EBK ECONOMICS: PRINCIPLES AND POLICY

13th Edition

ISBN: 9781305465626

Author: Blinder

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

Chapter 17, Problem 1DQ

To determine

Comment the statement regarding federal government tax.

Expert Solution & Answer

Explanation of Solution

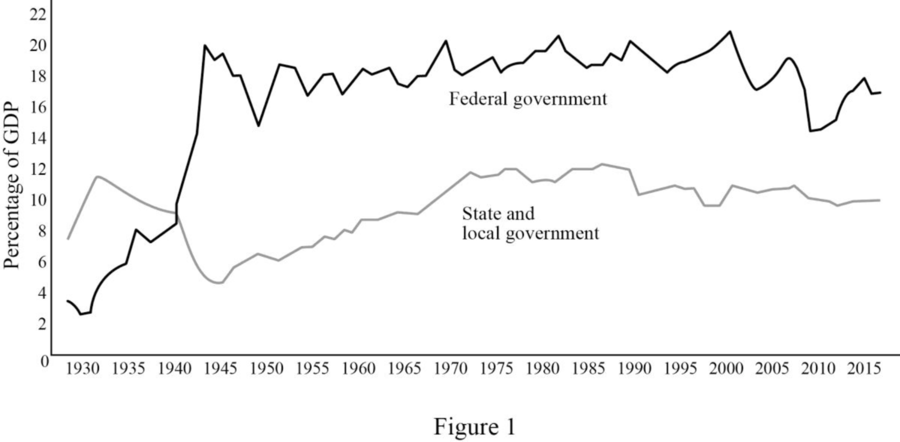

The tax as a percentage of GDP is shown in the figure below:

The federal government tax increases according to the proportion of

Want to see more full solutions like this?

Subscribe now to access step-by-step solutions to millions of textbook problems written by subject matter experts!

Students have asked these similar questions

do taxes generate the revenue?

What will the federal government do to taxes?

Which taxation system is best and which is the worst?

Chapter 17 Solutions

EBK ECONOMICS: PRINCIPLES AND POLICY

Knowledge Booster

Similar questions

- The tax on cigarettes in New York City is one of the highest in the nation—$5.85 per pack. What are some of the secondary effects of this tax? Check all that apply.arrow_forwardWhere does our taxes goes? What are the things that the government do to our taxes? Who are those people involved in a certain government projects?arrow_forwardwhy is the tax rate 6?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Economics Today and Tomorrow, Student EditionEconomicsISBN:9780078747663Author:McGraw-HillPublisher:Glencoe/McGraw-Hill School Pub Co

Economics Today and Tomorrow, Student EditionEconomicsISBN:9780078747663Author:McGraw-HillPublisher:Glencoe/McGraw-Hill School Pub Co Principles of Microeconomics (MindTap Course List)EconomicsISBN:9781305971493Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Microeconomics (MindTap Course List)EconomicsISBN:9781305971493Author:N. Gregory MankiwPublisher:Cengage Learning Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Exploring EconomicsEconomicsISBN:9781544336329Author:Robert L. SextonPublisher:SAGE Publications, Inc

Exploring EconomicsEconomicsISBN:9781544336329Author:Robert L. SextonPublisher:SAGE Publications, Inc Microeconomics: Principles & PolicyEconomicsISBN:9781337794992Author:William J. Baumol, Alan S. Blinder, John L. SolowPublisher:Cengage Learning

Microeconomics: Principles & PolicyEconomicsISBN:9781337794992Author:William J. Baumol, Alan S. Blinder, John L. SolowPublisher:Cengage Learning

Economics Today and Tomorrow, Student Edition

Economics

ISBN:9780078747663

Author:McGraw-Hill

Publisher:Glencoe/McGraw-Hill School Pub Co

Principles of Microeconomics (MindTap Course List)

Economics

ISBN:9781305971493

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Exploring Economics

Economics

ISBN:9781544336329

Author:Robert L. Sexton

Publisher:SAGE Publications, Inc

Microeconomics: Principles & Policy

Economics

ISBN:9781337794992

Author:William J. Baumol, Alan S. Blinder, John L. Solow

Publisher:Cengage Learning