Financial Accounting

15th Edition

ISBN: 9781337272124

Author: Carl Warren, James M. Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 15, Problem 7E

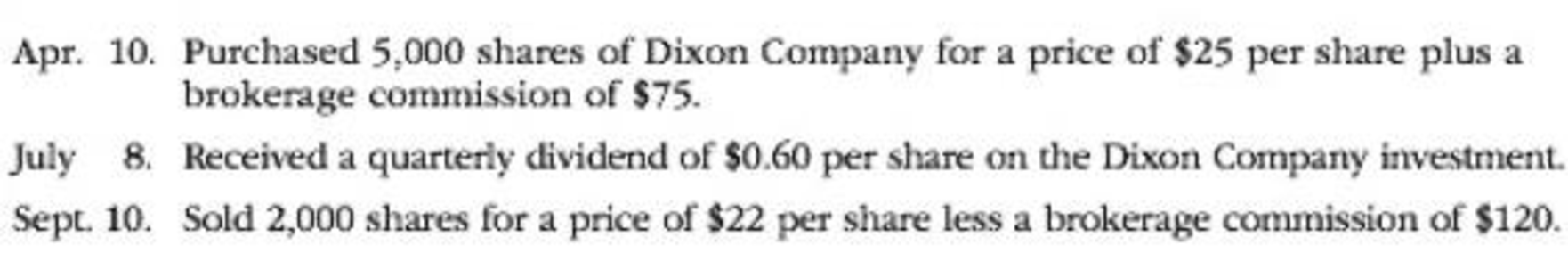

The following equity investment transactions were completed by Romero Company during a recent year:

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Please solve this accounting problem not use ai and chatgpt

Financial Accounting

Khayyam Company, which sells tents, has provided the following information:

Sales price per unit

Variable cost per unit

$40

19

$12,800

Fixed costs per month

What are the required sales in units for Khayyam to break even? (Round your answer up to the nearest whole unit.)

OA. 217 units

B. 674 units

OC. 610 units

D. 320 units

Chapter 15 Solutions

Financial Accounting

Ch. 15 - Why might a business invest cash in temporary...Ch. 15 - What causes a gain or loss on the sale of a bond...Ch. 15 - When is the equity method the appropriate...Ch. 15 - Prob. 4DQCh. 15 - Prob. 5DQCh. 15 - Prob. 6DQCh. 15 - Prob. 7DQCh. 15 - Prob. 8DQCh. 15 - Prob. 9DQCh. 15 - Prob. 10DQ

Ch. 15 - Prob. 1PEACh. 15 - Prob. 1PEBCh. 15 - Prob. 2PEACh. 15 - Prob. 2PEBCh. 15 - Prob. 3PEACh. 15 - Prob. 3PEBCh. 15 - On January 1, Valuation Allowance for Trading...Ch. 15 - On January 1, Valuation Allowance for Trading...Ch. 15 - On January 1, Valuation Allowance for...Ch. 15 - On January 1, Valuation Allowance for...Ch. 15 - On June 30, Setzer Corporation had a market price...Ch. 15 - Prob. 6PEBCh. 15 - Prob. 1ECh. 15 - Prob. 2ECh. 15 - Bocelli Co. purchased 120,000 of 6%, 20-year Sanz...Ch. 15 - Prob. 4ECh. 15 - Prob. 5ECh. 15 - On February 22, Stewart Corporation acquired...Ch. 15 - The following equity investment transactions were...Ch. 15 - Yerbury Corp. manufactures construction equipment....Ch. 15 - Seamus Industries Inc. buys and sells investments...Ch. 15 - Prob. 10ECh. 15 - Prob. 11ECh. 15 - On January 6, Year 1, Bulldog Co. purchased 34% of...Ch. 15 - Hawkeye Companys balance sheet reported, under the...Ch. 15 - JED Capital Inc. makes investments in trading...Ch. 15 - The investments of Charger Inc. include a single...Ch. 15 - Gruden Bancorp Inc. purchased a portfolio of...Ch. 15 - Last Unguaranteed Financial Inc. purchased the...Ch. 15 - The income statement for Delta-tec Inc. for the...Ch. 15 - Highland Industries Inc. makes investments in...Ch. 15 - The investments of Steelers Inc. include a single...Ch. 15 - Prob. 21ECh. 15 - Storm, Inc. purchased the following...Ch. 15 - During Year 1, its first year of operations,...Ch. 15 - During Year 2, Copernicus Corporation held a...Ch. 15 - Prob. 25ECh. 15 - The market price for Microsoft Corporation closed...Ch. 15 - Prob. 27ECh. 15 - Prob. 28ECh. 15 - Prob. 29ECh. 15 - Soto Industries Inc. is an athletic footware...Ch. 15 - Rios Financial Co. is a regional insurance company...Ch. 15 - Forte Inc. produces and sells theater set designs...Ch. 15 - Prob. 4PACh. 15 - Rekya Mart Inc. is a general merchandise retail...Ch. 15 - Prob. 2PBCh. 15 - Glacier Products Inc. is a wholesaler of rock...Ch. 15 - Teasdale Inc. manufactures and sells commercial...Ch. 15 - Selected transactions completed by Equinox...Ch. 15 - Prob. 1CPCh. 15 - Prob. 2CPCh. 15 - Berkshire Hathaway, the investment holding company...Ch. 15 - On July 16, 20Y1, Wyatt Corp. purchased 40 acres...Ch. 15 - International Financial Reporting Standard No. 16...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please need help with this accounting question answer do fastarrow_forwardJingle Ltd. and Bell Ltd. belong to the same industry. A snapshot ofsome of their financial information is given below: Jingle Ltd. Bell Ltd. Current Ratio 3.2 : 1 2 : 1 Acid - Test Ratio 1.7 : 1 1.1 : 1 Debt-Equity Ratio 30% 40% Times Interest earned 6 5 You are a loans officer and both companies have asked for an equal2-year loan. i) If you could facilitate only one loan, which company wouldyou refuse? Explain your reasoning brieflyii) If both companies could be facilitated, would you be willingto do so? Explain your argument briefly.arrow_forwardDetermine the total fixed costs of these accounting questionarrow_forward

- Perreth Drycleaners has capacity to clean up to 5,000 garments per month. Requirements 1. Complete the schedule below for the three volumes shown. 2. Why does the average cost per garment change? 3. Suppose the owner, Dale Perreth, erroneously uses the average cost per unit at full capacity to predict total costs at a volume of 2,000 garments. Would he overestimate or underestimate his total costs? By how much? Requirement 1. Complete the following schedule for the three volumes shown. (Round all unit costs to the nearest cent and all total costs to the nearest whole dollar.) Total variable costs Total fixed costs Total operating costs Variable cost per garment Fixed cost per garment 2,000 Garments 3,500 Garments 5,000 Garments $ 2,800 2.00 Average cost per garment Requirement 2. Why does the average cost per garment change? The average cost per garment changes as volume changes, due to the component of the dry cleaner's costs. The cost per unit decreases as volume , while the variable…arrow_forwardI need answer of this general accounting questionarrow_forwardCalculate the day's sales in receivables for this accounting questionarrow_forward

- Need help with this accounting questionarrow_forwardWhat is the number of shares outstanding for this accounting question?arrow_forwardQuestion 2Anti-Pandemic Pharma Co. Ltd. reports the following information inits income statement:Sales = $5,250,000;Costs = $2, 173,000;Other expenses = $187,400;Depreciation expense = $79,000;Interest expense= $53,555;Taxes = $76,000;Dividends = $69,000.$136,700 worth of new shares were also issued during the year andlong-term debt worth $65,300 was redeemed.a) Compute the cash flow from assetsb) Compute the net change in working capitalarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning- Business/Professional Ethics Directors/Executives...AccountingISBN:9781337485913Author:BROOKSPublisher:Cengage

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...

Accounting

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:Cengage Learning

Business/Professional Ethics Directors/Executives...

Accounting

ISBN:9781337485913

Author:BROOKS

Publisher:Cengage

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Stockholders Equity: How to Calculate?; Author: Accounting University;https://www.youtube.com/watch?v=2jZk1T5GIlw;License: Standard Youtube License