ATC 9-1 Business Applications Case Analyzing segments at Coca-Cola

The following excerpt is from Coca-Cola Company’s 2014 annual report filed with the SEC:

Management evaluates the performance of our operating segments separately to individually monitor the different factors affecting financial performance. Our Company manages income taxes and certain treasury-related items, such as interest income and expense, on a global basis within the Corporate operating segment. We evaluate segment performance based on income or loss before income taxes.

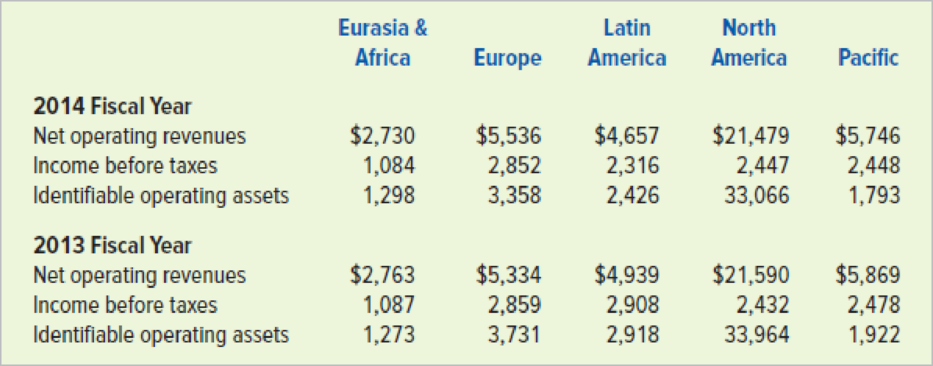

Below are selected segment data for Coca-Cola Company for the 2014 and 2013 fiscal years. Dollar amounts are in millions.

Required

- a. Compute the

ROI for each of Coke’s geographical segments for each fiscal year. Which segment appears to have the best performance during 2014 based their ROIs? Which segment showed the most improvement from 2013 to 2014? - b. Assuming Coke’s management expects a minimum return of 30 percent, calculate the residual income for each segment for each fiscal year. Which segment appears to have the best performance based on residual income? Which segment showed the most improvement from 2013 to 2014?

- c. Explain why the segment with the highest ROI in 2013 was not the segment with the highest residual income.

- d. Assume the management of Coke is considering a major expansion effort for the next five years. On which geographic segment would you recommend Coke focus its expansion efforts? Explain the rationale for your answer.

a.

Ascertain the return on investment (ROI) for each of the geographical segments of Company CC for the years 2014 and 2013, indicate the segment that has performed well in 2014, based on the ROI, and indicate the segment that has improved from 2013 to 2014.

Explanation of Solution

Return on investment (ROI): This financial ratio evaluates how efficiently the assets are used in earning income from operations. So, ROI is a tool used to measure and compare the performance of a units or divisions of companies.

Formula of ROI:

Ascertain the ROI of Segment EA for the years 2013 and 2014.

| Particulars | 2013 | 2014 |

| Income before taxes | $1,087,000,000 | $1,084,000,000 |

| Identifiable operating assets | ÷ 1,273,000,000 | ÷ 1,298,000,000 |

| ROI | 85.4% | 83.5% |

Table (1)

Ascertain the ROI of Segment E for the years 2013 and 2014.

| Particulars | 2013 | 2014 |

| Income before taxes | $2,859,000,000 | $2,852,000,000 |

| Identifiable operating assets | ÷ 3,713,000,000 | ÷ 3,358,000,000 |

| ROI | 77.0% | 84.9% |

Table (2)

Ascertain the ROI of Segment LA for the years 2013 and 2014.

| Particulars | 2013 | 2014 |

| Income before taxes | $2,908,000,000 | $2,316,000,000 |

| Identifiable operating assets | ÷ 2,918,000,000 | ÷ 2,426,000,000 |

| ROI | 99.7% | 95.5% |

Table (3)

Ascertain the ROI of Segment NA for the years 2013 and 2014.

| Particulars | 2013 | 2014 |

| Income before taxes | $2,432,000,000 | $2,447,000,000 |

| Identifiable operating assets | ÷ 33,964,000,000 | ÷ 33,066,000,000 |

| ROI | 7.2% | 7.4% |

Table (4)

Ascertain the ROI of Segment P for the years 2013 and 2014.

| Particulars | 2013 | 2014 |

| Income before taxes | $2,478,000,000 | $2,448,000,000 |

| Identifiable operating assets | ÷ 1,922,000,000 | ÷ 1,793,000,000 |

| ROI | 128.9% | 136.5% |

Table (5)

Analysis: Of all segments, Segment P has performed well in 2014, with the highest ROI of 136.5%. Segments E, NA, and P have improved from 2013 to 2014.

b.

Ascertain the residual income for each of the geographical segments of Company CC for the years 2014 and 2013, indicate the segment that has performed well in 2014, based on the ROI, and indicate the segment that has improved from 2013 to 2014.

Explanation of Solution

Residual income: The excess of income from operations over the desired acceptable income is referred to as residual income.

Formula of residual income:

Ascertain the residual income for each of the geographical segments of Company CC for the years 2013 (amount in millions).

| Segment | Income Before Taxes | ˗ | = | Residual Income | |

| EA | $1,087 | ˗ | = | $705 | |

| E | 2,859 | ˗ | = | 1,745 | |

| LA | 2,908 | ˗ | = | 2,033 | |

| NA | 2,432 | ˗ | = | (7,757) | |

| P | 2,478 | ˗ | = | 1,901 |

Table (6)

Ascertain the residual income for each of the geographical segments of Company CC for the years 2014 (amount in millions).

| Segment | Income Before Taxes | ˗ | = | Residual Income | |

| EA | $1,084 | ˗ | = | $695 | |

| E | 2,852 | ˗ | = | 1,845 | |

| LA | 2,316 | ˗ | = | 1,588 | |

| NA | 2,447 | ˗ | = | (7,743) | |

| P | 2,448 | ˗ | = | 1,910 |

Table (7)

Analysis: Of all segments, Segment P has performed well in 2014, with the highest residual income of $1,910 million, and Segment LA performed well in 2013, with highest residual income of $2,033 million. Segments E, NA, and P have improved from 2013 to 2014, but Segment E has improved the most.

c.

Explain the reason for the segment with highest ROI in 2013, was not the segment with highest residual income.

Explanation of Solution

Reason: Residual income depends on the operating assets value. Since Segment P had more operating assets, the residual income was lower in 2013, despite highest ROI.

d.

Indicate the segment that stands as the best investment opportunity for Company CC, and give reasons.

Explanation of Solution

Best investment opportunity: Segment P would be the best segment for the investment opportunity for Company CC, based on the ROI. Company CC should consider the non-quantitative factors too before investing in Segment P.

Want to see more full solutions like this?

Chapter 15 Solutions

Survey Of Accounting

- Kanye Achebe just became the operations manager of Weston Transportation. Weston transports large crates for online companies and transports containers overseas. Kanye would like to evaluate each divisional manager on a basis similar to segmental reporting required by generally accepted accounting principles (GAAP) financial statements contained in annual reports. These data include a presentation of net sales, operating profit and loss before and after taxes, total identifiable assets, and depreciation for segment reported. Kanye thinks that evaluating business division managers by the same criteria as the total company is appropriate. A. Explain why you think the chief financial officer (CFO) disagrees and tells Kanye that publicly reporting information might demotivate managers. B. For better evaluation of the managers, what type of information should Kanye propose that the CFO might accept?arrow_forwardEffect of Industry Characteristics on Financial Statement Relations: A Global Perspective. Effective financial statement analysis requires an understanding of a firms economic characteristics. The relations between various financial statement items provide evidence of many of these economic characteristics. Exhibit 1.24 (pages 6667) presents common-size condensed balance sheets and income statements for 12 firms in different industries. These common-size balance sheets and income statements express various items as a percentage of operating revenues. (That is, the statement divides all amounts by operating revenues for the year.) A dash for a particular financial statement item does not necessarily mean the amount is zero. It merely indicates that the amount is not sufficiently large for the firm to disclose it. A list of the 12 companies, the country of their headquarters, and a brief description of their activities follow. A. Accor (France): Worlds largest hotel group, operating hotels under the names of Sofitel, Novotel, Motel 6, and others. Accor has grown in recent years by acquiring established hotel chains. B. Carrefour (France): Operates grocery supermarkets and hypermarkets in Europe, Latin America, and Asia. C. Deutsche Telekom (Germany): Europes largest provider of wired and wireless telecommunication services. The telecommunications industry has experienced increased deregulation in recent years. D. E.ON AG (Germany): One of the major public utility companies in Europe and the worlds largest privately owned energy service provider. E. Fortis (Netherlands): Offers insurance and banking services. Operating revenues include insurance premiums received, investment income, and interest revenue on loans. Operating expenses include amounts actually paid or amounts it expects to pay in the future on insurance coverage outstanding during the year. F. Interpublic Group (U.S.): Creates advertising copy for clients. Interpublic purchases advertising time and space from various media and sells it to clients. Operating revenues represent the commissions or fees earned for creating advertising copy and selling media time and space. Operating expenses include employee compensation. G. Marks Spencer (U.K.): Operates department stores in England and other retail stores in Europe and the United States. Offers its own credit card for customers purchases. H. Nestl (Switzerland): Worlds largest food processor, offering prepared foods, coffees, milk-based products, and mineral waters. I. Roche Holding (Switzerland): Creates, manufactures, and distributes a wide variety of prescription drugs. J. Sumitomo Metal (Japan): Manufacturer and seller of steel sheets and plates and other construction materials. K. Sun Microsystems (U.S.): Designs, manufactures, and sells workstations and servers used to maintain integrated computer networks. Sun outsources the manufacture of many of its computer components. L. Toyota Motor (Japan): Manufactures automobiles and offers financing services to its customers. REQUIRED Use the ratios to match the companies in Exhibit 1.24 with the firms listed above.arrow_forwardBalanced scorecard American Express Company (AXP) is a major financial services company, noted for its American Express card. Below are some of the performance measures used by the company in its balanced scorecard. For each measure, identify whether the measure best fits the innovation, customer, internal process, or financial dimension of the balanced scorecard.arrow_forward

- Effect of Industry Characteristics on Financial Statement Relations. Effective financial statement analysis requires an understanding of a firms economic characteristics. The relations between various financial statement items provide evidence of many of these economic characteristics. Exhibit 1.22 (pages 6061) presents common-size condensed balance sheets and income statements for 12 firms in different industries. These common-size balance sheets and income statements express various items as a percentage of operating revenues. (That is, the statement divides all amounts by operating revenues for the year.) Exhibit 1.22 also shows the ratio of cash flow from operations to capital expenditures. A dash for a particular financial statement item does not necessarily mean the amount is zero. It merely indicates that the amount is not sufficiently large enough for the firm to disclose it. Amounts that are not meaningful are shown as n.m. A list of the 12 companies and a brief description of their activities follow. A. Amazon.com: Operates websites to sell a wide variety of products online. The firm operated at a net loss in all years prior to that reported in Exhibit 1.22. B. Carnival Corporation: Owns and operates cruise ships. C. Cisco Systems: Manufactures and sells computer networking and communications products. D. Citigroup: Offers a wide range of financial services in the commercial banking, insurance, and securities business. Operating expenses represent the compensation of employees. E. eBay: Operates an online trading platform for buyers to purchase and sellers to sell a variety of goods. The firm has grown in part by acquiring other companies to enhance or support its online trading platform. F. Goldman Sachs: Offers brokerage and investment banking services. Operating expenses represent the compensation of employees. G. Johnson Johnson: Develops, manufactures, and sells pharmaceutical products, medical equipment, and branded over-the-counter consumer personal care products. H. Kelloggs: Manufactures and distributes cereal and other food products. The firm acquired other branded food companies in recent years. I. MGM Mirage: Owns and operates hotels, casinos, and golf courses. J. Molson Coors: Manufactures and distributes beer. Molson Coors has made minority ownership investments in other beer manufacturers in recent years. K. Verizon: Maintains a telecommunications network and offers telecommunications services. Operating expenses represent the compensation of employees. Verizon has made minority investments in other cellular and wireless providers. L. Yum! Brands: Operates chains of name-brand restaurants, including Taco Bell, KFC, and Pizza Hut. REQUIRED Use the ratios to match the companies in Exhibit 1.22 with the firms listed above.arrow_forwardEffect of Industry Characteristics on Financial Statement Relations. Effective financial statement analysis requires an understanding of a firms economic characteristics. The relations between various financial statement items provide evidence of many of these economic characteristics. Exhibit 1.23 (pages 6263) presents common-size condensed balance sheets and income statements for 12 firms in different industries. These common-size balance sheets and income statements express various items as a percentage of operating revenues. (That is, the statement divides all amounts by operating revenues for the year.) Exhibit 1.23 also shows the ratio of cash flow from operations to capital expenditures. A dash for a particular financial statement item does not necessarily mean the amount is zero. It merely indicates that the amount is not sufficiently large for the firm to disclose it. A list of the 12 companies and a brief description of their activities follow. A. Abercrombie Fitch: Sells retail apparel primarily through stores to the fashionconscious young adult and has established itself as a trendy, popular player in the specialty retailing apparel industry. B. Allstate Insurance: Sells property and casualty insurance, primarily on buildings and automobiles. Operating revenues include insurance premiums from customers and revenues earned from investments made with cash received from customers before Allstate pays customers claims. Operating expenses include amounts actually paid or expected to be paid in the future on insurance coverage outstanding during the year. C. Best Buy: Operates a chain of retail stores selling consumer electronic and entertainment equipment at competitively low prices. D. E. I. du Pont de Nemours: Manufactures chemical and electronics products. E. Hewlett-Packard: Develops, manufactures, and sells computer hardware. The firm outsources manufacturing of many of its computer components. F. HSBC Finance: Lends money to consumers for periods ranging from several months to several years. Operating expenses include provisions for estimated uncollectible loans (bad debts expense). G. Kelly Services: Provides temporary office services to businesses and other firms. Operating revenues represent amounts billed to customers for temporary help services, and operating expenses include amounts paid to the temporary help employees of Kelly. H. McDonalds: Operates fast-food restaurants worldwide. A large percentage of McDonalds restaurants are owned and operated by franchisees. McDonalds frequently owns the restaurant buildings of franchisees and leases them to franchisees under long-term leases. I. Merck: A leading research-driven pharmaceutical products and services company. Merck discovers, develops, manufactures, and markets a broad range of products to improve human and animal health directly and through its joint ventures. J. Omnicom Group: Creates advertising copy for clients and is the largest marketing services firm in the world. Omnicom purchases advertising time and space from various media and sells it to clients. Operating revenues represent commissions and fees earned by creating advertising copy and selling media time and space. Operating expenses includes employee compensation. K. Pacific Gas Electric: Generates and sells power to customers in the western United States. L. Procter Gamble: Manufactures and markets a broad line of branded consumer products. REQUIRED Use the ratios to match the companies in Exhibit 1.23 with the firms listed above.arrow_forwardRiver Valley Production Inc. seeks to increase its market share and improve its results. The company takes as a starting point the current scenario and the results obtained in 2018 and 2019. Like other companies, River Valley uses financial ratios (ratios) as tools for analyzing the results obtained at the end of the period. Consider the data presented in the financial statements below and analyze the company's results based on the financial ratios.1. Use the financial statements to calculate the following financial ratios for the years 2018 and 2019:1.8 Return on Investment (ROI)1.9 Profit Margin1.10 Debt to Equity Ratio1.11 Price/Earning Ratio Balance Sheet 2018 2019 Cash $63,000 $201,000 Accounts Receivable 199,000 305,000 Marketable Securities 81,000 42,000 Inventories 441,000 455,000 Prepaids 5,000 9,000 Total Current Assets 789,000 1,012,000 Property, Plant, and Equipment, net 858,000 858,000…arrow_forward

- Classify each of the following actions as either being associated with the financial accounting information system (FS) or the cost management information system (CMS): a. Determining the total compensation of the CEO of a public company b. Issuing a quarterly earnings report c. Determining the unit product cost using TDABC d. Calculating the number of units that must be sold to break even e. Preparing a required report for the SEC f. Preparing a sales budget g. Using cost and revenue information to decide whether to keep, or drop, a product line h. Preparing an annual statement of financial position that conforms to generally accepted accounting principles (GAAP) i. Using cost and revenue information to decide whether to invest in a new production system or not j. Reducing costs by improving the overall quality of a product k. Using a debt-equity ratio and liquidity ratios from a balance sheet to assess the likelihood of bankruptcy l. Using a public companys financial statements to decide whether or not to buy its stockarrow_forwardWhich of the following best describes trend analysis? A comparing a company's financial statements with that of other companies B expressing each financial statement amount as a percentage of a budgeted amount C expressing each year's financial statement amounts as a percentage of the base year amounts D calculating key ratios to evaluate performancearrow_forwardDescribe some different types of ratios and how they are used to assess performance. Explain the components of the formula and the order of operations to calculate them. Discuss what these ratios say about the financial health of the organization. Determine why it is sometimes misleading to compare a company's financial ratios with those of other firms that operate within the same industry. Support your response with an example from your research.arrow_forward

- A company reports accounting data in its financial statements. This data is used for financial analyses that provide insights into a company’s strengths, weaknesses, performance in specific areas, and trends in performance. These analyses are often used to compare a company’s performance to that of its competitors or to its past or expected future performance. Such insight helps managers and analysts improve their decision making. Consider the following scenario: You work as an analyst at a credit-rating agency, and you are comparing firms in the construction and engineering sector. One company in the portfolio of companies you are analyzing is a Chinese firm. This firm stands out in the ratio analysis, because the company’s financial ratios are substantially lower than identical financial ratios of the other firms in the sector. You do not dissect the results of the ratio analysis and report this firm as an under-performing company. Which of the following statements about…arrow_forwardThe following article appeared in the Wall Street Journal. Washington—The Securities and Exchange Commission staff issued guidelines for companies grappling with the problem of dividing up their business into industry segments for their annual reports. An industry segment is defined by the Financial Accounting Standards Board as a part of an enterprise engaged in providing a product or service or a group of related products or services primarily to unaffiliated customers for a profit. Although conceding that the process is a “subjective task” that “to a considerable extent, depends on the judgment of management,” the SEC staff said companies should consider … various factors … to determine whether products and services should be grouped together or reported as segments. Instructions What does financial reporting for segments of a business enterprise involve? Identify the reasons for requiring financial data to be reported by segments. Identify the possible disadvantages of requiring…arrow_forwardPlease answer ASAP.Financial performance measures are essential tools used by managers to evaluate the financialhealth of their organization. They provide an overview of the company's financialperformance, help identify areas of improvement, and support decision making.CarniTrin is a manufacturer of Carnival costumes in a highly competitive market. Thecompany's management team is seeking guidance on the use of financial performancemeasures to identify the key drivers of the company's financial performance and develop astrategy to improve it.The following data relate to the company for the year 2019: In its clothing division, the company has $4,000,000 invested in assets. After-taxoperating income from sales of clothing in 2019 is $700,000. Income for the clothingdivision has grown steadily over the last few years. The cosmetics division has $12,000,000 invested in assets and an after-tax operatingincome in 2019 of $1,700,000. The weighted-average cost of capital for CarniTrin is 10%…arrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning  Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning