1.

Prepare the necessary journal entries and

1.

Explanation of Solution

Journal: Journal is the method of recording monetary business transactions in chronological order. It records the debit and credit aspects of each transaction to abide by the double-entry system.

Rules of Debit and Credit: Following rules are followed for debiting and crediting different accounts while they occur in business transactions:

- Debit, all increase in assets, expenses and dividends, all decrease in liabilities, revenues and stockholders’ equities.

- Credit, all increase in liabilities, revenues, and stockholders’ equities, all decrease in assets, expenses.

Prepare journal entries of Company O for the given transaction as follows:

| Date | Accounts title and explanation | Ref. | Debit ($) | Credit ($) | |

| January 1 | a. | Salaries and wages payable | 1,600 | ||

| Cash | 1,600 | ||||

| (To record accrued salaries and wages paid to employees) | |||||

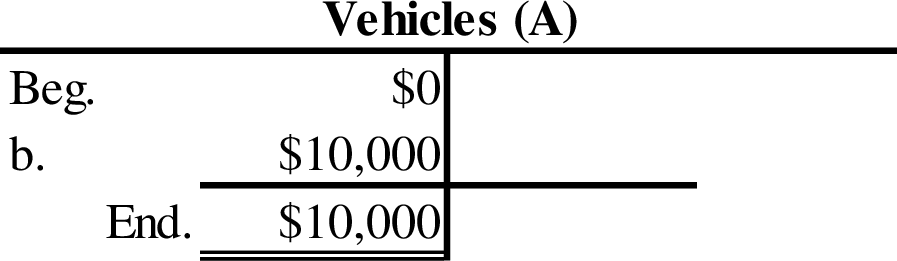

| January 2 | b. | Vehicles | 10,000 | ||

| Cash | 10,000 | ||||

| (To record the vehicles purchased for cash) | |||||

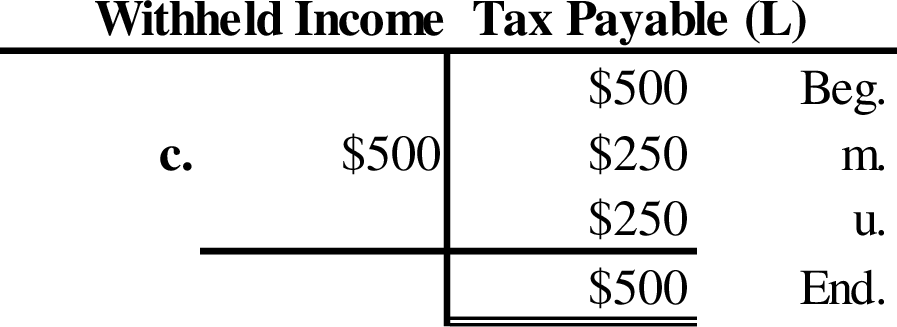

| January 3 | c. | Withheld income taxes payable | 500 | ||

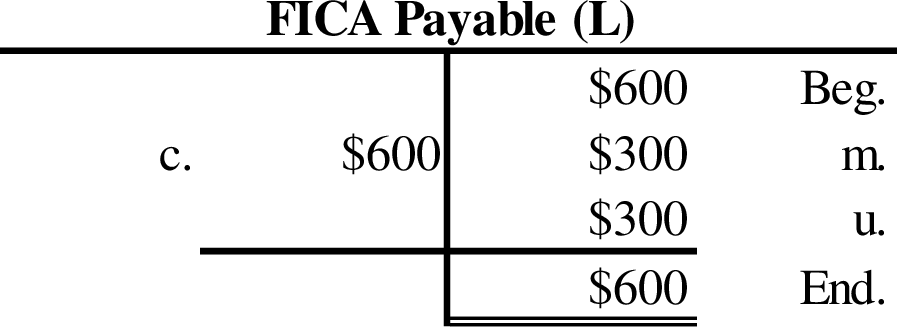

| FICA payable | 600 | ||||

| Cash | 1,100 | ||||

| (To record payroll withholdings and employer contribution) | |||||

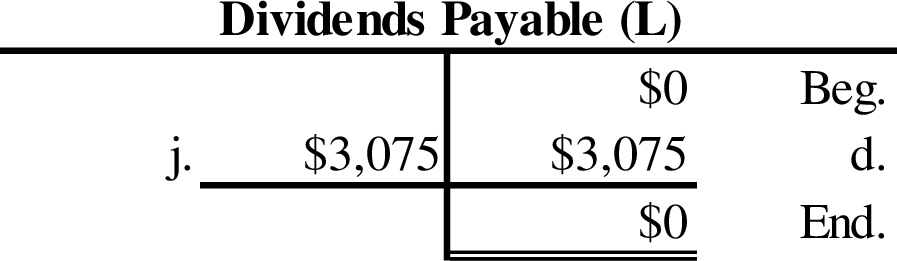

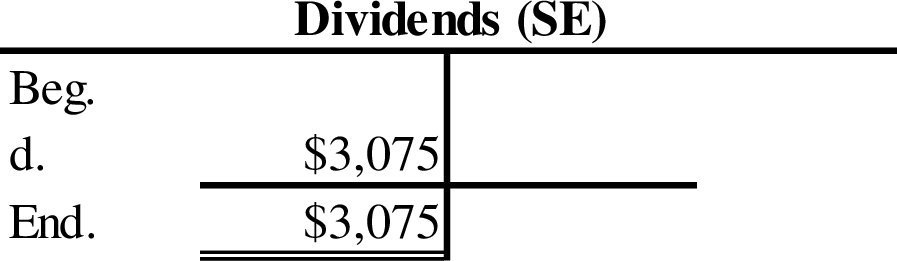

| January 4 | d. | Dividends(2) | 3,075 | ||

| Dividends payable | 3,075 | ||||

| (To record the dividends declared by board of directors) | |||||

| January 5 | e. | Allowance for doubtful accounts | 950 | ||

| Accounts receivable | 950 | ||||

| (To record uncollectable amounts written off) | |||||

| January 6 | f. | Accounts receivables | 27,825 | ||

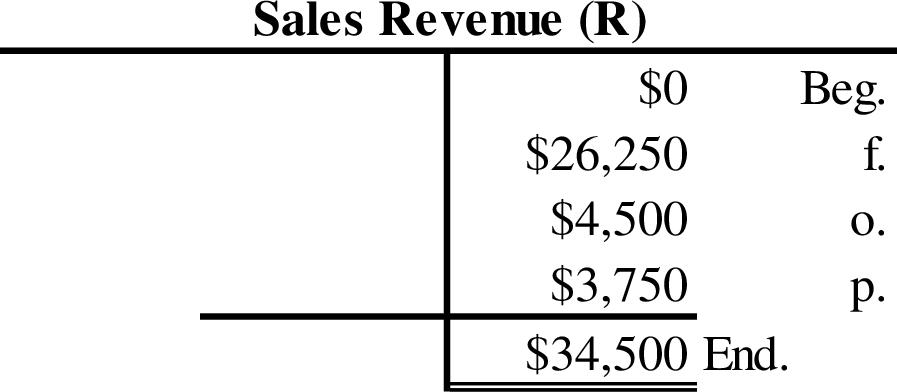

| Sales revenue(3) | 26,250 | ||||

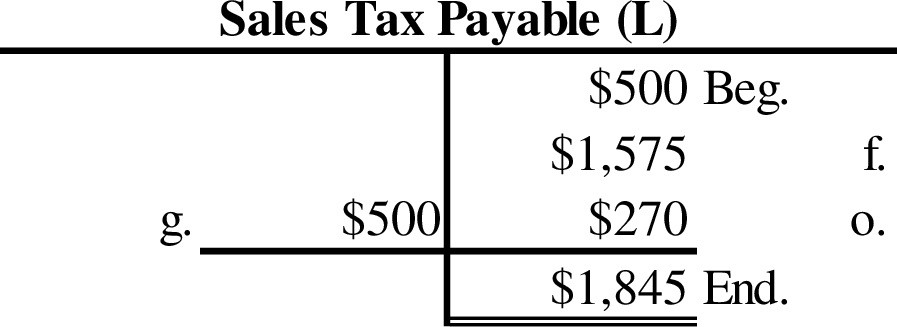

| Sales tax payable(4) | 1,575 | ||||

| (To record sales made on account and sales tax charged) | |||||

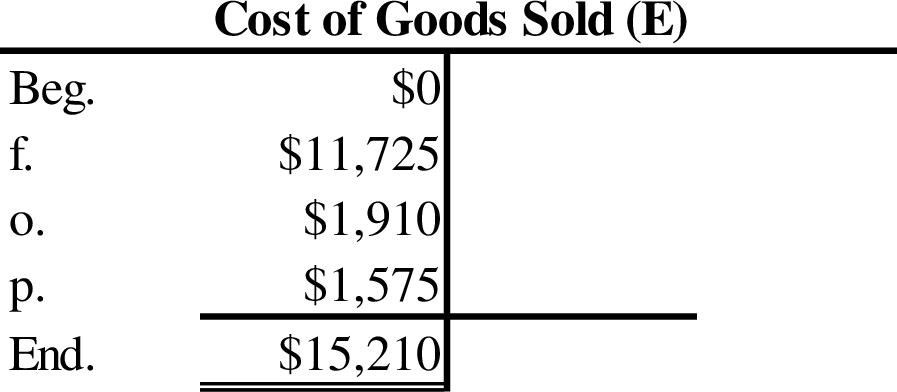

| Cost of goods sold(5) | 11,725 | ||||

| Inventory | 11,725 | ||||

| (To record the amount of inventory written off against the cost of goods sold) | |||||

| January 7 | g. | Sales tax payable | 500 | ||

| Cash | 500 | ||||

| (To record sales tax collected from customer) | |||||

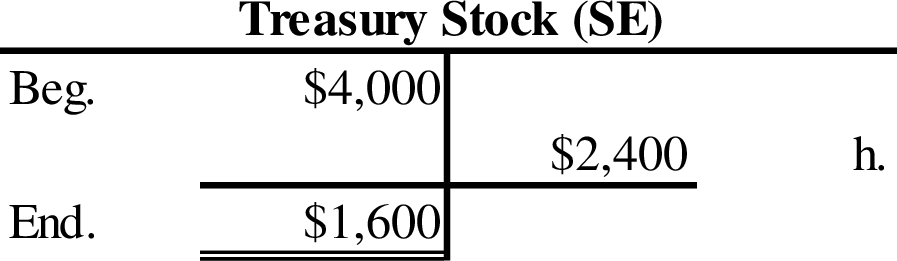

| January 8 | h. | Cash | 2,400 | ||

| | 2,400 | ||||

| (To record the 300 treasury stock purchased at $8 each) | |||||

| January 9 | i. | Cash | 8,500 | ||

| Accounts receivable | 8,500 | ||||

| (To record the cash received from the customer) | |||||

| January 10 | j. | Dividends payable | 3,075 | ||

| Cash | 3,075 | ||||

| (To record the dividends paid to stockholders) | |||||

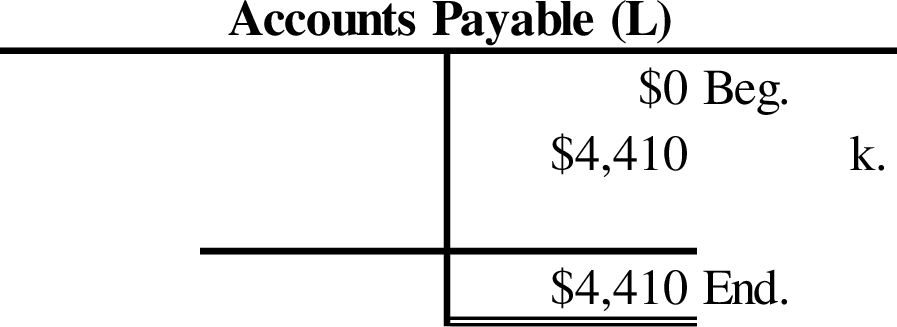

| January 11 | k. | Inventory | 4,410 | ||

| Accounts payable | 4,410 | ||||

| (To record the inventory purchased on account) | |||||

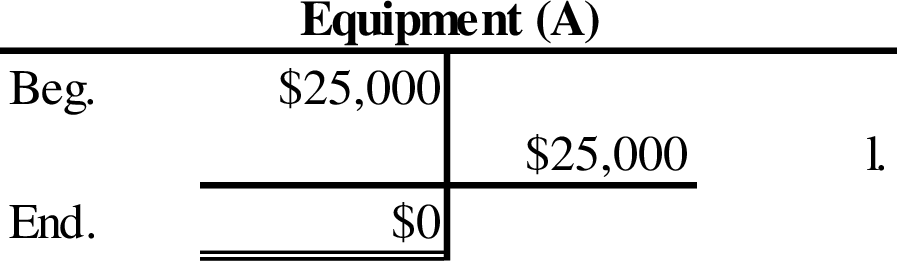

