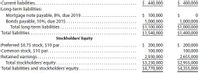

The comparative financial statements of Bettancort Inc. are as follows. The market price of Bettancort Inc. common stock was $71.25 on December 31, 2014.

Instructions

Determine the following measures for 2014, rounding to one decimal place:

1. a.Working capital

b.

c. Quick ratio

d.

e. Number of days' sales in receivables

f. Inventory turnover

g. Number of days' sales in inventory

h. Ratio of fixed assets to long-term liabilities

i. Ratio of liabilities to stockholders’ equity

j. Number of times interest charges are earned

k. Number of times preferred dividends are earned

2. a. Ratio of net sales to assets

b. Rate earned on total assets

c. Rate earned on stockholders' equity

d. Rate earned on common stockholders' equity

e. Earnings per share on common stock

f. Price-earnings ratio

g. Dividends per share of common stock

h. Dividend yield

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 6 images

- sarrow_forwardShown below are Apple Inc's Consolidated Statements of Operations for years ended September 24, 2022, September 25, 2021, and September 26, 2020; and Consolidated Balance Sheets at September 24, 2022, and September 25, 2021. Determine the following (show your work) for Apple Inc: a. Return on Equity for the year ended September 24, 2022. b. Acid-test ratio at September 24, 2022 Number of days sales in accounts receivable at September 24, 2022 Inventory turnover for the year ended September 24, 2022 With a common stock market price of $150.43 at September 24, 2022, the Price Earnings Ratio for the year ended september 24, 2022. C. d. e. f. 8. Do you conider the PE ratio in part e to be below average, average or above average? Why? The debt to equity ratio at September 24, 2022 Net sales: Products Services Total net sales Cost of sales: Products Services Total cost of sales Gross margin Operating expenses: Research and development Selling, general and administrative Total operating…arrow_forwardSuppose selected comparative statement data for the giant bookseller Barnes & Noble are as follows. All balance sheet data are as of the end of the fiscal year (in millions). Net sales Cost of goods sold Net income Accounts receivable Inventory Total assets Total common stockholders' equity 2022 $4,750.0 3.300.3 85.3 75.1 1,150.0 2,850.0 900.2 2021 $5,500.6 3,700.6 110.1 102.2 1.250.0 3,250.1 1.120.7arrow_forward

- Selected hypothetical comparative statement data for the giant bookseller Barnes & Noble are presented here. All balance sheet data are as of the end of the fiscal year (in millions). Net sales Cost of goods sold Net income Accounts receivable (net) Inventory Total assets Total common stockholders' equity a. b. C. d. e. Profit margin Asset turnover Return on assets 2025 $5,050.3 Gross profit rate 3,700.7 65.1 65.0 1.250.1 Compute the following ratios for 2025. (Round asset turnover to 2 decimal places, e.g 1.83 and all other answers to 1 decimal place, e.g. 1.8 or 2.5%) 2,950.1 940.6 Return on common stockholders' equity 2024 $5,800.9 3,200.1 190.9 106.6 1,350.1 3,250.1 1,100.5 % times % % %arrow_forwardExamine the following selected financial information for Best Value Corporation and Modern Stores, Inc., as of the end of their fiscal years ending in 2018: Data table (In millions) Best Value Corporation Modern Stores, Inc. 1. Total assets. . . . . . . . . . . . . . . . . . . . . . . . . . $15,256 $203,110 2. Total common stockholders' equity. . . . . $3,075 $71,460 3. Operating income. . . . . . . . . . . . . . . . . . . . $1,350 $26,820 4. Interest expense. . . . . . . . . . . . . . . . . . . . . . $88 $2,020 5. Leverage ratio. . . . . . . . . . . . . . . . . . . . . . . . 6. Total debt. . . . . . . . . . . . . . . . . . . . . . . . . . . . 7. Debt ratio. . . . . . . . . . . . . . . . . . . . . . . . . . . . 8. Times interest earned. . . . . . . . . . . . . . . . . Requirements…arrow_forwardDetermine the following measures for 20Y2 (round to one decimal place, including percentages, except for per-share amounts): Return on common stockholders' equity Earnings per share on common stock Price-earnings ratio Dividends per share of common stock Dividend yieldarrow_forward

- Using the following selected items from the comparative balance sheet of Oriole Products.Determine the horizontal analysis. (Round percentages to 2 decimal places, e.g. 12.21%. Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) ORIOLEPRODUCTSComparative Balance SheetDecember 31 2014 2013 Horizontal analysis Amount Percentage Amount Percentage Current assets $110,880 enter percentages % $128,216 enter percentages % Long-term assets 174,240 enter percentages % 117,304 enter percentages % Total assets 3,168,000 enter percentages % 2,728,000 enter percentages % Determine the vertical analysis. (Round percentages to 1 decimal place, e.g. 12.2%.) ORIOLEPRODUCTSComparative Balance SheetDecember 31 2014 2013 Vertical analysis Amount Percentage Amount Percentage Current assets $110,880…arrow_forwardDomesticarrow_forwardSelected current year company information follows: Net income Net sales Total liabilities, beginning-year Total liabilities, end-of-year $ 16,553 718,855 89,932 109,201 Total stockholders' equity, beginning-year 204,935 Total stockholders' equity, end-of-year 130,851 What is the return on total assets? (Do not round intermediate calculations.).arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education