Fundamentals of Cost Accounting

5th Edition

ISBN: 9781259565403

Author: William N. Lanen Professor, Shannon Anderson Associate Professor, Michael W Maher

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 17, Problem 30E

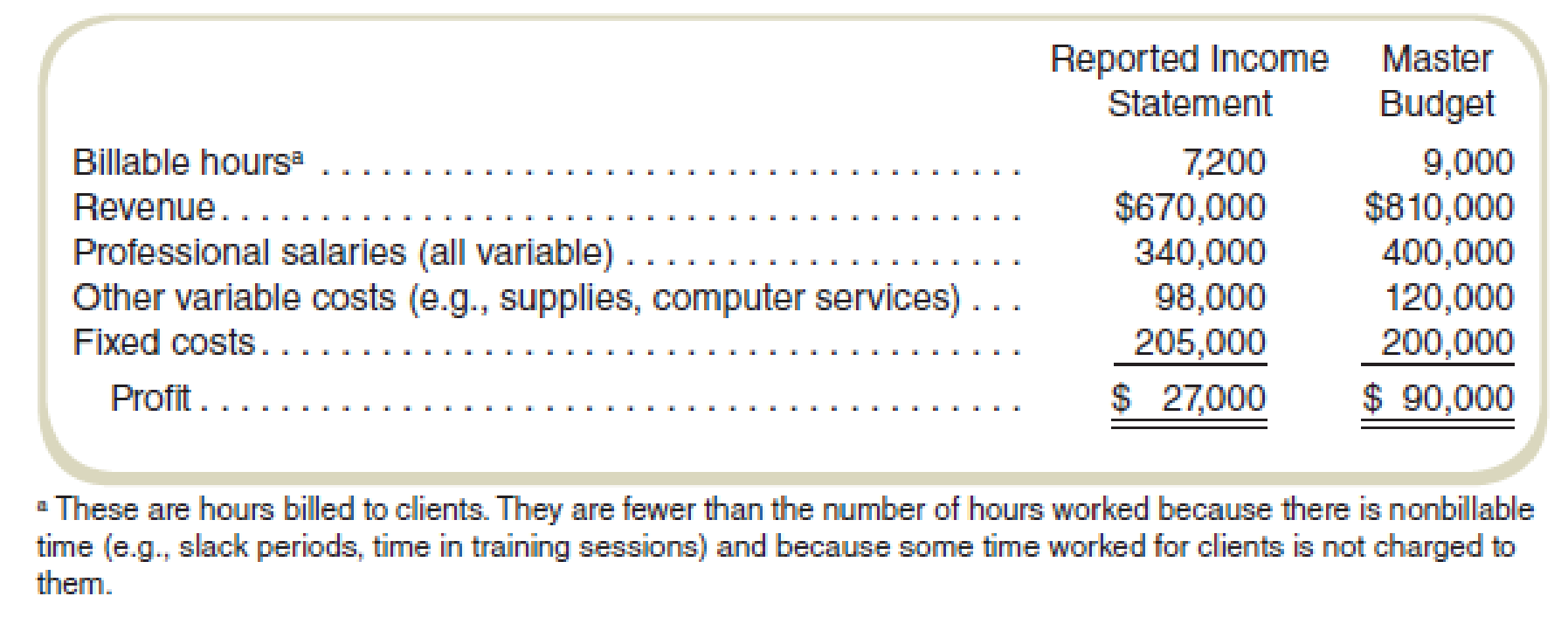

Flexible Budgeting, Service Organization

K&B is a small management consulting firm. Last month, the firm billed fewer hours than expected, and, as expected, profits were lower than anticipated.

Required

Prepare a flexible budget for K&B. Use billable hours as the measure of output (that is, units produced).

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

I want to correct answer general accounting

Can you help me with accounting questions

Acorn Construction (calendar-year-end C corporation) has had rapid expansion during the last half of the current year due to the housing market's recovery. The company has record income and would like to maximize its cost recovery deduction for the current year. (Use MACRS Table 1, Table 2, Table 3, Table 4, and Table 5.)

Note: Round your answer to the nearest whole dollar amount.

