Prepare the statement of

Explanation of Solution

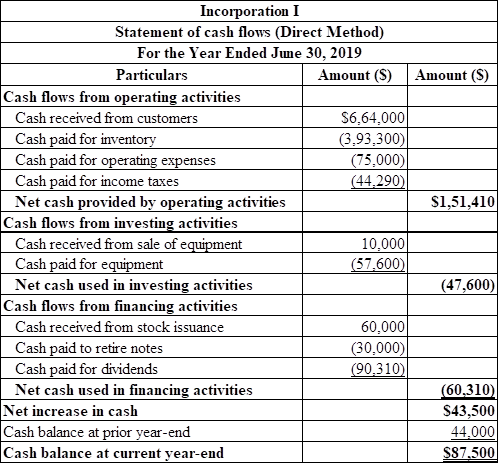

Statement of cash flows: Statement of cash flows reports all the cash transactions which are responsible for inflow and outflow of cash and result of these transactions is reported as ending balance of cash at the end of reported period. Statement of cash flows includes the changes in cash balance due to operating, investing, and financing activities.

Direct method: The direct method uses the cash basis of accounting for the preparation of the statement of cash flows. It takes into account those revenues and expenses for which cash is either received or paid.

Prepare the statement of cash flows using the direct method for the year ended June 30, 2019:

Table (1)

Working notes:

The amount of cash receipts from customers.

Step 1: Calculate the change in accounts receivable.

Step 2: The Calculate the amount of cash receipts from customers.

Calculate the cash payments to suppliers.

Step 1: Calculate the change in inventory.

Step 2: Calculate the change in accounts payable.

Step 3: Calculate the amount of cash payments to suppliers.

Calculate the amount of cash paid for other operating expenses:

Step 1: Calculate the change in prepaid expenses.

Step 2: Calculate the change in wages payable.

Step 3: Calculate the amount of cash paid for other operating expenses.

Calculate the amount of cash paid for income tax expenses:

Step 1: Calculate the change in income taxes payable.

Step 2: Calculate the amount of cash paid for income taxes.

Calculate the cash receipt from sale of equipment:

| Details | Amount ($) | Amount ($) |

| Cost of equipment sold | 48,600 | |

| Less: Accumulated depreciation | (40,600) | |

| Book value of equipment | 8,000 | |

| Gain on sale of equipment | 2,000 | |

| Cash receipt from sale of equipment | $10,000 |

Table (2)

Calculate the amount of cash paid for new equipment:

Calculate the amount of dividend paid:

Want to see more full solutions like this?

Chapter 16 Solutions

Principles of Financial Accounting.

- The following information was taken from Oregon Corporations accounting records for 2019: Oregons statement of cash flows for the year ended December 31, 2019, should show the following amounts for investing and financing activities, based on the preceding information:arrow_forwardSelected information from Brook Corporations accounting records and financial statements for 2019 follows: On the statement of cash flows for the year ended December 31, 2019, Brook should disclose a net increase in cash in the amount of: a. 1,700,000 b. 2,400,000 c. 3,700,000 d. 4,200,000arrow_forwardUse the following excerpts from Mountain Companys financial information to prepare a statement of cash flows (indirect method) for the year 2018.arrow_forward

- Use the following excerpts from Fromera Companys financial information to prepare the operating section of the statement of cash flows (direct method) for the year 2018.arrow_forwardUse the following excerpts from Victrolia Companys financial information to prepare a statement of cash flows (direct method) for the year 2018.arrow_forwardUse the following excerpts from Stern Companys financial information to prepare a statement of cash flows (indirect method) for the year 2018.arrow_forward

- Use the following excerpts from OpenAir Companys financial information to prepare a statement of cash flows (indirect method) for the year 2018.arrow_forwardUse the following excerpts from Unigen Companys financial information to prepare the operating section of the statement of cash flows (indirect method) for the year 2018.arrow_forwardUse the following excerpts from Wickham Companys financial information to prepare a statement of cash flows (indirect method) for the year 2018.arrow_forward

- Use the following excerpts from Swahilia Companys financial information to prepare a statement of cash flows (direct method) for the year 2018.arrow_forwardUse the following information from Isthmus Companys financial statements to prepare the operating activities section of the statement of cash flows (indirect method) for the year 2018.arrow_forwardUse the following information from Berlin Companys financial statements to prepare the operating activities section of the statement of cash flows (indirect method) for the year 2018.arrow_forward

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning  Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,