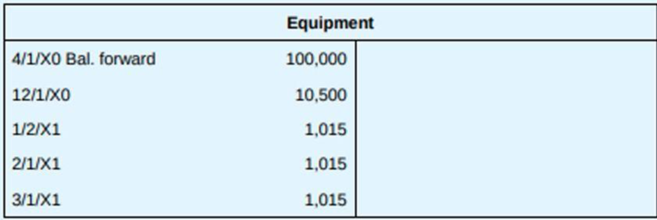

Chem-Lite, Inc., maintains its accounts on the basis of a fiscal year ending March 31. At March 31, 20X1, the Equipment account in the general ledger appeared as shown below. The company uses straight-line

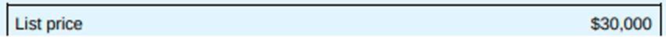

Upon further investigation, you find the following contract dated December 1, 20X0, covering the acquisition of equipment:

Required:

Prepare in good form, including full explanations, the

Want to see the full answer?

Check out a sample textbook solution

Chapter 13 Solutions

Principles Of Auditing & Other Assurance Services

- On August 3, Cinco Construction purchased special-purpose equipment at a cost of $6,560,400. The useful life of the equipment was estimated to be eight years, with an estimated residual value of $42,840. a. Compute the depreciation expense to be recognized each calendar year for financial reporting purposes under the straight-line depreciation method (half-year convention). b. Compute the depreciation expense to be recognized each calendar year for financial reporting purposes under the 200 percent declining-balance method (half-year convention) with a switch to straight-line when it will maximize depreciation expense. c. Which of these two depreciation methods (straight-line or double-declining-balance) results in the highest net income for financial reporting purposes during the first two years of the equipment’s use? a) year straight line ( half-year convention) 1 2 3 4 5 6 7 8 9 Totals $ b) year 200% declining…arrow_forwardAdkins Bakery uses the modified half-month convention to calculate depreciation expense in the year an asset is purchased or sold. Adkins has a calendar year accounting period and uses the straight-line method to compute depreciation expense. On March 17, 2024, Adkins acquired equipment at a cost of $120,000. The equipment has a residual value of $40,000 and an estimated useful life of 3 years. What amount of depreciation expense will be recorded for the year ending December 31, 2024? (Round any intermediate calculations to two decimal places, and your final answer to the nearest dollar.) OA. $22,222 OB. $13,333 O C. $20,000 OD. $26,667arrow_forwardOn August 3, Franko Construction purchased special - purpose equipment at a cost of $8, 900, 000. The useful life of the equipment was estimated to be eight years, with an estimated residual value of $20,000. Required: Compute the depreciation expense to be recognized each calendar year for financial reporting purposes under the straight - line depreciation method (half- year convention). Compute the depreciation expense to be recognized each calendar year for financial reporting purposes under the 200 percent declining - balance method (half-year convention) with a switch to straight line when it will maximize depreciation expense. Which of these two depreciation methods (straight line or double - declining - balance) results in the highest net income for financial reporting purposes during the first two years of the equipment's use?arrow_forward

- On August 3, Cinco Construction purchased special-purpose equipment at a cost of $1,000,000. The useful life of the equipment was estimated to be eight years, with an estimated residual value of $50,000. a. Compute the depreciation expense to be recognized each calendar year for financial reporting purposes under the straight-line depreciation method (half-year convention).arrow_forwardOn August 3, Cinco Construction purchased special-purpose equipment at a cost of $5,700,000. The useful life of the equipment was estimated to be eight years, with an estimated residual value of $80,000. a. Compute the depreciation expense to be recognized each calendar year for financial reporting purposes under the straight-line depreciation method (half-year convention). b. Compute the depreciation expense to be recognized each calendar year for financial reporting purposes under the 200 percent declining-balance method (half-year convention) with a switch to straight-line when it will maximize depreciation expense.arrow_forwardAdkins Bakery uses the modified half-month convention to calculate depreciation expense in the year an asset is purchased or sold. Adkins has a calendar year accounting period and uses the straight-line method to compute depreciation expense. On March 17, 2018, Adkins acquired equipment at a cost of $220,000. The equipment has a residual value of $43,000 and an estimated useful life of 4 years. What amount of depreciation expense will be recorded for the year ending December 31, 2018? (Round any intermediate calculations to two decimal places, and your final answer to the nearest dollar.) $44,250 $33,188 $36,875 $22,125arrow_forward

- On August 3, Srini Construction purchased special-purpose equipment at a cost of $1,000,000.The useful life of the equipment was estimated to be eight years, with a residual value of $50,000.a. Compute the depreciation expense to be recognized each calendar year for financial reportingpurposes under the straight-line depreciation method (half-year convention). b. Compute the depreciation expense to be recognized each calendar year for financial report-ing purposes under the 200 percent declining-balance method (half-year convention) with a switch to straight-line when it will maximize depreciation expense.c. Which of these two depreciation methods (straight-line or double-declining-balance) resultsin the highest net income for financial reporting purposes during the first two years of theequipment’s use? Explain.arrow_forwardOn August 3, Franko Construction purchased special-purpose equipment at a cost of $4,700,000. The useful life of the equipment was estimated to be eight years, with an estimated residual value of $90,000. Required: a. Compute the depreciation expense to be recognized each calendar year for financial reporting purposes under the straight-line depreciation method (half-year convention). b. Compute the depreciation expense to be recognized each calendar year for financial reporting purposes under the 200 percent declining-balance method (half-year convention) with a switch to straight-line when it will maximize depreciation expense. c. Which of these two depreciation methods (straight-line or double-declining-balance) results in the highest net income for financial reporting purposes during the first two years of the equipment's use? Complete this question by entering your answers in the tabs below. Required A Required B Required C Compute the depreciation expense to be recognized each…arrow_forwardSwindall Industries uses straight-line depreciation on all of its depreciable assets. The company records annual depreciation expense at the end of each calendar year. On January 11, 2017, the company purchased a machine costing $117,000. The machine's useful life was estimated to be 12 years with an estimated residual value of $17,200. Depreciation for partial years is recorded to the nearest full month. In 2021, after almost five years of experience with the machine, management decided to revise its estimated life from 12 years to 20 years. No change was made in the estimated residual value. The revised estimate of the useful life was decided prior to recording annual depreciation expense for the year ended December 31, 2021. a. Prepare journal entries in chronological order for the given events, beginning with the purchase of the machinery on January 11, 2017. Show separately the recording of depreciation expense in 2017 through 2021. (Do not round intermediate calculations. Round…arrow_forward

- On January 1, 20X1, the company purchased an equipment for $180,000. The equipment has a useful life of 12 years with no residual value. The company uses straight-line depreciation and revalues the equipment every three years. The company’s reporting date is December 31. The equipment’s fair value is $117,000 at December 31, 20X3, and $100,000 at December 31, 20X6. Prepare journal entries to revalue the equipment as at December 31, 20X3 and December 31, 20X6 (using the asset adjustment method).arrow_forwardFor the tangible and intangible assets acquired in the preceding transactions, determine the amount of depreciation and amortization that Palmer Cook Music Productions should report for the quarter ended March 31. For convenience, the equipment and vehicle are depreciated the same way, using the straight-line method with a useful life of five years and no residual value. The building is depreciated using the double-declining-balance method, with a 10-year useful life and residual value of $20,000. TIP: Calculate depreciation from the acquisition date to the end of the quarter.arrow_forwardSwanson & Hiller, Inc., purchased a new machine on September 1 of the current year at a cost of $149,000. The machine’s estimated useful life at the time of the purchase was five years, and its residual value was $9,000. The company reports on a calendar year basis. 1) Prepare a complete depreciation schedule, beginning with the current year, using the 200 percent declining-balance method. (Assume that the half-year convention is used). 2) Prepare a complete depreciation schedule, beginning with the current year, using the 150 percent declining-balance, switching to straight-line when that maximizes the expense. (Assume that the half-year convention is used).arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education