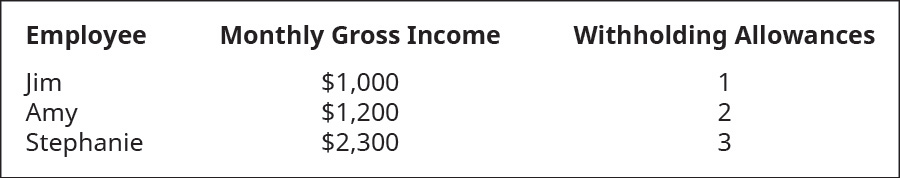

Use Figure 12.15 to complete the following problem. Roland Inc. employees’ monthly gross pay information and their W-4 Form withholding allowances follow.

Roland’s payroll deductions include FICA Social Security at 6.2%, FICA Medicare at 1.45%, FUTA at 0.6%, SUTA at 5.4%, federal income tax (based on withholdings table) of gross pay, state income tax at 3% of gross pay, and health insurance coverage premiums of $1,000 split 50% employees and 50% employer. Assume each employee files as single, gross income is the same amount each month, October is the first month of business operation for the company, and salaries have yet to be paid.

Record the entry or entries for accumulated employee and employer payroll for the month of October; dated October 31.

Want to see the full answer?

Check out a sample textbook solution

Chapter 12 Solutions

Principles of Accounting Volume 1

Additional Business Textbook Solutions

Financial Accounting (12th Edition) (What's New in Accounting)

Financial Accounting, Student Value Edition (5th Edition)

Business Essentials (12th Edition) (What's New in Intro to Business)

Engineering Economy (17th Edition)

Horngren's Accounting (12th Edition)

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

- A company's payroll records report $3,460 of gross pay and $484 of federal income tax withholding for an employee for the weekly pay period. Compute this employee's FICA Social Security tax (6.2%), FICA Medicare tax (1.45%), state income tax (1.0%), and net pay for the current pay period. Note: Round your final answers to 2 decimal places. Gross pay FICA Social Security tax deduction FICA Medicare tax deduction Federal income tax deduction State income tax deduction Total deductions Net payarrow_forwardAssume a tax rate of 6.2% on $118,500 for Social Security and 1.45% for Medicare. No one will reach the maximum for FICA. Complete the following payroll register. (Use the percentage method to calculate FIT for this weekly period.) (Use Table 7.1 and Table 7.2). (Do not round intermediate calculations and round your final answers to the nearest cent.) Employee Marital status Sam Rouche M Allowances claimed Gross pay 5 $ 3,400 FIT S.S. FICA Med. Net payarrow_forwardSubject - account Please help me. Thankyou.arrow_forward

- please answerarrow_forwardAssume a tax rate of 6.2% on $142,800 for Social Security and 1.45% for Medicare. No one will reach the maximum for FICA. Complete the following payroll register. (Use the percentage method to calculate FIT for this weekly period.) (Use Table 9.1). Note: Do not round intermediate calculations and round your final answers to the nearest cent. Employee Pat Brown Marital status S Gross pay $ 1,900 FIT Social Security FICA Medicare Net payarrow_forwardCalculate the net pay. The balance before this weekly payroll is $90 below maximum as related to cumulative earnings in calculating Social Security. Assume a tax rate of 6.2% for Social Security on $142,800 and 1.45% for Medicare. status = single Gross= 900 calculate: FIT, social security, Medicare, and Net payarrow_forward

- please answerarrow_forwardExercise 9-11 (Algo) Computing payroll taxes LO P2, P3 Mest Company has nine employees. FICA Social Security taxes are 6.2% of the first $137,700 paid to each employee, and FICA Medicare taxes are 1.45% of gross pay. FUTA taxes are 0.6% and SUTA taxes are 5.4 % of the first $7,000 paid to each employee. Cumulative pay for the current year for each of its employees follows. Employee Ken S Tim V Steve S Cumulative Pay $ 5,200 44,400 91,000 Employee Ken S Tim V Complete this question by entering your answers in the tabs below. Required A Compute the amounts in this table for each employee. Pay Subject to FICA Social Security Steve S Julie W Michael M Zach R Christina S Kitty O John W Totals a. Compute the amounts in this table for each employee. b. For the company, compute each total for FICA Social Security taxes, FICA Medicare taxes, FUTA taxes, and SUTA taxes. Hint Remember to include in those totals any employee share of taxes that the company must collect. Required B Employee Julie W…arrow_forwardplease give me answer in relatablearrow_forward

- I need some help with the questions reffering to the image below. Complete Accounting Services has the following payroll information for the week ended December 7. State income tax is computed as 20 percent of federal income tax. Assumed tax rates are as follows: FICA: Social Security, (employer) 6.2 percent (0.062) and (employee) 6.2 percent (0.062) on the first $118,500 for each employee, and Medicare, 1.45 percent (0.0145) on all earnings for each employee. State unemployment tax, 5.4 percent (0.054) on the first $7,000 for each employee. Federal unemployment tax, 0.6 percent (0.006) on the first $7,000 for each employee. Required: 1. Complete the payroll register. Payroll checks begin with Ck. No. 5714 in the payroll register. 2. Prepare the general journal entry to record the payroll as of December 7. The company's general ledger contains a Salary Expense account and a Salaries Payable account. 3. Prepare a general journal entry to record the payroll taxes as of December 7. 4.…arrow_forwardBased on the information in problem 2, calculate and record the employers payroll taxes for the period in the general journal below. The state employment tax rate is 5.4 percent, and the federal unemployment tax rate is 0.8 percent.arrow_forwardUse (a) the percentage method and (b) the wage-bracket method to compute the federal income taxes to withhold from the wages or salaries of each employee. Enter all amounts as positive numbers. Round your calculations and final answers to the nearest cent. Use the 2020 Federal income taxes tables for the percentage method table and the wage bracket method tablearrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning