FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

a) What was the income-sharing ratio in 20Y3? Enter the percentage per member and then select the ratio.

| Idaho Properties, LLC | _______% |

| Silver Streams, LLC | _______ % |

b) What was the income-sharing ratio in 20Y4? Enter the percentage per member and then select the ratio.

| Idaho Properties, LLC | ____________% |

| Silver Streams, LLC | ____________% |

| Thomas Dunn | ____________% |

c) How much cash did Thomas Dunn contribute to Bonanza, LLC, for his interest? _______

d) What percentage interest of Bonanza did Thomas Dunn acquire?

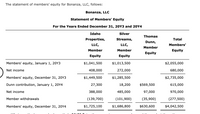

Transcribed Image Text:The statement of members' equity for Bonanza, LLC, follows:

Bonanza, LLC

Statement of Members' Equity

For the Years Ended December 31, 20Y3 and 20Y4

Idaho

Silver

Thomas

Properties,

Streams,

Total

Dunn,

LLC,

LLC,

Members'

Member

Member

Member

Equity

Equity

Equity

Equity

Members' equity, January 1, 20Y3

$1,041,500

$1,013,500

$2,055,000

Net income

408,000

272,000

680,000

Members' equity, December 31, 20Y3

$1,449,500

$1,285,500

$2,735,000

Dunn contribution, January 1, 20Y4

27,300

18,200

$569,500

615,000

Net income

388,000

485,000

97,000

970,000

Member withdrawals

(139,700)

(101,900)

(35,900)

(277,500)

Members' equity, December 31, 20Y4

$1,725,100

$1,686,800

$630,600

$4,042,500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Which of the following comprises 70% of business entities in the United States? a. corporations b. partnerships c. limited liability companies (LLCs) d. proprietorshipsarrow_forwardCompute Measures for DuPont Disaggregation Analysis Use the information below for 2018 for 3M Company to answer the requirements. ($ millions) Sales Net income, consolidated Net income attributable to 3M shareholders Pretax interest expense Assets Total equity Equity attributable to 3M shareholders Net income consolidated S a. Compute return on equity (ROE) from the perspective of a 3M shareholder. Note: 1. Select the appropriate numerator and denominator used to compute ROE from the drop-down menu options. 2. Enter the numerator and denominator amounts to compute ROE Numerator Denominator E Net income consolidated (adjusted) 2018 2017 $32,765 5,363 5,349 S 207 36,500 $37,987 9,848 11,622 9,796 11,563 S + Average total equity 5,349 $ b. Compute the DuPont model component measures for profit margin, asset turnover, and financial leverage. (Perform these computations from a consolidated perspective). Profit Margin (PM) Note: 1. Select the appropriate numerator and denominator used to…arrow_forwardThe relationship of $356,183 to $112,148, expressed as a ratio, is O a. 4.7 O b. 1.5 O c. 3.2 O d. 0.8arrow_forward

- Using the findings, provide a brief summary about the financial status of each of the companies and provide a recommendation for the investment choice.arrow_forwardSDJ, Incorporated, has net working capital of $3,490, current liabilities of $4,950, and inventory of $4,990. a. What is the current ratio? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. What is the quick ratio? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)arrow_forwardH2.arrow_forward

- Assume the following data for Cable Corporation and Multi-Media Incorporated. Net income Sales Total assets Total debt Stockholders' equity Cable Corporation $ 34,400 364,000 448,000 237,000 211,000 Cable Corporation Multi-Media, Incorporated a. 1. Compute return on stockholders' equity for both firms. Note: Input your answers as a percent rounded to 2 decimal places. Return on Stockholders' Equity Multi-Media Incorporated $ 128,000 2,700,000 % % 970,000 468,000 502,000arrow_forwardMerritt stone works is all - equity financed and has net sales of $217,800, taxable income of $32,600 a return on assets of 11.5percent, a tax rate of 21 percent and rotal debt of $63, 700. What are the value for the three components of the DuPont Identity?arrow_forwardCompute the current ratio for each of the following competitors. Which company is in the best position to pay its short-term obligations? Net sales Net income Current assets Current liabilities Total assets Current ratio Conclusion Complete this question by entering your answers in the tabs below. Gomez $ 1,350,000 110,000 342,000 190,000 410,000 Gomez Cruz Cruz $ 900,000 3,000 162,000 60,000 510,000 Compute the current ratio for each of the following competitors. Note: Round your answers to 2 decimal places. Current Ratioarrow_forward

- Directions: Click the Case Link above and use the information provided in Revolutionary Designs, Inc., Part B, to answer this question: What is the impact on Revolutionary Design's adjusted debt ratio (total liabilities less subordinated debt) to adjusted tangible net worth (tangible net worth plus subordinated debt) if we assume that the owner debt will no longer be subordinated in 20Y3? Adjusted debt to adjusted tangible net worth will increase from approximately 2.7 to approximately 3.8 in 2013. Adjusted debt to adjusted tangible net worth will improve from approximately 3.5 to approximately 2.6 in 20Y3. Adjusted debt to adjusted tangible net worth will increase from approximately 3.5 to approximately 3.8 in 20Y3. Bookmark for reviewarrow_forwardHow do i find the industry ratios for Walmart and Target 2022, comparing both retailers, Gross Margin Ratio, Profit Margin Ratio and Return on Asset to the industry.arrow_forwardSouthern Style Realty has total assets of S485, 390, net fixed assets of $250,000, current liabilities of S 23,456, and long-term liabilities of $148.000. What is the total debt ratio? Multiple Choice .30.35.69.53.68.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education