FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Using the financial statements and using these ratios from the picture, discuss the performance of Cobham PLC in 2016.

Transcribed Image Text:Below you will find the financials of Cobham PLC for 2014-2016:

Income statement £m

2016

2015

2014

Revenue

1,943.9

(1.567.3)

376.6

1,851.7

(1.408.2) (1.290.1)

561.6

(504.0)

57.6

2,072.0

Cost of sales

Gross profit

663.8

(1,155.7)

(779.1)

4.1

SG&A

(651.8)

12.0

Operating (loss) profit

Finance income

5.2

6.4

(72.9)

(847.9)

52.8

(795.1)

Finance cost

(57.0)

(39.8)

2.1

(37.7)

(39.7)

24.3

(Loss)/profit before taxation

Таxation

4.7

(Loss)/profit after taxation

29.0

Balance sheet £m

2016

2015

2014

Non-current assets

PPE & Intangibles

Investment properties

Investment in joint ventures and associates

Trade and other receivables

1,588.8

2,109.4

4.3

3.0

2,430.8

3.6

10.4

3.6

3.1

66.0

71.3

51.1

Deferred tax asset

42.3

11.4

10.5

25.8

1,730.1

Financial assets

12.6

2,212.0

13.7

2,519.6

Current assets

Inventories

405.3

410.4

429.5

Trade and other receivables

409.8

366.0

435.3

0.4

236.4

1,101.6

Current tax receivables

3.1

8.6

Financial assets (including cash)

244.7

1,062.9

320.6

1,105.6

Current liabilities

Borrowings and other financial liabilities

Trade and other payables

199.7

398.1

103.1

22.2

430.8

505.5

Provisions

180.6

74.3

60.5

Current tax liabilities

149.5

864.0

125.1

797.2

119.2

707.4

Non-current liabilities

Borrowings and other financial liabilities

Trade and other payables

1,235.7

31.5

1,359.0

24.8

1,462.3

36.2

Provisions

57.3

27.6

87.0

68.2

66.5

Deferred tax liabilities

102.0

134.5

Retirement benefit obligations

56.7

102.0

1,801.5

1,439.1

1,610.7

Equity

489.9

909.7

1112.3

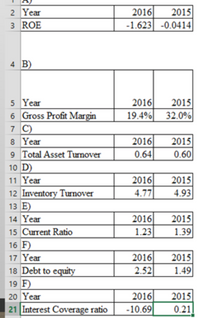

Transcribed Image Text:2 Year

2016

2015

3 ROE

-1.623 -0.0414

4 B)

5 Year

6 Gross Profit Margin

7 C)

2016|

19.4%

2015

32.0%

7

2016

2015

0.60

8 Year

9 Total Asset Turnover

0.64

10 D)

2016

4.77

2015

4.93

11 Year

12 Inventory Turnover

13 E)

14 Year

2016

2015

15 Current Ratio

1.23

1.39

16 F)

2016

2.52

17 Year

2015

18 Debt to equity

19 F)

1.49

2016

-10.69

2015

0.21

20 Year

21 Interest Coverage ratio

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- RATIO ANALYSIS The Corrigan Corporation’s 2017 and 2018 financial statements follow,along with some industry average ratios.a. Assess Corrigan’s liquidity position, and determine how it compares with peers andhow the liquidity position has changed over time.b. Assess Corrigan’s asset management position, and determine how it compares withpeers and how its asset management efficiency has changed over time.c. Assess Corrigan’s debt management position, and determine how it compares withpeers and how its debt management has changed over time.d. Assess Corrigan’s profitability ratios, and determine how they compare with peersand how its profitability position has changed over time.e. Assess Corrigan’s market value ratios, and determine how its valuation compares withpeers and how it has changed over time. Assume the firm’s debt is priced at par, sothe market value of its debt equals its book value. f. Calculate Corrigan’s ROE as well as the industry average ROE, using the DuPontequation.…arrow_forwarda) Calculate the following ratios for 2016 and 2015, showing detailed calculations as to how you arrive at each number. A ROE B Gross profit margin C Total asset turnover D Inventory turnover E Current ratio F Debt-to-equity G Interest coverage ratio. b) Using the financial statements and the ratios calculated above (and any other ratios you like to calculate), discuss the performance of Cobham PLC in 2016. c) Critically discuss the need for the public limited companies to prepare a Statement of Cash Flows and explain the usefulness of the information contained therein from the perspective of a financial analyst.arrow_forwardCalculate the financial indicators of the firm Merck for the year 2018 and fill in the spaces marked in the table. Company Name: Year 2018 Chemicals and Allied Products Industry Ratios ………….. Solvency or Debt Ratios Merck J&J 2018 Debt ratio …. …. 0.47 Debt-to-equity ratio …. …. 0.38 Interest coverage ratio …. …. -9.43 Liquidity Ratios Current ratio …. …. 3.47 Quick ratio …. …. 2.12 Cash ratio …. …. 2.24 Profitability Ratios Profit margin …. …. -93.4% ROE (Return on equity), after tax …. …. -248.5 ROA (Return on assets) …. …. -146.5 Gross margin …. …. 55.3% Operating margin (Return on sales) …. …. -42.9% Activity or Efficiency Ratios Asset turnover …. …. 1.08 Receivables turnover (days) …. …. 16 Inventory turnover (days)…arrow_forward

- Find in the Selected Financial Data or calculate, the following data: Dividends per share declared in 2017. Capital expenditures in 2016. Year total equity grew by the greatest amount over the previous year. Change in total debt from 2013 to 2017.arrow_forwardWhich of the following ratios best measures the profitability of a company? a) Return on equity b) Gross margin c) Current ratio d) Net operating asset turnoverarrow_forwardWhich of the following ratios helps in measuring the long term solvency of the company? Current ratio Debt equity ratio Net profit margin ratio Quick ratioarrow_forward

- DuPont system of analysis Use the following financial information for AT&T and Verizon to conduct a DuPont system of analysis for each company. Sales Earnings available for common stockholders Total assets Stockholders' equity a. Which company has the higher net profit margin? Higher asset turnover? b. Which company has the higher ROA? The higher ROE? c. Which company has the higher financial leverage multiplier? a. Net profit margin (Round to three decimal places.) AT&T Net profit margin AT&T $164,000 13,333 403,921 201,934 Verizon Verizon $126,280 13,608 244,280 24,232arrow_forwardAccounting Questionarrow_forwardi, j and karrow_forward

- Which of the following ratios is used to analyze a company's liquidity? a. Inventory turnover ratio b. Earnings per share c. Return on assets ratio d. Asset turnover ratioarrow_forwardCalculate the ratios of Woolworths Group (Australian retail company) for the year 2021: Ratios to calculate: Profitability (ROSF, ROCE, Gross margin, Operating profit margin, Cash flow to Sales*) Efficiency (Inventory turnover period, Average settlement period, Sales revenue to capital employed) Liquidity (Current ratio, Acid test (quick) ratio, Cash flow ratio*). Stability/Capital Structure (Gearing ratio, Interest cover ratio, Debt coverage ratio*) Investment/Market Performance (Earnings per share, Price earnings ratio, Operating cash flow per share*)arrow_forwardIf given the opportunity, in which of the firms would you invest based on the result of your analysis of both companies and the comparison with the industry? If you would not invest, explain your reasons according to the results obtained. Company Name: Year 2018 Chemicals and Allied Products Industry Ratios ………….. Solvency or Debt Ratios Merck J&J 2018 Debt ratio 0.67 0.61 0.47 Debt-to-equity ratio 0.93 0.51 0.38 Interest coverage ratio 12.27 18.91 -9.43 Liquidity Ratios Current ratio 1.17 1.47 3.47 Quick ratio 0.92 1.16 2.12 Cash ratio 0.40 0.63 2.24 Profitability Ratios Profit margin 14.64% 18.75% -93.4% ROE (Return on equity), after tax 23.03% 25.60% -248.5 ROA (Return on assets) 7.49% 10.00% -146.5 Gross margin 68.06% 66.79% 55.3% Operating margin (Return on sales) 19.62% 24.27%…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education