FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

a. Compute the following ratios:

i.

ii. Accounts Payable Turnover ratio;

iii. Average Collection Period;

iv. Average Payable Period;

v. Quick Ratio;

vi. Gross Profit Margin.

vii. Net Profit Margin

viii. Debt ratiob

b. Explain briefly what is factoring?

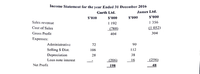

Transcribed Image Text:Income Statement for the year Ended 31 December 2016

Garth Ltd.

James Ltd.

$'000

$'000

$'000

$'000

Sales revenue

1 192

1 356

Cost of Sales

|(788)

(1 052)

Gross Profit

404

304

Expenses:

Administrative

72

90

Selling $ Dist.

106

112

Depreciation

28

38

Loan note interest

(206)

16

(256)

Net Profit

198

48

1

Transcribed Image Text:SECTION A

Instructions: Answer ALL questions from this section.

Daniel, an investor is considering purchasing shares in either Garth Ltd & James Ltd. Both

companies are in the same line of business and their accounts are summarized below:

Statement of financial Po

ion as at December 1st 2016

Assets

Garth Ltd

James Ltd.

Non Current Assets

$'000

$'000

S'000

$'000

At Cost

840

2 140

Accumulated Depreciation

(226)

614

(280)

1 852

Current Assets

Inventory

276

334

Receivables

138

196

Bank and Cash

192

606

18

548

1 220

2 400

Equity and Liabilities

1 800

Сapital

Retained Earnings

740

340

138

1 080

1 938

Non-Current Liabilities

10 % loan Note

160

Current Liabilities

240

Trade payables

Interest payable

120

Income tax

20

140

60

302

1 220

240

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Question: What is the formula for calculating the net profit margin? a. Net Profit / Revenue b. Revenue / Net Profit c. Net Profit / Total Assets d. Total Assets / Net Profitarrow_forwardWant The Correct Answer with calculation and explanation in text modearrow_forward6. The receivales turnover ratio is used to analyze profitability. liquidity. a. b. С. risk d. long-term solvency ofarrow_forward

- What is the purpose of calculating a set of financial ratios?arrow_forwardRequired: (a) You are required to calculate the following ratios:(i) Gross profit margin(ii) Operating profit margin(iii) Expenses to sales(iv) Return on Capital Employed(v) Asset turnover(vi) Non-current asset turnover(vii) Current Ratio(viii) Quick Ratio(ix) Inventory days(x) Receivables days(xi) Payable days(xii) Interest cover (b) In light of your calculations comment on the performance of the company over thelast two years.arrow_forwardPresent formulas and examples of the following financial ratios (Financial ratios)a. gross marginb. profit margin on salesc. return on equity (ROE)arrow_forward

- Provie The Correct Answer with calculationarrow_forwardWhich of the following ratios is used to analyze a company's liquidity? a. Inventory turnover ratio b. Earnings per share c. Return on assets ratio d. Asset turnover ratioarrow_forwardWhen should an average amount be used for the numerator or denominator? When the denominator is a balance sheet item or items. When a ratio consists of an income statement item and a balance sheet item. When the numerator is a balance sheet item or items. When the numerator is an income statement item or items.arrow_forward

- Using the information from 27A prepare the following ratios: gross profit margin profit margin return on assets earnings per share current ratio acid test ratio debt ratio Indicate what each is used for (ie: measuring efficiency, solvency etc)arrow_forwardwhich of the following comes first in the income statement O a. finance cost O b. gross profit O C. C. cost of sales O d. distribution costarrow_forwardCompare the key Financial Ratios?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education