Fundamentals of Cost Accounting

5th Edition

ISBN: 9781259565403

Author: William N. Lanen Professor, Shannon Anderson Associate Professor, Michael W Maher

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 17, Problem 33E

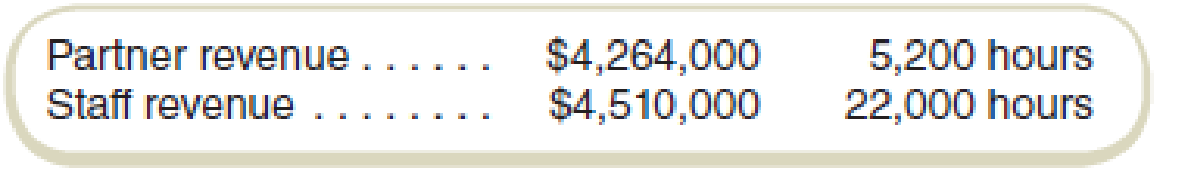

Sales Price and Activity Variances

EZ-Tax is a tax accounting practice with partners and staff members. Each billable hour of partner time has a $800 budgeted price and $375 budgeted variable cost. Each billable hour of staff time has a budgeted price of $210 and a budgeted variable cost of $120. For the most recent year, the

Required

Compute the sales price and activity variances for these data. Also compute the mix and quantity variances.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Please need answer the following requirements on these general accounting question

The following costs were incurred in June: Direct

Materials $25,000 Direct Labor $20,000 Manufacturing

(Factory) Overhead $25,000 Selling and Administrative

Expenses $40,000.

A. What is the amount of the prime costs?

B. What is the amount of the period costs?

C. What is the amount of the conversion costs?

D. What is the amount of the product costs?

General accounting problems

Chapter 17 Solutions

Fundamentals of Cost Accounting

Ch. 17 - What complication arises in variance analysis when...Ch. 17 - Variance analysis can be useful in a manufacturing...Ch. 17 - How would you recommend accounting for variances...Ch. 17 - What does a manager learn by computing an industry...Ch. 17 - Why is there no efficiency variance for revenues?Ch. 17 - For what decisions would a manager want to know...Ch. 17 - If the sales activity or materials efficiency...Ch. 17 - Prob. 8RQCh. 17 - Prob. 9RQCh. 17 - What is the advantage of recognizing materials...

Ch. 17 - How could a professional sports firm use the mix...Ch. 17 - Prob. 12CADQCh. 17 - How could a hospital firm use the mix variance to...Ch. 17 - Prob. 14CADQCh. 17 - There is no reason to investigate favorable...Ch. 17 - Prob. 16CADQCh. 17 - Consider a firm in the sharing economy, such as...Ch. 17 - Prob. 18ECh. 17 - Variable Cost Variances: Materials Purchased and...Ch. 17 - Industry Volume and Market Share Variances DB Ice...Ch. 17 - Industry Volume and Market Share Variances:...Ch. 17 - Industry Volume and Market Share: Missing Data The...Ch. 17 - Sales Mix and Quantity Variances A-Zone Media...Ch. 17 - Prob. 24ECh. 17 - Sales Mix and Quantity Variances The restaurant at...Ch. 17 - Sales Mix and Quantity Variances Chow-4-Hounds...Ch. 17 - Materials Mix and Yield Variances Stacy, Inc.,...Ch. 17 - Materials Mix and Yield Variances Johns...Ch. 17 - Labor Mix and Yield Variances Matts Eat N Run has...Ch. 17 - Flexible Budgeting, Service Organization KB is a...Ch. 17 - Sales Activity Variance, Service Organization...Ch. 17 - Profit Variance Analysis, Service Organization...Ch. 17 - Sales Price and Activity Variances EZ-Tax is a tax...Ch. 17 - Variable Cost Variances The standard direct labor...Ch. 17 - Investigating Variances Refer to the information...Ch. 17 - Variable Cost Variances: Materials Purchased and...Ch. 17 - Sales Mix and Quantity Variances Lake Cellars...Ch. 17 - Analyze Performance for a Restaurant Dougs Diner...Ch. 17 - Nonmanufacturing Cost Variances FSBCU is a...Ch. 17 - Performance Evaluation in Service Industries Bay...Ch. 17 - Investigating Variances Refer to the information...Ch. 17 - Prob. 42PCh. 17 - Sales Mix and Quantity Variances Refer to the data...Ch. 17 - Materials Mix and Yield Variances Plano Products...Ch. 17 - Labor Mix and Yield Variances Matthews Bros, is a...Ch. 17 - Prob. 46PCh. 17 - Derive Amounts for Profit Variance Analysis...Ch. 17 - Flexible Budget Oak Hill Township operates a motor...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A review of accounting records for last year disclosed the following selected information: Variable costs: Direct materials used 48,000 Direct labor 1,65,000 Manufacturing overhead 95,000 Selling costs 86,000 Fixed costs: Manufacturing overhead 2,50,000 Selling costs 1,00,000 Administrative costs ☐ 2,23,000 In addition, the company suffered a $15,200 uninsured factory fire loss during the year. What were the product costs and period costs for last year?arrow_forwardAccounting queryarrow_forwardMize Company provided $45,500 of services on account and collected $38,000 from customers during the year. The company also incurred $37,000 of expenses on account and paid $32,400 against its payables. As a result of these events: A. total assets would increase B. total liabilities would increase C. total equity would increase D. All of these answer choices are correct.arrow_forward

- On January 1, 2024, Wright Transport sold four school buses to the Elmira School District. In exchange for the buses, Wright received a note requiring payment of $532,000 by Elmira on December 31, 2026. The effective interest rate is 8%. Note: Use appropriate factor(s) from the tables provided. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Required: How much sales revenue would Wright recognize on January 1, 2024, for this transaction? Prepare journal entries to record the sale of merchandise on January 1, 2024 (omit any entry that might be required for the cost of the goods sold), the December 31, 2024, interest accrual, the December 31, 2025, interest accrual, and receipt of payment of the note on December 31, 2026.arrow_forwardJohnson Company calculates its allowance for uncollectible accounts as 10% of its ending balance in gross accounts receivable. The allowance for uncollectible accounts had a credit balance of $28,000 at the beginning of 2024. No previously written-off accounts receivable were reinstated during 2024. At 12/31/2024, gross accounts receivable totaled $466,700, and prior to recording the adjusting entry to recognize bad debts expense for 2024, the allowance for uncollectible accounts had a debit balance of 51,300. Required: Assume Johnson made no other adjustment of the allowance for uncollectible accounts during 2024. Determine the amount of accounts receivable written off during 2024. If Johnson instead used the direct write-off method, what would bad debt expense be for 2024?arrow_forwardJohnson Company calculates its allowance for uncollectible accounts as 10% of its ending balance in gross accounts receivable. The allowance for uncollectible accounts had a credit balance of $28,000 at the beginning of 2024. No previously written-off accounts receivable were reinstated during 2024. At 12/31/2024, gross accounts receivable totaled $466,700, and prior to recording the adjusting entry to recognize bad debts expense for 2024, the allowance for uncollectible accounts had a debit balance of 51,300. Required: What was the balance in gross accounts receivable as of 12/31/2023? What journal entry should Johnson record to recognize bad debt expense for 2024? Assume Johnson made no other adjustment of the allowance for uncollectible accounts during 2024. Determine the amount of accounts receivable written off during 2024. If Johnson instead used the direct write-off method, what would bad debt expense be for 2024?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

What is Risk Management? | Risk Management process; Author: Educationleaves;https://www.youtube.com/watch?v=IP-E75FGFkU;License: Standard youtube license