Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

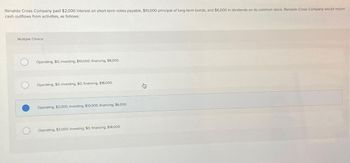

Transcribed Image Text:Renaldo Cross Company paid $2,000 interest on short-term notes payable, $10,000 principal of long-term bonds, and $6,000 in dividends on its common stock. Renaldo Cross Company would report

cash outflows from activities, as follows:

Multiple Choice

Operating, $0; investing, $10,000; financing, $8,000.

Operating, $0; investing, $0; financing, $18,000.

Operating, $2,000; investing, $10,000; financing, $6,000.

Operating, $2,000; investing, $0; financing, $16,000.

身

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- The following summary transactions occurred during the year for Marigold. Cash received from: Collections from customers Interest on notes receivable Collection of notes receivable sale of investments Issuance of notes payable Cash paid for: Purchase of inventory Interest on notes payable Purchase of equipment salaries to employees Payment of notes payable Dividends to shareholders $382,000 7,000 52,000 31,000 102,000 Required: Calculate net cash flows from Investing activities. (Amounts to be deducted should be indicated with a minus sign.) Cash flows from investing activities: 162,000 6,000 87,000 92,000 26,000 1,000 MARIGOLD COMPUTER Statement of Cash Flows (partial) For the Year Ended December 31, 2024 Net cash flows from investing activitiesarrow_forwardPaper Co. had net income of $70,000 during the year. Dividend payment was $10,000. The following information is available:What amount should Paper report as net cash provided by operating activities in its statement of cash flows for the year? Mortgage repayment Available-for-sale securities purchased Bonds payable-issued Inventory Accounts payable O $0 O $10,000 O $30,000 O $20,000 $20,000 10,000 increase 50,000 increase 40,000 increase 30,000 decreasearrow_forwardh Flows-Investing Activities The accountant for Foster Institute, Inc.. determined the cash flow for several transactions to be as follows: Payment to pay off notes payable (15 yr notes) Proceeds from issuance of bonds payable-due in 10 yrs $4 195,000 2$ $ 635,000 Payment to purchase equipment Payment of wages $4 275,000 2$ 115,000 Payment of dividends 2$ 155,000 On the basis of the above transactions alone, determine the net cash flow from financing activities only. [Must show your calculation for full credit.] (10 pts) A) $275,000 net cash used for financing activities. B) $440,000 net cash provided by financing activities. C) Zero: cash inflows equal cash outflows from financing activities. D) $285,000 net cash provided by financing activities.arrow_forward

- Accounting Net income was $469,000. Issued common stock for $77,000 cash. Paid cash dividend of $14,000. Paid $110,000 cash to settle a long-term notes payable at its $110,000 maturity value. Paid $117,000 cash to acquire its treasury stock. Purchased equipment for $92,000 cash. Use the above information to determine cash flows from financing activities. (Amounts to be deducted should be indicated with a minus sign.)arrow_forwardEffect of Transactions on Cash Flows State the effect (cash receipt or cash payment and amount) of each of the following transactions, considered individually, on cash flows: Retired $260,000 of bonds, on which there was $2,600 of unamortized discount, for $270,000. Sold 12,000 shares of $25 par common stock for $54 per share. Sold equipment with a book value of $63,000 for $90,700. Purchased land for $381,000 cash. Purchased a building by paying $49,000 cash and issuing a $100,000 mortgage note payable. Sold a new issue of $200,000 of bonds at 98. Purchased 6,500 shares of $30 par common stock as treasury stock at $59 per share. Paid dividends of $2.10 per share. There were 26,000 shares issued and 4,000 shares of treasury stock.arrow_forwardUse the following excerpts from Eagle Company’s financial records to determine net cash flows from financing activities.arrow_forward

- need best help with workingarrow_forwardDuring 2010, Arizona Company issued $500,000 in long-term bonds at 96, repaid $75,000 of bonds at face value, paid interest of $40,000, and paid dividends of $25,000. Prepare the cash flows from the financing activities section of the statement of cash flows.arrow_forwardAn analysis of the cash account reveals the following summary information: Beginning balance: 77,000 Paid for operating expenses: (290.000) Paid to purchase equipment: (100,000) Paid to purchase inventory: (410,000) Paid to shareholders for dividends: (12,000) Paid toward balance on note payable: (70,000) Received from customers: 905,000 Received from issuance of stock: 5000 Ending Balance: 105,000 Additional information: • Greenholt held 50,000 shares of common stock in Years 1 & 2 Greenholt had a beginning balance of $5,000 in Accounts Receivable on January 1, Year 2 Greenholt had a beginning balance of $20,000 in inventory on January 1, Year 2 Prepare a income statement, Cashflow statement and balance sheet statement with the given informationarrow_forward

- Morray Corporation had the following transactions. Classify each of these transactions by type of cash flow activity (operating, investing, or financing). 1. Issued $160,000 of bonds payable. 2. Paid utilities expense. 3. Issued 500 shares of preferred stock for $45,000. 4. Sold land and a building for $250,000. 5. Loaned $30,000 to Dead End Corporation, receiving Dead End's 1-year, 12% note.arrow_forwardTech Gear Corporation started the year with $100,000 cash and reported net cash provided by operating activities of $200,000, cash paid for dividends of $40,000, cash received from stock issuance of $30,000, cash paid for equipment purchases of $150,000, cash paid for intangible assets of $100,000, and cash paid on bank loan of $35,000. create a statement of cash flows from the above informationarrow_forwardUse the information below (in millions) to determine net cash inflows (outflows) from operating activities. Cash received from: Customers $ 3,000 Interest on investments 280 Sale of land 180 Sale of its own common stock 760 Issuance of debt securities 2,800 Cash paid for: Interest on debt $ 380 Income tax 160 Debt principal reduction 2,300 Purchase of equipment 5,600 Purchase of inventory 1,800 Dividends on its common stock 440 Operating expenses 660arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education