Principles Of Taxation For Business And Investment Planning 2020 Edition

23rd Edition

ISBN: 9781259969546

Author: Sally Jones, Shelley C. Rhoades-Catanach, Sandra R Callaghan

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 12, Problem 14AP

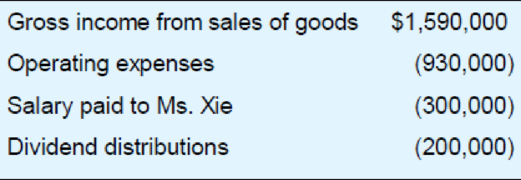

Ms. Xie, who is in the 37 percent tax bracket, is the sole shareholder and president of Xenon. The corporation’s financial records show the following.

- a. Compute the combined tax cost for Xenon and Ms. Xie. (Ignore payroll tax.)

- b. How would your computation change if Ms. Xie’s salary was $500,000 and Xenon paid no dividends?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

An ARO is to be calcualted for the Leashold improvement made in 2024. The book life given is 10 years (based on the lease) and it is Straight line depreciation.What are the amounts to capitalize and ARO when the given info is

1. total Capitalized cost is 1,100,000

2. estimated cost to tear down $200,000

the ridsk free Rate of interest is 3%, the firm assumes annual inflation of 2%

- What is the future value of single payment (use inflation rate)

- What is the present value of single payment (use risk free rate of return)

What would be the entries for the years to be made

METLOCK COMPANY

Comparative Balance Sheet

Assets Dec. 31, 2025

Dec. 31, 2024

Cash

$33,900

$12,500

Accounts receivable

17,500

14,500

Inventory

Prepaid insurance

Stock investments

26,400

19,200

8,500

10,000

-0-

15,700

Equipment

Accumulated depreciation-equipment

Total assets

88,000

44,000

(15,500)

(14,800)

$158,800

$101,100

Liabilities and Stockholders' Equity

Accounts payable

$34,700

$7,900

Bonds payable

37,000

49,400

Common stock

40,400

24,300

Retained earnings

46,700

19,500

Total liabilities and stockholder's equity

$158,800

$101,100

Additional information:

1

Net income for the year ending December 31, 2025 was $36,000.

2

Cash dividends of $8,800 were declared and paid during the year.

3.

Stock investments that had a book value of $15,700 were sold for $12,000.

4.

Sales for 2025 are $150,000.

Prepare a statement of cash flows for the year ended December 31, 2025 using the indirect method. (Show amounts that decrease cash

flow with either a-sign eg-15,000 or in parenthesise.g.…

Kindly give a step by step details explaination of each answers especially question 5 and 6. Please, don't just give answers without explaining how we arrived at the answer. Thanks!

The following are the questions:

1. What is the general journal entries the transactions described for Hogan Company. All sales are on account. Use the date of December 31 to make the entry to summarize sales for the year in the old territory and new territory.

2. Make the journal entries to record the write-off of accounts in the new territory.

3. Make the journal entry to record the write-off of accounts in the old territory.

4. Make the entry on December 31 to record uncollectible accounts expense for 20X1 for both territories. Make the calculation using the percentages developed by Hogan.

5. Let’s say the Allowance for Doubtful Accounts had a credit balance of $24,800 on September 30 before any of the above entries were made. Calculate the balance in the allowance account after…

Chapter 12 Solutions

Principles Of Taxation For Business And Investment Planning 2020 Edition

Ch. 12 - Mr. and Mrs. Velotta are self-employed...Ch. 12 - Prob. 2QPDCh. 12 - Ms. Johnson is eager to create a family...Ch. 12 - Discuss the tax and nontax reasons why the stock...Ch. 12 - Mr. Eros operates an antique store located on the...Ch. 12 - Prob. 6QPDCh. 12 - Prob. 7QPDCh. 12 - Prob. 8QPDCh. 12 - Prob. 9QPDCh. 12 - Prob. 10QPD

Ch. 12 - Prob. 11QPDCh. 12 - Ms. Knox recently loaned 20,000 to her closely...Ch. 12 - Explain the logic of the tax rate for both the...Ch. 12 - Prob. 14QPDCh. 12 - Prob. 15QPDCh. 12 - Prob. 16QPDCh. 12 - Mr. Tuck and Ms. Under organized a new business as...Ch. 12 - Grant and Marvin organized a new business as a...Ch. 12 - Prob. 3APCh. 12 - Ms. Kona owns a 10 percent interest in Carlton...Ch. 12 - Mrs. Franklin, who is in the 37 percent tax...Ch. 12 - Prob. 6APCh. 12 - Prob. 7APCh. 12 - Prob. 8APCh. 12 - Prob. 9APCh. 12 - Prob. 10APCh. 12 - Prob. 11APCh. 12 - Prob. 12APCh. 12 - Prob. 13APCh. 12 - Ms. Xie, who is in the 37 percent tax bracket, is...Ch. 12 - Prob. 15APCh. 12 - In 1994, Mr. and Mrs. Adams formed ADC by...Ch. 12 - Prob. 17APCh. 12 - Prob. 18APCh. 12 - Prob. 19APCh. 12 - Prob. 20APCh. 12 - Prob. 21APCh. 12 - Prob. 1IRPCh. 12 - Prob. 2IRPCh. 12 - Prob. 3IRPCh. 12 - REW Inc. is closely held by six members of the REW...Ch. 12 - Prob. 5IRPCh. 12 - Prob. 6IRPCh. 12 - Prob. 7IRPCh. 12 - Prob. 8IRPCh. 12 - Prob. 9IRPCh. 12 - Prob. 10IRPCh. 12 - Prob. 2TPCCh. 12 - Prob. 3TPC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The standard composition of workers and their wage rates for producing certain product during a given month are as follows:• 12 skilled workers @ OMR 8 per hour each• 8 semi-skilled workers @ OMR 6 per hour each• 10 unskilled workers @ OMR 4 per hour eachDuring the month, the actual composition of workers was:• 10 skilled workers @ OMR 9 per hour each• 6 semi-skilled workers @ OMR 5 per hour each• 8 unskilled workers @ OMR 3 per hour eachThe standard output of the group was expected to be 5 units per hour. However, the workers were unable to produce any output for 8 hours due to a power failure. The group of workers was engaged for 120 hours during the month, and 580 units of output were recorded calculate LCV, LRV, LEV, LIIV, LYV and LMVarrow_forwardAnswer? ? General Accountingarrow_forwardHelparrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT

Understanding U.S. Taxes; Author: Bechtel International Center/Stanford University;https://www.youtube.com/watch?v=QFrw0y08Oto;License: Standard Youtube License