a)

To determine: The effects on using leverage on the firm’s value

a)

Explanation of Solution

Compute the Original value of the firm:

Compute the original cost of capital:

With financial leverage (wd=30%):

Increasing the financial leverage by adding debt of $900,000 results in an growth in the value of the firm’s from $3,000,000 to $3,348,214.286.

b)

To determine: The price of Company R’s stock.

b)

Explanation of Solution

Compute price of stock:

Value of equity:

Price of stock:

Hence, price of the stock is $16.741.

c)

To determine: The effects EPS of the firm after recapitalization.

c)

Explanation of Solution

Compute number of shares:

Initial position:

Financial leverage:

EPS:

Hence, change in EPS is $0.342.

d)

To determine: The times-interest-earned ratio and the probability of not covering the interest payment at 30% debt level.

d)

Explanation of Solution

Compute price of stock:

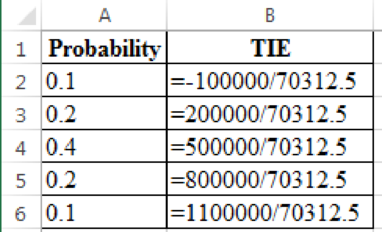

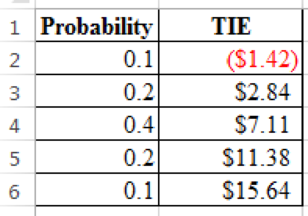

Excel workings:

Excel spread sheet:

- The interest payment is not covered if TIE < 1.0.

- The probability of this occurring is 10%.

Want to see more full solutions like this?

Chapter 15 Solutions

EBK FINANCIAL MANAGEMENT: THEORY & PRAC

- The Rivoli Company has no debt outstanding, and its financial position is given by the following data: What is Rivoli’s intrinsic value of operations (i.e., its unlevered value)? What is its intrinsic stock price? Its earnings per share? Rivoli is considering selling bonds and simultaneously repurchasing some of its stock. If it moves to a capital structure with 30% debt based on market values, its cost of equity, rs, will increase to 12% to reflect the increased risk. Bonds can be sold at a cost, rd, of 7%. Based on the new capital structure, what is the new weighted average cost of capital? What is the levered value of the firm? What is the amount of debt? Based on the new capital structure, what is the new stock price? What is the remaining number of shares? What is the new earnings per share?arrow_forwardBlue Ram Brewing Company currently has no debt in its capital structure, but it is considering using some debt and reducing its outstanding equity. The firm’s unlevered beta is 1.05, and its cost of equity is 12.40%. Because the firm has no debt in its capital structure, its weighted average cost of capital (WACC) also equals 12.40%. The risk-free rate of interest (rRFrRF) is 4%, and the market risk premium (RPMRPM) is 8%. Blue Ram’s marginal tax rate is 25%. Blue Ram is examining how different levels of debt will affect its costs of debt and equity, as well as its WACC. The firm has collected the financial information that follows to analyze its weighted average cost of capital (WACC). Complete the following table. D/Cap Ratio E/Cap Ratio D/E Ratio Bond Rating Before-Tax Cost of Debt (rdrd) Levered Beta (b) Cost of Equity (rsrs) WACC 0.0 1.0 0.00 — — 1.05 12.40% 12.40% 0.2 0.8 0.25 A 8.4% 13.976% 12.441% 0.4 0.6 0.67 BBB 8.9% 1.575 16.600% 0.6…arrow_forwardAn unlevered firm has expected earnings of $2,401 and a market value of equity of $19,600. The firm is planning to issue $4,000 of debt at 6 percent interest and use the proceeds to repurchase shares at their current market value. Ignore taxes. What will be the cost of equity after the repurchase?arrow_forward

- Blue Ram Brewing Company currently has no debt in its capital structure, but it is considering using some debt and reducing its outstanding equity. The firm's unlevered beta is 1.1, and its cost of equity is 11.80%. Because the firm has no debt in its capital structure, its weighted average cost of capital (WACC) also equals 11.80%. The risk-free rate of interest (rRF) is 3%, and the market risk premium (RP) is 8%. Blue Ram's marginal tax rate is 35%. Blue Ram is examining how different levels of debt will affect its costs of debt and equity, as well as its WACC. The firm has collected the financial information that follows to analyze its weighted average cost of capital (WACC). Complete the following table. D/Cap E/Сap Bond Before-Tax Cost of Levered Beta Cost of Equity ( Ratio Ratio D/E Ratio Rating Debt (ra) (b) Is) WACC 0.0 1.0 0.00 1.1 11.80% 11.80% 0.2 0.8 0.25 A 8.4% 13.232% 11.678% 0.4 0.6 0.67 BBB 8.9% 1.577 15.616% 0.6 0.4 1.50 BB 11.1% 2.173 12.483% 0.8 0.2 14.3% 3.960…arrow_forwardProkter and Gramble (PKGR) has historically maintained a debt-equity ratio of approximately 0.23. Its current stock price is $54 per share, with 2.1 billion shares outstanding. The firm enjoys very stable demand for its products, and consequently it has a low equity beta of 0.575 and can borrow at 4.3%, just 20 basis points over the risk-free rate of 4.1%. The expected return of the market is 9.9%, and PKGR's tax rate is 26%. a. This year, PKGR is expected to have free cash flows of $5.5 billion. What constant expected growth rate of free cash flow is consistent with its current stock price? b. PKGR believes it can increase debt without any serious risk of distress or other costs. With a higher debt-equity ratio of 0.575, it believes its borrowing costs will rise only slightly to 4.6%. If PKGR announces that it will raise its debt-equity ratio to 0.575 through a leveraged recap, determine the increase or decrease in the stock price that would result from the…arrow_forwardHandmon Enterprises is currently an all-equity firm with an expected return of 10.4%, it is considering borrowing money to buy back some of its existing shores Assume perfect capital markets. Suppose Hardmon borrows to the point that its debt-equity ratio is 0.50. With this amount of debt, the debt cost of capital is 4%. What will be the expected return of equity after this transaction b. Suppose instead Hardmon borrows to the point that its debl-equity ratio is 1.50. With this amount of debt, Handmon's debt will be much riskier. As a result, the debt cost of capital will be 6%. What will be the expected retum of equity in this case? A senior manager argues that it is in the best interest of the shareholders to choose the capital structure that leads to the highest expected return for the stock. How would you respond to this a Suppose Harmon bonows to the point that its debt-equity radio is 0.50 With this amount of debt, the debt cost of capital is 4%. What will be the expected retum…arrow_forward

- Remex (RMX) currently has no debt in its capital structure. The beta of its equity is 1.42. For each year into the indefinite future, Remex's free cash flow is expected to equal $28 million. Remex is considering changing its capital structure by issuing debt and using the proceeds to buy back stock. It will do so in such a way that it will have a 28% debt-equity ratio after the change, and it will maintain this debt-equity ratio forever. Assume that Remex's debt cost of capital will be 6.11%. Remex faces a corporate tax rate of 15%. Except for the corporate tax rate of 15%, there are no market imperfections. Assume that the CAPM holds, the risk-free rate of interest is 4.7%, and the expected return on the market is 10.34%. a. Using the information provided, fill in the table below. b. Using the information provided and your calculations in part (a), determine the value of the tax shield acquired by Remex if it changes its capital structure in the way it is considering. a. Using the…arrow_forwardXYZ Fried Chicken is trying to determine its WACC at the optimal capital structure. The firm now has only debt and equity, and estimates that it will continue to use only debt and equity in the future also. It has determined that the optimal capital structure is given by a debt-to-equity ratio of 0.5. At this ratio, its pre-tax cost of debt is 6%. It has estimated that if it had no debt, then its beta would be 1.2. Assume the risk-free rate is 2% and the market risk premium is 8%. Assume the firm? ’s tax rate is 40%. Based on this information, what is the WACC at the optimal capital structure?arrow_forwardRemex (RMX) currently has no debt in its capital structure. The beta of its equity is 1.44. For each year into the indefinite future, Remex's free cash flow is expected to equal $26 million. Remex is considering changing its capital structure by issuing debt and using the proceeds to buy back stock. It will do so in such a way that it will have a 25% debt-equity ratio after the change, and it will maintain this debt-equity ratio forever. Assume that Remex's debt cost of capital will be 6.37%. Remex faces a corporate tax rate of 15%. Except for the corporate tax rate of 15%, there are no market imperfections. Assume that the CAPM holds, the risk-free rate of interest is 4.9%, and the expected return on the market is 10.78%. a. Using the information provided, fill in the table below. b. Using the information provided and your calculations in part (a), determine the value of the tax shield acquired by Remex if it changes its capital structure in the way it is…arrow_forward

- Hardmon Enterprises is currently an all-equity firm with an expected return of 18%. It is considering a leveraged recapitalization in which it would borrow and repurchase existing shares. (Assume perfect capital markets.) a. Suppose Hardmon borrows to the point that its debt-equity ratio is 0.50. With this amount of debt, the debt cost of capital is 5%. What will the expected return of equity be after this transaction? b. Suppose instead Hardmon borrows to the point that its debt-equity ratio is 1.50. With this amount of debt, Hardmon's debt will be much riskier. As a result, the debt cost of capital will be 7%. What will the expected return of equity be in this case? c. A senior manager argues that it is in the best interest of the shareholders to choose the capital structure that leads to the highest expected return for the stock. How would you respond to this argument? a. Suppose Hardmon borrows to the point that its debt-equity ratio is 0.50. With this amount of debt, the debt cost…arrow_forwardWintermelon Corp.'s controller is considering a change in the capital structure consisting of 40% debt and 60% equity. Initially, Winter Melon Corp.'s tax rate is 40%, its beta is 2.5, and it has no debt. The risk-free rate is 3.0 percent and the market risk premium is 7.0 percent. What is the beta if the company did not resort to debt financing? * Your answerarrow_forwardCompany X is considering an expansion. The project has an estimated internal rate of return equal to 8%. The company has a debt to equity ratio equal to one. The yield to maturity on its bonds is 5%, while the cost of the company’s equity is estimated to be 15%. The company’s CEO, who is keen on the expansion project, argues that the project would be profitable if the company were to entirely finance it by issuing debt. The CFO, however, is sceptical and believes there is a logical flaw in the CEO’s argument. Who do you think is right? In no more than 200 words, give reasons for your answer by referencing relevant corporate finance theories.arrow_forward