Concept explainers

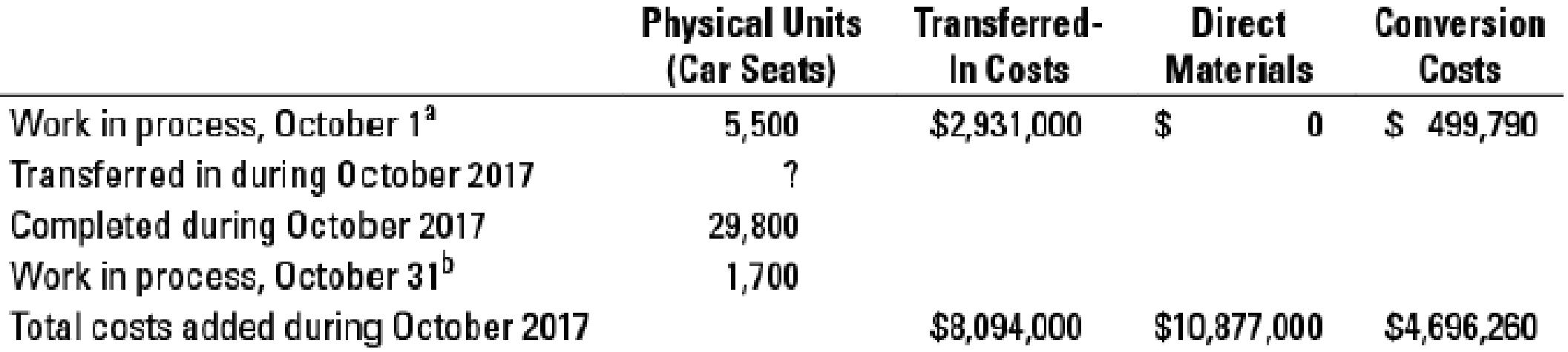

Transferred-in costs, FIFO method (continuation of 17-39). Refer to the information in Problem 17-39. Suppose that Hoffman Company uses the FIFO method instead of the weighted-average method in all of its departments. The only changes to Problem 17-39 under the FIFO method are that total transferred-in costs of beginning work in process on October 1 are $2,879,000 (instead of $2,931,000) and that total transferred-in costs added during October are $9,048,000 (instead of $8,094,000).

Using the FIFO process-costing method, complete Problem 17-39.

17-39 Transferred-in costs, weighted-average method (related to 17-36 to 17-38). Hoffman Company, as you know, is a manufacturer of car seats. Each car seat passes through the assembly department and testing department. This problem focuses on the testing department. Direct materials are added when the testing department process is 90% complete. Conversion costs are added evenly during the testing department’s process. As work in assembly is completed, each unit is immediately transferred to testing. As each unit is completed in testing, it is immediately transferred to Finished Goods.

Hoffman Company uses the weighted-average method of

a Degree of completion: transferred-in costs, ?%; direct materials, ?%; conversion costs, 65%.

b Degree of completion: transferred-in costs, ?%; direct materials, ?%; conversion costs, 45%.

- 1. What is the percentage of completion for (a) transferred-in costs and direct materials in beginning work-in-process inventory and (b) transferred-in costs and direct materials in ending work-in-process inventory?

- 2. For each cost category, compute equivalent units in the testing department. Show physical units in the first column of your schedule.

- 3. For each cost category, summarize total testing department costs for October 2017, calculate the cost per equivalent unit, and assign costs to units completed (and transferred out) and to units in ending work in process.

- 4. Prepare

journal entries for October transfers from the assembly department to the testing department and from the testing department to Finished Goods.

Want to see the full answer?

Check out a sample textbook solution

Chapter 17 Solutions

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Additional Business Textbook Solutions

Financial Accounting (11th Edition)

Fundamentals Of Cost Accounting (6th Edition)

Managerial Accounting

Auditing and Assurance Services (16th Edition)

Horngren's Financial & Managerial Accounting, The Financial Chapters (Book & Access Card)

- Ripley, Inc., costs products using a normal costing system. The following data are available for last year: Overhead is applied on the basis of direct labor hours. Required: 1. What was the predetermined overhead rate? 2. What was the applied overhead for last year? 3. Was overhead over- or underapplied, and by how much? 4. What was the total cost per unit produced (carry your answer to four significant digits)?arrow_forwardFor XYZ Company, the following information related to costs is available for the last quarter: direct materials $2,000, direct labor $3,000, variable MOH $400, fixed MOH $1,600 and selling and administrative expenses $3,000. The product cost under absorption costing is: O a. none of the given answers O b. $6,600 c. O c. $5,400 O d. $10,000O e. $7,000arrow_forwardThe Gangwere Company has assembled the following data pertaining to certain costs that cannot be easily identified as either fixed or variable. Gangwere Company has heard about a method of measuring cost functions called the high-low method and has decided to use it in this situation. Month Cost Hours January $44,900 3,500 February 24,400 2,000 March 31,280 2,450 April 36,400 3,000 May 44,160 3,900 June 42,400 3,740How is the cost function stated? Question 12 options: a) y = $3,600 + $10.40X b) y = $10,112 + $8.64X c) y = $26,672 + $1.84X d) y = $21,360 + $10.40arrow_forward

- I want to correct solutionarrow_forwardSubject: Cost AccountingPlease answer the given questions. Thank you!arrow_forward*(A)The Mortise Company has assembled the following data pertaining to certain costs that cannot be easily identified as either fixed or variable. Mortise has heard about a method of measuring cost functions called the high-low method and has decided to use it in this situation.Month Cost HoursJanuary $40,000 3,600 February 38,500 3,000 March 36,280 3,300 April 38,000 3,500 May 69,850 5,850 June 45,000 4,250Required:a. What is the slope coefficient?b. What is the constant for the estimated cost equation?c. What is the estimated cost function for the above data? d. What is the estimated total cost at an operating level of 3,100 hours? *(B) The XYY company has received an initial order for eight of its products (GGG). The information about products as follows: - Direct material cost per (GGG) $ 100,000 - Direct- assembly labor time for first GGG 4,000 labor-hours - Learning curve for assembly labor time per GGG 80% cumulative average time- Direct -assembly labor cost $ 50 per hour-…arrow_forward

- But the answer appears 19,504 in the Direct Labor. How did that happen? Can you make a solution for this?arrow_forwardLearned Corporation has provided the following information: Direct materials. Direct labor Variable manufacturing overhead Fixed manufacturing overhead Sales commissions a. Total product cost b. Total period cost Cost per Unit Cost per Period $ 5.80 $ 4.00 $ 1.60 c. Contribution margin per unit d. Total direct manufacturing cost e. Total indirect manufacturing cost $ 0.70 $ 0.60 Variable administrative expense Fixed selling and administrative expense Required: a. For financial reporting purposes, what is the total amount of product costs incurred to make 6,000 units? b. For financial reporting purposes, what is the total amount of period costs incurred to sell 6,000 units? c. If the selling price is $23.30 per unit, what is the contribution margin per unit sold? Note: Round your answer to 2 decimal places. d. If 7,000 units are produced, what is the total amount of direct manufacturing cost incurred? e. If 7,000 units are produced, what is the total amount of indirect manufacturing…arrow_forwardVinubhaiarrow_forward

- please answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forward5..arrow_forwardHow do I find the fixed total overhead using absorption costing? Milton Company reports the following information for the current year: Units produced this year 45,000 units Units sold this year 53,000 units Direct materials $ 5 per unit Direct labor $ 2 per unit Variable overhead $ 6 per unit Fixed overhead ? in total If the company's cost per unit of finished goods using absorption costing is $18, what is total fixed overhead?arrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning