FINANCIAL ACCOUNTING

9th Edition

ISBN: 9781119620631

Author: Kimmel

Publisher: WILEY

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Chapter 12, Problem 12.1DIE

To determine

Introduction:

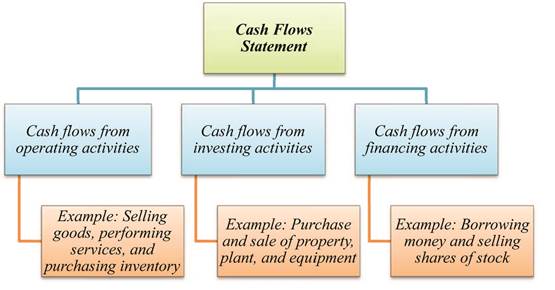

Statement of cash flows

Statement of cash flow is a financial statement that shows the cash and cash equivalents of a company for a particular period of time. It shows the net changes in cash, by reporting the sources and uses of cash as a result of operating, investing, and financing activities of a company.

Type of activities reported in statement of cash flows:

Figure (1)

To Classify: Transactions by type of cash flow activity.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Use the following information to calculate the net

cash provided (inflow) or used by (outflow) from

financing activities for the Lulu Corporation:

(a) Net income, $10,000

(b) Sold common stock for $40,000 cash

(c) Paid cash dividend of $13,000

(d) Repayment of bond payable, $26,000

(e) Purchased equ

for $12,000 cash

(f) Issued long term mortgage notes payable for

$250,000 cash.

(Note: in the answer space, write only the

number, with no $ signs or commas. That is, if

your answer is $1,000, white it as : 1000 ).

Answer:

State the effect (cash receipt or payment and amount) of each of the following transactions, considered individually, on cash flows:

a. Retired $290,000 of bonds, on which there was $2,900 of unamortized discount, for $302,000.

b. Sold 12,000 shares of $25 par common stock for $57 per share.

c. Sold equipment with a book value of $49,400 for $71,100.

d. Purchased land for $327,000 cash.

e. Purchased a building by paying $49,000 cash and issuing a $90,000 mortgage note payable.

f. Sold a new issue of $260,000 of bonds at 98.

g. Purchased 4,500 shares of $40 par common stock as treasury stock at $73 per share.

h. Paid dividends of $1.90 per share. There were 20,000 shares issued and 3,000 shares of treasury stock.

Effect

Amount

а.

b.

Cash payment

C.

$4

Cash receipt

d.

е.

f.

$

g.

2$

h.

$4

Assume the following excerpts from a company's balance sheet:

Property, plant, and equipment

Long-term investments

Beginning Balance Ending Balance

$ 3,500,000

$ 1,100,000

$ 3,750,000

$ 950,000

During the year, the company did not purchase any property, plant, and equipment. It sold

equipment that had accumulated depreciation of $150,000 for a loss of $20,000. The

company did not sell any long-term investments during the period. Based solely on the

information provided, the company's net cash provided by (used in) investing activities would

be:

Chapter 12 Solutions

FINANCIAL ACCOUNTING

Ch. 12 - Prob. 1QCh. 12 - Prob. 2QCh. 12 - Prob. 3QCh. 12 - Prob. 4QCh. 12 - Prob. 5QCh. 12 - Prob. 6QCh. 12 - Why is it necessary to use comparative balance...Ch. 12 - Prob. 8QCh. 12 - Prob. 9QCh. 12 - Prob. 10Q

Ch. 12 - Prob. 11QCh. 12 - Prob. 12QCh. 12 - Prob. 13QCh. 12 - Prob. 14QCh. 12 - Prob. 15QCh. 12 - Prob. 17QCh. 12 - Prob. 18QCh. 12 - Prob. 19QCh. 12 - Prob. 20QCh. 12 - Prob. 21QCh. 12 - Prob. 22QCh. 12 - Prob. 12.2BECh. 12 - Prob. 12.3BECh. 12 - Prob. 12.8BECh. 12 - Prob. 12.10BECh. 12 - The management of Uhuru Inc. is trying to decide...Ch. 12 - Prob. 12.13BECh. 12 - Prob. 12.1DIECh. 12 - Prob. 12.11ECh. 12 - Prob. 12.13ECh. 12 - Prob. 12.12APCh. 12 - Prob. 12.2EYCTCh. 12 - Prob. 12.3EYCTCh. 12 - Prob. 12.8EYCTCh. 12 - Prob. 12.9EYCTCh. 12 - Prob. 12.1IECh. 12 - Prob. 12.2IECh. 12 - Prob. 12.3IE

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- State the effect (cash receipt or payment and amount) of each of the following transactions, considered individually, on cash flows: a. Retired $320,000 of bonds, on which there was $3,200 of unamortized discount, for $333,000.b. Sold 7,000 shares of $30 par common stock for $53 per share.c. Sold equipment with a book value of $59,700 for $86,000.d. Purchased land for $339,000 cash.e. Purchased a building by paying $64,000 cash and issuing a $90,000 mortgage note payable.f. Sold a new issue of $300,000 of bonds at 97.g. Purchased 3,600 shares of $20 par common stock as treasury stock at $37 per share.h. Paid dividends of $1.90 per share. There were 24,000 shares issued and 4,000 shares of treasury stock.arrow_forwardState the effect (cash receipt or payment and amount) of each of the following transactions, considered individually, on cash flows:a. Retired $400,000 of bonds, on which there was $3,000 of unamortized discount, for $411,000.b. Sold 20,000 shares of $5 par common stock for $22 per share.c. Sold equipment with a book value of $55,800 for $60,000.d. Purchased land for $650,000 cash.e. Purchased a building by paying $50,000 cash and issuing a $450,000 mortgage note payable.f. Sold a new issue of $500,000 of bonds at 98.g. Purchased 10,000 shares of $40 par common stock as treasury stock at $50 per share.h. Paid dividends of $1.50 per share. There were 1,000,000 shares issued and 120,000 shares of treasury stock.arrow_forwardAugusta Company reported that its bonds with a face value of $62,000 and a carrying value of $56,000 are retired for $62,000 cash. The amount to be reported under cash flows from financing activities is:arrow_forward

- The following summary transactions occurred during the year for Petunia. Cash received from: Collections from customers Interest on notes receivable Collection of notes receivable Sale of investments Issuance of notes payable Cash paid for: Purchase of inventory Interest on notes payable Purchase of equipment Salaries to employees Payment of notes payable Dividends to shareholders $384,000 8,000 54,000 34,000 104,000 Required: Calculate net cash flows from financing activities. (Amounts to be deducted should be indicated with a minus sign.) Cash flows from financing activities: 164,000 7,000 89,000 94,000 27,000 1,000 PETUNIA COMPUTER Statement of Cash Flows (partial) For the Year Ended December 31, 2024 Net cash flows from financing activitiesarrow_forwardRainey enterprises loaned $50,000 to Small Co. on June 1, Year 1, for one year at 6% interest. Rainey Enterprises loaned $50,000 to Small Co. on June 1, Year 1, for one year at 6 percent interest. Required Show the effects of the following transactions in a horizontal statements. In the Cash Flow column, indicate whether the item is an operating activity (OA), an investing activity (IA), or a financing activity (FA). For any element not affected by the event, leave the cell blank. (Not every cell will require entry. Do not round intermediate calculations. Enter any decreases to account balances and cash outflows with a minus sign. Round your answers to the nearest whole dollar.) (1) The loan to Small Co. (2) The adjusting entry at December 31, Year 1. (3) The adjusting entry and collection of the note on June 1, Year 2. RAINEY ENTERPRISES Horizontal Statements Model Assets Equity Income Statenment Statement of Cash Flow Date Liabilinies Notes Receivable Interest Receivable Retained…arrow_forwardThe following summary transactions occurred during the year for Bluebonnet. Cash received from: Collections from customers Interest on notes receivable Collection of notes receivable Sale of investments Issuance of notes payable Cash paid for: Purchase of inventory Interest on notes payable Purchase of equipment Salaries to employees Payment of notes payable Dividends to shareholders $380,000 6,000 50,000 Cash flows from financing activities: 30,000 100,000 Required: Calculate net cash flows from financing activities. (Amounts to be deducted should be indicated with a minus sign.) Net cash flows from financing activities 160,000 5,000 85,000 90,000 25,000 20,000 BLUEBONNET COMPUTER Statement of Cash Flows (partial) For the Year Ended December 31, 2024 $arrow_forward

- FDN Trading provided the following information during the current year. Proceeds from bank loans, 950,000 Proceeds from sale of second-hand equipment, #88,500 Interest paid on bank loan, $50,000 Payment of bank loan principal, $498,000 Withdrawals of owner, P132,000 Additional investments of owner, #519,000 How much should be reported on the Statement of Cash Flows as net cash provided by (used in) financing activities? Note: Encode as a negative amount if the final answer is used in.arrow_forwardGRAY Company uses the direct method to prepare its statement of cash flows. GRAY had the following cash flows during 2021: Cash receipts from sale of an old van - P 160,000; Cash receipts from issuance of ordinary shares - P 2,000,000; Cash receipts from the issuance of 10%, 10-yr bonds - P 1,500,000; Cash receipts from customers - P 1,000,000; Cash receipts from repayment of loan made to another company - P 1,200,000; cash receipts from dividends - P 150,000; Cash receipts from interest - P 150,000; Cash payments for operating expenses - P 650,000; Cash payments for taxes - P300,000; Cash payments for equity securities bought classified as FVOCI - P 900,000; Cash payment for equipment purchased -P 300,000; Cash payments for land required - P 1,200,000. What is the net cash provided (used) from investing activities?arrow_forwardRainey Enterprises loaned $20,000 to Small Company on June 1, Year 1, for one year at 6 percent interest. Required Show the effects of the following transactions in a horizontal statements model. In the Statement of Cash Flows column, indicate whether the item is an operating activity (OA), an investing activity (IA), or a financing activity (FA). For any element not affected by the event, leave the cell blank. Note: Enter any decreases to account balances and cash outflows with a minus sign. Leave cells blank if no input is needed. (1) The loan to Small Company (2) The adjusting entry at December 31, Year 1. (3) The adjusting entry and collection of the note on June 1, Year 2. 3. Date 1. 6/1/Y1 2. 12/31/Y1 3. 6/1/72 (Adjusting entry) 6/1/Y2 (Collection of the note) Cash + + + + Assets Notes Receivable + + + + + RAINEY ENTERPRISES Horizontal Statements Model Balance Sheet Interest Receivable = Liabilities + + + + + Stockholders' Equity Retained Earnings Income Statement Revenue -…arrow_forward

- Renaldo Cross Company paid $2,000 interest on short-term notes payable, $10,000 principal of long-term bonds, and $6,000 in dividends on its common stock. Renaldo Cross Company would report cash outflows from activities, as follows: Multiple Choice Operating, $0; investing, $10,000; financing, $8,000. Operating, $0; investing, $0; financing, $18,000. Operating, $2,000; investing, $10,000; financing, $6,000. Operating, $2,000; investing, $0; financing, $16,000. 身arrow_forwardMoore Company is preparing its statement of cash flows for the current year. During the year, the company retired two issuances of debt and properly recorded the transactions. These transactions were as follows: Paid cash of $12,700 to retire bonds payable with a face value of $15,000 and a book value of $13,300. Paid cash of $48,000 to retire bonds payable with a face value of $45,000 and a book value of $47,000. Required: Record, in journal entry form, the entries that Moore would make for the preceding transactions on its spreadsheet to prepare its statement of cash flows. If an amount box does not require an entry, leave it blank.arrow_forwardRainey Enterprises loaned $45,000 to Small Company on June 1, Year 1, for one year at 7 percent interest. Required Show the effects of the following transactions in a horizontal statements model. In the Statement of Cash Flows column, indicate whether the item is an operating activity (OA), an investing activity (IA), or a financing activity (FA). Note: Enter any decreases to account balances and cash outflows with a minus sign. Leave cells blank if no input is needed. (1) The loan to Small Company (2) The adjusting entry at December 31, Year 1. (3) The adjusting entry and collection of the note on June 1, Year 2.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License