a)

Determine the percentage increase in sales and prepare the pro forma income statement.

a)

Explanation of Solution

The formula to calculate the percentage of increase in sales:

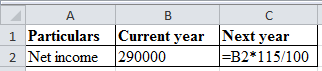

Compute net income:

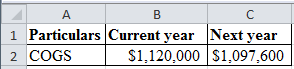

Excel workings:

Table (1)

Excel spread sheet:

Table (2)

Compute the sales value:

Consider sales as X:

Hence, sales are $1,817,500.

Compute selling and administration expenses:

Hence, the selling and administration expenses are $211,750.

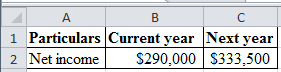

Prepare a pro forma income statement:

Table (3)

Hence, the net income is $333,500.

Compute the percentage of increase in sales:

Hence, the percentage of increase in sales is 13.59%.

b)

Prepare the pro forma income statement and the other ideas to reach the Company T’s goal.

Given information:

Discount rate of 2% on COGS

b)

Explanation of Solution

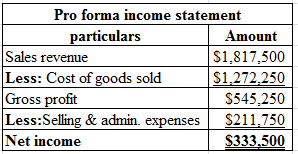

Compute the COGS:

Excel workings:

Table (4)

Excel spread sheet:

Table (5)

Hence, the COGS are $1,097,600.

Compute the selling and administration expenses:

Consider selling and administration expenses as X:

Hence, selling and administration expenses are $168,900.

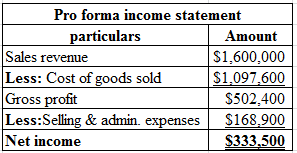

Prepare a pro forma income statement:

Excel spreadsheet:

Table (6)

Hence, the net income is $333,500.

The management cuts the selling and administrative expenses by the amount of $21,100 that is

c)

Whether the company can reach the goal of Company T

c)

Explanation of Solution

Compute projected sales:

Hence, the projected sales are $1,840,000.

Compute the projected cost of goods sold:

Hence, the projected cost of goods sold is $1,288,000.

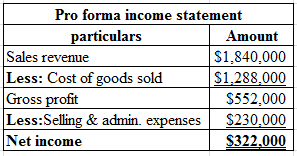

Prepare a pro forma income statement:

Excel spreadsheet:

Table (7)

Hence, the net income is $322,000.

The company cannot reach the goal as the desired profit is less than the actual that is $322,000 is less than the $333,500.

Want to see more full solutions like this?

Chapter 14 Solutions

Survey Of Accounting

- Question 1 The management accountant at Miller Merchandising & More, Odail Russell is in the process of preparing the cash budget for the business for the fourth quarter of 2021. It is customary for the business to borrow money during this quarter. Extracts from the sales and purchases budgets are as follows: Month Cash Sales Sales On Account Purchases August $85,000 $640,000 $420,000 September $70,000 $550,000 $550,000 October $88,550 $600,000 $500,000 November $77,160 $800,000 $600,000 December $174,870 $500,000 $450,000 - An analysis of the records shows that trade receivables are settled according to the following credit pattern, in accordance with the credit terms 4/30, n90: 50% in the month of sale 30% in the first month following the sale 20% in the second month following the sale -Expected purchases include monthly cash purchases of 5%. All other purchases are on Accounts payable are settled as follows,…arrow_forwardQuestion 1 The management accountant at Miller Merchandising & More, Odail Russell is in the process of preparing the cash budget for the business for the fourth quarter of 2021. It is customary for the business to borrow money during this quarter. Extracts from the sales and purchases budgets are as follows: Month Cash Sales Sales On Account Purchases August $85,000 $640,000 $420,000 September $70,000 $550,000 $550,000 October $88,550 $600,000 $500,000 November $77,160 $800,000 $600,000 December $174,870 $500,000 $450,000 - An analysis of the records shows that trade receivables are settled according to the following credit pattern, in accordance with the credit terms 4/30, n90: 50% in the month of sale 30% in the first month following the sale 20% in the second month following the sale -Expected purchases include monthly cash purchases of 5%. All other purchases are on Accounts payable are settled as follows,…arrow_forwardQuestion 1 The management accountant at Miller Merchandising & More, Odail Russell is in the process of preparing the cash budget for the business for the fourth quarter of 2021. It is customary for the business to borrow money during this quarter. Extracts from the sales and purchases budgets are as follows: Month Cash Sales Sales On Account Purchases August $85,000 $640,000 $420,000 September $70,000 $550,000 $550,000 October $88,550 $600,000 $500,000 November $77,160 $800,000 $600,000 December $174,870 $500,000 $450,000 - An analysis of the records shows that trade receivables are settled according to the following credit pattern, in accordance with the credit terms 4/30, n90: 50% in the month of sale 30% in the first month following the sale 20% in the second month following the sale -Expected purchases include monthly cash purchases of 5%. All other purchases are on Accounts payable are settled as follows,…arrow_forward

- *CAN YOU ANSWER PART 4* Deacon Company is a merchandising company that is preparing a budget for the three-month period ended June 30. The following information is available Deacon CompanyBalance SheetMarch 31 Assets Cash $ 68,200 Accounts receivable 42,000 Inventory 63,400 Buildings and equipment, net of depreciation 122,000 Total assets $ 295,600 Liabilities and Stockholders’ Equity Accounts payable $ 96,400 Common stock 70,000 Retained earnings 129,200 Total liabilities and stockholders’ equity $ 295,600 Budgeted Income Statements April May June Sales $ 178,000 $ 188,000 $ 208,000 Cost of goods sold 106,800 112,800 124,800 Gross margin 71,200 75,200 83,200 Selling and administrative expenses 19,000 20,500 23,500 Net operating income $ 52,200 $ 54,700 $ 59,700 Budgeting Assumptions: 60% of sales are cash sales and 40% of sales are credit sales. Twenty…arrow_forwardQuestion 1 The management accountant at Miller Merchandising & More, Odail Russell is in the process of preparing the cash budget for the business for the fourth quarter of 2021. It is customary for the business to borrow money during this quarter. Extracts from the sales and purchases budgets are as follows: Month Cash Sales Sales On Account Purchases August $85,000 $640,000 $420,000 September $70,000 $550,000 $550,000 October $88,550 $600,000 $500,000 November $77,160 $800,000 $600,000 December $174,870 $500,000 $450,000 - An analysis of the records shows that trade receivables are settled according to the following credit pattern, in accordance with the credit terms 4/30, n90: 50% in the month of sale 30% in the first month following the sale 20% in the second month following the sale -Expected purchases include monthly cash purchases of 5%. All other purchases are on Accounts payable are settled as follows,…arrow_forwardProblem 10-49: Budgeting for a Merchandising Firm Background Budgeted sales: December $250,000 January $225,000 Collections of A/R: Collected in month of sale 50.00% Collected following month 48.00% Est B/D expense 2.00% Discount for early payment 1.00% Gross margin % 30% Target End Inv, as % of following month's sales 80.00% Merchandise payments: % paid in month following month of purchase 100.00% Other operating expenses (cash) = $25,000 Annual depreciation expense = $216,000 Goldberg Company's statement of financial position at the close of business on November 30th follows: GOLDBERG COMPANY Statement of Financial Position November 30, 2016 Assets Cash…arrow_forward

- Problem 10-49: Budgeting for a Merchandising Firm Background Budgeted sales: December $250,000 January $225,000 Collections of A/R: Collected in month of sale 50.00% Collected following month 48.00% Est B/D expense 2.00% Discount for early payment 1.00% Gross margin % 30% Target End Inv, as % of following month's sales 80.00% Merchandise payments: % paid in month following month of purchase 100.00% Other operating expenses (cash) = $25,000 Annual depreciation expense = $216,000 Goldberg Company's statement of financial position at the close of business on November 30th follows: GOLDBERG COMPANY Statement of Financial Position November 30, 2016 Assets Cash…arrow_forwardQuestion ANSWER B ONLY AND CALCULATE TOTAL The management accountant at Miller Merchandising & More, Odail Russell is in the process of preparing the cash budget for the business for the fourth quarter of 2021. It is customary for the business to borrow money during this quarter. Extracts from the sales and purchases budgets are as follows:Month Cash Sales Sales on Account PurchasesAugust $85,000 $640,000 $420,000September 70,000 550,000 550,000October 88,550 600,000 500,000 November 77,160 800,000 600,000December 174,870 500,000 450,000 i) An analysis of the records shows that trade receivables are settled according to the following credit pattern, in accordance with the credit terms 4/30, n90:50%…arrow_forwardQuestion 2 Deacon Company is a merchandising company that is preparing a budget for the three-month period ended June 30. The following information is available: Green Sport Balance Sheet March 31 Assets Cash $ 55,000 Accounts receivable 36,000 Inventory 40,000 Buildings and equipment, net of depreciation 100,000 Total assets $231,000 Liabilities and Stockholders’ Equity Accounts payable $ 51,300 Retained earnings 179,700 Total liabilities and stockholders’ equity $231,000 Budgeted Income Statements April May June Sales $100,000 110,000 130,000 Cost of goods sold 60,000 66,000 78,000 Gross margin 40,000 44,000 52,000 Selling and administrative expenses 15,000 16,500 19,500 Net operating income $ 25,000 $ 27,500 $ 32,500 Budgeting Assumptions: 60% of sales are cash sales…arrow_forward

- Q1) Sales are budgeted at $360,000 for November, $380,000 for December, and $370,000 for January. The cost of goods sold is 74% of sales. The company desires an ending merchandise inventory equal to 75% of the cost of goods sold in the following month. Payment for merchandise is made in the month following the purchase. Other monthly expenses to be paid in cash are $22,400. Monthly depreciation is $22,200. Ignore taxes. Balance SheetOctober 31 Assets Cash $ 23,200 Accounts receivable 84,200 Merchandise inventory 199,800 Property, plant and equipment (net of $606,000 accumulated depreciation) 1,016,000 Total assets $ 1,323,200 Liabilities and Stockholders' Equity Accounts payable $ 197,200 Common stock 610,000 Retained earnings 516,000 Total liabilities and stockholders' equity $ 1,323,200 Required: (need these two parts)d. Prepare Budgeted Income Statements for November and December. e. Prepare a Budgeted Balance Sheet for…arrow_forwardProblem 1-49 (Static) Cost Data for Managerial Purposes—Budgeting (LO 1-3) Assume that The AM Bakery is preparing a budget for the month ending November 30. Management prepares the budget by starting with the actual results for August that are shown below. Then, management considers what the differences in costs will be between August and November. THE AM BAKERY Bakery Sales Actual Costs For the Month Ending August 31 Actual Budgeted Difference Ingredients Flour $ 3,900 $ 3,700 $ 200 Butter 3,500 3,400 100 Oil 1,700 1,800 (100) Fruit 1,300 1,000 300 Nuts 900 800 100 Chocolate 800 800 - Other 400 300 100 Total ingredients $ 12,500 $ 11,800 $ 700 Labor Channel manager $ 4,500 4500 - Other 10,700 10,900 (200) Utilities 2,400 2,300 100 Rent 3,600 3,600 - Marketing 200 100 100 Total bakery costs $ 33,900 $ 33,200 $ 700 Revenues $ 52,200 $ 52,200 - Management expects revenue in November to be 30 percent higher than in August, and…arrow_forwardQUESTION 1Nana Adom Company Limited is a wholesale company that deals in general goods. Thefollowing information relates to the next budget period.1. Expenses: (in GH¢)October November DecemberSelling & distribution 20,000 30,000 34,000General & administration 15,000 18,000 12,000Bad debts 21,000 15,000 20,000Rate 8,000 6,000 10,000Interest charges 1,600 2,000 2,400Depreciation expenses 30,000 10,000 10,000Expenses are payable in the month of incurrence.2. A contingent liability of GH¢10,000 is expected to mature in November3. Estimated cash balance at the end of September will be GH¢5000. Cash balances shouldnot be less than GH¢10,000. Cash can be borrowed in multiples of GH¢10,000 to financeany deficit at an interest rate of 15% per annum.4. The sales manager's salary, which is GH¢ 7000 per month is expected to increase byGH¢1000 every month after June.5. Motor vehicle will be purchased in November at GH¢240,000. Depreciation for motor vanshould be calculated at 10% in…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education