FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

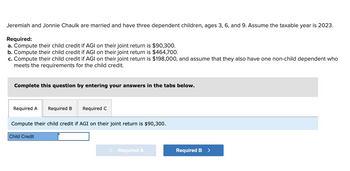

Transcribed Image Text:Jeremiah and Jonnie Chaulk are married and have three dependent children, ages 3, 6, and 9. Assume the taxable year is 2023.

Required:

a. Compute their child credit if AGI on their joint return is $90,300.

b. Compute their child credit if AGI on their joint return is $464,700.

c. Compute their child credit if AGI on their joint return is $198,000, and assume that they also have one non-child dependent who

meets the requirements for the child credit.

Complete this question by entering your answers in the tabs below.

Required A Required B

Required C

Compute their child credit if AGI on their joint return is $90,300.

Child Credit

< Required A

Required B >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Evaluate the Debt Safety Ratio using worksheet 6.1: By listing Chloe’s outstanding debts, and then calculate her debt safety Given her current take-home pay, what is the maximum amount of monthly debt payments that Chloe can have if she wants her debt safety ratio to be 12.5 percent? Given her current monthly debt payment load, what would Chloe’s take-home pay have to be if she wanted a 12.5 percent debt safety ratio? Chloe Young is evaluating her debt safety ratio. Her monthly take- home pay is $3,320. Each month, she pays $380 for an auto loan, $120 on a personal line of credit, $60 on a department store charge card, and $85 on her bank credit card.arrow_forward18 Banzai Plus Work BEYOND BANZAI PLUS VOCAB FILL IN THE BLANK Complete the paragraph using the terms below. Pay Stub Net Income Gross Income Taxes Premium Direct Deposit Direct Deposit Coraline just got her very first paycheck! Because she uses money was deposited into her account automatically. She logs in to her employer's paycheck portal to the and is shocked to see how much her is view her after deductions. Her work deducts her health insurance with and that combined means that over $100 was taken from her But she still has enough left for her expenses-phew!arrow_forwardAlpesharrow_forward

- Hello theree! Im stuck in this kindly helparrow_forward! Required information [The following information applies to the questions displayed below.] Julie paid a day care center to watch her two-year-old son while she worked as a computer programmer for a local start- up company. What amount of child and dependent care credit can Julie claim in 2023 in each of the following alternative scenarios? Use Exhibit 8-9. e. Julie paid $5,800 to the day care center, and her AGI is $14,000 ($3,800 salary and $10,200 unearned income). Child and dependent care creditarrow_forwardIf Inez is charged an interest of $357.76 on a loan of $18946 for 2 months, calculate the rate of interest charged on the loan. (Calculate to two decimals and enter without the percent sign, eg 1.23% = 1.23 or 12.34% = 12.34) Answer:arrow_forward

- ! Required information [The following information applies to the questions displayed below.] Julie paid a day care center to watch her two-year-old son while she worked as a computer programmer for a local start- up company. What amount of child and dependent care credit can Julie claim in 2023 in each of the following alternative scenarios? Use Exhibit 8-9. e. Julie paid $4,400 to the day care center, and her AGI is $14,000 ($2,400 salary and $11,600 unearned income). Child and dependent care creditarrow_forwardBased of the given image fill in the chart with the amount you would use or have.arrow_forward3. Which type of student loan will the government pay your interest while enrolled and even up to 6 months after graduation A. State B. Private C. Subsidized D. Unsubsidizedarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education