FUNDAMENTAL'S OF COST ACCOUNTING LL

6th Edition

ISBN: 9781260998993

Author: LANEN

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 12, Problem 38E

Single versus Dual Rates: Ethical Considerations

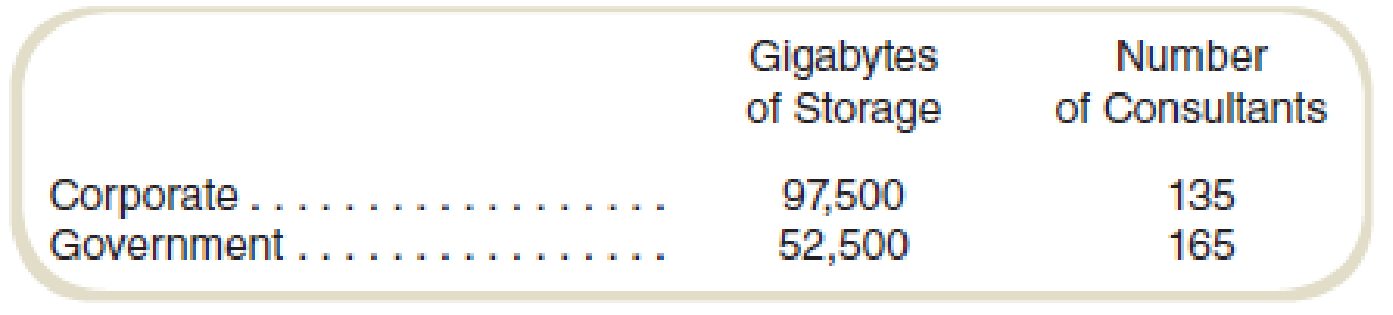

A consulting firm has two departments, Corporate and Government. Computer support is common to both departments. The cost of computer support is $9 million. The following information is given:

Required

- a. What is the cost charged to each department if the allocation is based on the number of gigabytes of storage?

- b. What is the cost charged to each department if number of consultants is the allocation basis?

- c. Most of the business in the Corporate Department is priced on a fixed fee basis, and most of the work in the Government Department is priced on a cost-plus fixed fee basis. Will this affect the choice of the allocation base? Should it?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Lamothe Solutions is a management consulting firm. Its Business Division advises firms on the adoption and use of

financial systems. Civic Division consults with state and local governments. Civic Division has a client that is interested in

implementing a new costing system in its public works department. The division's head approached the head of Business

Division about using one of its associates. Corporate Division charges clients $770 per hour for associate services, the

same rate other consulting companies charge. The Civic Division head complained that it could hire its own associate at

an estimated variable cost of $370 per hour, which is what Business pays its associates.

Required:

a. What is the maximum price that Civic Division should pay?

b. What is the maximum transfer price that Business Division should obtain for its services, assuming that it is operating at

capacity?

A consulting firm has two departments, Corporate and Government. Computer support is common to both departments. The cost of computer support is $9 million. The following information is given:

Gigabytesof Storage

Numberof Consultants

Corporate

97,500

135

Government

52,500

165

Required:

What is the cost allocation if fixed computer costs of $7 million are allocated on the basis of number of consultants and the remaining costs (all variable) are allocated on the basis of the number of gigabytes of storage used by the department? (Enter your answers in dollars, not in millions. Do not round intermediate calculations.)

Kentfield Advisory Services (KAS) is a large management consulting firm organized into two groups: Governmental Services (GS) and

Commercial Support (CS). Corporate information technology (IT) services support both groups. The cost of computer support is $47

million. The following information is given:

Governmental Services

Commercial Support

Utilization Revenues ($000)

$ 241,400

438,600

Required A

Required:

a. What is the cost charged to each group if the allocation is based on the utilization?

b. What is the cost charged to each group if revenue is the allocation basis?

c. Most of the business in Commercial Support is priced on a fixed fee basis, and most of the work in the Governmental Services

Department is priced on a cost-plus fixed fee basis. Will the allocation base selected affect the amount of revenue?

Complete this question by entering your answers in the tabs below.

Required B Required C

43%

Governmental services

Commercial Support

57

What is the cost charged to each group…

Chapter 12 Solutions

FUNDAMENTAL'S OF COST ACCOUNTING LL

Ch. 12 - What does decentralization mean in the context of...Ch. 12 - Why is performance measurement an important...Ch. 12 - Prob. 3RQCh. 12 - What does dysfunctional decision making refer to?Ch. 12 - Prob. 5RQCh. 12 - What are the five basic kinds of decentralized...Ch. 12 - What is goal congruence? How is it different from...Ch. 12 - Prob. 8RQCh. 12 - What is relative performance evaluation?Ch. 12 - Prob. 10RQ

Ch. 12 - Prob. 11RQCh. 12 - Prob. 12RQCh. 12 - The management control system collects information...Ch. 12 - Salespeople are often paid a commission based on...Ch. 12 - Prob. 15CADQCh. 12 - Prob. 16CADQCh. 12 - On December 30, a manager determines that income...Ch. 12 - Prob. 18CADQCh. 12 - Prob. 19CADQCh. 12 - The manager of an operating department just...Ch. 12 - In the previous chapters, we considered different...Ch. 12 - A company has a bonus plan that states that...Ch. 12 - Prob. 23CADQCh. 12 - Prob. 24CADQCh. 12 - Prob. 25CADQCh. 12 - Prob. 26CADQCh. 12 - Prob. 27CADQCh. 12 - Prob. 28CADQCh. 12 - Prob. 29ECh. 12 - Evaluating Management Control SystemsEthical...Ch. 12 - Prob. 31ECh. 12 - Management Control Systems and Incentives A...Ch. 12 - Prob. 33ECh. 12 - Prob. 34ECh. 12 - Prob. 35ECh. 12 - Alternative Allocation Bases: Service Bartolo...Ch. 12 - Prob. 37ECh. 12 - Single versus Dual Rates: Ethical Considerations A...Ch. 12 - Single versus Dual Rates

Using the data for the...Ch. 12 - Alternative Allocation Bases Thompson Aeronautics...Ch. 12 - Tone at the Top, Ethics Once upon a time, a major...Ch. 12 - Prob. 42ECh. 12 - Prob. 43ECh. 12 - Internal Controls Commonly in many organizations,...Ch. 12 - Evaluating Management Control Systems SPG Company...Ch. 12 - Analyze Performance Report for Decentralized...Ch. 12 - Divisional Performance Measurement: Behavioral...Ch. 12 - Prob. 48PCh. 12 - Prob. 49PCh. 12 - Cost Allocations: Comparison of Dual and Single...Ch. 12 - Cost Allocation for Travel Reimbursement Your...Ch. 12 - Incentives, Illegal Activities, and Ethics An...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Lamothe Solutions is a management consulting firm. Its Business Division advises firms on the adoption and use of financial systems. Civic Division consults with state and local governments. Civic Division has a client that is interested in implementing a new costing system in its public works department. The division's head approached the head of Business Division about using one of its associates. Corporate Division charges clients $780 per hour for associate services, the same rate other consulting companies charge. The Civic Division head complained that it could hire its own associate at an estimated variable cost of $380 per hour, which is what Business pays its associates. Suppose that Civic Division will charge the client interested in implementing a costing system by the hour based on cost plus a fixed fee, where the cost is primarily the consultant's hourly pay. Assume also that Civic Division cannot hire additional consultants. That is, if it is to do this job, it will need…arrow_forwardLamothe Solutions is a management consulting firm. Its Business Division advises firms on the adoption and use of financial systems. Civic Division consults with state and local governments. Civic Division has a client that is interested in implementing a new costing system in its public works department. The division's head approached the head of Business Division about using one of its associates. Corporate Division charges clients $780 per hour for associate services, the same rate other consulting companies charge. The Civic Division head complained that it could hire its own associate at an estimated variable cost of $380 per hour, which is what Business pays its associates. Suppose that Civic Division will charge the client interested in implementing a costing system by the hour based on cost plus a fixed fee, where the cost is primarily the consultant's hourly pay. Assume also that Civic Division cannot hire additional consultants. That is, if it is to do this job, it will need…arrow_forwardRequired information [The following information applies to the questions displayed below.] Data Performance, a computer software consulting company, has three major functional areas: computer programming, information systems consulting, and software training. Carol Bingham, a pricing analyst, has been asked to develop total costs for the functional areas. These costs will be used as a guide in pricing a new contract. In computing these costs, Carol is considering three different methods of the departmental allocation approach to allocate overhead costs: the direct method, the step method, and the reciprocal method. She assembled the following data from the two service departments, information systems and facilities: a. b. Budgeted overhead (base) Information Systems (computer hours) Facilities (square feet) C. Service Departments Information Systems $ 368,000 240 Direct Method Step Method (Information Systems Goes First) Step Method (Facilities Goes First) Reciprocal method Computer…arrow_forward

- Lamothe Solutions is a management consulting firm. Its Business Division advises firms on the adoption and use of financial systems. Civic Division consults with state and local governments. Civic Division has a client that is interested in implementing a new costing system in its public works department. The division's head approached the head of Business Division about using one of its associates. Corporate Division charges clients $815 per hour for associate services, the same rate other consulting companies charge. The Civic Division head complained that it could hire its own associate at an estimated variable cost of $415 per hour, which is what Business pays its associates. Required: a. What is the maximum price that Civic Division should pay? b. What is the maximum transfer price that Business Division should obtain for its services, assuming that it is operating at capacity? c-1. Is there any change in maximum price as indicated in part (a), if Business Division had idle…arrow_forwardRequired information [The following information applies to the questions displayed below.] Cranshaw Business Services (CBS) operates an information technology (IT) consulting firm out of two offices: Detroit and Los Angeles. Corporate services, such as legal, finance, and personnel, are centralized at the main office and the costs of these services are allocated to the two offices for the purposes of profitability assessment. The Detroit office is the original unit of the company and is well established, having long-time clients from the automotive and other manufacturing industries. The Los Angeles office is new with a smaller, much more varied, clientele. The costs of personnel services at CBS are currently allocated on the basis of the number of employees in each office. The annual costs of the personnel department total $510,000. Data for the fiscal year just ended show the following: Number of employees Number of new hires. Number of employees departing Allocation based on…arrow_forward(Ch 8) Which departments in an organization produce services for external customers? Question 1 options: Support departments. Dual-rate departments. Operating departments. Sales departments. (Ch 8) When allocating support department costs, managers must identify cost pools. The choice of cost pools is: Question 2 options: not influenced by the allocation base. not important, because all support department costs will eventually be allocated anyway. influenced by the design of the accounting information system. determined by whether a company uses IFRS or ASPE.arrow_forward

- Analyze Horsepower Hookup, Inc. Horsepower Hookup, Inc., is a large automobile company that specializes in the production of high-powered trucks. The company is determining cost allocations for purposes of performance evaluation. A portion of company bonuses depends on divisions achieving cost management goals. This necessitates highly accurate support department cost allocation. Management has also stated that it has the means to implement as complex a method as necessary. The general manager over the Mid-Size D wants to get a good idea of what factors are driving the costs of the support departments in order to make accurate cost allocations, so finding accurate support department cost drivers is important. Support department costs include Janitorial (163,100) and Security (285,400). The Janitorial costs vary depending on the number of vehicles produced, increasing with larger production volumes. Security costs are fixed based on the size of the lot, and do not change with respect to how many vehicles are in the lot or warehouse. Joint costs involved in producing the trucks before the split-off point where the various makes, models, and colors are produced are 946,000 for the period. All makes, models, and colors sell at relatively similar margins, but the sports models and metallic colors are normally more difficult to produce during the joint production process. a. Which support department cost allocation method (direct, sequential, or reciprocal services) should be used to allocate support department cost? b. What driver would be best for allocating Janitorial costs? c. What driver would be best for allocating Security costs? d. If Janitorial costs were to be allocated based on square footage, and Security costs based on asset value, what percentage of each support departments costs would be allocated to each production department using the sequential method (allocating Security costs first) given the following: e. Should Janitorial and Security costs be considered when evaluating the performance of cost management employees? f. What joint cost allocation method should be used for performance evaluation purposes?arrow_forwardTwo departments within Cougar Gear Inc. are Production and Sales. Each department has a unique scorecard, as follows: The Production Department scorecard focuses on the learning and growth and internal processes perspectives. The Sales Department scorecard focuses on the learning and growth and customer perspectives. Both scorecards have the learning and growth performance metrics of median training hours per employee and average employee tenure. The Production scorecard has the unique metrics of production time per unit and number of production shutdowns. The Sales scorecard has the unique metrics of percentage of customers who shop again and online customer satisfaction rating. The performance targets for each metric are shown in the tan boxes just under the performance metrics. The actual achieved metrics are shown in the red boxes just below the tan boxes. When evaluating both departments, Cougar Gears management looks at the median training hours per employee and average employee tenure metrics and subsequently decides to give the Sales Department a large bonus while giving the Production Department a minimal bonus. a. Determine and define the type of cognitive bias Cougar Gears management has exhibited in this instance. b. Determine which department would have received the larger bonus had the companys management not been biased in the evaluation. c. Discuss one advantage and one disadvantage of using unique balanced scorecards for different departments or divisions of a company.arrow_forwardAs manager of department B in MarIeys Manufacturing, based on the costs you identified in the previous exercise for further research, how does this impact the financial performance of your department, and what might be some questions you want to ask or solutions you might propose to Marleys management?arrow_forward

- 1. Describe the key features of the reciprocal method. 2. Allocate the support departments' costs (human resources and information systems) to the two operating departments using the reciprocal method. Use (a) linear equations and (b) repeated iterations. 3. In the case presented in this exercise, which method (direct, step-down, or reciprocal) would you recommend? Why? Direct allocation data Support Departments Operating Departments HR Info. Systems Corporate Consumer Total Costs incurred $90,000 $227,000 $994,000 $484,000 $1,795,000 Allocation of HR costs (90,000) 49,500 40,500 Allocation of Info. Systems costs (227,000) 158,900 68,100 Total budgeted costs of operating departments $0 $0 $1,202,400 $592,600 $1,795,000 A B C D E 1 SUPPORT DEPARTMENTS OPERATING DEPARTMENTS 2 Human Resources Information Systems…arrow_forward! Required Information [The following Information applies to the questions displayed below.] Cranshaw Business Services (CBS) operates an Information technology (IT) consulting firm out of two offices: Detroit and Los Angeles. Corporate services, such as legal, finance, and personnel, are centralized at the main office and the costs of these services are allocated to the two offices for the purposes of profitability assessment. The Detroit office is the original unit of the company and is well established, having long-time clients from the automotive and other manufacturing Industries. The Los Angeles office is new with a smaller, much more varied, clientele. The costs of personnel services at CBS are currently allocated on the basis of the number of employees in each office. The annual costs of the personnel department total $350,000. Data for the fiscal year just ended show the following: Number of employees Number of new hires Number of employees departing Detroit 380 Los Angeles…arrow_forward! Required information [The following information applies to the questions displayed below.] Cranshaw Business Services (CBS) operates an information technology (IT) consulting firm out of two offices: Detroit and Los Angeles. Corporate services, such as legal, finance, and personnel, are centralized at the main office and the costs of these services are allocated to the two offices for the purposes of profitability assessment. The Detroit office is the original unit of the company and is well established, having long-time clients from the automotive and other manufacturing industries. The Los Angeles office is new with a smaller, much more varied, clientele. The costs of personnel services at CBS are currently allocated on the basis of the number of employees in each office. The annual costs of the personnel department total $440,000. Data for the fiscal year just ended show the following: Number of employees Number of new hires Number of employees departing a. Using current…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

What is Cost Allocation? Definition & Process; Author: FloQast;https://www.youtube.com/watch?v=hLhvvHvZ3JM;License: Standard Youtube License