Judgment Case 2: Impact of Judgment in Accounting for Stock Dividends

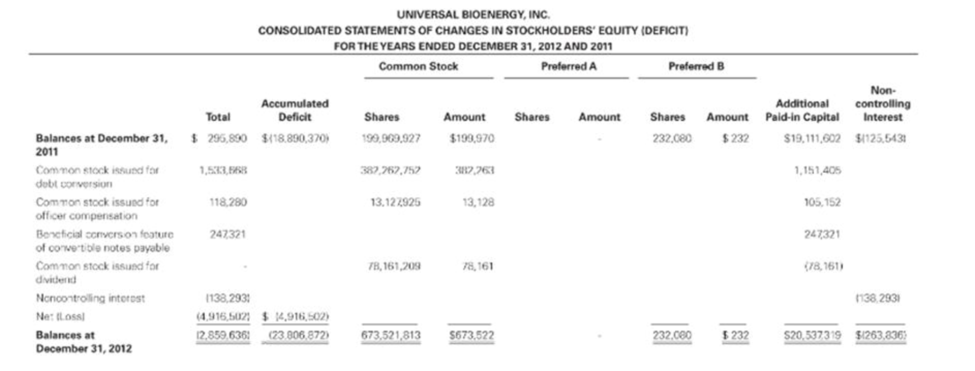

On June 6, 2012. Universal Bioenergy, Inc. declared a 20% stock dividend. Because it is a 20% dividend, it had the flexibility to account for this as a small or large stock dividend. Its common stock was trading at $0.01 per share at that time. Excerpts from its 10-K follow the questions.

- 1. What

journal entry did Universal Bioenergy record on June 6? What journal entry did it record on July 20? Did Universal Bioenergy account for this stock dividend as a small or large stock dividend? You may find ASC 505-20-30-5 helpful in understanding this entity’s approach. - 2. What would be the impact on the accounts if Universal Bioenergy did not use the alternative treatment permitted for closely held entities?

- 3. What would be the impact on the accounts if Universal Bioenergy did not use the alternative treatment permitted for closely held entities and chose a different basic treatment? That is, if the company recorded it as a small stock dividend, how would the accounts change?

Discussion of the stock dividend included in ITEM 1 in the 10-K

Approval of Stock Dividend

Universal Bioenergy uses the phrase “10 for 2 basis” in its financial statements when describing the stock dividend —that is, the company issued 2 shares for every 10 shares held.

On June 6, 2012, our Board of Directors passed a resolution and declared a stock dividend to distribute to all registered shareholders of record on or before July 13, 2012, on a 10 for 2 basis. On July 20, 2012, our transfer agent issued 78,161,209 shares of common stock to all registered shareholders of record in accordance with the resolution and declaration.

Excerpts from financial statements

| UNIVERSAL BIOENERGY, INC. CONSOLIDATED BALANCE SHEETS | ||

| Assets: | December 31, 2012 | December 31, 2011 |

| Current Assets: | ||

| Cash | $ 2,274 | $ 3,706 |

| 4,800,967 | 10,004,123 | |

| Other loans | 600 | — |

| Total current assets | 4,803,841 | 10,007829 |

| Property and Equipment - net | 6,989 | 8,951 |

| UNIVERSAL BIOENERGY, INC. CONSOLIDATED BALANCE SHEETS | |||||

| Assets: | December 31, 2012 |

December 31, 2011 | |||

| Other Assets: Accounts receivable - other |

10,050 | 10,050 | |||

| Investments | 2,919,500 | 889,500 | |||

| Intangible assets | 250,000 | 250,000 | |||

| Deposit | 7,453 | 46,516 | |||

| Total other assets | 3,187,7003 | 1,196,066 | |||

| Total Assets | $7,997,833 | $11,212,846 | |||

| Liabilities and Stockholder’s Equity (Deficit): | |||||

| Current Liabilities | |||||

| Accounts payable | $ 4,983,318 | $ 10,099,502 | |||

| Other accounts payable and accrued expenses | 185,422 | 208,848 | |||

| Accrued interest payable | 468,572 | 101,860 | |||

| Line of credit | 7,942 | 7,850 | |||

| Current portion of long-term debt | 248,395 | 172,560 | |||

| Derivative liability | 350,237 | – | |||

| Advances from affiliates | 4,250 | 4,250 | |||

| Total current liabilities | 6.248,136 | 10,594,870 | |||

| Long-term Debt | |||||

| Notes payable | $ 2,261,406 | $ 131,086 | |||

| Notes payable- related parties | 934,729 | 191,000 | |||

| Total Long-term Debt | 3,196,135 | 322,086 | |||

| Total Liabilities | 9,444,270 | 10,916,956 | |||

| Preferred stock. $.001 par value. 10,000,000 shares authorized. Preferred stock Series A, zero issued and outstanding shares | – | – | |||

| December 31. 2012 and December 31. 2011, respectively | |||||

| Preferred stock Series B, 232,080 issued and outstanding shares December 31, 2012 and December 31, 2011, respectively | 232 | 232 | |||

| Common stock. $.001 par value. 3,000,000.000 shares authorized; 673,521,813 and 199,969,927 issued and outstanding as of December 31, 2012 and December 31, 2011, respectively | 673,522 | 199.970 | |||

| Additional paid-in capital | 20,546,023 | 19,111,601 | |||

| Noncontrolling interest | (263,836) | (125,543) | |||

| Accumulated deficit | (22,402,379) | (18,890,370) | |||

| Total stockholders’ equity (deficit) | (1,466,438) | 295,890 | |||

| Total Liabilities and Stockholders’ Equity | $ 7,997,832 | $ 11,212,846 | |||

Excerpt from the notes to the financial statements follow:

NOTE 4 Equity

On December 26, 2012, the Company amended its Articles of Incorporation, and increased the authorized shares of common stock from 1,000,000,000 to 3,000,000,000 shares at $. 001 par value. There are 673,521,813 shares of common stock issued and outstanding as of December 30, 2012.

On June 6, 2012, our Board of Directors passed a resolution and declared a stock dividend to distribute to all registered shareholders of record on, or before, July 13, 2012, on a 10 for 2 basis. On July 20, 2012, our transfer agent issued 78,161,209 shares of common stock to all registered shareholders of record in accordance with the resolution and declaration.

The Company has authorized a total of 10,000,000

Want to see the full answer?

Check out a sample textbook solution

Chapter 15 Solutions

Intermediate Accounting

- 1. Compute Tidepool's EPS for the year. 2. Assume Tidepool's market price of a share of common stock is $ 7 per share Compute Tidepool's price / earnings ratio Tidepool Corp. earned net income of $133,340 and paid the minimum dividend to preferred stockholders for 2018. Assume that there are no changes in common shares outstanding during 2018. Tidepool's books include the following figuresarrow_forwardM11-4 Analyzing and Recording the Issuance of Common Stock To expand operations, Aragon Consulting issued 1,000 shares of previously unissued common stock with a par value of $1. The price for the stock was $50 per share. Analyze the accounting equation effects and record the journal entry for the stock issuance. Would your answer be different if the par value were $2 per share? If so, analyze the accounting equation effects and record the journal entry for the stock issuance with a par value of $2. bar 24 sicles) M11-5 Analyzing and Recording the Issuance of No-Par Value Common Stock mosch to the issued stock has HO DIE ling equation effects total assets, total list total stockholders equity differ from the LO 11-2arrow_forwardAccording to a company press release, on January 5, 2012, Hansen Natural Corporation changed its name to Monster Beverage Corporation. According to Yahoo Finance, on that day the value of the company stock (symbol: MNST) was $15.64 per share. On January 5, 2018, the stock closed at $63.49 per share. This represents an increase of nearly 306%. A. Discuss the factors that might influence the increase in share price. B. Consider yourself as a potential shareholder. What factors would you consider when deciding whether or not to purchase shares in Monster Beverage Corporation today?arrow_forward

- Stock Dividend The balance sheet of Cohen Enterprises includes the following stockholders equity section: Required: On April 15, 2019, when its stock was selling for $18 per share, Cohen Enterprises issued a small stock dividend. After making the journal entry to recognize the stock dividend, Cohens total capital stock increased by $270,000. In percentage terms, what was the size of the stock dividend? Ignoring the small stock dividend discussed in Requirement 1, assume that on June 1, 2019, when its stock was selling for $22 per share, Cohen issued a large stock dividend. After making the journal entry to recognize the stock dividend, Cohens retained earnings decreased by $75,000. In percentage terms, what was the size of the stock dividend?arrow_forwardResearch online to find a company that bought back shares of its own stock (treasury stock) within the last 6–12 months. Why did it repurchase the shares? What happened to the companys stock price immediately after the repurchase and in the months since then? Is there any reason to think the repurchase impacted the price?arrow_forwardLyon Company shows the following condensed income statement information for the year ended December 31, 2019: Lyon declared dividends of 6,000 on preferred stock and 17,280 on common stock. At the beginning of 2019, 10,000 shares of common stock were outstanding. On May 1, 2019, the company issued 2,000 additional common shares, and on October 31, 2019, it issued a 20% stock dividend on its common stock. The preferred stock is not convertible. Required: 1. Compute the 2019 basic earnings per share. 2. Show the 2019 income statement disclosure of basic earnings per share. 3. Draft a related note to accompany the 2019 financial statements.arrow_forward

- Nutritious Pet Food Companys board of directors declares a large stock dividend (50%) on June 30 when the stocks market value per share is $30. At that time, there are 10,000 shares of $1 par value common stock outstanding (none held in treasury). What is the journal entry to record the declaration of the dividend?arrow_forwardNutritious Pet Food Companys board of directors declares a small stock dividend (20%) on June 30 when the stocks market value per share is $30. At that time, there are 10,000 shares of $1 par value common stock outstanding (none held in treasury). What is the journal entry to record the declaration of the dividend?arrow_forwardThe following selected transactions and events occurred during 2013: a. Issued 200 shares of preferred stock for 20,000. b. Sold 800 shares of treasury stock for 2,800. c. Declared and issued a 4% common stock dividend. The market value on the date of declaration was 5 per share. d. Generated a net loss for the year of 16,000. e. Declared and paid the full years dividend on all the preferred stock and a dividend of 15 per share on common stock outstanding at the end of the year. Enter beginning balances for 2013 on STOCKEQ2. Then erase all 2012 entries and enter the transactions for 2013. Save the results as STOCKEQ4. Print the results.arrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning