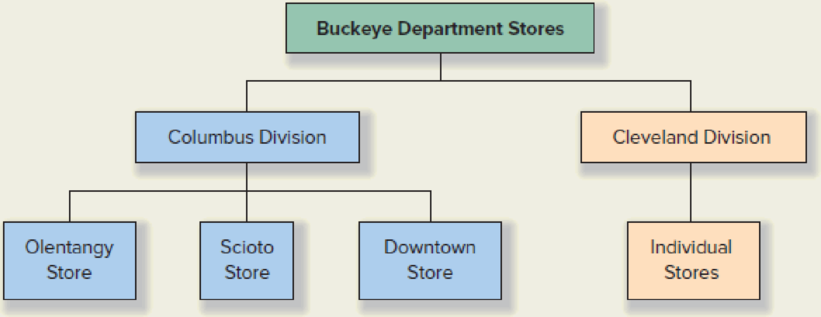

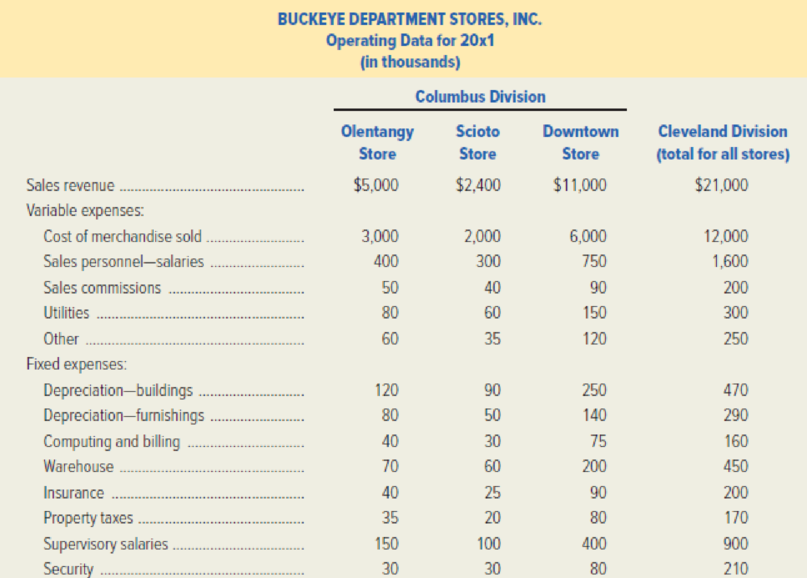

Buckeye Department Stores, Inc. operates a chain of department stores in Ohio. The company’s organization chart appears below. Operating data for 20x1 follow.

The following fixed expenses are controllable at the divisional level: depreciation—furnishings, computing and billing, warehouse, insurance, and security. In addition to these expenses, each division annually incurs $50,000 of computing costs, which are not allocated to individual stores.

The following fixed expenses are controllable only at the company level: depreciation—building, property taxes, and supervisory salaries. In addition to these expenses, each division incurs costs for supervisory salaries of $100,000, which are not allocated to individual stores.

Buckeye Department Stores incurs common fixed expenses of $120,000, which are not allocated to the two divisions. Income-tax expense for 20x1 is $1,950,000.

Required:

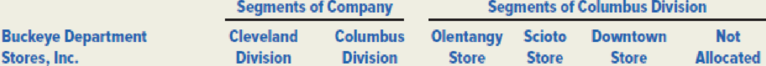

- 1. Prepare a segmented income statement similar to Exhibit 12–7 for Buckeye Department Stores, Inc. The statement should have the following columns:

Prepare the statement in the contribution format, and indicate the controllability of expenses. Subtract all variable expenses, including cost of merchandise sold, from sales revenue to obtain the contribution margin.

- 2. How would the segmented income statement help the president of Buckeye Department Stores manage the company?

Want to see the full answer?

Check out a sample textbook solution

Chapter 12 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

- BluStar Company has two service departments, Administration and Accounting, and two operating departments, Domestic and International. Administration costs are allocated on the basis of employees, and Accounting costs are allocated on the basis of number of transactions. A summary of BluStar operations follows. Employees Transactions Department direct costs Required A Administration 37,000 $363,000 Required: a. Allocate the cost of the service departments to the operating departments using the direct method. b. Allocate the cost of the service departments to the operating departments using the step method. Start with Administration. c. Allocate the cost of the service departments to the operating departments using the reciprocal method. Complete this question by entering your answers in the tabs below. Required B Required C From Accounting Domestic International 26 47 22,000 $141,000 $955,000 Department costs Administration allocation Accounting allocation Total cost Allocate the cost…arrow_forwardIn divisional income statements prepared for Demopolis Company, the Payroll Department costs are charged back to user divisions on the basis of the number of payroll distributions, and the Purchasing Department costs are charged back on the basis of the number of purchase requisitions. The Payroll Department had expenses of $48,024, and the Purchasing Department had expenses of $22,000 for the year. The following annual data for Residential, Commercial, and Government Contract divisions were obtained from corporate records: Line Item Description Residential Commercial Government Contract Sales $460,000 $609,000 $1,399,000 Number of employees: Weekly payroll (52 weeks per year) 110 85 90 Monthly payroll 30 41 28 Number of purchase requisitions per year 2,100 1,500 1,400 Required: a. Determine the total amount of payroll checks and purchase requisitions processed per year by the company and each division. Line Item Description Residential Commercial…arrow_forwardIn divisional income statements prepared for Demopolis Company, the Payroll Department costs are charged back to user divisions on the basis of the number of payroll distributions, and the Purchasing Department costs are charged back on the basis of the number of purchase requisitions. The Payroll Department had expenses of $51,792, and the Purchasing Department had expenses of $22,000 for the year. The following annual data for Residential, Commercial, and Government Contract divisions were obtained from corporate records: Residential Commercial GovernmentContract Sales $ 460,000 $ 609,000 $ 1,399,000 Number of employees: Weekly payroll (52 weeks per year) 170 65 70 Monthly payroll 36 47 34 Number of purchase requisitions per year 2,100 1,500 1,400 a. Determine the total amount of payroll checks and purchase requisitions processed per year by the company and each division. Residential Commercial Government Contract…arrow_forward

- In divisional income statements prepared for Demopolis Company, the Payroll Department costs are charged back to user divisions on the basis of the number of payroll distributions, and the Purchasing Department costs are charged back on the basis of the number of purchase requisitions. The Payroll Department had expenses of $90,784, and the Purchasing Department had expenses of $31,270 for the year. The following annual data for Residential, Commercial, and Government Contract divisions were obtained from corporate records: Residential Commercial GovernmentContract Sales $ 654,000 $ 866,000 $ 1,989,000 Number of employees: Weekly payroll (52 weeks per year) 250 80 85 Monthly payroll 28 39 26 Number of purchase requisitions per year 2,200 1,600 1,500 a. Determine the total amount of payroll checks and purchase requisitions processed per year by the company and each division. Residential Commercial Government Contract…arrow_forwardThe following data were summarized from the accounting records for Jersey Coast Construction Company for the year ended June 30, 20Y8: Cost of goods sold: Commercial Division $916,250 Residential Division 450,675 Administrative expenses: Commercial Division $149,200 Residential Division 128,800 Service department charges: Commercial Division $112,740 Residential Division 68,850 Sales: Commercial Division $1,360,500 Residential Division 749,500 Prepare divisional income statements for Jersey Coast Construction Company. Refer to the Amount Descriptions list provided for the exact wording of the answer choices for text entries. X Amount Descriptions Amount Descriptions Administrative expenses Cost of goods sold Gross profit Income from operations Income from operations before service department charges Sales Selling expenses Service department charges…arrow_forwardGrael Technology has two divisions, Consumer and Commercial, and two corporate service departments, Tech Support and Purchasing. The corporate costs for the year ended December 31, 20Y7, are as follows: Tech Support Department $336,000 Purchasing Department 67,500 Other corporate administrative costs 448,000 Total corporate costs $851,500 The other corporate administrative costs include officers’ salaries and miscellaneous smaller costs required by the corporation. The Tech Support Department allocates the divisions for services rendered, based on the number of computers in the department, and the Purchasing Department allocates divisions for services, based on the number of purchase orders for each department. The usage of service by the two divisions is as follows: Tech Support Purchasing Consumer Division 300 computers 1,800 purchase orders Commercial Division 180 2,700 Total 480 computers 4,500 purchase orders The service department allocations…arrow_forward

