Engineering Economy (17th Edition)

17th Edition

ISBN: 9780134870069

Author: William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 12, Problem 3P

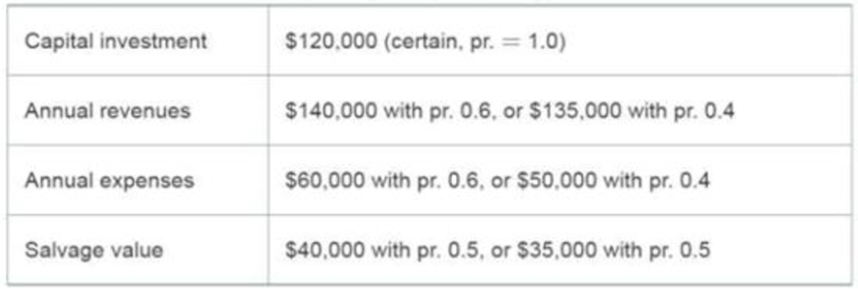

A new snow making machine utilizes technology that permits snow to be produced in ambient temperature of 70 degrees Fahrenheit or below. The estimated cash flows for the ski resort contemplating this investment are uncertain as shown below (note: pr. = probability).

The machine is expected to have a useful life of 12 years, and the MARR of the ski resort is 8% per year. What is the expected present worth of this investment?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

It is estimated that an investment alternative with an

initial investment cost of 150000 TL will generate

annual revenues of 85000 TL and annual expenses of

20000 TL. It is expected to have a scrap value of 95000

TL at the end of its 5-year life. Find out how sensitive

the investment decision of this investment alternative

is to its revenues. (MARR: %10)

The tree diagram in figure below describes the uncertain cash flows for an engineering project. The analysis period is two years, and MARR = 12% per year. Based on this information,

a. What are the E(PW), V(PW), and SD(PW) of the project?

b. What is the probability that PW≥ 0?

Click the icon to view the tree diagram.

Click the icon to view the interest and annuity table for discrete compounding when the MARR is 12% per year.

a. Calculate the E(PW), V(PW), and SD(PW) of the project.

E(PW) = $ (Round to the nearest dollar.)

More Info

0

-$29,000

0.2

0.6

0.2

Time Period

1

$5,500

$11,000

$17,500

0.1

0.1

0.8

0.1

0.7

0.2

0.2

0.3

0.5

2

$17,200

$20,200

$24,800

$20,100

$24,600

$29.300

$21,900

$28,000

$31,100

C

Q

- X

More Info

N

1

2

3

4

5

Discrete Compounding; i = 12%

Compound

Amount

Factor

To Find F

Given A

FIA

1.0000

2.1200

3.3744

4.7793

6.3528

Single Payment

Compound

Amount

Factor

To Find F

Given P

F/P

1.1200

1.2544

1.4049

1.5735

1.7623

Present

Worth Factor

To Find P

Given F

P/F

0.8929

0.7972…

If the company's MARR is known to be 10%, is the investment justified?

Chapter 12 Solutions

Engineering Economy (17th Edition)

Ch. 12 - Prob. 1PCh. 12 - Prob. 2PCh. 12 - A new snow making machine utilizes technology that...Ch. 12 - Prob. 4PCh. 12 - Prob. 5PCh. 12 - Prob. 6PCh. 12 - Prob. 7PCh. 12 - Prob. 8PCh. 12 - Prob. 9PCh. 12 - Prob. 10P

Ch. 12 - Prob. 11PCh. 12 - Prob. 12PCh. 12 - Prob. 13PCh. 12 - Prob. 14PCh. 12 - Prob. 15PCh. 12 - Prob. 16PCh. 12 - Prob. 17PCh. 12 - Prob. 18PCh. 12 - Prob. 19PCh. 12 - Prob. 20PCh. 12 - Prob. 21PCh. 12 - Prob. 22PCh. 12 - If the interest rate is 8% per year, what decision...Ch. 12 - Prob. 24PCh. 12 - Prob. 25PCh. 12 - Prob. 26SE

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- A company is considering an investment (at time = 0) in a machine that produces large plastic boxes. The cost of the machine is 43,118 dollars with zero expected salvage value. Annual production in units during the 3-year life of the machine is expected to be (starting at time = 1) 4,213, 8,486, and 12,468. The sale price per unit of the plastic boxes is 12 dollars in year one, and then expected to increase by 9% per year. Production costs per unit will be 5 dollars in year one, and then expected to increase by 3% per year. Depreciation on the machine is 10,192 dollars per year, the tax rate is 40% and the minimum acceptable rate of return is 6% percent. Calculate the net present value of this investment. Assume all flows are at the end of each year. (note: round your answer to the nearest cent, and do not include spaces, currency signs, plus or minus signs, or commas)arrow_forwardThe tree diagram in figure below describes the uncertain cash flows for an engineering project. The analysis period is two years, and MARR = 18% per year. Based on this information, a. What are the E(PW), V(PW), and SD(PW) of the project? b. What is the probability that PW20? Click the icon to view the tree diagram. Click the icon to view the interest and annuity table for discrete compounding when the MARR is 18% per year, a. Calculate the E(PW), V(PW), and SD(PW) of the project. E(PW)-$ (Round to the nearest dollar) KILRarrow_forwardBulaklak Oil Company must install anti-pollution equipment in a new refinery in Bataan to meet clean air legislation. It is considering three types of equipment, and the following data are available:Use MARR = 20%, repeatability assumption and solution by PW.arrow_forward

- An equipment costing $57,500 is being considered for a production process at Dewey Chemicals. The expected benefits per year is $4,500 and estimated salvage value is $10,000. Determine the rate of return the company can get in this equipment proposal. Equipment life = 15 years.arrow_forwardMary has $255,906 accumulated in a 401K plan. The fund is earning a low, but safe, 3% per year. The withdrawals will take place at the end of each year starting a year from now. How soon will the fund be exhausted if Mary withdraws $30,000 each year? Group of answer choices 8.5 years. 8.8 years. 10 years. None is correct. 11 years.arrow_forwardA distribution company is considering three different alternatives to satisfy their customer's demands. Their options are to rent a ready distribution center (D01), Rent and mobilize a center (D02), or outsourcing (OS). The estimate for each method is shown. The lifetime for D01, D02, and OS are 3, 6, and 2 respectively. MARR is 0.04 per year, and the percentage of change for all of the cases are 0 % Note: all units are in thousand $ D01 First Cost, $ Annual Operation Cost, $ Salvage Value, $ a: Calculate the Fw of D01? -136 -92 28 D02 OS -973 0 -59 -123 333 0arrow_forward

- Please use a financial calculator to solve. Be sure to list your steps. You are evaluating two different silicon wafer milling machines. The Techron I costs $237,000, has a three-year life, and has pretax operating costs of $62, 000 per year. The Techron II costs $ 415,000, has a five - year life, and has pretax operating costs of $ 35,000 per year. For both milling machines, use straight - line depreciation to zero over the project's life and assume a salvage value of $39, 000. If your tax rate is 21 percent and your discount rate is 8 percent, compute the EAC for both machines. (Your answer should be a negative value and indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.)arrow_forwardAn integrated, combined cycle power plant produces 285 MW of electricity by gasifying coal. The capital investment for the plant is $570 million, spread evenly over two years. The operating life of the plant is expected to be 20 years. Additionally, the plant will operate at full capacity 75% of the time (downtime is 25% of any given year). The MARR is 6% per year. Solve, a. If this plant will make a profit of three cents per kilowatt-hour of electricity sold to the power grid, what is the simple payback period of the plant? Is it a low-risk venture? b. What is the IRR for the plant? Is it profitable?arrow_forwardVidhi is investing in some rental property in Collegeville and is investigating her income from the investment. She knows the rental revenue will increase each year, but so will the maintenance expenses. She has been able to generate the data that follows regarding this investment opportunity. Assume that all cash flows occur at the end of each year and that the purchase and sale of this property are not relevant to the study. • If Vidhi's MARR = 6% per year, is this investment a profitable undertaking? Use Future Worth method! Year Revenue Year Expenses 1 $6,000 1 $3,100 2 6,200 2 3,300 6,300 3 3,500 6,400 4 3,700 6,500 5 3,900 6,600 6 6,100 6,700 7 4,300 6,800 8 4,500 6,900 4,700 7,000 4,900 3 4 5 6 7 8 9 10 9 10arrow_forward

- A Loader cost Ph 2,115,000 to purchase. Fuel, oil grease, and minor maintenance are estimated to cost Ph580 per operating hour. A set of tires cost Ph150,000 to replace, and their estimated life is 2,800 use hours. A Ph282,000 major repair will probably be required after 4,200hr of use. The equipment is expected to last for 8,400 hr, after which it will be sold at a price equal to 15% of the original purchase price. A final set of new tires will not be purchased before the sale. How much should the owner of the Dozer charge per hour of use, if it is expected that the machine will operate 1,400 hr per year? The company’s capital rate is 8%.arrow_forwardTwo laser machines (A & B) used in a project and are being compared to choose one of them, for a medical center specialized in eye's treatments. The price of machine A is 1,200,000 Usdand requires an annual maintenance of 100,000 Usd, while the price of machine B is 1,000,000Dhs and requires an annual maintenance of 120,000 Usd. The expected life time for bothmachines is 8 years after which the two machines salvage values will be 150,000 Usd formachine A and 125,000 Usd for machine B. The MARR decided by the medical centeradministration is 9% per year. So tell the future calculated worth analysis to decide whuch a or b will be good to be purchased?arrow_forwardAn equipment costing $57,500 is being considered for a production process at Dew Chemicals. The expected benefits per year is $4,500 and estimated salvage value is $10,000. Determine the rate of return the company can get in this equipment proposal. Equipment life = 15 years. ( Can I have detailed answer)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education

Valuation Analysis in Project Finance Models - DCF & IRR; Author: Financial modeling;https://www.youtube.com/watch?v=xDlQPJaFtCw;License: Standard Youtube License