Principles of Financial Accounting.

24th Edition

ISBN: 9781260158601

Author: Wild

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 16, Problem 3AP

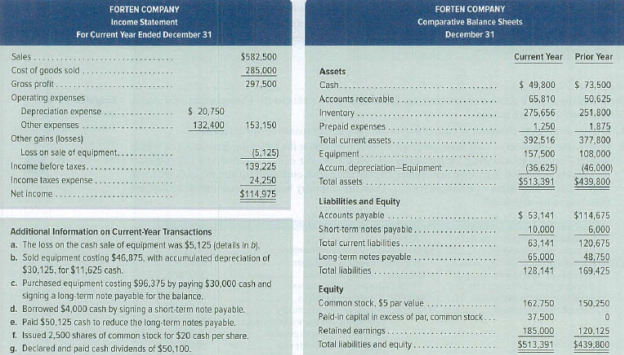

Forten Company’s current-year income statement, comparative balance sheets, and additional information follow. For the year, (1) all sales are credit sales, (2) all credits to

Required

- 1. Prepare a complete statement of

cash flows using the indirect method for the current year. Disclose any noncash investing and financing activities in a note.

Analysis Component

- 2. Analyze and discuss the statement of cash flows prepared in part 1, giving special attention to the wisdom of the cash dividend payment.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Golden Corporation's current year income statement, comparative balance sheets, and additional information follow. For

the year, (1) all sales are credit sales, (2) all credits to Accounts Receivable reflect cash receipts from customers, (3) all

purchases of inventory are on credit, (4) all debits to Accounts Payable reflect cash payments for inventory, and (5) any

change in Income Taxes Payable reflects the accrual and cash payment of taxes.

Assets

Cash

Accounts receivable

Inventory

Total current assets

Equipment

Accumulated depreciation-Equipment

Total assets

Liabilities and Equity

Accounts payable

Income taxes payable

Total current liabilities

GOLDEN CORPORATION

Comparative Balance Sheets

December 31

Equity

Common stock, $2 par value

Paid-in capital in excess of par value, common stock

Retained earnings

Total liabilities and equity

GOLDEN CORPORATION

Income Statement

For Current Year Ended December 31

Sales

Cost of goods sold

Gross profit

Operating expenses (excluding depreciation)…

Golden Corporation's current year income statement, comparative balance sheets, and additional information follow. For

the year, (1) all sales are credit sales, (2) all credits to Accounts Receivable reflect cash receipts from customers, (3) all

purchases of inventory are on credit, (4) all debits to Accounts Payable reflect cash payments for inventory, and (5) any

change in Income Taxes Payable reflects the accrual and cash payment of taxes.

Assets

Cash

Accounts receivable

Inventory

Total current assets

Equipment

Accumulated depreciation-Equipment

Total assets

Liabilities and Equity

Accounts payable

Income taxes payable

Total current liabilities

Equity

Common stock, $2 par value

Paid-in capital in excess of par value, common stock.

Retained earnings

Total liabilities and equity

Sales

Cost of goods sold

Gross profit

GOLDEN CORPORATION

Comparative Balance Sheets

December 31

GOLDEN CORPORATION

Income Statement

For Current Year Ended December 31

Operating expenses (excluding depreciation)…

Forten Company's current year income statement, comparative balance sheets, and additional information follow. For the year, (1) all sales are credit sales, (2) all credits to Accounts Receivable reflect cash receipts from customers, (3) all purchases of inventory are on credit, (4) all debits to Accounts Payable reflect cash payments for inventory, and (5) Other Expenses are paid in advance and are initially debited to Prepaid Expenses.

FORTEN COMPANYComparative Balance SheetsDecember 31

Current Year

Prior Year

Assets

Cash

$

49,800

$

73,500

Accounts receivable

65,810

50,625

Inventory

275,656

251,800

Prepaid expenses

1,250

1,875

Total current assets

392,516

377,800

Equipment

157,500

108,000

Accum. depreciation—Equipment

(36,625

)

(46,000

)

Total assets

$

513,391

$

439,800

Liabilities and Equity…

Chapter 16 Solutions

Principles of Financial Accounting.

Ch. 16 - A company uses the indirect method to determine...Ch. 16 - Prob. 2MCQCh. 16 - Prob. 3MCQCh. 16 - Prob. 4MCQCh. 16 - The following information is available for a...Ch. 16 - Prob. 1DQCh. 16 - Prob. 2DQCh. 16 - Prob. 3DQCh. 16 - Prob. 4DQCh. 16 - When a statement of cash flows is prepared using...

Ch. 16 - Prob. 6DQCh. 16 - Prob. 7DQCh. 16 - Prob. 8DQCh. 16 - Prob. 9DQCh. 16 - If a company reports positive net income for the...Ch. 16 - Prob. 11DQCh. 16 - Prob. 12DQCh. 16 - Prob. 13DQCh. 16 - Prob. 14DQCh. 16 - Prob. 15DQCh. 16 - Classify the following cash flows as either...Ch. 16 - Statement of cash flows Label the following...Ch. 16 - Prob. 3QSCh. 16 - Prob. 4QSCh. 16 - Prob. 5QSCh. 16 - Prob. 6QSCh. 16 - Prob. 7QSCh. 16 - Prob. 8QSCh. 16 - Prob. 9QSCh. 16 - The plant assets section of the comparative...Ch. 16 - Prob. 11QSCh. 16 - Prob. 12QSCh. 16 - Prob. 13QSCh. 16 - Prob. 14QSCh. 16 - Prob. 15QSCh. 16 - Prob. 16QSCh. 16 - Prob. 17QSCh. 16 - Prob. 18QSCh. 16 - Prob. 19QSCh. 16 - A company uses a spreadsheet to prepare its...Ch. 16 - Prob. 21QSCh. 16 - Bioware Co. reports cost of goods sold of 42,000....Ch. 16 - Prob. 23QSCh. 16 - Prob. 24QSCh. 16 - Refer to the data in QS 16-7. 1. How much cash is...Ch. 16 - Refer to the data in QS 16-7. 1. How much cash is...Ch. 16 - Prob. 27QSCh. 16 - Prob. 1ECh. 16 - Prob. 2ECh. 16 - Prob. 3ECh. 16 - Prob. 4ECh. 16 - Fitz Company reports the following information....Ch. 16 - Prob. 6ECh. 16 - Prob. 7ECh. 16 - Prob. 8ECh. 16 - Use the following information to determine cash...Ch. 16 - For each of the following separate transactions,...Ch. 16 - Prob. 11ECh. 16 - Use the following information to prepare a...Ch. 16 - Prob. 13ECh. 16 - Complete the following spreadsheet in preparation...Ch. 16 - Prob. 15ECh. 16 - Prob. 16ECh. 16 - Prob. 17ECh. 16 - Prob. 18ECh. 16 - Use the following information about Ferron Company...Ch. 16 - Prob. 20ECh. 16 - Prob. 1APCh. 16 - Refer to the information in Problem 16-1A....Ch. 16 - Forten Companys current-year income statement,...Ch. 16 - Prob. 4APCh. 16 - Prob. 5APCh. 16 - Golden Corp.s current-year income statement,...Ch. 16 - Prob. 7APCh. 16 - Prob. 8APCh. 16 - Prob. 1BPCh. 16 - Prob. 2BPCh. 16 - Gazelle Corporations current-year income...Ch. 16 - Prob. 4BPCh. 16 - Prob. 5BPCh. 16 - Prob. 6BPCh. 16 - Prob. 7BPCh. 16 - Prob. 8BPCh. 16 - Prob. 16SPCh. 16 - Use Apples financial statements in Appendix A to...Ch. 16 - Prob. 2AACh. 16 - Prob. 3AACh. 16 - Prob. 1BTNCh. 16 - COMMUNICATING IN PRACTICE Your friend, Diana Wood,...Ch. 16 - Prob. 3BTNCh. 16 - Prob. 5BTNCh. 16 - Prob. 6BTN

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Forten Company's current year income statement, comparative balance sheets, and additional information follow. For the year, (1) all sales are credit sales, (2) all credits to Accounts Receivable reflect cash receipts from customers, (3) all purchases of inventory are on credit, (4) all debits to Accounts Payable reflect cash payments for inventory, and (5) Other Expenses are paid in advance and are initially debited to Prepaid Expenses. FORTEN COMPANYComparative Balance SheetsDecember 31 Current Year Prior Year Assets Cash $ 49,800 $ 73,500 Accounts receivable 65,810 50,625 Inventory 275,656 251,800 Prepaid expenses 1,250 1,875 Total current assets 392,516 377,800 Equipment 157,500 108,000 Accum. depreciation—Equipment (36,625 ) (46,000 ) Total assets $ 513,391 $ 439,800 Liabilities and Equity…arrow_forwardForten Company's current year income statement, comparative balance sheets, and additional information follow. For the year, (1) all sales are credit sales, (2) all credits to Accounts Receivable reflect cash receipts from customers, (3) all purchases of inventory are on credit, (4) all debits to Accounts Payable reflect cash payments for inventory, and (5) Other Expenses are paid in advance and are initially debited to Prepaid Expenses. FORTEN COMPANY Comparative Balance Sheets December 31 Current Year Prlor Year Assets Cash $ 73,900 89,930 $ 89,500 66,625 Accounts receivable Inventory Prepaid expenses 299,656 267,800 1,370 2,215 Total current assets 464,856 426,140 Equipment Accum. depreciation-Equipment 124,000 (54,000) $ 496,140 141,500 (44,625) 561,731 Total assets 24 Liabilities and Equity Accounts payable Short-term notes payable 24 69,141 $ 138,675 14,800 9,200 Total current liabilities 83,941 57,000 147,875 64,750 Long-term notes payable Total liabilities 140,941 212,625…arrow_forwardForten Company's current year income statement, comparative balance sheets, and additional information follow. For the year, (1) all sales are credit sales, (2) all credits to Accounts Receivable reflect cash receipts from customers, (3) all purchases of inventory are on credit, (4) all debits to Accounts Payable reflect cash payments for inventory, and (5) Other Expenses are paid in advance and are initially debited to Prepaid Expenses. Assets Cash Accounts receivable Inventory Prepaid expenses Total current assets Equipment Accumulated depreciation-Equipment Total assets Liabilities and Equity Accounts payable Short-term notes payable Total current liabilities Long-term notes payable. Total liabilities Equity Common stock, $5 par value Paid-in capital in excess of par, common stock Retained earnings Total liabilities and equity Sales Cost of goods sold Gross profit Operating expenses Depreciation expense Other expenses Other gains (losses). Loss on sale of equipment Income before…arrow_forward

- Forten Company's current year income statement, comparative balance sheets, and additional information follow. For the year, (1) all sales are credit sales, (2) all credits to Accounts Receivable reflect cash receipts from customers, (3) all purchases of inventory are on credit, (4) all debits to Accounts Payable reflect cash payments for inventory, and (5) Other Expenses are paid in advance and are initially debited to Prepaid Expenses. FORTEN COMPANYComparative Balance SheetsDecember 31 Current Year Prior Year Assets Cash $ 49,800 $ 73,500 Accounts receivable 65,810 50,625 Inventory 275,656 251,800 Prepaid expenses 1,250 1,875 Total current assets 392,516 377,800 Equipment 157,500 108,000 Accum. depreciation—Equipment (36,625 ) (46,000 ) Total assets $ 513,391 $ 439,800 Liabilities and Equity…arrow_forwardPanzarella Corporation's current year income statement, comparative balance sheets, and additional information follow. For the year, (1) all sales are credit sales, (2) all credits to Accounts Receivable reflect cash receipts from customers, (3) all purchases of inventory are on credit, (4) all debits to Accounts Payable reflect cash payments for inventory, (5) Other Expenses are all cash expenses, and (6) any change in Income Taxes Payable reflects the accrual and cash payment of taxes. Assets Cash Accounts receivable Inventory Total current assets PANZARELLA CORPORATION Comparative Balance Sheets December 31 Equipment Accumulated depreciation-Equipment Total assets Liabilities and Equity Accounts payable Income taxes payable Total current liabilities Equity Common stock, $2 par value Paid-in capital in excess of par value, common stock Retained earnings Total liabilities and equity PANZARELLA CORPORATION Income Statement For Year Ended December 31 Sales Cost of goods sold Gross…arrow_forwardForten Company's current year income statement, comparative balance sheets, and additional information follow. For the year, (1) all sales are credit sales, (2) all credits to Accounts Receivable reflect cash receipts from customers, (3) all purchases of inventory are on credit, (4) all debits to Accounts Payable reflect cash payments for inventory, and (5) Other Expenses are paid in advance and are initially debited to Prepaid Expenses. FORTEN COMPANYComparative Balance SheetsDecember 31 Current Year Prior Year Assets Cash $ 49,800 $ 73,500 Accounts receivable 65,810 50,625 Inventory 275,656 251,800 Prepaid expenses 1,250 1,875 Total current assets 392,516 377,800 Equipment 157,500 108,000 Accum. depreciation—Equipment (36,625 ) (46,000 ) Total assets $ 513,391 $ 439,800 Liabilities and Equity…arrow_forward

- Golden Corporation's current year income statement, comparative balance sheets, and additional information follow. For the year, (1) all sales are credit sales, (2) all credits to Accounts Receivable reflect cash receipts from customers, (3) all purchases of inventory are on credit, (4) all debits to Accounts Payable reflect cash payments for inventory, and (5) any change in Income Taxes Payable reflects the accrual and cash payment of taxes. GOLDEN CORPORATION Comparative Balance Sheets December 31 Current Year Prior Year Assets Cash $ 171,000 $ 114,700 Accounts receivable 93,500 78,000 Inventory 611,500 533,000 Total current assets 876,000 725,700 Equipment 353,800 306,000 Accumulated depreciation—Equipment (161,500) (107,500) Total assets $ 1,068,300 $ 924,200 Liabilities and Equity Accounts payable $ 101,000 $ 78,000 Income taxes payable 35,000 28,600 Total current liabilities 136,000 106,600 Equity Common stock, $2 par value…arrow_forwardGolden Corporation's current year income statement, comparative balance sheets, and additional information follow. For the year, (1) all sales are credit sales, (2) all credits to Accounts Receivable reflect cash receipts from customers, (3) all purchases of inventory are on credit, (4) all debits to Accounts Payable reflect cash payments for inventory, and (5) any change in Income Taxes Payable reflects the accrual and cash payment of taxes. GOLDEN CORPORATION Comparative Balance Sheets December 31 Assets Cash Accounts receivable Inventory Total current assets Equipment Accumulated depreciation-Equipment Total assets Liabilities and Equity Accounts payable Current Year Prior Year $ $ 171,000 114,700 93,500 78,000 611,500 533,000 876,000 725,700 353,800 306,000 (161,500) (107,500) $ $ 1,068,300 924,200 $ 101,000 $ 78,000 35,000 28,600 Income taxes payable Total current liabilities 136,000 106,600 Equity Common stock, $2 par value 600,400 575,000 Paid-in capital in excess of par value,…arrow_forwardGolden Corporation's current year income statement, comparative balance sheets, and additional information follow. For the year, (1) all sales are credit sales, (2) all credits to Accounts Receivable reflect cash receipts from customers, (3) all purchases of inventory are on credit, (4) all debits to Accounts Payable reflect cash payments for inventory, and (5) any change in Income Taxes Payable reflects the accrual and cash payment of taxes. GOLDEN CORPORATIONComparative Balance SheetsDecember 31 Current YearPrior YearAssets Cash$ 180,000$ 124,600Accounts receivable107,00087,000Inventory625,000542,000Total current assets912,000753,600Equipment378,100315,000Accumulated depreciation—Equipment(166,000)(112,000)Total assets$ 1,124,100$ 956,600Liabilities and Equity Accounts payable$ 119,000$ 87,000Income taxes payable44,00033,100Total current liabilities163,000120,100Equity Common stock, $2 par value611,200584,000Paid-in capital in excess of par value, common…arrow_forward

- Forten Company's current year income statement, comparative balance sheets, and additional information follow. For the year, (1) all sales are credit sales, (2) all credits to Accounts Receivable reflect cash receipts from customers, (3) all purchases of inventory are on credit, and (4) all debits to Accounts Payable reflect cash payments for inventory. Sales Cost of goods sold Gross profit Operating expenses (excluding depreciation) Depreciation expense Other gains (losses) Loss on sale of equipment Income before taxes Income taxes expense Net income Assets Cash FORTEN COMPANY Income Statement For Current Year Ended December 31 Accounts receivable Inventory Prepaid expenses Total current assets FORTEN COMPANY Comparative Balance Sheets December 31 Equipment Accumulated depreciation-Equipment Total assets Liabilities and Equity Accounts payable Long-term notes payable Total liabilities Equity Common stock, $5 par value Paid-in capital in excess of par, common stock Retained earnings…arrow_forwardGolden Corp.'s current year income statement, comparative balance sheets, and additional information follow. For the year, (1) all sales are credit sales, (2) all credits to Accounts Receivable reflect cash receipts from customers, (3) all purchases of inventory are on credit, (4) all debits to Accounts Payable reflect cash payments for inventory, (5) Other Expenses are all cash expenses, and (6) any change in Income Taxes Payable reflects the accrual and cash payment of taxes. Required:Prepare a complete statement of cash flows using a spreadsheet under the indirect method. (Enter all amounts as positive values.)arrow_forwardGolden Corp.'s current year income statement, comparative balance sheets, and additional information follow. For the year, (1) all sales are credit sales, (2) all credits to Accounts Receivable reflect cash receipts from customers, (3) all purchases of inventory are on credit, (4) all debits to Accounts Payable reflect cash payments for inventory, (5) Other Expenses are all cash expenses, and (6) any change in Income Taxes Payable reflects the accrual and cash payment of taxes. GOLDEN CORPORATIONComparative Balance SheetsDecember 31 Current Year Prior Year Assets Cash $ 164,000 $ 107,000 Accounts receivable 83,000 71,000 Inventory 601,000 526,000 Total current assets 848,000 704,000 Equipment 335,000 299,000 Accum. depreciation—Equipment (158,000 ) (104,000 ) Total assets $ 1,025,000 $ 899,000 Liabilities and Equity…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License