- eBook Service Department Charges In divisional income statements prepared for Iguana Construction Company, the Payroll Department costs are charged back to user divisions on the basis of the number of payroll checks, and the Purchasing Department costs are charged back on the basis of the number of purchase requisitions. The Payroll Department had expenses of $46,248, and the Purchasing Department had expenses of $26,840 for the year. The following annual data for the Residential, Commercial, and Government Contract divisions were obtained from corporate records: Residential Commercial GovernmentContract Sales $561,000 $743,000 $1,707,000 Number of employees: Weekly payroll (52 weeks per year) 130 70 75 Monthly payroll 28 39 26 Number of purchase requisitions per year 2,600 1,800 1,700 a. Determine the total amount of payroll checks and purchase requisitions processed per year by each division and the company in total.…arrow_forwardThe following data were summarized from the accounting records for Jersey Coast Construction Company for the year ended June 30, 20Y8: Cost of goods sold: Service department charges: Commercial Division $422,110 Commercial Division $57,560 Residential Division 218,470 Residential Division 37,840 Administrative expenses: Net sales: Commercial Division $76,750 Commercial Division $639,560 Residential Division 78,030 Residential Division 390,130 Prepare divisional income statements for Jersey Coast Construction Company. Jersey Coast Construction CompanyDivisional Income StatementsFor the Year Ended June 30, 20Y8 Commercial Division Residential Division $Net sales $Net sales Cost of goods sold Cost of goods sold $Gross profit $Gross profit Administrative expenses Administrative expenses $Income from operations before service department charges $Income from operations before service department charges…arrow_forwardIn divisional income statements prepared for LeFevre Company, the Payroll Department costs are charged back to user divisions on the basis of the number of payroll distributions, and the Purchasing Department costs are charged back on the basis of the number of purchase requisitions. The Payroll Department had expenses of $63,568, and the Purchasing Department had expenses of $25,370 for the year. The following annual data for Residential, Commercial, and Government Contract divisions were obtained from corporate records: Residential Commercial GovernmentContract Sales $530,000 $703,000 $1,614,000 Number of employees: Weekly payroll (52 weeks per year) 145 65 70 Monthly payroll 34 45 32 Number of purchase requisitions per year 1,800 1,300 1,200 a. Determine the total amount of payroll checks and purchase requisitions processed per year by the company and each division. Residential Commercial Government Contract Total…arrow_forward

- In divisional income statements prepared for LeFevre Company, the Payroll Department costs are charged back to user divisions on the basis of the number of payroll distributions, and the Purchasing Department costs are charged back on the basis of the number of purchase requisitions. The Payroll Department had expenses of $63,568, and the Purchasing Department had expenses of $25,370 for the year. The following annual data for Residential, Commercial, and Government Contract divisions were obtained from corporate records: Government Residential Commercial Contract Sales $530,000 $703,000 $1,614,000 Number of employees: Weekly payroll (52 weeks per year) 145 65 70 Monthly payroll 34 45 32 Number of purchase requisitions per year 1,800 1,300 1,200 a. Determine the total amount of payroll checks and purchase requisitions processed per year by the company and each division. Government Residential Commercial Total Contract Number of payroll checks: Weekly payroll Monthly payroll Total…arrow_forwardThe following data were summarized from the accounting records for Jersey Coast Construction Company for the year ended June 30, 20Y8: Cost of goods sold: Service department charges: Commercial Division $331,840 Commercial Division $45,250 Residential Division 163,310 Residential Division 28,290 Administrative expenses: Net sales: Commercial Division $60,330 Commercial Division $502,790 Residential Division 58,320 Residential Division 291,620 Prepare divisional income statements for DeSalvo Construction Company. JERSEY COAST CONSTRUCTION COMPANY Divisional Income Statements For the Year Ended June 30, 20Y8 Commercial Division Residential Division $ $ $ $ $ $ $ $arrow_forwardMarks Corporation has two operating departments, Drilling and Grinding, and an office. The three categories of office expenses are allocated to the two operating departments using different allocation bases. The following information is available for the current period: Office Expenses Total Allocation Base Salaries $ 30,000 Number of employees Depreciation 20,000 Cost of goods sold Advertising 40,000 Percentage of total sales Department Number of employees Sales Cost of goods sold Drilling 1,000 $ 325,000 $ 75,000 Grinding 1,500 475,000 125,000 Total 2,500 $ 800,000 $ 200,000 The amount of salaries that should be allocated to Grinding for the current period is:arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub