Concept explainers

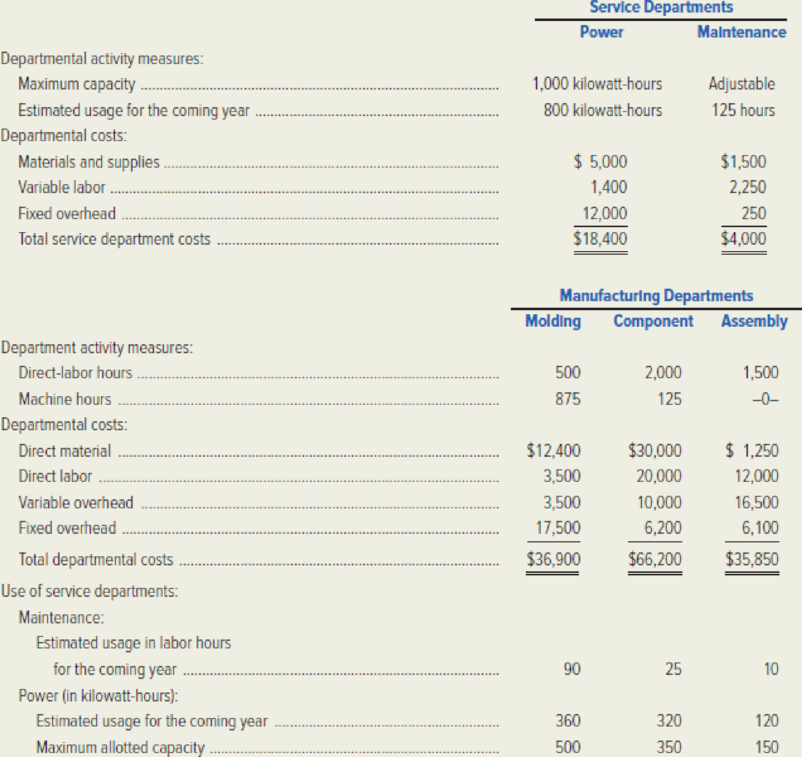

Travelcraft Company manufactures a complete line of fiberglass suitcases and attaché cases. The firm has three manufacturing departments: Molding, Component, and Assembly. There are also two service departments: Power and Maintenance.

The sides of the cases are manufactured in the Molding Department. The frames, hinges, and locks are manufactured in the Component Department. The cases are completed in the Assembly Department. Varying amounts of materials, time, and effort are required for each of the cases. The Power Department and Maintenance Department provide services to the three manufacturing departments.

Travelcraft has always used a plantwide

Karen Mason, director of cost management, has recommended that Travelcraft use departmental overhead rates. The planned operating costs and expected levels of activity for the coming year have been developed by Mason and are presented by department in the following schedules. (All numbers are in thousands.)

Required:

- 1. Calculate the plantwide overhead rate for Travelcraft Company for the coming year using the same method as used in the past.

- 2. Karen Mason has been asked to develop departmental overhead rates for comparison with the plantwide rate. The following steps are to be followed in developing the departmental rates.

- a. The Maintenance Department costs should be allocated to the three manufacturing departments using the direct method.

- b. The Power Department costs should be allocated to the three manufacturing departments using dual cost allocation combined with the direct method of service department cost allocation. Fixed costs are to be allocated according to maximum allotted capacity, and variable costs are to be allocated according to planned usage for the coming year.

- c. Calculate departmental overhead rates for the three manufacturing departments using a machine-hour cost driver for the Molding Department and a direct-labor-hour cost driver for the Component and Assembly departments.

- 3. As Karen Mason’s assistant, draft a memo for her to send to Travelcraft’s president recommending whether the company should use a plantwide rate or departmental rates to assign overhead to products.

Want to see the full answer?

