Financial Accounting

14th Edition

ISBN: 9781305088436

Author: Carl Warren, Jim Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 15, Problem 4PA

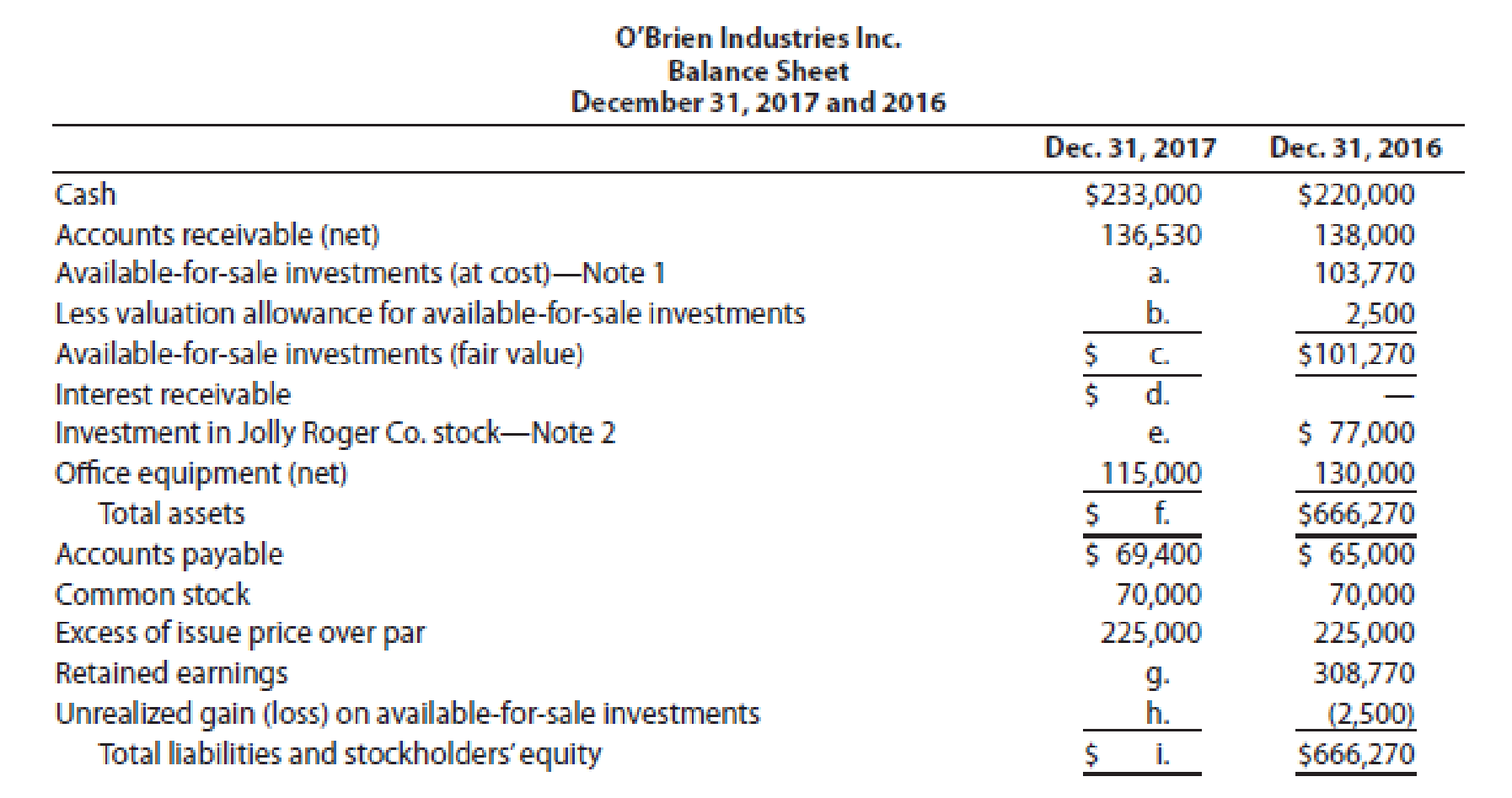

O’Brien Industries Inc. is a book publisher. The comparative unclassified balance sheets for December 31, 2017 and 2016 follow. Selected missing balances are shown by letters.