Acorn provided you with the following information:

Asset

Placed in Service

Basis

New equipment and tools

August 20

$ 3,800,000

Used light-duty trucks

October 17

2,000,000

Used machinery

November 6

1,525,000

Total

$ 7,325,000

The used assets had been contributed to the business by its owner in a tax-deferred transaction two years ago.

a. What is Acorn's maximum cost recovery deduction in the current year?

Chapter 17 Solutions

Fundamentals of Cost Accounting

Ch. 17 - What complication arises in variance analysis when...Ch. 17 - Variance analysis can be useful in a manufacturing...Ch. 17 - How would you recommend accounting for variances...Ch. 17 - What does a manager learn by computing an industry...Ch. 17 - Why is there no efficiency variance for revenues?Ch. 17 - For what decisions would a manager want to know...Ch. 17 - If the sales activity or materials efficiency...Ch. 17 - Prob. 8RQCh. 17 - Prob. 9RQCh. 17 - What is the advantage of recognizing materials...

Ch. 17 - How could a professional sports firm use the mix...Ch. 17 - Prob. 12CADQCh. 17 - How could a hospital firm use the mix variance to...Ch. 17 - Prob. 14CADQCh. 17 - There is no reason to investigate favorable...Ch. 17 - Prob. 16CADQCh. 17 - Consider a firm in the sharing economy, such as...Ch. 17 - Prob. 18ECh. 17 - Variable Cost Variances: Materials Purchased and...Ch. 17 - Industry Volume and Market Share Variances DB Ice...Ch. 17 - Industry Volume and Market Share Variances:...Ch. 17 - Industry Volume and Market Share: Missing Data The...Ch. 17 - Sales Mix and Quantity Variances A-Zone Media...Ch. 17 - Prob. 24ECh. 17 - Sales Mix and Quantity Variances The restaurant at...Ch. 17 - Sales Mix and Quantity Variances Chow-4-Hounds...Ch. 17 - Materials Mix and Yield Variances Stacy, Inc.,...Ch. 17 - Materials Mix and Yield Variances Johns...Ch. 17 - Labor Mix and Yield Variances Matts Eat N Run has...Ch. 17 - Flexible Budgeting, Service Organization KB is a...Ch. 17 - Sales Activity Variance, Service Organization...Ch. 17 - Profit Variance Analysis, Service Organization...Ch. 17 - Sales Price and Activity Variances EZ-Tax is a tax...Ch. 17 - Variable Cost Variances The standard direct labor...Ch. 17 - Investigating Variances Refer to the information...Ch. 17 - Variable Cost Variances: Materials Purchased and...Ch. 17 - Sales Mix and Quantity Variances Lake Cellars...Ch. 17 - Analyze Performance for a Restaurant Dougs Diner...Ch. 17 - Nonmanufacturing Cost Variances FSBCU is a...Ch. 17 - Performance Evaluation in Service Industries Bay...Ch. 17 - Investigating Variances Refer to the information...Ch. 17 - Prob. 42PCh. 17 - Sales Mix and Quantity Variances Refer to the data...Ch. 17 - Materials Mix and Yield Variances Plano Products...Ch. 17 - Labor Mix and Yield Variances Matthews Bros, is a...Ch. 17 - Prob. 46PCh. 17 - Derive Amounts for Profit Variance Analysis...Ch. 17 - Flexible Budget Oak Hill Township operates a motor...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Don't use ai given answer accounting questionsarrow_forwardMultiple Choice 2-32 Educational Incentives (LO 2.14) Wendy is a single taxpayer and pays tuition of $7,800 in 2021. Her 2021 AGI is $66,000. What is the amount of Wendy's tuition deduction? X a. $2,000 O b. $0 O c. $3,733.33 O d. $4,000 O e. $7,800arrow_forwardMultiple Choice 2-32 Educational Incentives (LO 2.14) Wendy is a single taxpayer and pays tuition of $7,800 in 2021. Her 2021 AGI is $66,000. What is the amount of Wendy's tuition deduction? X a. $2,000 O b. $0 O c. $3,733.33 O d. $4,000 O e. $7,800arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Responsibility Accounting| Responsibility Centers and Segments| US CMA Part 1| US CMA course; Master Budget and Responsibility Accounting-Intro to Managerial Accounting- Su. 2013-Prof. Gershberg; Author: Mera Skill; Rutgers Accounting Web;https://www.youtube.com/watch?v=SYQ4u1BP24g;License: Standard YouTube License, CC-BY