predetermined overhead rate or rates and activity-based costing calculate over and underapplied overhead calculate adjusted cost of goods sold Job Costing What is the total cost of the job and average cost per unit. Cost of Goods Manufactured and cost of goods sold Calculate break even and target profit Create a contribution format income statement Gross margin calculations absorption or variable costing…arrow_forwardThe manager of the manufacturing unit of a company is responsibie for the costs of the manufacturing unit. The president is in the process of deciding whether to evaluate the manager af the manutacturing unit by the average cast per unit or the vartable cost per unit Quality and umely delivery would be used in coruncton with the cost meesure lo rewerd the maneger. Required: a What problems are associated with using the average cost per unit as a pertormance measure? b. What problems are associated with using the variable cost per unit as a performance measure?arrow_forward

- Required: Compute for the total cost transferred to the next department using average costing. * Compute for the unit cost transferred to the next department using FIFO. * Compute for the total cost accounted for using FIFO.arrow_forwardExercise 9-34 and 9-35 (Algo) [The following information applies to the questions displayed below.] Benton Corporation manufactures computer microphones, which come in two models: Standard and Premium. Data for a representative quarter for the two models follow: Units produced Production runs per quarter Direct materials cost per unit Direct labor cost per unit Supervision Setup labor Incoming inspection Total overhead Standard 10,800 $ 222,750 251,775 186,300 $ 660,825 50 $ 30 50 Manufacturing overhead in the plant has three main functions: supervision, setup labor, and incoming materfal inspection. Data on manufacturing overhead for a representative quarter follow: Premium 2,700 25 $ 64 75arrow_forwardFIFO method (continuation of 17-36).1. Do Problem 17-36 using the FIFO method of process costing. Explain any difference between the cost per equivalent unit in the assembly department under the weighted-average method and the FIFO method.2. Should Larsen’s managers choose the weighted-average method or the FIFO method? Explain briefly.arrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning