Principles Of Taxation For Business And Investment Planning 2020 Edition

23rd Edition

ISBN: 9781259969546

Author: Sally Jones, Shelley C. Rhoades-Catanach, Sandra R Callaghan

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 17, Problem 29AP

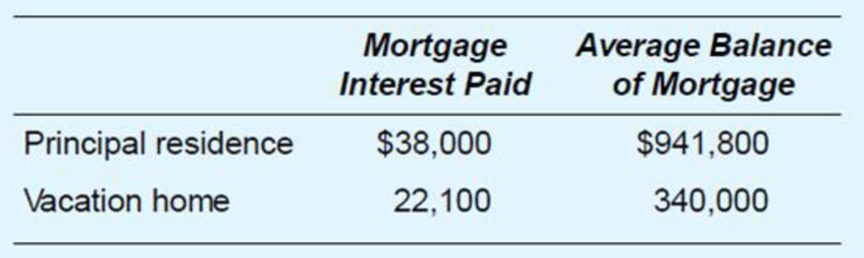

Mr. and Mrs. Kim, married filing jointly, own a principal residence and a vacation home. Each residence is subject to a mortgage that qualifies as acquisition debt, and both mortgages were incurred before December 15, 2017. This year, the mortgage holders provided the following information.

Compute Mr. and Mrs. Kim’s qualified residence interest.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Mr. and Mrs. Kim, married filing jointly, own a principal residence and a vacation home. Each residence is subject to a mortgage that

qualifies as acquisition debt, and both mortgages were incurred before December 15, 2017. This year, the mortgage holders provided

the following information:

Principal residence

Vacation home

Mortgage

Interest Paid

$ 44,500

26,000

Average

Balance of

Mortgage

$ 967,800

359,500

Required:

Assume the taxable year is 2022. Compute Mr. and Mrs. Kim's qualified residence interest.

Note: Do not round intermediate calculations. Round your final answer to the nearest dollar amount.

Tyrone and Akira, who are married, incurred and paid the following amounts of interest during 2021

Home acquisition debt interest

Credit card interest

Home equity loan interest (used for home improvement)

Investment interest expense

Mortgage insurance premiums (PMI)

Required:

$ 11,250

3,500

5,525

9,000

1,000

With 2021 net investment income of $1,125, calculate the amount of their allowable deduction for investment interest expense and their

total deduction for allowable interest. Home acquisition principal and the home equity loan principal combined are less than $750,000.

Deduction for investment interest expense

Total deduction for allowable interest

Amounts

Mr. Tolen made the following interest payments. Assume the taxable year is 2022.

Required:

Determine the extent to which he can deduct each payment on his Form 1040.

a. $4,600 on credit card debt.

b. $14,100 on a $210,000 mortgage secured by his vacation home in Key West. Mr. Tolen incurred the mortgage to purchase this

second home.

c. $1,300 on a $22,000 unsecured loan from a credit union. Mr. Tolen used the loan proceeds to add a boat dock to his Key West

home.

d. $3,700 on a $100,000 unsecured loan from his mother-in-law. Mr. Tolen used the loan proceeds as working capital for his business

as an independent insurance agent.

e. $2,400 on a $50,000 loan from a bank. Mr. Tolen used the loan proceeds to purchase an interest in Farlee Limited Partnership,

which is his only investment asset. This year, Mr. Tolen was allocated a $790 ordinary loss from the partnership.

f. $800 in a $35,000 loan from a car dealership that financed the purchase of Mr. Tolen's new family automobile.

Note: For…

Chapter 17 Solutions

Principles Of Taxation For Business And Investment Planning 2020 Edition

Ch. 17 - Prob. 1QPDCh. 17 - Discuss the tax policy reasons why gifts and...Ch. 17 - In what way does the tax law give preferential...Ch. 17 - Prob. 4QPDCh. 17 - A basic principle of federal tax law is that a...Ch. 17 - Prob. 6QPDCh. 17 - If an individual purchases property insurance on...Ch. 17 - Prob. 8QPDCh. 17 - Last year, both the Burton family and the Awad...Ch. 17 - Prob. 10QPD

Ch. 17 - Prob. 11QPDCh. 17 - Prob. 12QPDCh. 17 - Prob. 1APCh. 17 - Prob. 2APCh. 17 - Buddy Bushey is a student at a local community...Ch. 17 - Four years ago, Lyle Mercer was injured in a...Ch. 17 - Ann Moore receives a 1,000 monthly payment from...Ch. 17 - Will and Sandra Emmet were divorced this year. As...Ch. 17 - Prob. 7APCh. 17 - Mr. and Mrs. Nester had the following items of...Ch. 17 - Prob. 9APCh. 17 - Milt Payner purchased an automobile several years...Ch. 17 - Conrad South, a business executive, is an avid...Ch. 17 - Prob. 12APCh. 17 - Mr. and Mrs. Compton paid 9,280 of medical...Ch. 17 - Mr. and Mrs. Moss have major medical and dental...Ch. 17 - Mr. Curtis paid the following taxes. To what...Ch. 17 - Mrs. Stuart paid the following taxes. To what...Ch. 17 - Prob. 17APCh. 17 - Mary Vale contributed a bronze statuette to a...Ch. 17 - Prob. 19APCh. 17 - Prob. 20APCh. 17 - Mr. and Mrs. Remy have the following allowable...Ch. 17 - Prob. 22APCh. 17 - Prob. 23APCh. 17 - Prob. 24APCh. 17 - Mr. and Mrs. Marcum live in Southern California in...Ch. 17 - Prob. 26APCh. 17 - Sandy Assam enjoys betting on horse and dog races....Ch. 17 - Prob. 28APCh. 17 - Mr. and Mrs. Kim, married filing jointly, own a...Ch. 17 - Ms. Imo, who is single, purchased her first home...Ch. 17 - Prob. 31APCh. 17 - Prob. 32APCh. 17 - Prob. 33APCh. 17 - Prob. 1IRPCh. 17 - Prob. 2IRPCh. 17 - Prob. 3IRPCh. 17 - Prob. 4IRPCh. 17 - Prob. 5IRPCh. 17 - Prob. 6IRPCh. 17 - Prob. 7IRPCh. 17 - Mrs. Newton, who is a self-employed author, paid...Ch. 17 - Prob. 9IRPCh. 17 - Prob. 10IRPCh. 17 - Prob. 11IRPCh. 17 - Prob. 12IRPCh. 17 - Prob. 13IRPCh. 17 - Prob. 14IRPCh. 17 - Prob. 15IRPCh. 17 - Prob. 16IRPCh. 17 - Prob. 1RPCh. 17 - Prob. 2RPCh. 17 - Prob. 3RPCh. 17 - Prob. 4RPCh. 17 - Prob. 5RPCh. 17 - Prob. 1TPCCh. 17 - Prob. 2TPCCh. 17 - Prob. 3TPCCh. 17 - Prob. 1CPCh. 17 - Mrs. Cora Yank (age 42) is divorced and has full...Ch. 17 - Tom and Allie Benson (ages 53 and 46) are...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Shanna, a calendar year and cash basis taxpayer, rents property to be used in her business from Janice. As part of the rental agreement, Shanna pays 8,400 rent on April 1, 2019, for the 12 months ending March 31, 2020. a. How much is Shannas deduction for rent expense in 2019? b. Assume the same facts, except that the 8,400 is for 24 months rent ending March 31, 2021. How much is Shannas deduction for rent expense in 2019?arrow_forwardMs. Zhang, a single taxpayer, purchased her principal residence in 2015 and financed the purchase with a mortgage secured by the residence. In 2021, the average balance of the mortgage was $1,500,000, and Ms. Zhang paid $30,000 of mortgage interest. Compute Ms. Zhang's potential itemized deduction for her home mortgage interest in 2021. Group of answer choices: $0 $15,000 $20,000 $30,000arrow_forwardTed and Alice were divorced in January 2018. The provisions of the divorce decree and Alices's obligations follow: 1. Transfer the title in their resort condo to Ted. At the time of the transfer, the condo had a basis to Alice of $95,000, a fair market value of $115,000; it was subject to a mortgage of $85,000. 2. Alice is to make the mortgage paynents for 17 years regardless of how long Ted lives. Alice paid $12,000 in 2020. 3. Alice is to pay Ted $1,000 per month, beginning in 2018, for 10 years or until Ted dies. Of this amount, $500 is designated as child support. Alice made five payments of $900 each in 2021 (January - May). What is the amount of alimony from his settlement that is includible in Ted's gross income for 2021?arrow_forward