Check out a sample textbook solution

Chapter 17 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

- Golding Manufacturing, a division of Farnsworth Sporting, Inc., produces two different models of bows and eight models of knives. The bow-manufacturing process involves the production of two major subassemblies: the limbs and the handle. The limbs pass through four sequential processes before reaching final assembly: lay-up, molding, fabricating, and finishing. In the Lay-Up Department, limbs are created by laminating layers of wood. In Molding, the limbs are heat treated, under pressure, to form a strong resilient limb. In the Fabricating Department, any protruding glue or other processing residue is removed. Finally, in Finishing, the limbs are cleaned with acetone, dried, and sprayed with the final finishes. The handles pass through two processes before reaching final assembly: pattern and finishing. In the Pattern Department, blocks of wood are fed into a machine that is set to shape the handles. Different patterns are possible, depending on the machines setting. After coming out of the machine, the handles are cleaned and smoothed. They then pass to the Finishing Department where they are sprayed with the final finishes. In Final Assembly, the limbs and handles are assembled into different models using purchased parts such as pulley assemblies, weight adjustment bolts, side plates, and string. Golding, since its inception, has been using process costing to assign product costs. A predetermined overhead rate is used based on direct labor dollars (80 percent of direct labor dollars). Recently, Golding has hired a new controller, Karen Jenkins. After reviewing the product costing procedures, Karen requested a meeting with the divisional manager, Aaron Suhr. The following is a transcript of their conversation: KAREN: Aaron, I have some concerns about our cost accounting system. We make two different models of bows and are treating them as if they were the same product. Now I know that the only real difference between the models is the handle. The processing of the handles is the same, but the handles differ significantly in the amount and quality of wood used. Our current costing does not reflect this difference in direct material input. AARON: Your predecessor is responsible. He believed that tracking the difference in direct material cost wasnt worth the effort. He simply didnt believe that it would make much difference in the unit cost of either model. KAREN: Well, he may have been right, but I have my doubts. If there is a significant difference, it could affect our views of which model is more important to the company. The additional bookkeeping isnt very stringent. All we have to worry about is the Pattern Department. The other departments fit what I view as a process-costing pattern. AARON: Why dont you look into it? If there is a significant difference, go ahead and adjust the costing system. After the meeting, Karen decided to collect cost data on the two models: the Deluxe model and the Econo model. She decided to track the costs for one week. At the end of the week, she had collected the following data from the Pattern Department: a. There were a total of 2,500 bows completed: 1,000 Deluxe models and 1,500 Econo models. b. There was no beginning work in process; however, there were 300 units in ending work in process: 200 Deluxe and 100 Econo models. Both models were 80 percent complete with respect to conversion costs and 100 percent complete with respect to direct materials. c. The Pattern Department experienced the following costs: d. On an experimental basis, the requisition forms for direct materials were modified to identify the dollar value of the direct materials used by the Econo and Deluxe models: Required: 1. Compute the unit cost for the handles produced by the Pattern Department, assuming that process costing is totally appropriate. 2. Compute the unit cost of each handle, using the separate cost information provided on materials. 3. Compare the unit costs computed in Requirements 1 and 2. Is Karen justified in her belief that a pure process-costing relationship is not appropriate? Describe the costing system that you would recommend. 4. In the past, the marketing manager has requested more money for advertising the Econo line. Aaron has repeatedly refused to grant any increase in this products advertising budget because its per-unit profit (selling price less manufacturing cost) is so low. Given the results in Requirements 1 through 3, was Aaron justified in his position?arrow_forwardCardioTrainer Equipment Company manufactures stationary bicycles and treadmills. The products are produced in the Fabrication and Assembly production departments. In addition to production activities, several other activities are required to produce the two products. These activities and their associated activity rates are as follows:ActivityActivity RateFabrication$22 per machine hour (mh)Assembly$12 per direct labor hour (dlh)Setup$40 per setupInspecting$18 per inspectionProduction scheduling$8 per production orderPurchasing$5 per purchase orderThe activity-base usage quantities and units produced for each product were as follows:Stationary BicycleTreadmillMachine hours1,6801,070 Direct labor hours243131 Setups4520 Inspections15894 Production orders6032 Purchase orders24098 Units produced500350Use the activity rate and usage information to compute the total activity costs and the activity costs per unit for each product. If required, round your answers to two decimal places.arrow_forwardCrane Industries works hard to keep pace with demand for its modern chandelier. To get it out the door, Crane first machines raw materials into key component parts. Next, the component parts are assembled. These two processing departments work together, coordinating the output from the machining process into the assembly process. All DM resources are added at the beginning of the machining process, while conversion costs are added evenly throughout the process. For May, the following information was available for the machining process. Units in beginning WIP Inventory Beginning WIP Inventory degree of completion Costs in beginning WIP Inventory New units started Costs added to WIP Inventory this period Units completed Units in ending WIP Inventory Ending WIP Inventory degree of completion (a) Total cost of units completed Cost of units in ending WIP Inventory $ Units $ 400 7,900 7,100 1,200 DM ? $35,800 $379,200 ? Conversion Costs 70% Determine the total cost of units completed and the…arrow_forward

- Lens Care Inc. (LCI) manufactures specialized equipment for polishing optical lenses. There are two models - one mainly used for fine eyewear (F-32) and another for lenses used in binoculars, cameras, and similar equipment (B-13).The manufacturing cost of each unit is calculated using activity-based costing, using the following manufacturing cost pools: Cost Pools Allocation Base Costing Rate Materials handling Number of parts $ 3.20 per part Manufacturing supervision Hours of machine time $ 14.88 per hour Assembly Number of parts $ 3.70 per part Machine setup Each setup $ 56.90 per setup Inspection and testing Logged hours $ 45.90 per hour Packaging Logged hours $ 19.90 per hour LCI currently sells the B-13 model for $3,575 and the F-32 model for $3,460. Manufacturing costs and activity usage for the two products are as follows: B-13 F-32 Direct materials $ 164.90 $ 75.92 Number of parts 168 128 Machine hours 8.30 4.28…arrow_forwardLens Care Inc. (LCI) manufactures specialized equipment for polishing optical lenses. There are two models - one mainly used for fine eyewear (F-32) and another for lenses used in binoculars, cameras, and similar equipment (B-13).The manufacturing cost of each unit is calculated using activity-based costing, using the following manufacturing cost pools: Cost Pools Allocation Base Costing Rate Materials handling Number of parts $ 4.20 per part Manufacturing supervision Hours of machine time $ 14.98 per hour Assembly Number of parts $ 4.20 per part Machine setup Each setup $ 57.40 per setup Inspection and testing Logged hours $ 46.40 per hour Packaging Logged hours $ 20.40 per hour LCI currently sells the B-13 model for $5,825 and the F-32 model for $6,260. Manufacturing costs and activity usage for the two products are as follows: B-13 F-32 Direct materials $ 165.40 $ 76.32 Number of parts 178.00 138 Machine hours 8.80…arrow_forwardLens Care Inc. (LCI) manufactures specialized equipment for polishing optical lenses. There are two models - one mainly used for fine eyewear (F-32) and another for lenses used in binoculars, cameras, and similar equipment (B-13).The manufacturing cost of each unit is calculated using activity-based costing, using the following manufacturing cost pools: Cost Pools Allocation Base Costing Rate Materials handling Number of parts $ 2.40 per part Manufacturing supervision Hours of machine time $ 14.80 per hour Assembly Number of parts $ 3.30 per part Machine setup Each setup $ 56.50 per setup Inspection and testing Logged hours $ 45.50 per hour Packaging Logged hours $ 19.50 per hour LCI currently sells the B-13 model for $1,775 and the F-32 model for $1,220. Manufacturing costs and activity usage for the two products are as follows: B-13 F-32 Direct materials $ 164.50 $ 75.60 Number of parts 160 120 Machine hours 7.90 4.20…arrow_forward

- Lens Care Inc. (LCI) manufactures specialized equipment for polishing optical lenses. There are two models - one mainly used for fine eyewear (F-32) and another for lenses used in binoculars, cameras, and similar equipment (B-13).The manufacturing cost of each unit is calculated using activity-based costing, using the following manufacturing cost pools: Cost Pools Allocation Base Costing Rate Materials handling Number of parts $ 2.40 per part Manufacturing supervision Hours of machine time $ 14.80 per hour Assembly Number of parts $ 3.30 per part Machine setup Each setup $ 56.50 per setup Inspection and testing Logged hours $ 45.50 per hour Packaging Logged hours $ 19.50 per hour LCI currently sells the B-13 model for $1,775 and the F-32 model for $1,220. Manufacturing costs and activity usage for the two products are as follows: B-13 F-32 Direct materials $ 164.50 $ 75.60 Number of parts 160 120 Machine hours 7.90 4.20…arrow_forwardLens Care Inc. (LCI) manufactures specialized equipment for polishing optical lenses. There are two models - one mainly used for fine eyewear (F-32) and another for lenses used in binoculars, cameras, and similar equipment (B-13).The manufacturing cost of each unit is calculated using activity-based costing, using the following manufacturing cost pools: Cost Pools Allocation Base Costing Rate Materials handling Number of parts $ 2.40 per part Manufacturing supervision Hours of machine time $ 14.80 per hour Assembly Number of parts $ 3.30 per part Machine setup Each setup $ 56.50 per setup Inspection and testing Logged hours $ 45.50 per hour Packaging Logged hours $ 19.50 per hour LCI currently sells the B-13 model for $1,775 and the F-32 model for $1,220. Manufacturing costs and activity usage for the two products are as follows: B-13 F-32 Direct materials $ 164.50 $ 75.60 Number of parts 160 120 Machine hours 7.90 4.20…arrow_forwardLens Care Inc. (LCI) manufactures specialized equipment for polishing optical lenses. There are two models - one mainly used for fine eyewear (F-32) and another for lenses used in binoculars, cameras, and similar equipment (B-13).The manufacturing cost of each unit is calculated using activity-based costing, using the following manufacturing cost pools: Cost Pools Allocation Base Costing Rate Materials handling Number of parts $ 2.50 per part Manufacturing supervision Hours of machine time $ 14.81 per hour Assembly Number of parts $ 3.35 per part Machine setup Each setup $ 56.55 per setup Inspection and testing Logged hours $ 45.55 per hour Packaging Logged hours $ 19.55 per hour LCI currently sells the B-13 model for $2,000 and the F-32 model for $1,500. Manufacturing costs and activity usage for the two products are as follows: B-13 F-32 Direct materials $ 164.55 $ 75.64 Number of parts 161 121 Machine hours 7.95 4.21…arrow_forward

- Gibson Manufacturing produces two keyboards, one for laptop computers and the other for desktop computers. The production process is automated, and the company has found activity-based costing useful in assigning overhead costs to its products. The company has identified five major activities involved in producing the keyboards. Activity Materials receiving & handling Production setup Assembly Quality inspection Packing and shipping Activity measures for the two kinds of keyboards follow: Laptops Desktops Required Allocation Base Cost of material Number of setups Number of parts Inspection time Number of orders Labor Cost $ 1,190 1,080 Material Number of Number of Cost $ 5,600 7,500 Setups 31 11 Parts 47 28 Allocation Rate 2% of material cost $ 113.00 per setup $ 5.00 per part $ 1.30 per minute $ 12.00 per order Number of Inspection Time Orders 6,800 minutes 5,200 minutes 67 22 a. Compute the cost per unit of laptop and desktop keyboards, assuming that Gibson made 210 units of each…arrow_forwardRooney Manufacturing produces two keyboards, one for laptop computers and the other for desktop computers. The production process is automated, and the company has found activity-based costing useful in assigning overhead costs to its products. The company has identified five major activities involved in producing the keyboards. Activity Materials receiving & handling Production setup Assembly Quality inspection Packing and shipping Activity measures for the two kinds of keyboards follow: Laptops Desktops Labor Cost $ 1,250 1,140 Laptop keyboards Desktop keyboards Material Number of Number of Cost $ 6,100 7,000 Allocation Base Cost of material Number of setups Number of parts Inspection time Number of orders Cost Per Unit Setups 28 10 Allocation Rate 1% of material cost $ 120.00 per setup $ 7.00 per part $ 1.20 per minute $ 8.00 per order Parts Inspection Time 7,100 minutes 4,900 minutes 46 29 Required a. Compute the cost per unit of laptop and desktop keyboards, assuming that Rooney…arrow_forwardCarson Paint Company, which manufactures quality paint to sell at premium prices, uses a single production department. Production begins by blending the various chemicals that are added at the beginning of the process and ends by filling the paint cans. The gallon cans are then transferred to the shipping department for crating and shipment. Direct labor and overhead are added continuously throughout the process. Factory overhead is applied at the rate of $3 per direct labor dollar. The company combines direct labor and overhead in computing product cost. Prior to May, when a change in the manufacturing process was implemented, Work-in-Process Inventories were insignificant. The changed manufacturing process, which has resulted in increased equipment capacity, allows increased production but also results in considerable amounts of Work-in-Process Inventory. Also, the company had 1,000 spoiled gallons in May-one- half of which was normal spoilage and the rest abnormal spoilage. The…arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning