Cost Allocation: Step Method with Analysis and Decision Making

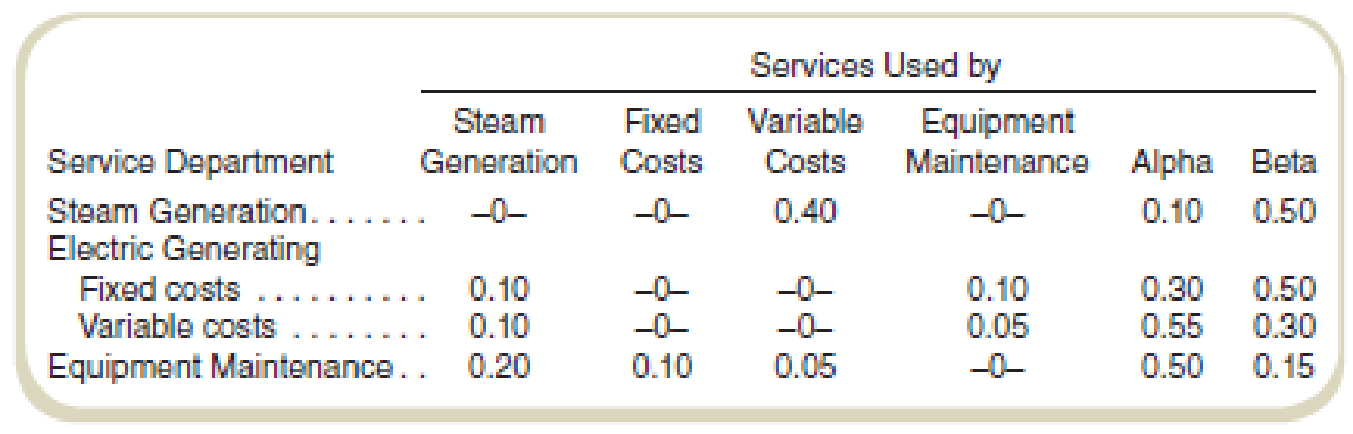

Steamco is reviewing its operations to see what additional energy-saving projects it might adopt. The company’s manufacturing plant generates its own electricity using a process capturing steam from its production processes. A summary of the use of service departments by other service departments as well as by the two producing departments at the plant follows:

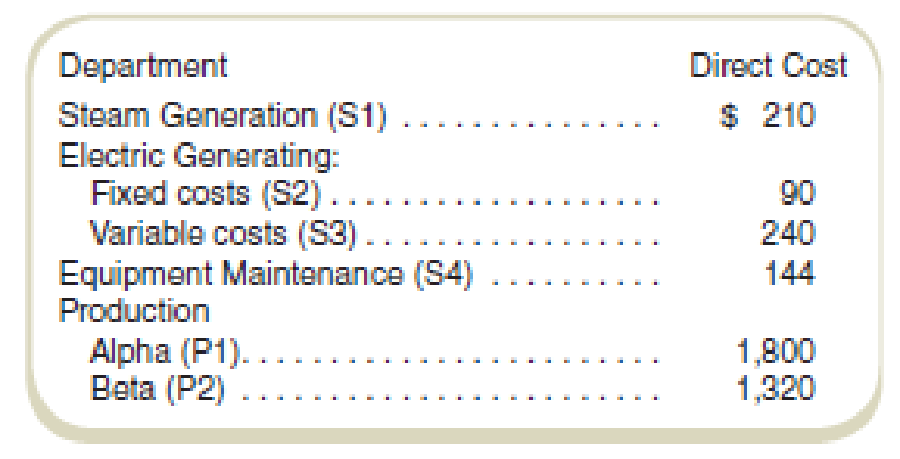

Direct costs (in thousands) in the various departments follow:

Steamco currently allocates costs of service departments to production departments using the step method. The local power company indicates that it would charge $480,000 per year for the electricity that Steamco now generates internally. Management rejected switching to the power company on the grounds that its rates would cost more than the $330,000 ($90,000 + $240,000) cost of the present, company-owned, system.

Required

- a. What costs of electric

service did management use to prepare the basis for its decision to continue generating power internally? - b. Prepare for management an analysis of the costs of the company’s own electric generating operations. (Use the step method.) The rank order of allocation is (1) S1, (2) S4, (3) S2, and (4) S3.

- c. Add a section to your analysis to management that you prepared for requirement (b) to indicate whether your answer there would change if the company could realize $174,000 per year from the sale of the steam now used for electric generating. (Assume no selling costs.)

Want to see the full answer?

Check out a sample textbook solution

Chapter 11 Solutions

FUNDAMENTALS OF...(LL)-W/ACCESS>IP<

- Use this information for Square Yard Products Inc. to answer the question that follow.Materials used by Square Yard Products Inc. in producing Division 3's product are currently purchased from outside suppliers at a cost of $5.00 per unit. However, the same materials are available with Division 6. Division 6 has unused capacity and can produce the materials needed by Division 3 at a variable cost of $3.00 per unit. A transfer price of $3.20 per unit is established, and 40,000 units of material are transferred, with no reduction in Division 6's current sales.How much will Division 3's income from operations increase?arrow_forwardA manufacturing company has two service and two production departments. Building Maintenance and Factory Office are the service departments. The production departments are Assembly and Machining. The following data have been estimated for next years operations: The direct charges identified with each of the departments are as follows: The building maintenance department services all departments of the company, and its costs are allocated using floor space occupied, while factory office costs are allocable to Assembly and Machining on the basis of direct labor hours. 1. Distribute the service department costs, using the direct method. 2. Distribute the service department costs, using the sequential distribution method, with the department servicing the greatest number of other departments distributed first.arrow_forwardA manufacturing company has two service and two production departments. Human Resources and Machine Repair are the service departments. The production departments are Grinding and Polishing. The following data have been estimated for next years operations: The direct charges identified with each of the departments are as follows: The human resources department services all departments of the company, and its costs are allocated using the numbers of employees within each department, while machine repair costs are allocable to Grinding and Polishing on the basis of machine hours. 1. Distribute the service department costs, using the direct method. 2. Distribute the service department costs, using the sequential distribution method, with the department servicing the greatest number of other departments distributed first.arrow_forward

- Assigning Costs to a Cost Object, Direct and Indirect Costs Hummer Company uses manufacturing cells to produce its products (a cell is a manufacturing unit dedicated to the production of subassemblies or products). One manufacturing cell produces small motors for lawn mowers. Suppose that the motor manufacturing cell is the cost object. Assume that all or a portion of the following costs must be assigned to the cell. a. Salary of cell supervisor b. Power to heat and cool the plant in which the cell is located c. Materials used to produce the motors d. Maintenance for the cells equipment (provided by the maintenance department) e. Labor used to produce motors f. Cafeteria that services the plants employees g. Depreciation on the plant h. Depreciation on equipment used to produce the motors i. Ordering costs for materials used in production j. Engineering support (provided by the engineering department) k. Cost of maintaining the plant and grounds l. Cost of the plants personnel office m. Property tax on the plant and land Required: Classify each of the costs as a direct cost or an indirect cost to the motor manufacturing cell.arrow_forwardYoung Company is beginning operations and is considering three alternatives to allocate manufacturing overhead to individual units produced. Young can use a plantwide rate, departmental rates, or activity-based costing. Young will produce many types of products in its single plant, and not all products will be processed through all departments. In which one of the following independent situations would reported net income for the first year be the same regardless of which overhead allocation method had been selected? a. All production costs approach those costs that were budgeted. b. The sales mix does not vary from the mix that was budgeted. c. All manufacturing overhead is a fixed cost. d. All ending inventory balances are zero.arrow_forwardCharlies Wood Works produces wood products (e.g., cabinets, tables, picture frames, and so on). Production departments include Cutting and Assembly. The Janitorial and Security departments support the Cutting and Assembly departments. The Assembly Department spans about 46,400 square feet and holds assets valued at about 60,000. The Cutting Department spans about 33,600 square feet and holds assets valued at about 140,000. Charlies Wood Works allocates support department costs using the direct method. If costs from the Janitorial Department are allocated based on square feet and costs from the Security Department are allocated based on asset value, determine (a) the percentage of Janitorial costs that should be allocated to the Assembly Department and (b) the percentage of Security costs that should be allocated to the Cutting Department.arrow_forward

- Support department cost allocation Blue Mountain Masterpieces produces pictures, paintings, and other home decor. The Printing and Framing production departments are supported by the Janitorial and Security departments. Janitorial costs are allocated to the production departments based on square feet, and security costs are allocated based on asset value. Information about these departments is detailed in the following table: Management has experimented with different support department cost allocation methods in the past. The different allocation methods did not yield large differences of cost allocation to the production departments. Instructions 1. Determine which support department cost allocation method Blue Mountain Masterpieces would most likely use to allocate its support department costs to the production departments. 2. Determine the total costs allocated from each support department to each production department using the method you determined in part (1). 3. Without doing calculations, consider and answer the following: If Blue Mountain Masterpieces decided to use square feet instead of asset value as the cost driver for security services, how would this change the allocation of Security Department costs?arrow_forwardThe management of Wheeler Company has decided to develop cost formulas for its major overhead activities. Wheeler uses a highly automated manufacturing process, and power costs are a significant manufacturing cost. Cost analysts have decided that power costs are mixed; thus, they must be broken into their fixed and variable elements so that the cost behavior of the power usage activity can be properly described. Machine hours have been selected as the activity driver for power costs. The following data for the past eight quarters have been collected: Required: 1. Prepare a scattergraph by plotting power costs against machine hours. Does the scatter-graph show a linear relationship between machine hours and power cost? 2. Using the high and low points, compute a power cost formula. 3. Use the method of least squares to compute a power cost formula. Evaluate the coefficient of determination. 4. Rerun the regression and drop the point (20,000; 26,000) as an outlier. Compare the results from this regression to those for the regression in Requirement 3. Which is better?arrow_forwardThe management of Hartman Company is trying to determine the amount of each of two products to produce over the coming planning period. The following information concerns labor availability, labor utilization, and product profitability: a. Develop a linear programming model of the Hartman Company problem. Solve the model to determine the optimal production quantities of products 1 and 2. b. In computing the profit contribution per unit, management does not deduct labor costs because they are considered fixed for the upcoming planning period. However, suppose that overtime can be scheduled in some of the departments. Which departments would you recommend scheduling for overtime? How much would you be willing to pay per hour of overtime in each department? c. Suppose that 10, 6, and 8 hours of overtime may be scheduled in departments A, B, and C, respectively. The cost per hour of overtime is 18 in department A, 22.50 in department B, and 12 in department C. Formulate a linear programming model that can be used to determine the optimal production quantities if overtime is made available. What are the optimal production quantities, and what is the revised total contribution to profit? How much overtime do you recommend using in each department? What is the increase in the total contribution to profit if overtime is used?arrow_forward

- Reducir, Inc., produces two different types of hydraulic cylinders. Reducir produces a major subassembly for the cylinders in the Cutting and Welding Department. Other parts and the subassembly are then assembled in the Assembly Department. The activities, expected costs, and drivers associated with these two manufacturing processes are given below. Note: In the assembly process, the materials-handling activity is a function of product characteristics rather than batch activity. Other overhead activities, their costs, and drivers are listed below. Other production information concerning the two hydraulic cylinders is also provided: Required: 1. Using a plantwide rate based on machine hours, calculate the total overhead cost assigned to each product and the unit overhead cost. 2. Using activity rates, calculate the total overhead cost assigned to each product and the unit overhead cost. Comment on the accuracy of the plantwide rate. 3. Calculate the global consumption ratios. 4. Calculate the consumption ratios for welding and materials handling (Assembly) and show that two drivers, welding hours and number of parts, can be used to achieve the same ABC product costs calculated in Requirement 2. Explain the value of this simplification. 5. Calculate the consumption ratios for inspection and engineering, and show that the drivers for these two activities also duplicate the ABC product costs calculated in Requirement 2.arrow_forwardBlue Africa Inc. produces laptops and desktop computers. The companys production activities mainly occur in what the company calls its Laser and Forming departments. The Cafeteria and Security departments support the companys production activities and allocate costs based on the number of employees and square feet, respectively. The total cost of the Security Department is 273,000. The total cost of the Cafeteria Department is 180,000. The number of employees and the square footage in each department are as follows: Using the reciprocal services method of support department cost allocation, determine the total costs from the Security Department that should be allocated to the Cafeteria Department and to each of the production departments.arrow_forwardKagle design engineers are in the process of developing a new green product, one that will significantly reduce impact on the environment and yet still provide the desired customer functionality. Currently, two designs are being considered. The manager of Kagle has told the engineers that the cost for the new product cannot exceed 550 per unit (target cost). In the past, the Cost Accounting Department has given estimated costs using a unit-based system. At the request of the Engineering Department, Cost Accounting is providing both unit-and activity-based accounting information (made possible by a recent pilot study producing the activity-based data). Unit-based system: Variable conversion activity rate: 100 per direct labor hour Material usage rate: 20 per part ABC system: Labor usage: 15 per direct labor hour Material usage (direct materials): 20 per part Machining: 75 per machine hour Purchasing activity: 150 per purchase order Setup activity: 3,000 per setup hour Warranty activity: 500 per returned unit (usually requires extensive rework) Customer repair cost: 25 per repair hour (average) Required: 1. Select the lower-cost design using unit-based costing. Are logistical and post-purchase activities considered in this analysis? 2. Select the lower-cost design using ABC analysis. Explain why the analysis differs from the unit-based analysis. 3. What if the post-purchase cost was an environmental contaminant and amounted to 10 per unit for Design A and 40 per unit for Design B? Assume that the environmental cost is borne by society. Now which is the better design?arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning