PRIN.OF CORPORATE FINANCE

13th Edition

ISBN: 9781260013900

Author: BREALEY

Publisher: RENT MCG

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 17, Problem 20PS

After-tax WACC* Gaucho Services starts life with all-equity financing and a

- a. Use MM’s proposition 2 to calculate the new cost of equity. Gaucho pays taxes at a marginal rate of Tc = 40%.

- b. Calculate Gaucho’s after-tax weighted-average cost of capital.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

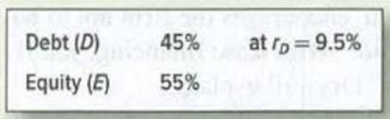

Gaucho Services starts life with all-equity financing and a cost of equity of 14%. Suppose it refinances to the following market-value capital structure:Debt (D) 45% at rD = 9.5%Equity (E) 55%Use MM’s proposition 2 to calculate the new cost of equity. Gaucho pays taxes at a marginal rate of T c = 40%. Calculate Gaucho’s after-tax weighted-average cost of capital.

Gaucho Services starts life with all-equity financing and a cost of equity of 15%. Suppose it refinances to the following market-value capital structure: Debt (D) 46% at rD = 9.6% Equity (E) 54% Use MM’s proposition 2 to calculate the new cost of equity. Gaucho pays taxes at a marginal rate of Tc = 35%. Calculate Gaucho’s after-tax weighted-average cost of capital.

The market values and after-tax costs of various sources of capital used by Ridge Tool are shown in the following table. Source of capital Market value Individual cost Long-term debt $700,000 5.3% Preferred stock 50,000 12.0 Common stock equity 650,000 16.0 a. Calculate the firm’s WACC. b. Explain how the firm can use this cost in the investment decision-making process. Please show your work.

Chapter 17 Solutions

PRIN.OF CORPORATE FINANCE

Ch. 17 - Homemade leverage Ms. Kraft owns 50,000 shares of...Ch. 17 - Homemade leverage Companies A and B differ only in...Ch. 17 - Corporate leverage Suppose that Macbeth Spot...Ch. 17 - Corporate leverage Reliable Gearing currently is...Ch. 17 - MMs propositions True or false? a. MMs...Ch. 17 - MMs propositions What is wrong with the following...Ch. 17 - Prob. 7PSCh. 17 - MM proposition 1 Executive Cheese has issued debt...Ch. 17 - Prob. 9PSCh. 17 - Prob. 10PS

Ch. 17 - MM proposition 2 Spam Corp. is financed entirely...Ch. 17 - MM proposition 2. Increasing financial leverage...Ch. 17 - Prob. 13PSCh. 17 - MM proposition 2 Look back to Section 17-1....Ch. 17 - MM proposition 2 Hubbards Pet Foods is financed...Ch. 17 - MM proposition 2 Imagine a firm that is expected...Ch. 17 - MM proposition 2 Archimedes Levers is financed by...Ch. 17 - MM proposition 2 Look back to Problem 17. Suppose...Ch. 17 - Prob. 19PSCh. 17 - After-tax WACC Gaucho Services starts life with...Ch. 17 - After-tax WACC Omega Corporation has 10 million...Ch. 17 - After-tax WACC Gamma Airlines has an asset beta of...Ch. 17 - Prob. 23PSCh. 17 - Investor choice People often convey the idea...Ch. 17 - Investor choice Suppose that new security designs...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- 1.a. Austin Metal Company reported Current Assets of $209,000 and Current Liabilities of $110,000. Calculate working capital and explain the results 1.b. The Company DEN has a beta of 1.30. The risk-free rate of return is 1.90 percent and the market rate of return is 5.10 percent. What is the CAPM cost of equity? kindly explain in detailarrow_forwardCalculate the company's asset beta, if the firm's equity beta is 1.6, the debt equity ratio is 0.6 and the marginal tax rate is 30%. Select a O O 1.1268 2.1268 O 1.2618 2.216arrow_forwardTo help them estimate the company's cost of capital, Smithco has hired you as a consultant. You have been provided with the following data: D₁ = $1.45; Po = $22.50; and gL = 6.50% (constant). Based on the dividend growth approach, what is the cost of common from reinvested earnings? O a. 13.59% O b. 12.94% c 11.10% d. 12.30% e. 11.68% Oarrow_forward

- Please answer all A company has days of inventory 80 days, days receivable of 30 days, and days payable of 90 days. Calculate the company’s funding gap. 3. Use your own words to explain the following: Weighted Average Cost of Capital (WACC): formula and what it measures Cost of Debt: formula and what it measures Capital Asset Pricing Model (CAPM): formula and what it measuresarrow_forwardThe user cost of capital: Consider the basic formula for the user cost ofcapital in the presence of a corporate income tax. Suppose the baseline casefeatures an interest rate of 2 percent, a rate of depreciation of 6 percent, aprice of capital that rises at 1 percent per year, and a 0 percent corporate taxrate. Starting from this baseline case, what is the user cost of capital after thefollowing changes?(a) No changes—the baseline case.(b) Te corporate tax rate rises to 35 percent.(c) Te interest rate doubles to 4 percent.(d) Both (b) and (c).arrow_forwardYou have the following information about Burgundy Basins, a sink manufacturer. Equity shares outstanding Stock price per share Yield to maturity on debt Book value of interest-bearing debt Coupon interest rate on debt Market value of debt Book value of equity Cost of equity capital Tax rate a. What is the internal rate of return on the investment? Note: Round your answer to 2 decimal places. Internal rate of return I Weighted-average cost Burgundy is contemplating what for the company is an average-risk investment costing $38 million and promising an annual ATCF of $4.9 million in perpetuity. % b. What is Burgundy's weighted-average cost of capital? Note: Round your answer to 2 decimal places. 20 million % $39 7.5% $350 million 4.4% $ 245 million $ 410 million 11.8% 35%arrow_forward

- Estimating Cost of Equity Capital Assume that a company’s market beta equals 0.8, the risk-free rate is 5%, and the market return equals 8%. Compute the company’s cost of equity capital. Round answer to one decimal place (ex: 0.0245 = 2.5%) Answer%arrow_forward1. Using capital asset pricing model, compute for the cost of equity with risk-free rate of 4%, market return on 8%, beta of 1.5 and tax rate of 30%. 2. With risk-free rate of 5%, beta of 1.5, market return of 8%, prevailing credit spread (rate applied on debt on top of risk-free rate) of 3%, tax rate of 30% and equity ratio of 30%, compute for the weighted average cost of capital. 3. The appropriate WACC of a company is 8%. With risk-free rate of 4%, market return of 10%, prevailing credit spread of 2%, tax rate of 30% and equity ratio of 40%, compute the beta.arrow_forward1.a. Austin Metal Company reported Current Assets of $209,000 and Current Liabilities of $110,000. Calculate working capital and explain the results 1.b. The Company DEN has a beta of 1.30. The risk-free rate of return is 1.90 percent and the market rate of return is 5.10 percent. What is the CAPM cost of equity?arrow_forward

- Calculation of individual costs and WACC Dillon Labs has asked its financial manager to measure the cost of each specific type of capital as well as the weighted average cost of capital. The weighted average cost is to be measured by using the following weights: 50% long-term debt, 15% preferred stock, and 35% common stock equity (retained earnings, new common stock, or both). The firm's tax rate is 29%. Debt The firm can sell for $1015 a 20-year, $1,000-par-value bond paying annual interest at a 6.00% coupon rate. A flotation cost of 2% of the par value is required. Preferred stock 9.50% (annual dividend) preferred stock having a par value of $100 can be sold for $98. An additional fee of $2 per share must be paid to the underwriters. Common stock The firm's common stock is currently selling for $90 per share. The stock has paid a dividend that has gradually increased for many years, rising from $3.00 ten years ago to the $5.63 dividend payment,…arrow_forwardCalculate the cost of equity with the CAPM Calculate the cost od debt based on what the company is currently paying for its debt - Beta of the industry = 1.16 - Equity Risk Premium = 6.97% - Risk-free rate = 3.77% - Objective capital structure of the industry = 13.24%arrow_forward13. Using Weighted Average Cost of Capital (WACC) ignoring taxes compute the cost of capital of a company with debt ratio of 0.75:1 and is paying yearly average interest for its loans of 4% and dividend rate of 5% yearly. a) 4.00% b) 4.25% c) 4.5% d) 5.00% 14. Using capital Asset Pricing Method (CAPM) compute for the cost of capital (equity) with risk free rate of 5%, market return of 12% and Beta of 1.3. a) 14.01% b) 14.10% c) 14.00% d) 14.11% 15. Using capital Asset Pricing Method (CAPM) compute for the cost of capital (equity) with risk free rate of 4%, market return of 8% and Beta of 1.5. a) 10.00% b) 11.00% c) 12.00% d) 13.00%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning

Financial leverage explained; Author: The Finance story teller;https://www.youtube.com/watch?v=GESzfA9odgE;License: Standard YouTube License, CC-BY