Financial and Managerial Accounting: Information for Decisions

6th Edition

ISBN: 9780078025761

Author: John J Wild, Ken Shaw Accounting Professor, Barbara Chiappetta Fundamental Accounting Principles

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 14, Problem 4MCQ

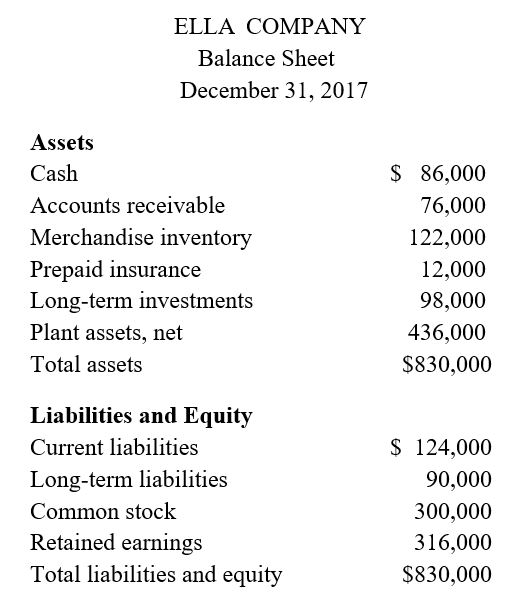

What is Ella Company’s debt ratio?

a. 25.78%

b. 100.00%

c. 74.22%

d. 137.78%

e. 34.74%

Use the following information for question 2 through 5.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

STEP 3: Solve

Calculating the four benchmark financial ratios found in Table 15.3, we get the following:

Ratio with

Ratio

Existing Common Stock with Debt

Financing

Ratio

Formula

Ratio

Financing

Debt ratio

Total Liabilities

35.2%

26.4%

51.5%

Total Assets

Interest-bearing

Interest-Bearing Debt

20.1

15.1

40.2

debt ratio

Total Assets

Times interest

Net Operating Income or EBIT

27.08

31.25

11.72

earned

Interest Expense

Depreciation Amortization

6.84

8.20

3.08

EBITDA

Earnings Before

coverage ratio

Interest and Taxes

Expense

Expense

Principal Payments

Interest Expense + (-

1

Tax Rate

STEP 4: Analyze

Whether the entire $10 million is raised by issuing equity or by borrowing has a dramatic effect on the firm's

capital structure. For example, the debt ratio will either drop from 35.2 percent to 26.4 percent if equity is used or

increase to 51.5 percent if debt is used. The interest-bearing debt ratio will change in a similar manner, dropping

from 20.1 percent to 15.1 percent if equity financing…

Which statement is correct?

O A. current ratio 1.00

D. gross margin > net margin

Required:

Compute the following: (For Requirements 1 to 4, enter your percentage answers rounded to 2 decimal places (i.e., 0.1234 should

be entered as 12.34).)

1. Gross margin percentage.

2. Net profit margin percentage.

3. Return on total assets.

4. Return on equity.

5. Was financial leverage positive or negative for the year?

1. Gross margin percentage

%

2. Net profit margin percentage

%

3. Return on total assets

%

4. Return on equity

%

5. Financial Leverage

Chapter 14 Solutions

Financial and Managerial Accounting: Information for Decisions

Ch. 14 - Prob. 1MCQCh. 14 - What is Ella Company’s current ratio? a.0.69...Ch. 14 - What is Ella Company’s acid-test ratio? a.2.39...Ch. 14 - What is Ella Company’s debt ratio? a. 25.78% b....Ch. 14 - What is Ella Company’s equity ratio? a.25.78%...Ch. 14 - Describe the managerial accountant’s role in...Ch. 14 - Distinguish between managerial and financial...Ch. 14 - Prob. 3DQCh. 14 - Prob. 4DQCh. 14 - Distinguish between (a) factory overhead and (b)...

Ch. 14 - Prob. 6DQCh. 14 - What product cost is both a prime cost and a...Ch. 14 - Prob. 8DQCh. 14 - Prob. 9DQCh. 14 - Prob. 10DQCh. 14 - Prob. 11DQCh. 14 - Prob. 12DQCh. 14 - Prob. 13DQCh. 14 - Prob. 14DQCh. 14 - Prob. 15DQCh. 14 - Prob. 16DQCh. 14 - Prob. 17DQCh. 14 - What are the three categories of manufacturing...Ch. 14 - List several examples of factory overhead.Ch. 14 - Prob. 20DQCh. 14 - Prob. 21DQCh. 14 - Prob. 22DQCh. 14 - Prob. 23DQCh. 14 - Prob. 24DQCh. 14 - Prob. 25DQCh. 14 - Prob. 1QSCh. 14 - Prob. 2QSCh. 14 - QS 14-4 Direct and indirect costs C2

Diez Company...Ch. 14 - Classifying product costs C2 Identify each of the...Ch. 14 - QS 14-6 Product and period costs C3

Identify each...Ch. 14 - Prob. 6QSCh. 14 - Prob. 7QSCh. 14 - Prob. 8QSCh. 14 - Prob. 9QSCh. 14 - Prob. 10QSCh. 14 - Prob. 11QSCh. 14 - Prob. 12QSCh. 14 - Prob. 13QSCh. 14 - Prob. 14QSCh. 14 - Exercise 14-1 Sources of accounting information C1...Ch. 14 - Prob. 2ECh. 14 - Exercise 14-3 Cost classifications for a service...Ch. 14 - Exercise 14-4 Cost classifications for a service...Ch. 14 - Prob. 5ECh. 14 - Prob. 6ECh. 14 - Prob. 7ECh. 14 - Prob. 8ECh. 14 - Prob. 9ECh. 14 - Prob. 10ECh. 14 - Prob. 11ECh. 14 - Prob. 12ECh. 14 - Prob. 13ECh. 14 - Prob. 14ECh. 14 - Prob. 15ECh. 14 - Prob. 16ECh. 14 - Exercise 14-17 Lean business practice C6 Many...Ch. 14 - Prob. 1PSACh. 14 - Prob. 2PSACh. 14 - Prob. 3PSACh. 14 - Prob. 4PSACh. 14 - Prob. 5PSACh. 14 - Prob. 1PSBCh. 14 - Prob. 2PSBCh. 14 - Prob. 3PSBCh. 14 - Prob. 4PSBCh. 14 - Prob. 5PSBCh. 14 - Prob. 14SPCh. 14 - Prob. 1BTNCh. 14 - Prob. 2BTNCh. 14 - Prob. 3BTNCh. 14 - Prob. 4BTNCh. 14 - Prob. 5BTNCh. 14 - Prob. 6BTNCh. 14 - Prob. 7BTNCh. 14 - Prob. 8BTNCh. 14 - Prob. 9BTN

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Select the Income Statements and Balance Sheets of Aramco Saudi from the calculate the following financial ratios: a. Long-term debt ratios b. Total debt ratio c. Times interest earned d. Cash coverage ration e. current ratio f. Quick ratio g. Operating profit margin h. Inventory Turnover i. Days in inventory j. Average collection period k. Return on equity I. Return on assets m. Payout rationsarrow_forwardAssume that you are given the following ratios: Asset turn-over: -1.5x Return on Assets: -3% Return on equity: -5% What is the debt ratio?arrow_forwardDefinitional problems: Listed are 11 terms that relate to ratio analysis:1. Book value per share2.Inventoryturnover3. Debt-to-equity ratio4. Average collection period5. Average sales period6. Return on common equity7. Earnings per share8. Price/earnings ratio9. Return on total assets10. Current ratio11. Accounts-receivable turnoverChoose the financial ratio or term from the list that most appropriately completes each of the following statements:1. The__________ tends to have an effect on the market price per share asreflected in the price/earnings ratio.2. The__________ indicates whether a stock is relatively cheap or relativelyexpensive in relation to current earnings. 3. The________ measures the amount that would be distributed to holders of common stock if all assets were sold at their balance-sheet carrying amount and if all creditors were paid off.4. The_____________ is a rough measure of how many times a company'saccounts…arrow_forward

- Questions: 1. Times interest earned ratio 2. Debt to equity ratioarrow_forwardHow to Compute the following ratios i. Gross Profit % ii. Operating profit % iii. Net Profit % iv. Current Ratio v. Acid Test Ratio vi. Cash Ratio vii. Cash Operating Cycle in days viii. Average Debt collection Period in days ix. Average Creditor Payment Period in days x. Average Stock Holding Period in days xi. Total liabilities to Total Equity Ratio xii. Interest Cover Ratio xiii. Return on Total Assets xiv. Return on Equityarrow_forwarda. Compute the following ratios: i. Accounts Receivable Turnover ratio;ii. Accounts Payable Turnover ratio;iii. Average Collection Period;iv. Average Payable Period;v. Quick Ratio;vi. Gross Profit Margin.vii. Net Profit Marginviii. Debt ratiob b. Explain briefly what is factoring?arrow_forward

- Present formulas and examples of the following financial ratios (Financial ratios)a. gross marginb. profit margin on salesc. return on equity (ROE)arrow_forwardIn analyzing the financial statements which are given can you please compute the following ratios: 1.GROSS PROFIT RATE 2.RATE OF RETURN ON OWNER'S EQUITY 3. AVERAGE COLLECTION PERIOD 4. EARNINGS PER SHARE 5.BOOK VALUE PER SHAREarrow_forwardFind the following using the data bellow Accounts receivable = 111,100,000 Current assets = 316,500,000 Total assets = 600,000,000 A. Return on assets B. Common equity C .Quick ratioarrow_forward

- ly course FINA 415-1-202 General UNIT and For short term credit decisions which ratio is used? Select one: O a. Current Ratio O b. None O c. Savings ratio O d. Solvency ratio e. Return on Equityarrow_forwardAt December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable Common stock, $10 par value Retained earnings Total liabilities and equity Cost of goods sold Other operating expenses Current Year $ 26,053 77,051 95, 908 8, 732 242,846 $ 450, 590 Interest expense Income tax expense Total costs and expenses Net income Earnings per share 1 Year Ago Current Year $ 31, 386 54, 925 69, 706 $ 66,303 $ 113, 319 87, 252 162, 500 87, 519 89, 341 162,500 70, 296 $ 450, 590 $ 388, 440 $ 357, 318 181, 588 9,958 7,615 7,994 224, 429 388, 440 The company's income statements for the current year and one year ago, follow. 1 Year Ago For Year Ended December 31 Sales $ 585, 767 2 Years Ago 556, 479 S 29, 288 $ 1.80 $31, 085 43, 156 46,425 3,596 199, 438 $ 323, 700 $ 42,728 70, 822 162,500 47,650 $ 323, 700 $ 300, 459 116, 948 10, 632 6,934 $ 462,244 434,973 $ 27,271 $ 1.68arrow_forwardThe following financial statements apply to Finch Company: Revenues Expenses Cost of goods sold Selling expenses General and administrative expenses Interest expense Income tax expense Total expenses Net income Assets Current assets. Cash Marketable securities Accounts receivable Inventories Prepaid expenses Total current assets Plant and equipment (net) Intangibles Total assets Liabilities and Stockholders' Equity Liabilities Current liabilities Accounts payable Other Total current liabilities Bonds payable Total liabilities Stockholders' equity Common stock (43,000 shares) Retained earnings Total stockholders' equity Total liabilities and stockholders' equity Year 2 $219, 100 124,400 101, 100 19,700 17,700 10,000 9,000 1,700 1,700 20, 100 16,900 175,900 146,400 $ 43,200 $36,400 $ 4,800 $ 7,200 2,800 2,800 36,600 101,600 3,900 149,700 106,400 21,500 $277,600 $38,500 15,800 Year 1 $182, 800 54,300 64,300 118,600 114,900 44, 100 159,000 $277,600 31, 100 94, 100 2,900 138, 100 106,400 0…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...

Accounting

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License