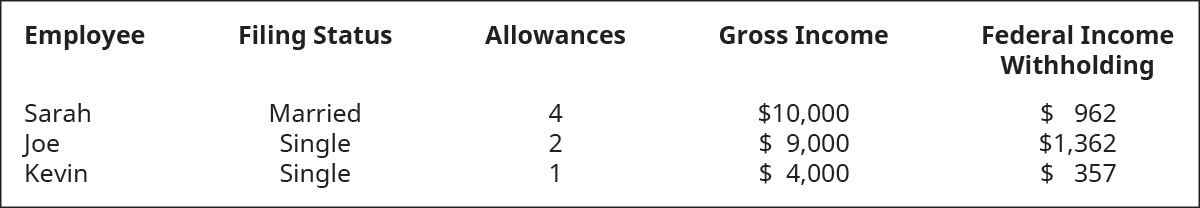

Problem 1MC: Which of the following is not considered a current liability? A. Accounts Payable B. Unearned... Problem 2MC: A company regularly purchases materials from a manufacturer on credit. Payments for these purchases... Problem 3MC: The following is selected financial data from Block Industries: How much does Block Industries have... Problem 4MC: A ski company takes out a $400,000 loan from a bank. The bank requires eight equal repayments of the... Problem 5MC: Nido Co. has a standing agreement with a supplier for purchasing car parts. The terms of the... Problem 6MC: A client pays cash in advance for a magazine subscription to Living Daily. Living Daily has yet to... Problem 7MC: Lime Co. incurs a $4,000 note with equal principal installment payments due for the next eight... Problem 8MC: Which of the following best describes a contingent liability that is likely to occur but cannot be... Problem 9MC: Blake Department Store sells television sets with one-year warranties that cover repair and... Problem 10MC: What accounts are used to record a contingent warranty liability that is probable and estimable but... Problem 11MC: Which of the following best describes a contingent liability that is unlikely to occur? A. remote B.... Problem 12MC: Which of the following accounts are used when a short-term note payable with 5% interest is honored... Problem 13MC: Which of the following is not a characteristic of a short-term note payable? A. Payment is due in... Problem 14MC: Sunlight Growers borrows $250,000 from a bank at a 4% annual interest rate. The loan is due in three... Problem 15MC: Marathon Peanuts converts a $130,000 account payable into a short-term note payable, with an annual... Problem 16MC: An employee earns $8,000 in the first pay period. The FICA Social Security Tax rate is 6.2%, and the... Problem 17MC: Which of the following is considered an employer payroll tax? A. FICA Medicare B. FUTA C. SUTA D. A... Problem 18MC: Employees at Rayon Enterprises earn one day a month of vacation compensation (twelve days total each... Problem 19MC: An employee and employer cost-share health insurance. If the employee covers three-fourths of the... Problem 1Q: Why is Accounts Payable classified as a current liability? Problem 2Q: On which financial statement are current liabilities reported? Problem 3Q: What is the difference between a noncurrent liability and a current liability? Problem 4Q: How is the sales tax rate usually determined? Does the company get to keep the sales tax as earned... Problem 5Q: If Bergen Air Systems takes out a $100,000 loan, with eight equal principal payments due over the... Problem 6Q: What amount is payable to a state tax board if the original sales price is $3,000, and the tax rate... Problem 7Q: What specific accounts are recognized when a business purchases equipment on credit? Problem 8Q: What is a contingent liability? Problem 9Q: What are the two FASB required conditions for a contingent liability to be recognized? Problem 10Q: If a bankruptcy is deemed likely to occur and is reasonably estimated, what would be the recognition... Problem 11Q: Name the four contingent liability treatments. Problem 12Q: A companys sales for January are $250,000. If the company projects warranty obligations to be 5% of... Problem 13Q: What is a key difference between a short-term note payable and a current portion of a noncurrent... Problem 14Q: What business circumstance could bring about a short-term note payable created from a purchase? Problem 15Q: What business circumstance could produce a short-term notes payable created from a loan? Problem 16Q: Jain Enterprises honors a short-term note payable. Principal on the note is $425,000, with an annual... Problem 17Q: What are examples of involuntary deductions employers are required to collect for employee and... Problem 18Q: What are the tax rates for FICA Social Security and FICA Medicare? What are the maximum taxable... Problem 19Q: What are FUTA and SUTA taxes? Is there any possible reduction in the FUTA tax rate? If so, what is... Problem 20Q: Use Figure 12.15 as a reference to answer the following questions. A. If an employee makes $1,400... Problem 1EA: Campus Flights takes out a bank loan in the amount of $200,500 on March 1. The terms of the loan... Problem 2EA: Consider the following accounts and determine if the account is a current liability, a noncurrent... Problem 3EA: Lamplight Plus sells lamps to consumers. The company contracts with a supplier who provides them... Problem 4EA: Review the following transactions and prepare any necessary journal entries for Olinda Pet Supplies.... Problem 5EA: Review the following transactions and prepare any necessary journal entries for Tolbert Enterprises.... Problem 6EA: Elegant Electronics sells a cellular phone on September 2 for $450. On September 6, Elegant sells... Problem 7EA: Homeland Plus specializes in home goods and accessories. In order for the company to expand its... Problem 8EA: Bhakti Games is a chain of board game stores. Record entries for the following transactions related... Problem 9EA: Following is the unadjusted trial balance for Sun Energy Co. on December 31, 2017. You are also... Problem 10EA: Barkers Baked Goods purchases dog treats from a supplier on February 2 at a quantity of 6,000 treats... Problem 11EA: Use information from EA10. Compute the interest expense due when Barkers honors the note. Show the... Problem 12EA: Scrimiger Paints wants to upgrade its machinery and on September 20 takes out a loan from the bank... Problem 13EA: Following are payroll deductions for Mars Co. Classify each payroll deduction as either a voluntary... Problem 14EA: Toren Inc. employs one person to run its solar management company. The employees gross income for... Problem 15EA: In EA14, you prepared the journal entries for the employee of Toren Inc. You have now been given the... Problem 16EA: An employee and employer cost-share pension plan contributions and health insurance premium... Problem 1EB: Everglades Consultants takes out a loan in the amount of $375,000 on April 1. The terms of the loan... Problem 2EB: Match each of the following accounts with the appropriate transaction or description. Problem 3EB: Pianos Unlimited sells pianos to customers. The company contracts with a supplier who provides it... Problem 4EB: Review the following transactions and prepare any necessary journal entries for Bernard Law Offices.... Problem 5EB: Review the following transactions and prepare any necessary journal entries for Lands Inc. A. On... Problem 6EB: Monster Drinks sells twenty-four cases of beverages on October 18 for $120 per case. On October 25,... Problem 7EB: McMasters Inc. specializes in BBQ accessories. In order for the company to expand its business, they... Problem 8EB: Following is the unadjusted trial balance for Pens Unlimited on December 31, 2017. You are also... Problem 9EB: Airplanes Unlimited purchases airplane parts from a supplier on March 19 at a quantity of 4,800... Problem 10EB: Use information from EB9. Compute the interest expense due when Airplanes Unlimited honors the note.... Problem 11EB: Whole Leaves wants to upgrade their equipment, and on January 24 the company takes out a loan from... Problem 12EB: Reference Figure 12.15 and use the following information to complete the requirements. A. Determine... Problem 13EB: Marc Associates employs Janet Evanovich at its law firm. Her gross income for June is $7,500.... Problem 14EB: In EB13, you prepared the journal entries for Janet Evanovich, an employee of Marc Associates. You... Problem 15EB: An employee and employer cost-share 401(k) plan contributions, health insurance premium payments,... Problem 1PA: Consider the following situations and determine (1) which type of liability should be recognized... Problem 2PA: Stork Enterprises delivers care packages for special occasions. They charge $45 for a small package,... Problem 3PA: Review the following transactions, and prepare any necessary journal entries for Renovation Goods.... Problem 4PA: Review the following transactions, and prepare any necessary journal entries for Juniper Landscaping... Problem 5PA: Review the following transactions, and prepare any necessary journal entries. A. On July 16, Arrow... Problem 6PA: Machine Corp. has several pending lawsuits against its company. Review each situation and (1)... Problem 7PA: Emperor Pool Services provides pool cleaning and maintenance services to residential clients. It... Problem 8PA: Serene Company purchases fountains for its inventory from Kirkland Inc. The following transactions... Problem 9PA: Mohammed LLC is a growing consulting firm. The following transactions take place during the current... Problem 10PA: Lemur Corp. is going to pay three employees a year-end bonus. The amount of the year-end bonus and... Problem 11PA: Record the journal entries for each of the following payroll transactions. Problem 1PB: Consider the following situations and determine (1) which type of liability should be recognized... Problem 2PB: Perfume Depot sells two different tiers of perfume products to customers. They charge $30 for tier 1... Problem 3PB: Review the following transactions, and prepare any necessary journal entries for Sewing Masters Inc.... Problem 4PB: Review the following transactions and prepare any necessary journal entries for Woodworking... Problem 5PB: Review the following transactions and prepare any necessary journal entries. A. On January 5, Bunnet... Problem 6PB: Roundhouse Tools has several potential warranty claims as a result of damaged tool kits. Review each... Problem 7PB: Shoe Hut sells custom, handmade shoes. It offers a one-year warranty on all shoes for repair or... Problem 8PB: Air Compressors Inc. purchases compressor parts for its inventory from a supplier. The following... Problem 9PB: Pickles R Us is a pickle farm located in the Northeast. The following transactions take place: A. On... Problem 10PB: Use Figure 12.15 to complete the following problem. Roland Inc. employees monthly gross pay... Problem 11PB: Use the information from PB10 to complete this problem. Record entries for each transaction listed. format_list_bulleted

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,