COLLEGE ACCOUNTING (LL)W/ACCESS>CUSTOM<

4th Edition

ISBN: 9781260255157

Author: Haddock

Publisher: MCG CUSTOM

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 13, Problem 1FSA

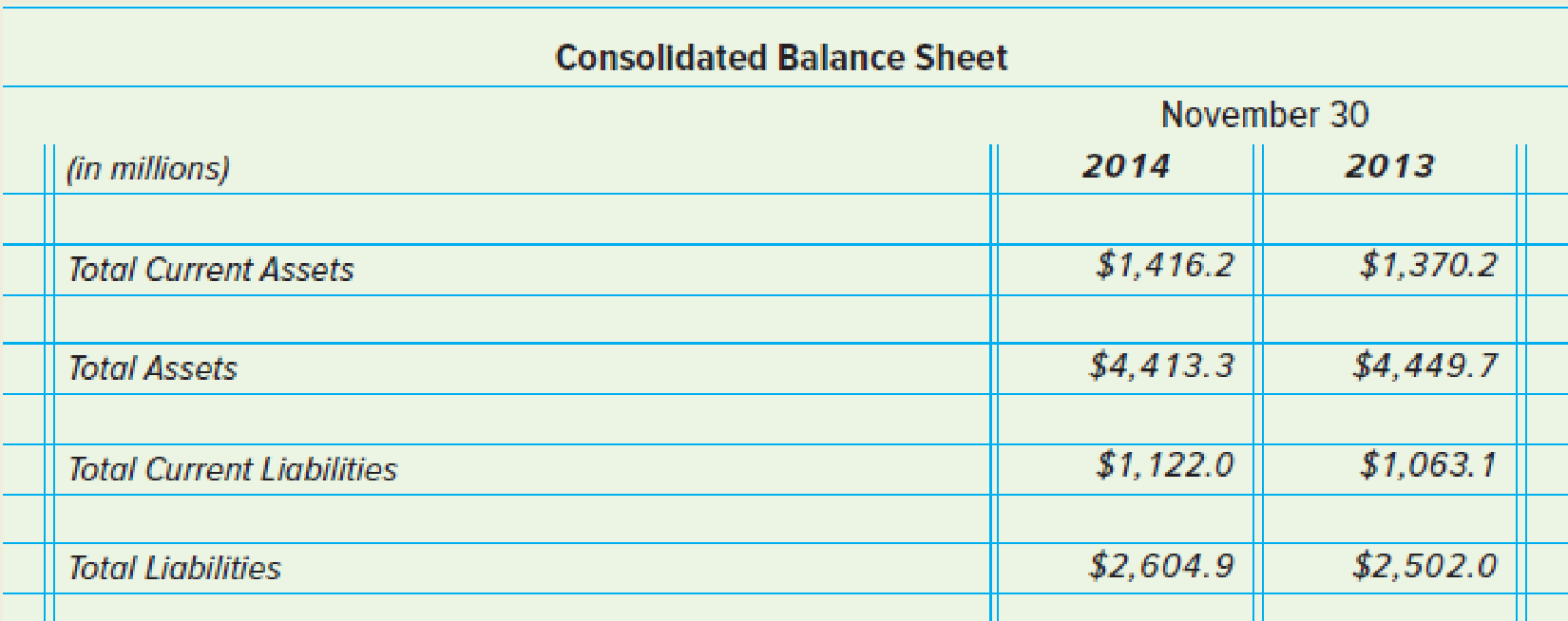

McCormick & Company, Incorporated, is a global leader in the manufacture, marketing, and distribution of spices, seasoning mixes, condiments, and other products to the food industry. McCormick & Company, Incorporated, reported the following in its 2014 Annual Report:

Analyze:

- 1. What is the

current ratio for both 2014 and 2013? - 2. Did the current ratio improve or decline from 2013 to 2014?

- 3. The company reported net sales of $4,243.2 million and gross profit of $1,730.2 million for its fiscal year ended November 30, 2014. What is the gross profit percentage for this period?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Calculate gross profit, cost of goods sold, and selling price MBI, Inc., had sales of $600 million for fiscal 2016. The company’s gross profit ratio for that year was 31.2%.Required:a. Calculate the gross profit and cost of goods sold for MBI, Inc., for fiscal 2016.b. Assume that a new product is developed and that it will cost $1,634 to manufacture. Calculate the selling price that must be set for this new product if its gross profit ratio is to be the same as the average achieved for all products for fiscal 2016.c. From a management viewpoint, what would you do with this information?

Happy Valley Homecare Suppliers, Incorporated (HVHS), had $11.7 million in sales in 2015. Its cost of goods sold was $4.68 million, and its average inventory balance was $1.84 million.

a. Calculate the average number of days inventory outstanding ratios for HVHS.

b. The average number of inventory days in the industry is 73 days. By how much must HVHS reduce its investment in inventory to improve its inventory days to meet the industry?

(Hint: Use a 365-day year.)

a. Calculate the number of days inventory outstanding ratios for HVHS.

The number of inventory days outstanding is

days. (Round to two demical places.)

b. The average number of inventory days in the industry is 73 days. By how much must HVHS reduce its investment in inventory to improve its inventory days to meet the industry?

To match the industry average number of inventory days, HVHS would reduce its inventory by $ million. (Round to three decimal place.)

Booker Inc. is a distributor of building supplies. Management for the company has developed the following forecasts of net income:

Table 8

Forecasted Net Income of Booker Inc. in USD (As of December 31st of each year)

Year

Forecasted Net Income

2011

$111,432

2012

$131,490

2013

$156,473

2014

$178,379

2015

$199,784

Management expects net income to grow at a rate of 7% per year after 2015 and the company's cost of equity capital is 14%. Management has set a dividend payout ratio equal to 25% of net income and plans to continue this policy. Booker’s common shareholders' equity at January 1, 2011, is $544,902.

Using the residual income model, compute the value of equity of Booker as of January 1, 2011.

Using the dividend discount model, compute the value of equity of Booker as of January 1, 2011.

Compare the results in parts (a) and (b) and discuss possible reasons for any discrepancies.

Chapter 13 Solutions

COLLEGE ACCOUNTING (LL)W/ACCESS>CUSTOM<

Ch. 13 - Why are financial statements prepared in...Ch. 13 - What is the distinction between current...Ch. 13 - Prob. 1.3SRQCh. 13 - Which of the following is not a current asset? a....Ch. 13 - How should purchases returns and allowances be...Ch. 13 - Assume that a business listed the Freight In...Ch. 13 - Why do adjusting entries need detailed...Ch. 13 - Which adjusting entries should be reversed?Ch. 13 - Prob. 2.3SRQCh. 13 - A reversing entry is made for an end-of-period...

Ch. 13 - Prob. 2.5SRECh. 13 - At the end of the previous accounting period, an...Ch. 13 - Prob. 1CSRCh. 13 - Prob. 2CSRCh. 13 - Prob. 3CSRCh. 13 - Prob. 4CSRCh. 13 - Which of the following should have a debit balance...Ch. 13 - Prob. 6CSRCh. 13 - Prob. 7CSRCh. 13 - Prob. 1DQCh. 13 - Prob. 2DQCh. 13 - What are operating expenses?Ch. 13 - Prob. 4DQCh. 13 - Prob. 5DQCh. 13 - Prob. 6DQCh. 13 - Prob. 7DQCh. 13 - Prob. 8DQCh. 13 - Prob. 9DQCh. 13 - Prob. 10DQCh. 13 - Prob. 11DQCh. 13 - Prob. 12DQCh. 13 - Prob. 13DQCh. 13 - Prob. 14DQCh. 13 - Prob. 15DQCh. 13 - Prob. 16DQCh. 13 - Prob. 17DQCh. 13 - Gomez Company had a current ratio of 2.0 in 2018...Ch. 13 - Prob. 1ECh. 13 - Prob. 2ECh. 13 - The worksheet of Bridgets Office Supplies contains...Ch. 13 - Prob. 4ECh. 13 - Prob. 5ECh. 13 - Prob. 6ECh. 13 - Prob. 7ECh. 13 - The Adjusted Trial Balance section of the...Ch. 13 - Prob. 9ECh. 13 - Prob. 10ECh. 13 - Superior Hardwood Company distributes hardwood...Ch. 13 - Good to Go Auto Products distributes automobile...Ch. 13 - Obtain all data necessary from the worksheet...Ch. 13 - Obtain all data that is necessary from the...Ch. 13 - Prob. 5PACh. 13 - ComputerGeeks.com is a retail store that sells...Ch. 13 - Hog Wild is a retail firm that sells motorcycles,...Ch. 13 - Prob. 3PBCh. 13 - Prob. 4PBCh. 13 - The data below concerns adjustments to be made at...Ch. 13 - Programs Plus is a retail firm that sells computer...Ch. 13 - Teagan Fitzgerald is the owner of Newport Jewelry,...Ch. 13 - Prob. 1MFCh. 13 - Spectrum Company had an increase in sales and net...Ch. 13 - Prob. 3MFCh. 13 - Prob. 4MFCh. 13 - Prob. 5MFCh. 13 - Prob. 6MFCh. 13 - Prob. 7MFCh. 13 - It is standard accounting procedures, or GAAP, to...Ch. 13 - McCormick Company, Incorporated, is a global...Ch. 13 - The Fashion Rack is a retail merchandising...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A company's sales in Seattle were $380,000 in 2012, while their sales in Portland were $285,000 for the same year. Complete the following statements:a. Seattle's sales were % larger than Portland's.b. Portland sales were % smaller than Seattle's.c. Portland sales were % of Seattle's.arrow_forwardNobility Homes, Incorporated, is a small maker of manufactured homes sold throughout the state of Florida. The following are selected financial data for the company for the period 2012-2016. Year 2012 2013 2014 2015 2016 2012 % 2013 0.4 100.0 0.44 1.09 17.4 Profit margin (8) Retention ratio (8) Asset turnover (X) Financial leverage (X) Growth rate in sales (t) Source: Data from Nobility Homes 2012 to 2016 annual reports a. Calculate Nobility Homes' annual sustainable growth rate for the years 2012 through 2016. Note: Round your answers to 1 decimal place. Sustainable Growth Rate % % % 6.7 % 2014 5.0 100.0 0.49 1.13 16.9 2015 5.4 100.0 0.54 1.16 14.4 9.4 100.0 0.59 2016 1.21 30.9 17.4 100.0 0.64 1.29 22.4arrow_forwardSmith Corporation had Sales of $2,350,000 in 2021 and $2,125,000 in 2020. Cost of Good Sold were $1,400,000 in 2021 and $1,325,000 in 2020. a. What was the percentage change in Sales year to year? b. What was the percentage change in Cost of Goods Sold year to year? c. Relative to the percentage in Sales, would you say the percentage change on Cost of Goods Sold was favorable or unfavorable? d. Is this an example of horizontal or vertical analysis?arrow_forward

- (Analysis of Given Ratios) Picasso Company is a wholesale distributor of packaging equipment and supplies. The company’s sales have averaged about $900,000 annually for the 3-year period 2015–2017. The firm’s total assets at the end of 2017 amounted to $850,000.The president of Picasso Company has asked the controller to prepare a report that summarizes the financial aspects of the company’s operations for the past 3 years. This report will be presented to the board of directors at their next meeting.In addition to comparative financial statements, the controller has decided to present a number of relevant financial ratios which can assist in the identification and interpretation of trends. At the request of the controller, the accounting staff has calculated the following ratios for the 3-year period 2015–2017. Check the below image for following ratios. In preparation of the report, the controller has decided first to examine the financial ratios independent of any other data to…arrow_forwardKyzera manufactures, markets, and sells cellular telephones. The average total assets for Kyzera is $250,000. In its most recent year, Kyzera reported net income of $65,000 on revenues of $475,000. Does return on assets seem satisfactory for Kyzera given that its competitors average a 12% return onassets?arrow_forwardHappy Valley Homecare Suppliers, Incorporated (HVHS), had $13.6 million in sales in 2010. Its cost of goods sold was $5.44 million, and its average inventory balance was $1.67 million. a. Calculate the average number of days inventory outstanding ratios for HVHS. b. The average number of inventory days in the industry is 73 days. By how muchmust HVHS reduce its investment in inventory to improve its inventory days to meet the industry? (Hint: Use a 365-day year.)arrow_forward

- Nobility Homes, Incorporated, is a small maker of manufactured homes sold throughout the state of Florida. The following are selected financial data for the company for the period 2012-2016. Profit margin (%) Retention ratio (%) Asset turnover (X) Financial leverage (X) Growth rate in sales (%) Source: Data from Nobility Homes 2012 to 2016 annual reports 2012 0.3 100.0 0.54 1.19 18.4 Year 2012 2013 2014 2015 2016 % % % % % 2013 4.0 100.0 0.59 1.23 17.9 2014 2015 6.4 100.0 0.64 1.26 15.4 a. Calculate Nobility Homes' annual sustainable growth rate for the years 2012 through 2016. Note: Round your answers to 1 decimal place. Sustainable Growth Rate 2016 18.4 10.4 100.0 100.0 0.69 0.74 1.31 1.39 31.9 23.4arrow_forwardFor a recent year Best Buy (BBY) reported sales of $39,528 million. It's gross profit was $9,191 million. What was the amount of Best Buy's cost of goods sold?arrow_forwardAnswer each of the questions In the following unrelated situations. (@) The curTent ratio of a company Is 6:1 and Its acid-test ratio is 1:1. If the Inventories and prepald items amount to $523,000, what Is the amount of current llabillitles? Current Llabilities (b) A company had an aVerage Inventory last year of $210,000 and Its Inventory tumover Was 5. If sales volume and unit cost remaln the samne this year as last and Inventory turnover Is 8 this year, what will average Inventory have to be during the current year? (Nound answer do 0 decimal places, e.g.125. Average Inventory (c) A company has current assets of S95,000 (of which $38,000 15 Inventory and prepaid tems) and current llabilities of $38,000, What Is the Current ratlo? What Is the aeid-test rabo? IF the company borows $13,000 cash from a bank on a 120-day loan, what will its current ratlo be? What will the add-test ratio bez (Round answers to 2 decimalplaces, c.0. 2.50.) Current Ratlo Add Test Ratio New Current Ratio New…arrow_forward

- Pharoah reported the following information for its fiscal year end: On net sales of $56.600 billion, the company earned net income after taxes of $6.792 billion. It had a cost of goods sold of $24.055 billion and EBIT of $9.622 billion. What are the company’s gross profit margin, operating profit margin, and net profit margin? (Round answers to 1 decimal place, e.g.12.5%.) Gross profit margin % Operating profit margin % Net profit margin %arrow_forwardA consumer products company reported a 20 percent increase in sales from last year to this year. Sales last year were $130,000. This year, the company reported Cost of Goods Sold in the amount of $94,692. What was the gross profit percentage this year?arrow_forwardStryker Corporation is a leading medical technology company headquartered in Kalamazoo, Michigan, that trades on the New York Stock Exchange. Following are selected financial data for Stryker for the period 2009 to 2013. Profit margin (%) Retention ratio (%) Asset turnover (X) Financial leverage (X) Growth rate in sales (%) 2009 Source: Data from Stryker 2009 to 2013 annual reports. Year 2009 2010 2011 2012 2013 17.3 83.1 0.70 1.70 1.1 Sustainable Growth Rate % % % % % 2010 18.3 82.0 0.70 1.70 9.3 2011 Calculate Stryker's annual sustainable growth rate from 2009 through 2013. Note: Round your answers to 1 decimal place. 17.3 80.3 0.70 1.70 14.0 2012 16.1 76.1 0.70 1.70 4.8 2013 12.3 61.3 0.60 1.80 5.3arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

How To Analyze an Income Statement; Author: Daniel Pronk;https://www.youtube.com/watch?v=uVHGgSXtQmE;License: Standard Youtube License