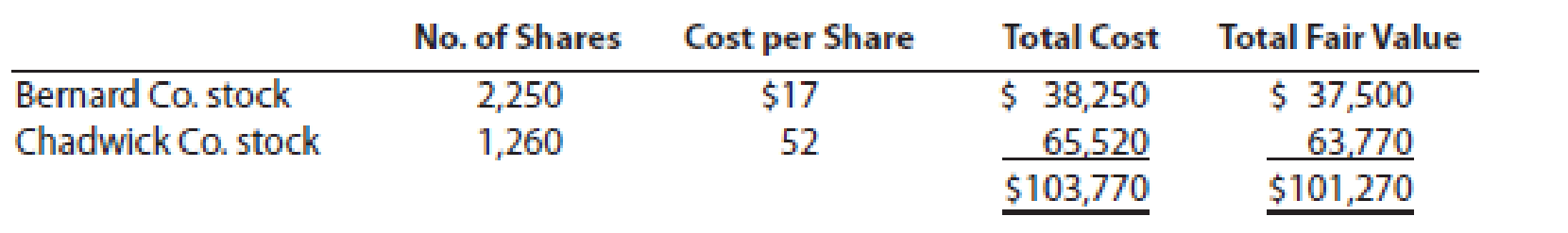

Note 1. Investments are classified as available for sale. The investments at cost and fair value on December 31, 2016, are as follows:

Note 2. The investment in Jolly Roger Co. stock is an equity method investment representing 30% of the outstanding shares of Jolly Roger Co. The following selected investment transactions occurred during 2017:

| May 5. | Purchased 3,080 shares of Gozar Inc. at $30 per share including brokerage commission. Gozar Inc. is classified as an available-for-sale security. |

| Oct. 1. | Purchased $40,000 of Nightline Co. 6%, 10-year bonds at 100. The bonds are classified as available for sale. The bonds pay interest on October 1 and April 1. |

| 9. | Dividends of $12,500 are received on the Jolly Roger Co. investment. |

| Dec. 31. | Jolly Roger Co. reported a total net income of $112,000 for 2017. O’Brien Industries Inc. recorded equity earnings for its share of Jolly Roger Co. net income. |

| 31. | Accrued three months of interest on the Nightline bonds. |

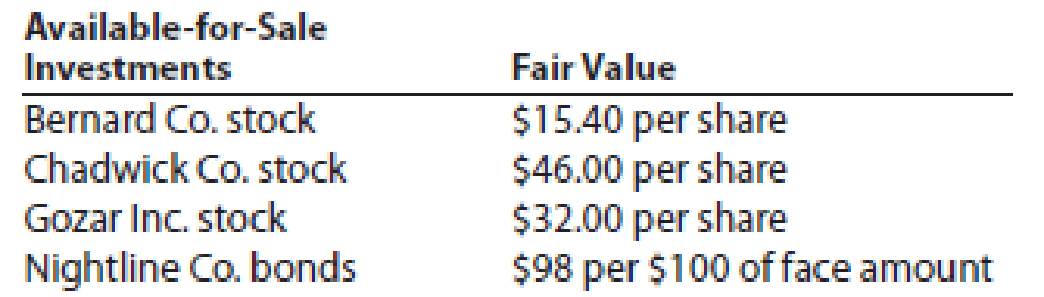

| 31. | Adjusted the available-for-sale investment portfolio to fair value, using the following fair value per-share amounts: |

| 31. | Closed the O’Brien Industries Inc. net income of $146,230. O’Brien Industries Inc. paid no dividends during the year. |

Instructions

Determine the missing letters in the unclassified balance sheet. Provide appropriate supporting calculations.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Record the appropriate journal entry to reflect the following:

The investments that Veggies-R-Us. Inc. currently has in their investment account (current asset) represents investments that were purchased recently. Based upon stock market auotes obtained for December 31, 20XX, the market value of these investments = $112,000. (It is management's intent to actively manage these shares for profit.)

You have been provided with the partial Trail Balance for this company below:

Veggies-R-Us.

Trial Balance (Partial)

December 31, 20XX

Cash $26,750 (Debit)

Accounts Receivable $47,630 (Debit)

Allowance for doubtful accounts $250 (Debit)

Prepaid rent $1,680 (Debit)

Supplies $8,700 (Debit)

Investments $113,520 (Debit)

Furniture $15,350 (Debit)

JED Capital Inc. makes investments in trading securities. Selected income statement items for the years ended December 31, Year 2 and Year 3, plus selected items from comparative balance sheets, are as follows:

Please see the attachment for details:

Determine the missing lettered items.

Following balances are extracted from the books of City Light Supply Corporation

$

as on 31st March, 2016 :

$

Equity Shares

Debentures

Sundry Creditors on Open Accounts

Depreciation Fund

Capital Expenditure on 31-3-2015

Capital Expenditure during 2015-16

Sundry Debtors for Current Supplied

Other Debtors

Stores in Hand

Cash in Hand

Cost of Generation of Electricity

Cost of Distribution of Electricity

Rent, Rates and Taxes

Management Expenses

Depreciation

Interest on Debentures

Interim Dividend

Sale of Current

Meter Rent

Balance of Net Revenue Account as on 1st April, 2015

1,64,700

60,000

300

75,000

2,85,000

18,300

12,000

150

1,500

1,500

9,000

1,500

1,500

3,600

6,000

3,000

6,000

39,000

1,500

8,550

3,49,050

3,49,050

Prepare:-

(a) Capital Account

(b) Revenue Account

(c) Net Revenue Account and

(d) General Balance sheet from the above Trail Balance.

Chapter 15 Solutions

Financial Accounting

Ch. 15.MJ - Prob. 1DQCh. 15.MJ - What is the difference between classifying an...Ch. 15.MJ - If a functional expense classification is used for...Ch. 15.MJ - Prob. 4DQCh. 15.MJ - What are two main differences in inventory...Ch. 15.MJ - Prob. 6DQCh. 15.MJ - Prob. 7DQCh. 15.MJ - Prob. 8DQCh. 15.MJ - Prob. 9DQCh. 15.MJ - How is treasury stock reported under IFRS? How...

Ch. 15.MJ - IFRS Activity 1

Unilever Group is a global company...Ch. 15.MJ - IFRS Activity 2 The following is a recent...Ch. 15.MJ - Prob. 3IFRSCh. 15 - Why might a business invest cash in temporary...Ch. 15 - What causes a gain or loss on the sale of a bond...Ch. 15 - When is the equity method the appropriate...Ch. 15 - Prob. 4DQCh. 15 - Prob. 5DQCh. 15 - Prob. 6DQCh. 15 - Prob. 7DQCh. 15 - Prob. 8DQCh. 15 - Prob. 9DQCh. 15 - Prob. 10DQCh. 15 - Prob. 1PEACh. 15 - Prob. 1PEBCh. 15 - On February 10, 15,000 shares of Sting Company are...Ch. 15 - Prob. 2PEBCh. 15 - Prob. 3PEACh. 15 - Prob. 3PEBCh. 15 - Prob. 4PEACh. 15 - Prob. 4PEBCh. 15 - Prob. 5PEACh. 15 - On January 1, 2016, Valuation Allowance for...Ch. 15 - Prob. 6PEACh. 15 - Prob. 6PEBCh. 15 - Parilo Company acquired 170,000 of Makofske Co.,...Ch. 15 - Prob. 2ECh. 15 - Prob. 3ECh. 15 - Prob. 4ECh. 15 - Prob. 5ECh. 15 - On March 4, Breen Corporation acquired 7,500...Ch. 15 - Prob. 7ECh. 15 - Prob. 8ECh. 15 - Seamus Industries Inc. buys and sells investments...Ch. 15 - Prob. 10ECh. 15 - Prob. 11ECh. 15 - Prob. 12ECh. 15 - Prob. 13ECh. 15 - JED Capital Inc. makes investments in trading...Ch. 15 - Prob. 15ECh. 15 - Prob. 16ECh. 15 - Prob. 17ECh. 15 - Prob. 18ECh. 15 - Prob. 19ECh. 15 - The investments of Steelers Inc. include a single...Ch. 15 - Prob. 21ECh. 15 - Storm, Inc. purchased the following...Ch. 15 - Prob. 23ECh. 15 - Prob. 24ECh. 15 - Prob. 25ECh. 15 - Prob. 26ECh. 15 - Prob. 27ECh. 15 - Prob. 28ECh. 15 - Prob. 29ECh. 15 - Prob. 1PACh. 15 - Prob. 2PACh. 15 - Prob. 3PACh. 15 - OBrien Industries Inc. is a book publisher. The...Ch. 15 - Prob. 1PBCh. 15 - Prob. 2PBCh. 15 - Prob. 3PBCh. 15 - Prob. 4PBCh. 15 - Selected transactions completed by Equinox...Ch. 15 - On July 16, 1998, Wyatt Corp. purchased 40 acres...Ch. 15 - International Financial Reporting Standard No. 16...Ch. 15 - Prob. 3CPCh. 15 - Berkshire Hathaway, the investment holding company...Ch. 15 - Prob. 5CP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- REQUIRED: (Round all numbers to the nearest RM) (a) Prepare related journal entries to record the above transactions. (b) Prepare an extract of the Statement of Profit or Loss and Other Comprehensive Income for the year ended 2017. (c) Explain the general accounting and reporting rule for equity investment of held-for-trading and non-trading.arrow_forwardAccounting for equity investments Money Man Investments completed the following transactions during 2018: Requirements Journalize Money Man’s transactions. Explanations are not required. Classify and prepare partial financial statements for Money Man’s 25% Technomite investment for the year ended December 31, 2018.arrow_forwardThe following was reported by Church Financial in its December 31, 2024, financial statements: Investments at FVTPL, December 31, 2023 Investments at FVTPL, December 31, 2024. Investment income or (loss) Additional information: 1. 2. 3. $13,400 18,300 (600) The investments at FVTPL are investments in equity securities held for trading purposes. Investment income or loss consists of: holding gain on the FVTPL investments of $3,100, and loss on sale of the FVTPL investments of $3,700. The carrying amount of the FVTPL investment sold was $4,900.arrow_forward

- Threads Limited manufactures nuts and bolts, which are sold to industrial users. The abbreviated financial statements for 2018 and 2019 are as follows: See images Dividends were paid on ordinary shares of £70,000 and £72,000 for 2018 and 2019, respectively. Required: (a) Calculate the following financial ratios for both 2018 and 2019 (using year-end figures for statement of financial position items): 1 return on capital employed 2 operating profifit margin 3 gross profifit margin 4 current ratio 5 acid test ratio 6 settlement period for trade receivables 7 settlement period for trade payables 8 inventories turnover period. (b) Comment on the performance of Threads Limited from the viewpoint of a business considering supplying a substantial amount of goods to Threads Limited on usual trade credit terms.arrow_forwardInstrument Corp. has the following equity investments which were held throughout 2010-2011: Fair Value Cost 12/31/10 12/31/11 FVTOCI $300,000 $400,000 $420,000 FVTPL 300,000 320,000 380,000 What amount of gain or loss would Instrument Corp. report in its income statement for the year ended December 31, 2011 related to Its Investments and what amount is reported in its statement of financial position ended December 31, 2011 for its investments? S Investment gain and Sarrow_forwarda) Prepare any journal entries you consider necessary, including year-end entries (December 31), assuming these investments (except investment in Coconut Plc. share) are managed to profit from changes in market price (held for trading). Benji Company doesn’t have equity investment before 2020. b) Prepare a partial statement of financial position showing the Investment account at December 31, 2020arrow_forward

- The accountant of Crane Shoe has compiled the following information from the company’s records as a basis for an income statement for the year ended December 31, 2022. Rent revenue £ 23,200 Interest expense 14,400 Unrealized gain on equity securities designated at fair value through other comprehensive income, net of tax 24,800 Selling expenses 112,000 Income tax 24,480 Administrative expenses 144,800 Cost of goods sold 412,800 Net sales 784,000 Cash dividends declared 12,800 Loss on sale of plant assets 12,000 There were 20,000 ordinary shares outstanding during the year. (a) Prepare a comprehensive income statement using the combined statement approach. (Round earnings per share to 2 decimal places, e.g. 1.48.) CRANE SHOEStatement of Comprehensive Incomechoose the accounting period enter an income statement item £ enter a pound amount enter an income statement item enter a pound…arrow_forwardThe accountant of Crane Shoe has compiled the following information from the company’s records as a basis for an income statement for the year ended December 31, 2022. Rent revenue £ 23,200 Interest expense 14,400 Unrealized gain on equity securities designated at fair value through other comprehensive income, net of tax 24,800 Selling expenses 112,000 Income tax 24,480 Administrative expenses 144,800 Cost of goods sold 412,800 Net sales 784,000 Cash dividends declared 12,800 Loss on sale of plant assets 12,000 There were 20,000 ordinary shares outstanding during the year. (a) New attempt is in progress. Some of the new entries may impact the last attempt grading. Your answer is partially correct. Prepare a comprehensive income statement using the combined statement approach. (Round earnings per share to 2 decimal places, e.g. 1.48.) CRANE SHOEStatement of Comprehensive Incomechoose the accounting…arrow_forwardFollowing is a portion of the investments footnote from Redfield Inc.'s 2017 annual report. (in millions) 2017 Amortized cost of marketable equity $546,673 Gross unrealized gains 13,114 Gross unrealized losses $ 38,983 What amount does Redfield report for its passive investments in marketable equity securities on it 2017 balance sheet?arrow_forward

- The beginning balance sheet of Desk Source Co. included a $700,000 investment in Est stock (25% ownership, Desk has significant influence over Est). During the year, Desk Source completed the following investment transactions: i (Click the icon to view the transactions.) Read the requirements. Requirement 1. Journalize the transactions for the year of Desk Source. (Record debits first, then credits. Select the explanation on the last line of the journal entry table. If no entry is required, select "No entry required" on the first line of the Accounts and Explanation column and leave the remaining cells blank.) Mar. 3: Purchased 9,000 shares at $8 per share of Rast Software common stock as a long-term equity investment, representing 2% ownership, no signifi Date Accounts and Explanation Credit Mar. 3 Requirements Debit 1. Journalize the transactions for the year of Desk Source. 2. Post transactions to T-accounts to determine the December 31, 2024, balances related to the investment and…arrow_forwardThe condensed financial statements of John Cully Company, for the years ended June 30, 2017 and 2016, are presented below. Compute the following ratios for 2017 and 2016. Return on assets. (Assets on 6/30/15 were $3,349.9.) Return on common stockholders’ equity. (Stockholders’ equity on 6/30/15 was $1,795.9.) Debt to assets ratio. Times interest earned.arrow_forwardBI's income for the year ended December 31, 2021 was $ 4,000,000. This was earned evenly over the year. In addition BI paid dividends of $ 300,000 each on March 31, June 30, September 30 and December 31, 2021 to their shareholders of records on that date. The inventory on July 1, 2021 was 75% sold as of December 31, 2021. Required. For the investment in AI 1. Using IFRS 9 prepare the journal entries for DC for all of 2021. 2. Using ASPE prepare the journal entries for DC for all of 2021. For the investment in BI 3. Using IFRS prepare the journal entries for DC for 2021. 4. Using ASPE prepare the joumal entries for DC for 2021 for all options available under ASPE.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial instruments products; Author: fi-compass;https://www.youtube.com/watch?v=gvxozM3TUIg;License: Standard Youtube License