- Lewis and Laurie are married and jointly own a home valued at $262,000. They recently paid off the mortgage on their home. The couple borrowed money from the local credit union in January of 2022. How much interest may the couple deduct in each of the following alternative situations? (Assume they itemize deductions no matter the amount of interest.) Note: Leave no answer blank. Enter zero if applicable. Required: The couple borrows $62,000, and the loan is secured by their home. The credit union calls the loan a "home equity loan." Lewis and Laurie use the loan proceeds for purposes unrelated to the home. The couple pays $3,800 interest on the loan during the year, and the couple files a joint return. The couple borrows $154,000, and the loan is secured by their home. The credit union calls the loan a "home equity loan." Lewis and Laurie use the loan proceeds to add a room to their home. The couple pays $6,300 interest on the loan during the year, and the couple files a joint…arrow_forwardGeorge and Amal file a joint return in 2019 and have AGI of $39,800. They each make a $1,600 contribution to their respective IRAs. Assuming that they are not eligible for any other credits, what is the amount of their Saver’s Credit?arrow_forwardA taxpayer gets into rocky straits with their spouse and begins the process of filing for divorce, choosing to file separately for TY2021. Part of this process involved a discharge of the couple's mortgage debt. The total amount of debt discharged is $750,000. Assume both spouses are equal owners in the property. How much income is included on each of the taxpayers' returns? Select one: a. $750, 000 b. $375,000 c. $0 d. $750,000 for one taxpayer, $0 for the one who chooses not to take the income.arrow_forward

- Jillian and Greg are married and file a joint return. They expect to have $420,000 of taxable income in the next year and are considering whether to purchase a personal residence that would provide additional tax deductions of $126,000 for mortgage interest and real estate taxes. View the 2022 tax rate schedule for the Married Filing Joint filing status. Read the requirements. the divi: (Lintas as pervomayed in the tuitial plaut.) What is the marginal tax rate if the personal residence is not purchased? What is the marginal tax rate if the personal residence is purchased? Tax without purchase of personal residence Tax with purchase of personal residence Tax savings 32 % Requirement b. What is the tax savings if the residence is acquired? (Do not round intermediary calculations. Only round the amounts you input in the cells to the nearest cent.) 83,283.50 54,832 28,451.50 24 % eens 10...3 eensh 10...0 eensh 10...1 Parrow_forwardDan bought his Los Angeles property last December, and it’s nowAugust. The property is encumbered with the liens shown below. Indicate the order of priority in which the liens would be paid off in case of foreclosure. Do not simply use the date (there are other considerations) • Deed of trust for purchase loan (recorded December 19) • Deed of trust for equity loan (recorded May 31) • Property tax lien for current tax year (attached January 1) • Judgment lien (attached June 2) • Mechanic’s lien for work begun on May 22 (recorded June 15)arrow_forwardJeremiah and Jonnie Chaulk are married and have three dependent children, ages 3, 6, and 9. Assume the taxable year is 2023. Required: a. Compute their child credit if AGI on their joint return is $90,300. b. Compute their child credit if AGI on their joint return is $464,700. c. Compute their child credit if AGI on their joint return is $198,000, and assume that they also have one non-child dependent who meets the requirements for the child credit. Complete this question by entering your answers in the tabs below. Required A Required B Required C Compute their child credit if AGI on their joint return is $90,300. Child Creditarrow_forward

- Patricia purchased a home on January 1, 2017 for $1,270,000 by making a down payment of $100,000 and financing the remaining $1,170,000 with a 30-year loan, secured by the residence, at 6 percent. During year 2017 and 2018, Patricia made interest-only payments on the loan of $70,000. what amount of the $70,200 interest expense Patricia paid during 2018 may she deduct as an itemized deduction? (Assume not married filing separately.) Multiple Choice ____ $0. ____ $10,200. ____ $60,000. ____ $70,200.arrow_forwardJavier and Anita Sanchez purchased a home on January 1 of year 1 for $1,000,000 by paying $200,000 down and borrowing the remaining $800,000 with a 6 percent loan secured by the home. The Sanchezes made interest-only payments on the loan in years 1 and 2. (Leave no answer blank. Enter zero if applicable.) a. Assuming year 1 is 2017, how much interest would the Sanchezes deduct in year 2? Maximum deductible interest expensearrow_forwardThis year (2022), Teresa purchased a personal residence at a cost of $950,000. She borrowed $800,000 secured by the home to make the purchase. This year, she paid interest expense on this mortgage of $40,000. How much mortgage interest may she deduct as an itemized deduction?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT

How to Calculate your Income Tax? Step-by-Step Guide for Income Tax Calculation; Author: ETMONEY;https://www.youtube.com/watch?v=QdJKpSXCYmQ;License: Standard YouTube License, CC-BY

How to Calculate Federal Income Tax; Author: Edspira;https://www.youtube.com/watch?v=2LrvRqOEYk8;License: Standard Youtube License