Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

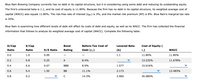

Transcribed Image Text:**Blue Ram Brewing Company Capital Structure Analysis**

Blue Ram Brewing Company is assessing the impact of introducing debt into its capital structure to replace some of its equity. This analysis involves estimating how different debt levels could affect the company's costs of debt and equity, as well as its weighted average cost of capital (WACC).

**Initial Conditions and Assumptions:**

- **Unlevered Beta:** 1.1

- **Cost of Equity (Unlevered):** 11.80%

- **Weighted Average Cost of Capital (Initial):** 11.80%

- **Risk-Free Rate of Interest:** 3% (\(i_{RF}\))

- **Market Risk Premium:** 8% (RP)

- **Marginal Tax Rate:** 35%

**Objective:**

To understand the financial effects of varying levels of debt on Blue Ram's capital costs and overall WACC.

**Analysis Overview:**

| **D/Cap Ratio** | **E/Cap Ratio** | **D/E Ratio** | **Bond Rating** | **Before-Tax Cost of Debt (\(r_d\))** | **Levered Beta (\(b\))** | **Cost of Equity (\(r_s\))** | **WACC** |

|-----------------|-----------------|---------------|----------------|---------------------------------------|--------------------------|------------------------------|-----------|

| 0.0 | 1.0 | 0.00 | — | — | 1.1 | 11.80% | 11.80% |

| 0.2 | 0.8 | 0.25 | A | 8.4% | — | 13.232% | 11.678% |

| 0.4 | 0.6 | 0.67 | BBB | 8.9% | 1.577 | 15.616% | 11.685% |

| 0.6 | 0.4 | 1.50 | BB | 11.1% | 2.173 | — | 12.483% |

| 0.8 | 0.2 | — | C | 14.3% | 3.960 | 34.680% | —

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Ganado's Cost of Capital. Maria Gonzalez, Ganado's Chief Financial Officer, estimates the risk-free rate to be 3.30%, the company's credit risk premium is 3.60%, the domestic beta is estimated at 0.94, the international beta is estimated at 0.61, and the company's capital structure is now 75% debt. The expected rate of return on the market portfolio held by a well-diversified domestic investor is 9.80% and the expected return on a larger globally integrated equity market portfolio is 8.60%. The before-tax cost of debt estimated by observing the current yield on Ganado's outstanding bonds combined with bank debt is 7.60% and the company's effective tax rate is 42%. For both the domestic CAPM and ICAPM, calculate the following: a. Ganado's cost of equity b. Ganado's after-tax cost of debt c. Ganado's weighted average cost of capital a. Using the domestic CAPM, what is Ganado's cost of equity? % (Round to two decimal places.)arrow_forwardPlease show all steps or else skip, all parts pls i will definitely like or else dislike thanksarrow_forwardA firm's unlevered beta is 0.5 and tax rate is 30%. If it is with 20% debt. What is the firm's levered beta? 0.9012 1.2533 0.5875 0.6235arrow_forward

- Consider this case: Globex Corp. currently has a capital structure consisting of 30% debt and 70% equity. However, Globex Corp.'s CFO has suggested that the firm increase its debt ratio to 50%. The current risk-free rate is 3.5%, the market risk premium is 7.5%, and Globex Corp.'s beta is 1.15. If the firm's tax rate is 25%, what will be the beta of an all-equity firm if its operations were exactly the same? Now consider the case of another company: US Robotics Inc. has a current capital structure of 30% debt and 70% equity. Its current before-tax cost of debt is 10%, and its tax rate is 25%. It currently has a levered beta of 1.15. The risk-free rate is 3.5%, and the risk premium on the market is 7.5%. US Robotics Inc. is considering changing its capital structure to 60% debt and 40% equity. Increasing the firm's level of debt will cause its before-tax cost of debt to increase to 12%. First, solve for US Robotics Inc.'s unlevered beta. Use US Robotics Inc.'s unlevered beta to solve…arrow_forwardHampton Corporation has a beta of 1.6 and a marginal tax rate of 34%. The expected return on the market is 11% and the risk-free interest rate is 6%. Estimate the firm's cost of internal equity. 13.8% 6.56% 12.8% 12.5% 14.0%arrow_forwardA company is considering its optimal capital structure. The firm currently has 1 million shares outstanding at $ 20 per share (tax rate = 40%) and a debt balance of $5 million. Currently, its (levered) beta is 1.5 and its ERP is 5.5%. The current risk-free rate is 5%. Your research indicate the following ratings and pre-tax cost of debt across the different debt ratios: D/(D+E) Rating Pre-tax cost of debt 0% AAA 10% 10% AA 10.5% 20% A 11% 30% BBB 12% 40% BB 13% 50% B 14% 60% CCC 16% 70% CC 18% 80% C 20% 90% D 25% a. Using the optimal WACC approach, what is the firm's optimal debt ratio? b. Calculate the company's unlevered value, assuming that the probability of default is 5% and the company loses 30% of its value in the event of a default.arrow_forward

- NewLinePhone Corp. is very risky, with a beta equal to 2.8 and a standard deviation of returns of 32%. The risk-free rate of return is 3% and the market risk premium is 8%. NewLinePhone's marginal tax rate is 35%. Use the capital asset pricing model (CAPM) to estimate NewLinePhone's cost of retained earnings. (*You must show your calculation process as well.)arrow_forwardCorcovado Pharmaceuticals. Corcovado Pharmaceutical’s cost of debt is 7%. The risk-free rate of interest is 3%. The expected return on the market portfolio is 8%. After effective taxes, Corcovado’s effective tax rate is 25%. Its optimal capital structure is 60% debt and 40% equity. If Corcovado’s beta is estimated at 1.1, what is its weighted average cost of capital? If Corcovado’s beta is estimated at 0.8, significantly lower because of the continuing profit prospects in the global pharma sector, what is its weighted average cost of capital?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education