Concept explainers

1.

Prepare the necessary

1.

Explanation of Solution

Straight-line depreciation method: The depreciation method which assumes that the consumption of economic benefits of long-term asset could be distributed equally throughout the useful life of the asset is referred to as straight-line method.

Prepare the necessary journal entries to record the given transactions as follows:

| Date | Account Title & Explanation | Debit ($) | Credit($) |

| January 2, 2016 | Trucks (1) | 160,000 | |

| Cash | 160,000 | ||

| (To record the purchase of trucks for cash) | |||

| December 31, 2016 | Depreciation expense (2) | 30,400 | |

| | 30,400 | ||

| (To record the depreciation expense incurred at the end of the accounting year) | |||

| January 1, 2017 | Cash | 4,000 | |

|

Accumulated depreciation-Trucks ($8,000−$4,000) | 4,000 | ||

| Trucks ($8,000×1 truck) | 8,000 | ||

| (To record the retirement of trucks ( truck retired at 2017)) | |||

| December 31, 2017 | Depreciation expense (4) | 28,880 | |

| Accumulated depreciation-Trucks | 28,880 | ||

| (To record the depreciation expense incurred at the end of the accounting year) | |||

| January 1, 2018 | Cash | 11,000 | |

|

Accumulated depreciation-Trucks ($24,000−$11,000) | 13,000 | ||

| Trucks ($8,000×3 trucks) | 24,000 | ||

| (To record the retirement of trucks (3 trucks retired at 2018)) | |||

| December 31, 2018 | Depreciation expense (4) | 24,320 | |

| Accumulated depreciation-Trucks | 24,320 | ||

| (To record the depreciation expense incurred at the end of the accounting year) | |||

| January 1, 2019 | Cash | 19,000 | |

|

Accumulated depreciation-Trucks ($48,000−$19,000) | 29,000 | ||

| Trucks ($8,000×6 trucks) | 48,000 | ||

| (To record the retirement of trucks (6 trucks retired at 2019)) | |||

| December 31, 2019 | Depreciation expense (4) | 15,200 | |

| Accumulated depreciation-Trucks | 15,200 | ||

| (To record the depreciation expense incurred at the end of the accounting year) | |||

| January 1, 2020 | Cash | 6,000 | |

|

Accumulated depreciation-Trucks ($40,000−$6,000) | 34,000 | ||

| Trucks ($8,000×5 trucks) | 40,000 | ||

| (To record the retirement of trucks (5 trucks retired at 2020)) | |||

| December 31, 2020 | Depreciation expense (4) | 7,600 | |

| Accumulated depreciation-Trucks | 7,600 | ||

| (To record the depreciation expense incurred at the end of the accounting year) | |||

| January 1, 2021 | Cash | 4,000 | |

|

Accumulated depreciation-Trucks ($24,000−$4,000) | 20,000 | ||

| Trucks ($8,000×3 trucks) | 24,000 | ||

| (To record the retirement of trucks (3 trucks retired at 2021)) | |||

| December 31, 2021 | Depreciation expense (4) | 3,040 | |

| Accumulated depreciation-Trucks | 3,040 | ||

| (To record the depreciation expense incurred at the end of the accounting year) | |||

| January 1, 2022 | Cash | 1,000 | |

|

Accumulated depreciation-Trucks ($16,000−$1,000) | 15,000 | ||

| Trucks ($8,000×2 trucks) | 16,000 | ||

| (To record the retirement of trucks (2 trucks retired at 2022)) | |||

| December 31, 2022 | Loss on disposal of property, plant and equipment (6) | 5,560 | |

| Accumulated depreciation-Trucks | 5,560 | ||

| (To record the loss on disposal of property, plant and equipment) |

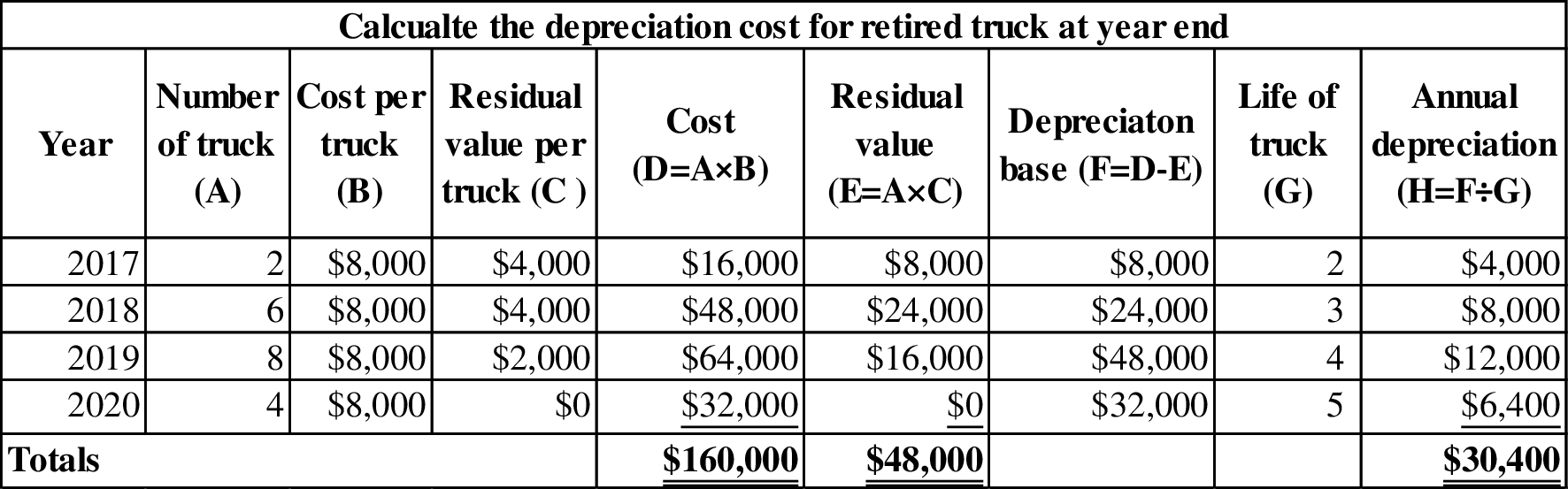

Table (1)

Working note (1):

Calculate the total cost of trucks.

Cost of trucks = Cost per truck× Number of trucks purchased=$8,000×20=$160,000

Working note (2):

Figure (1)

Working note (3):

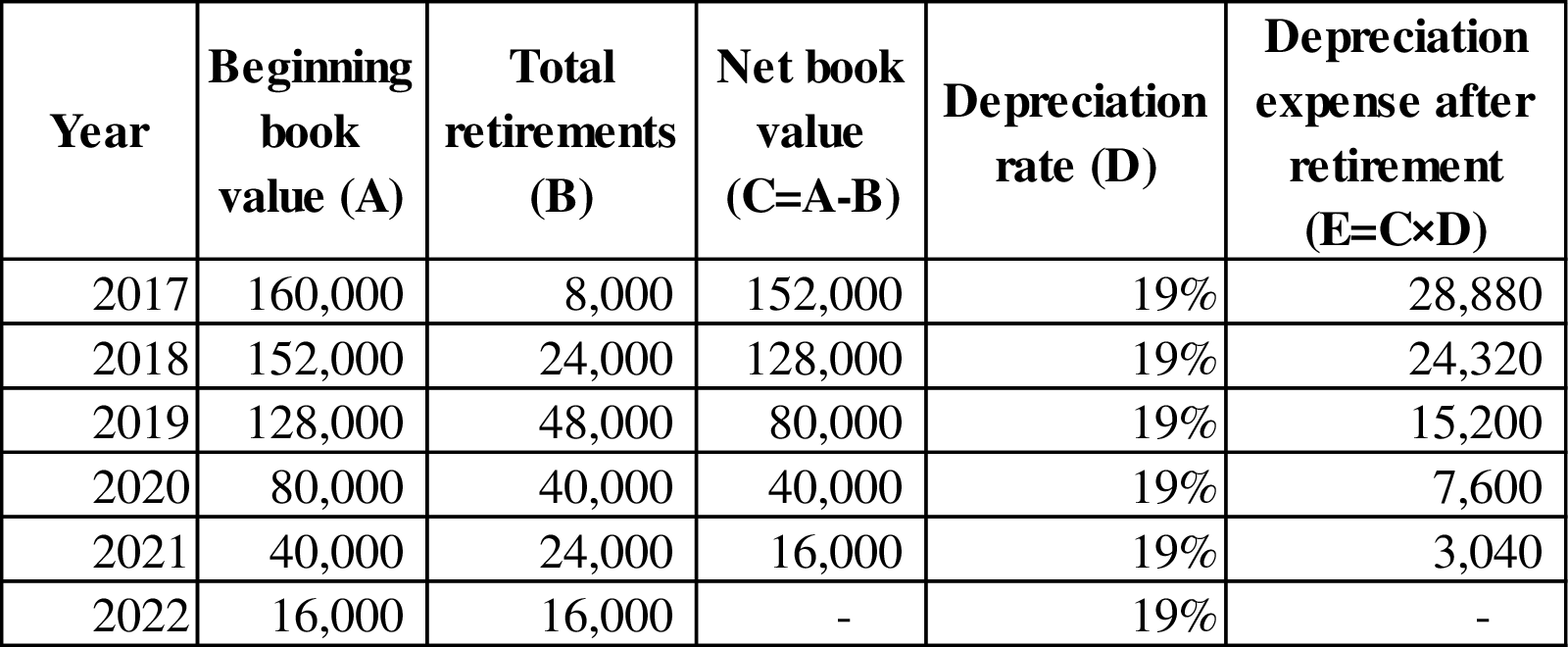

Calculate the depreciation rate.

Depreciation rate = [Total annual depreciation for retired trucksTotal cost of trucks×100]=$30,400 (2)$160,000 (1)×100=19%

Working note (4):

Calculate the depreciation expense after retirement of truck for each year.

Figure (2)

Working note (5):

Calculate the total accumulated depreciation incurred at the time of retirement of truck and total depreciation expense after retirement of truck.

| Year | Accumulated depreciation incurred at the time of retirement of truck ($) | Depreciation expense for each year ($) |

| 2016 | $0 | $30,400 (2) |

| 2017 | $4,000 | $28,880 (4) |

| 2018 | $13,000 | $24,320 (4) |

| 2019 | $29,000 | $15,200 (4) |

| 2020 | $34,000 | $7,600 (4) |

| 2021 | $20,000 | $3,040 (4) |

| 2022 | $15,000 | $0 |

| Total depreciation | $115,000 | $109,440 |

Table (2)

Working note (6):

Calculate the loss on disposal of property, plant and equipment.

Loss on disposal of assets = ((Total accumulated depreciation incurred at the time of retirement of truck (5))−Total depreciation expense for each year (5))=$115,000−$109,440=$5,560

2.

Prepare necessary journal entries for all 6 years, if trucks are retired at $1,600 each.

2.

Explanation of Solution

Prepare necessary journal entries for all 6 years, if trucks are retired at $1,600 each as follows:

| Date | Account Title & Explanation | Debit ($) | Credit($) |

| January 2, 2016 | Trucks (1) | 1,60,000 | |

| Cash | 1,60,000 | ||

| (To record the purchase of trucks for cash) | |||

| December 31, 2016 | Depreciation expense (7) | 32,000 | |

| Accumulated depreciation-Trucks | 32,000 | ||

| (To record the depreciation expense incurred at the end of the accounting year) | |||

| January 1, 2017 | Cash | 4,000 | |

|

Accumulated depreciation-Trucks ($8,000−$4,000) | 4,000 | ||

| Trucks ($8,000×1 truck) | 8,000 | ||

| (To record the retirement of trucks ( truck retired at 2017)) | |||

| December 31, 2017 | Depreciation expense (8) | 30,400 | |

| Accumulated depreciation-Trucks | 30,400 | ||

| (To record the depreciation expense incurred at the end of the accounting year) | |||

| January 1, 2018 | Cash | 11,000 | |

|

Accumulated depreciation-Trucks ($24,000−$11,000) | 13,000 | ||

| Trucks ($8,000×3 trucks) | 24,000 | ||

| (To record the retirement of trucks (3 trucks retired at 2018)) | |||

| December 31, 2018 | Depreciation expense (8) | 25,600 | |

| Accumulated depreciation-Trucks | 25,600 | ||

| (To record the depreciation expense incurred at the end of the accounting year) | |||

| January 1, 2019 | Cash | 19,000 | |

|

Accumulated depreciation-Trucks ($48,000−$19,000) | 29,000 | ||

| Trucks ($8,000×6 trucks) | 48,000 | ||

| (To record the retirement of trucks (6 trucks retired at 2019)) | |||

| December 31, 2019 | Depreciation expense (8) | 16,000 | |

| Accumulated depreciation-Trucks | 16,000 | ||

| (To record the depreciation expense incurred at the end of the accounting year) | |||

| January 1, 2020 | Cash | 6,000 | |

|

Accumulated depreciation-Trucks ($40,000−$6,000) | 34,000 | ||

| Trucks ($8,000×5 trucks) | 40,000 | ||

| (To record the retirement of trucks (5 trucks retired at 2020)) | |||

| December 31, 2020 | Depreciation expense (8) | 8,000 | |

| Accumulated depreciation-Trucks | 8,000 | ||

| (To record the depreciation expense incurred at the end of the accounting year) | |||

| January 1, 2021 | Cash | 4,000 | |

|

Accumulated depreciation-Trucks ($24,000−$4,000) | 20,000 | ||

| Trucks ($8,000×3 trucks) | 24,000 | ||

| (To record the retirement of trucks (3 trucks retired at 2021)) | |||

| December 31, 2021 | Depreciation expense (8) | 800 | |

| Accumulated depreciation-Trucks | 800 | ||

| (To record the depreciation expense incurred at the end of the accounting year) | |||

| January 1, 2022 | Cash | 1,000 | |

|

Accumulated depreciation-Trucks ($16,000−$1,000) | 15,000 | ||

| Trucks ($8,000×2 trucks) | 16,000 | ||

| (To record the retirement of trucks (2 trucks retired at 2022)) | |||

| December 31, 2022 | Loss on disposal of property, plant and equipment (12) | 2,200 | |

| Accumulated depreciation-Trucks | 2,200 | ||

| (To record the loss on disposal of property, plant and equipment) |

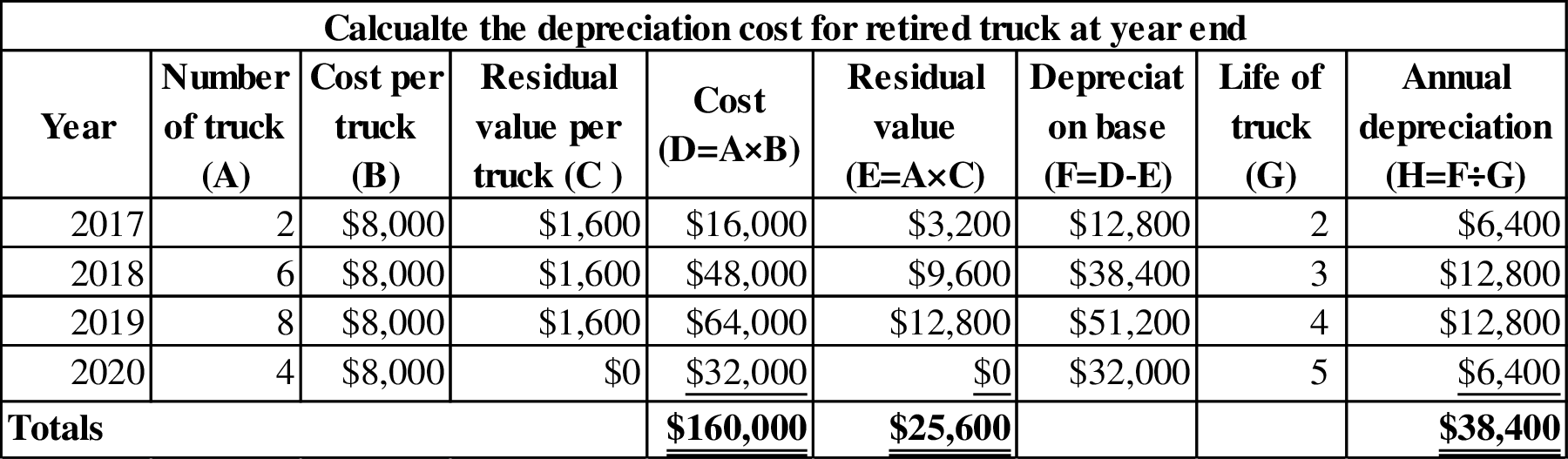

Table (3)

Working note (7):

Calculate the group depreciation cost under straight line method:

Depreciation expenses=Acquisition cost – Residual valueUseful life =160,000 (1)−$32,0004 years=$32,000 per year

Working note (8):

Calculate the depreciation rate.

Depreciation rate = [Total annual depreciation for retired trucksTotal cost of trucks×100]=$32,000 (8)$160,000 (1)×100=20%

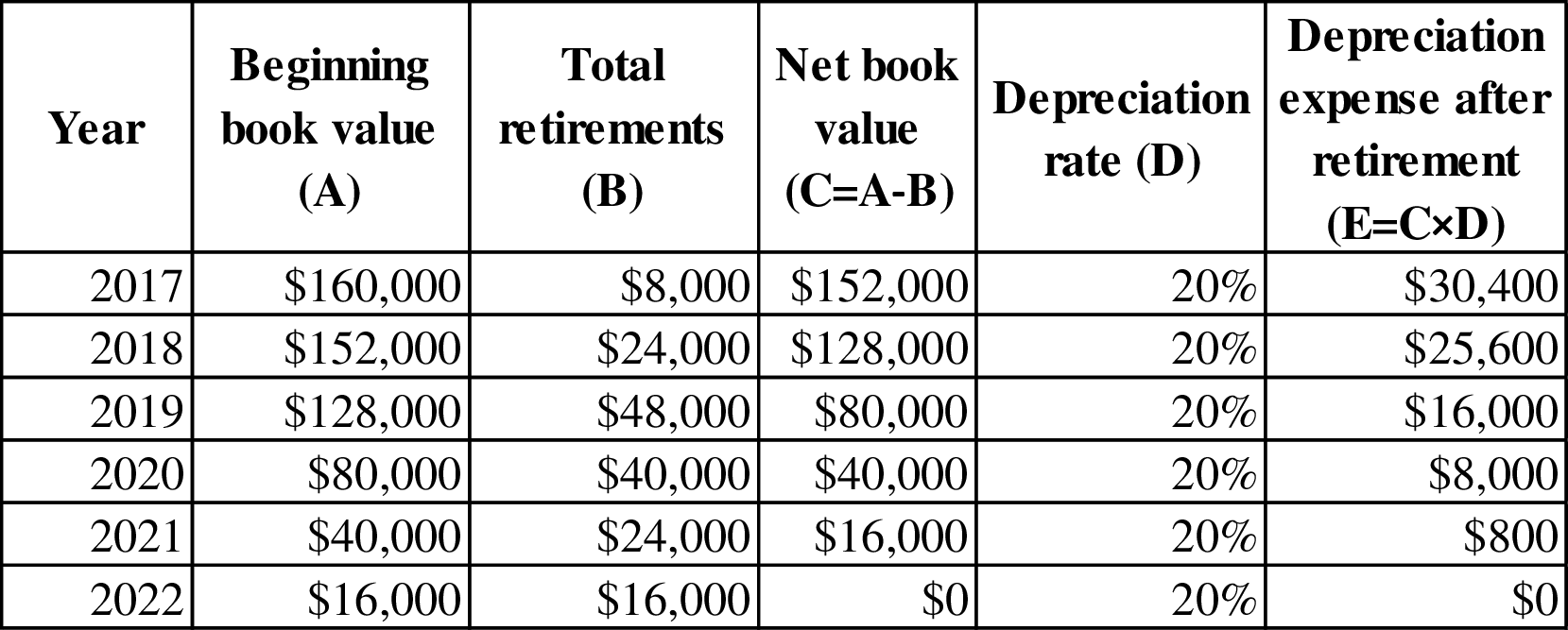

Working note (9):

Calculate the depreciation expense after retirement of truck for each year.

Figure (3)

Note: Depreciation expense after retirement for the year 2021 is $800, because the amount of $3,200 would reduce the book value of remaining two trucks (2 trucks) in the year 2022. Hence, the depreciation expense for 2021 is 800($3,2002×50%).

Working note (10):

Calculate the depreciation expense after retirement of truck for each year.

Figure (4)

Working note (11):

Calculate the total accumulated depreciation incurred at the time of retirement of truck and total depreciation expense after retirement of truck.

| Year | Accumulated depreciation incurred at the time of retirement of truck ($) | Depreciation expense for each year ($) |

| 2016 | $0 | $32,000 (7) |

| 2017 | $4,000 | $30,400 (10) |

| 2018 | $13,000 | $25,600 (10) |

| 2019 | $29,000 | $16,000 (10) |

| 2020 | $34,000 | $8,000 (10) |

| 2021 | $20,000 | $800 (10) |

| 2022 | $15,000 | $0 |

| Total depreciation | $115,000 | $112,800 |

Table (4)

Working note (12):

Calculate the loss on disposal of property, plant and equipment.

Loss on disposal of assets = ((Total accumulated depreciation incurred at the time of retirement of truck (11))−Total depreciation expense for each year (11))=$115,000−$112,800=$2,200

Want to see more full solutions like this?

Chapter 11 Solutions

Intermediate Accounting: Reporting and Analysis

- Jorgansen Lighting, Incorporated, manufactures heavy-duty street lighting systems for municipalities. The company uses variable costing for internal management reports and absorption costing for external reports to shareholders, creditors, and the government. The company has provided the following data: Inventories: Beginning (units) Ending (units) Variable costing operating income Year 1 Year 2 Year 3 310 260 260 290 290 350 $ 1,091,400 $ 1,043,400 $ 1,007,400 The company's fixed manufacturing overhead per unit was constant at $670 for all three years. Required: 1. Determine each year's absorption costing operating income. Note: Enter any losses or deductions as a negative value. Reconciliation of Variable Costing and Absorption Costing Operating Incomes Year 1 Year 2 Year 3 Variable costing operating income Add (deduct) fixed manufacturing overhead cost deferred in (released from) inventory under absorption costing Absorption costing operating incomearrow_forwardCalculate Dynamic's net income for the year ??arrow_forwardProvide correct option general accounting questionarrow_forward

- On January 1, 2023, Pharoah Ltd. had 702,000 common shares outstanding. During 2023, it had the following transactions that affected the common share account: Feb. 1 Issued 160,000 shares Mar. 1 Issued a 10% stock dividend May 1 Acquired 181,000 common shares and retired them June 1 Issued a 3-for-1 stock split Oct. 1 Issued 78,000 shares ♡ The company's year end is December 31Determine the weighted average number of shares outstanding as at December 31, 2023. (Round answer to O decimal places, eg. 5,275.) Weighted average number of shares outstandingarrow_forwarduse the high-low method to calculate Smithson's fixed costs per month.arrow_forwardGeneral accounting questionarrow_forward