Concept explainers

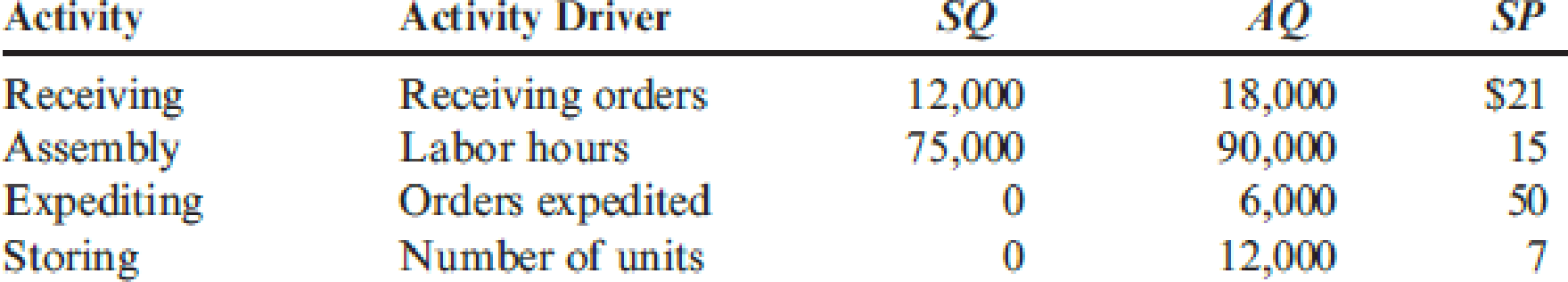

Cicleta Manufacturing has four activities: receiving materials, assembly, expediting products, and storing goods. Receiving and assembly are necessary activities; expediting and storing goods are unnecessary. The following data pertain to the four activities for the year ending 20x1 (actual price per unit of the activity driver is assumed to be equal to the standard price):

Required:

- 1. Prepare a cost report for the year ending 20x1 that shows value-added costs, non-value-added costs, and total costs for each activity.

- 2. Explain why expediting products and storing goods are non-value-added activities.

- 3. What if receiving cost is a step-fixed cost with each step being 1,500 orders whereas assembly cost is a variable cost? What is the implication for reducing the cost of waste for each activity?

1.

Construct a cost report for C Company showing the value-added, non-value cost and total cost of each activity.

Explanation of Solution

Value-added cost: A value added cost is the cost incurred by the business to perform the value added activities in order to achieve optimum efficiency in their operations. Value-added costs are calculated using the following formula.

Non-value added cost: A non-value added cost is the cost incurred by a business on non-value added activities that adds to the total cost of the business but does not contribute to the required efficiency. Non-value-added costs are calculated using the following formula.

Prepare a cost report of C Company showing the value-added, non-value added and total cost of each activity of C Company.

| Value and non-value added | |||

| Cost report of C Company | |||

| Activity |

Value-Added cost ($) |

Non-value Added cost ($) |

Total Cost ($) |

| Receiving | 252,000 (1) | 126,000(3) | 378,000(7) |

| Assembly | 1,125,000(2) | 225,000(4) | 1,350,000(8) |

| Expediting | 0 | 300,000(5) | 300,000(9) |

| Storing | 0 | 84,000(6) | 84,000(10) |

| Total | 1,377,000 | 735,000 | 2,112,000 |

Table (1)

Working notes:

(1) Compute the value-added cost of receiving activity of C Company.

(2) Compute the value-added cost of assembly activity of C Company.

(3) Compute the non-value-added cost of receiving activity of C Company.

(4) Compute the non-value-added cost of assembling activity of C Company.

(5) Compute the non-value-added cost of expediting activity of C Company.

(6) Compute the non-value-added cost of storing activity of C Company.

(7) Compute the total cost of receiving activity of C Company.

(8) Compute the total cost of assembling activity of C Company.

(9) Compute the total cost of expediting activity of C Company.

(10) Compute the total cost of storing activity of C Company.

2.

Give reasons for the activity of expediting products and storing goods being catagorized as non-value added activities.

Explanation of Solution

Both expediting aand storing activities are actually unnecessary activities that consume resource without influencing any change in the quality and customer perspective of the product.

3.

Explain the implications for reducing the cost of waste for reach activity assuming receiving cost is a step-fixed cost with each step being 1,500 orders and assembly cost is a variable cost.

Explanation of Solution

For receiving activities, cost reduction can only be made when the actual demand for receiving orders is reduced by each block of 1,500 orders. In the case of assembly activities, each hour that is saved produce a saving of $15. As a result, reduction in spending can benefit better for assembly activity than for receiving activity.

Want to see more full solutions like this?

Chapter 12 Solutions

Bundle: Cornerstones of Cost Management, Loose-Leaf Version, 4th + CengageNOWv2, 1 term Printed Access Card

- Sanford, Inc., has developed value-added standards for four activities: purchasing parts, receiving parts, moving parts, and setting up equipment. The activities, the activity drivers, the standard and actual quantities, and the price standards for 20x1 are as follows: The actual prices paid per unit of each activity driver were equal to the standard prices. Required: 1. Prepare a cost report that lists the value-added, non-value-added, and actual costs for each activity. 2. Which activities are non-value-added? Explain why. Also, explain why value-added activities can have non-value-added costs.arrow_forwardSummarized data for Backdraft Co. for its first year of operations are as follows: A. Prepare an income statement under absorption costing B. Prepare an income statement under variable costingarrow_forwardPatterson Company produces wafers for integrated circuits. Data for the most recent year are provided: aCalculated using number of dies as the single unit-level driver. bCalculated by multiplying the consumption ratio of each product by the cost of each activity. Required: 1. Using the five most expensive activities, calculate the overhead cost assigned to each product. Assume that the costs of the other activities are assigned in proportion to the cost of the five activities. 2. Calculate the error relative to the fully specified ABC product cost and comment on the outcome. 3. What if activities 1, 2, 5, and 8 each had a cost of 650,000 and the remaining activities had a cost of 50,000? Calculate the cost assigned to Wafer A by a fully specified ABC system and then by an approximately relevant ABC approach. Comment on the implications for the approximately relevant approach.arrow_forward

- Using the data in P4-2 and Microsoft Excel: 1. Separate the variable and fixed elements. 2. Determine the cost to be charged to the product for the year. 3. Determine the cost to be charged to factory overhead for the year. 4. Determine the plotted data points using Chart Wizard. 5. Determine R2. 6. How do these solutions compare to the solutions in P4-2 and P4-3? 7. What does R2 tell you about this cost model?arrow_forwardThis information was collected for the first year of manufacturing for Appliance Apps: Prepare an income statement under variable costing, and prepare a reconciliation to the income under the absorption method.arrow_forwardYalland Manufacturing Company makes two different products, M and N. The company’s two departments are named after the products; for example, Product M is made in Department M. Yalland’s accountant has identified the following annual costs associated with these two products. Identify the costs that are (1) direct costs of Department M, (2) direct costs of Department N, and (3) indirect costs. Select the appropriate cost drivers for the indirect costs and allocate these costs to Departments M and N. Determine the total estimated cost of the products made in Departments M and N. Assume that Yalland produced 2,000 units of Product M and 4,000 units of Product N during the year. If Yalland prices its products at cost plus 40 percent of cost, what price per unit must it charge for Product M and for Product N?arrow_forward

- Case #1 – Dorilane Company The Dorilane Company produces a set of wood patio furniture consisting of a table and four chairs. The company has enough customer demand to justify producing its full capacity of 2,000 sets per year. Annual cost data at full capacity follow: Direct labor $ 118,000 Advertising $50,000 Factory supervision $40,000 Property taxes, factory building $3,500 Sales commissions $80,000 Insurance, factory $2,500 Depreciation, administrative office equipment $4,000 Lease cost, factory equipment $ 12,000 Indirect materials, factory $6,000 Depreciation, factory building $ 10,000 Administrative office supplies (billing) $3,000 Administrative office salaries $60,000 Direct materials used (wood, bolts, etc.) $94,000 Utilities, factory $20,000arrow_forwardRequired: a) Classify each cost element as either fixed, variable, or mixed b) Calculate: i) the variable production cost per unit and the total fixed production overhead. ii) The total variable cost per unit and the total fixed costs Hint: Use the high-low method to separate mixed costs into their fixed and variable components c) Assuming sales of 5,000 units, prepare a contribution margin income statement for the year ended December 31, 2020, detailing the components of total variable costs and total fixed costs, and clearly showing contribution and net income.arrow_forwarda) Classify each cost element as either fixed, variable, or mixed b) Calculate: (i) the variable production cost per unit and the total fixed production overhead. (ii) The total variable cost per unit and the total fixed costs Hint: Use the high-low method to separate mixed costs into their fixed and variable components. c) Assuming sales of 5,000 units, prepare a contribution margin income statement for the year ended December 31, 2020, detailing the components of total variable costs and total fixed costs, and clearly showing contribution and net income.arrow_forward

- a) Classify each cost element as either fixed, variable, or mixed b) Calculate:i) the variable production cost per unit and the total fixed production overhead.ii) The total variable cost per unit and the total fixed costsHint: Use the high-low method to separate mixed costs into their fixed and variable components.c) Assuming sales of 5,000 units, prepare a contribution margin income statement for the year ended December 31, 2020, detailing the components of total variable costs and total fixed costs, and clearly showing contribution and net income.arrow_forwardChrzan, Incorporated, manufactures and sells two products: Product EO and Product NO. Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below: Product E0 Product Ne Total direct labor-hours Activity Cost Pools Labor-related Production orders Order size The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity: Estimated Overhead Cost Multiple Choice $33.94 per MH $54.20 per MH Direct Expected Labor-Hours Production Per Unit 10.1 410 1,550 9.1 $51.98 per MH $21.40 per MH Activity Measures DLHS orders MHs Total Direct Labor- Hours $ 301,890 61,087 585,366 $948,343 The activity rate for the Order Size activity cost pool under activity-based costing is closest to: 4,141 14, 105 18,246 Product E 4,141 850 5,550 Expected Activity Product NO 14, 105 950 5,250 Total 18,246 1,800 10,800arrow_forwardThe controller at Wesson Company's manufacturing plant has provided you with the following information for the first quarter's operations: Direct materials Fixed manufacturing overhead costs Sales price Variable manufacturing overhead Direct labor Fixed marketing and administrative costs Units produced and sold during the quarter Variable marketing and administrative costs Required: a. Prepare a gross margin income statement. b. Prepare a contribution margin income statement. Complete this question by entering your answers Required A Required B Prepare a contribution margin income statement. Contribution Margin Income Statementarrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College