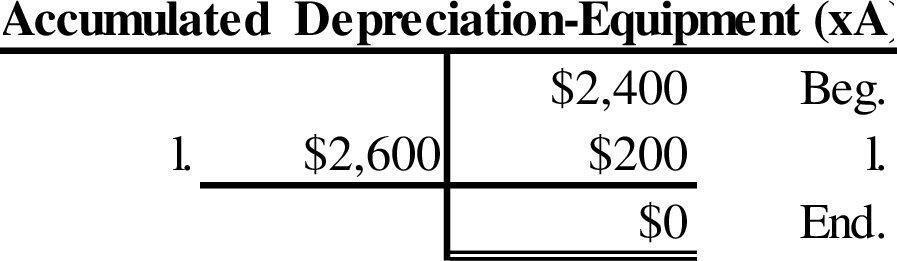

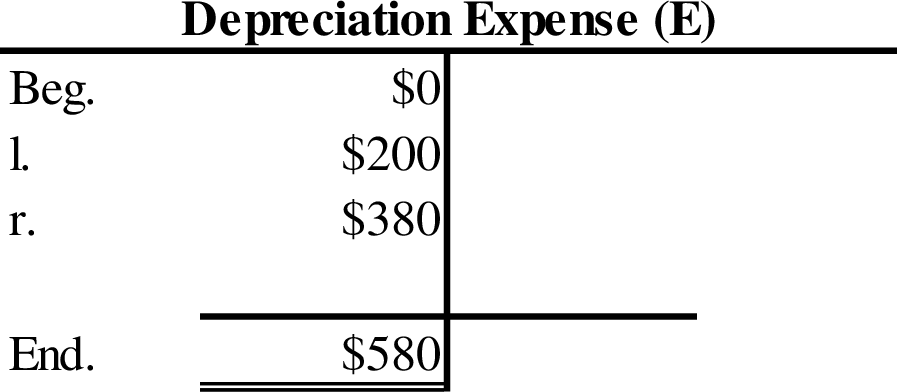

| January 12 | l. | 200 | |||

| | 200 | ||||

| (To record the depreciation expense incurred during year) | |||||

| Cash | 23,000 | ||||

| Accumulated depreciation-Equipment(8) | 2,600 | ||||

| Equipment | 25,000 | ||||

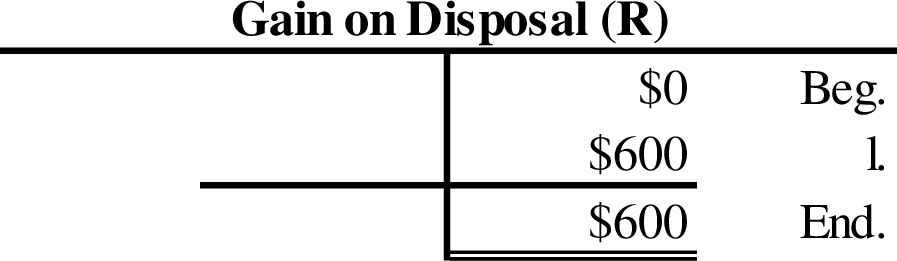

| Gain on disposal(9) | 600 | ||||

| (To record the sale of equipment and the gain from the sales) | |||||

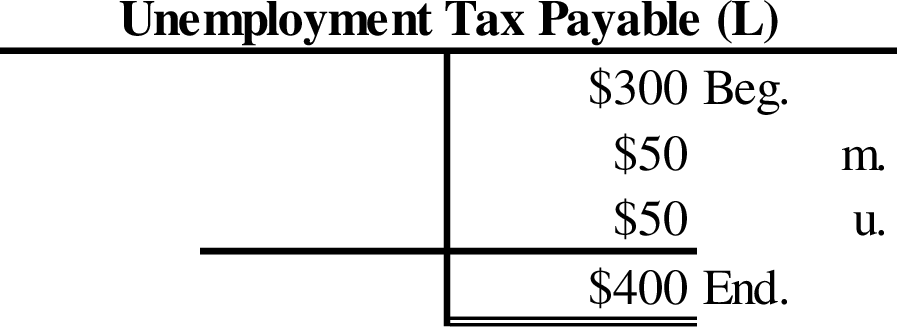

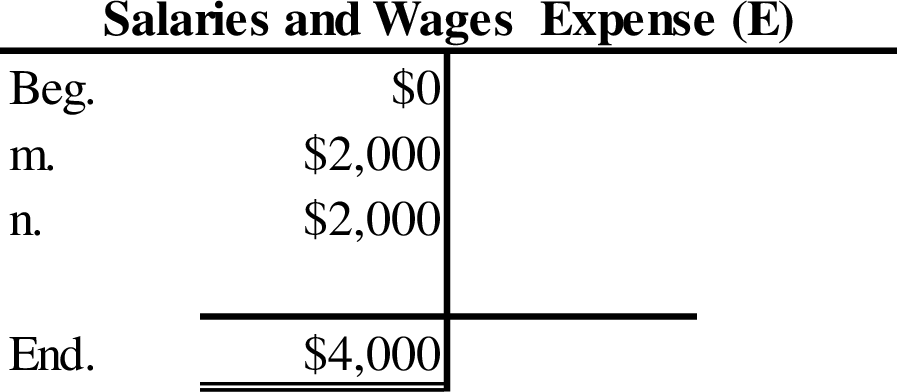

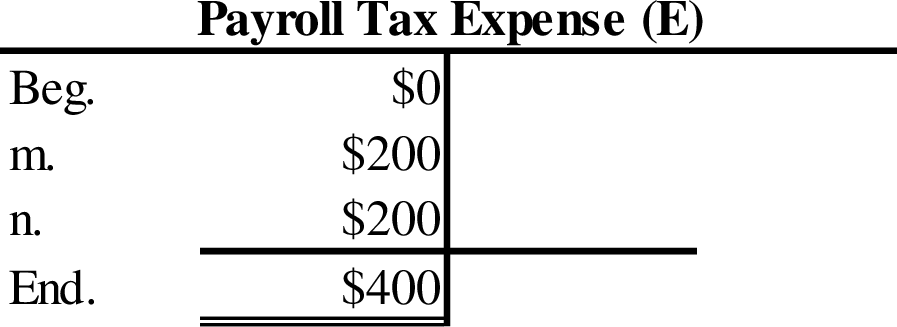

| January 13 | m. | Salaries and wages expense | 2,000 | ||

| Payroll tax expense (10) | 200 | ||||

| Withheld income tax payable | 250 | ||||

| FICA payable (11) | 300 | ||||

| | 50 | ||||

| Cash (12) | 1,600 | ||||

| (To record salaries and wages expense paid during the year) | |||||

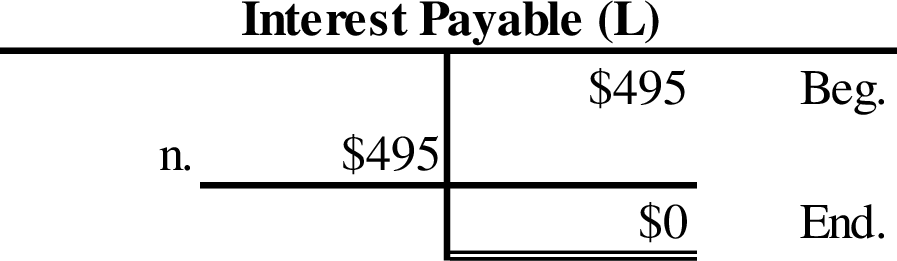

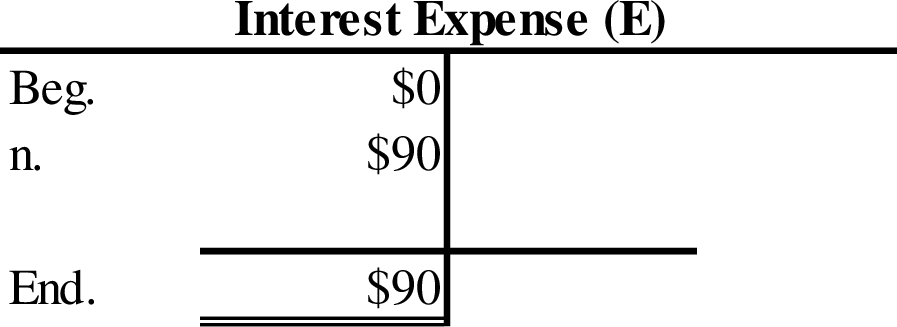

| January 14 | n. | Notes payable | 22,000 | ||

| Interest payable | 495 | ||||

| Interest expense | 90 | ||||

| Cash | 22,585 | ||||

| (To record cash paid to creditors along with interest) | |||||

| January 27 | o. | Accounts receivable | 4,770 | ||

| Sales revenue (13) | 4,500 | ||||

| Sales tax payable (14) | 270 | ||||

| (To record sales made on account and sales tax charged) | |||||

| Cost of goods sold (15) | 1,910 | ||||

| Inventory | 1,910 | ||||

| (To record the amount of inventory written off against the cost of goods sold) | |||||

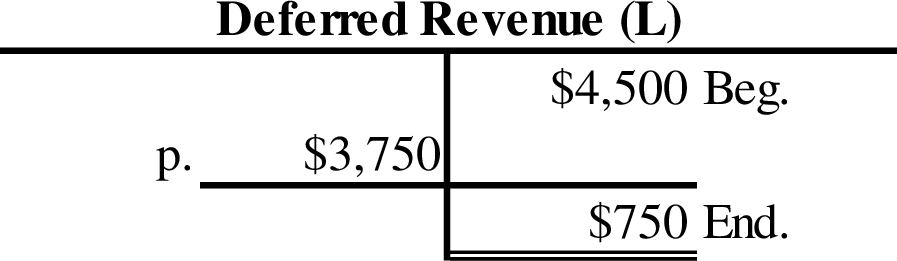

| January 29 | p. | Deferred revenue | 3,750 | ||

| Sales revenue (16) | 3,750 | ||||

| (To record the sales revenue recognized during the year) | |||||

| Cost of goods sold (17) | 1,575 | ||||

| Inventory | 1,575 | ||||

| (To record the amount of inventory written off against the cost of goods sold) | |||||

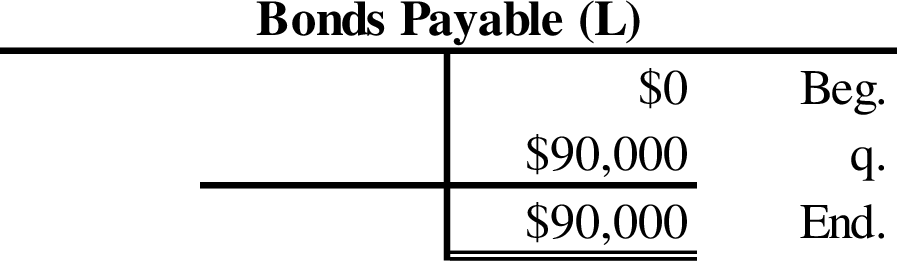

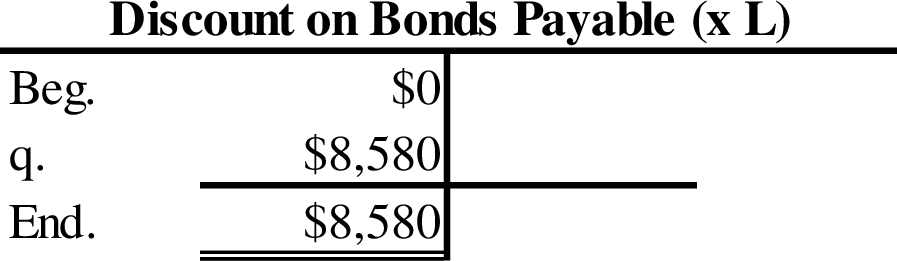

| January 30 | q. | Cash | 81,420 | ||

| Discount on bonds payable | 8,580 | ||||

| Bonds payable | 90,000 | ||||

| (To record the cash borrowed against the bonds) | |||||

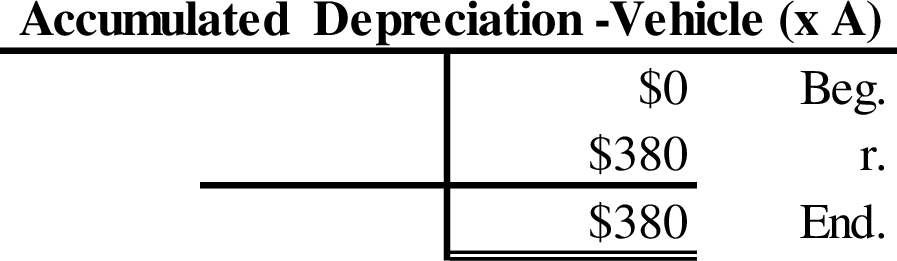

| January 31 | r. | Depreciation expense (18) | 380 | ||

| Accumulated depreciation-Vehicles | 380 | ||||

| (To record the depreciation expense incurred during the year) | |||||

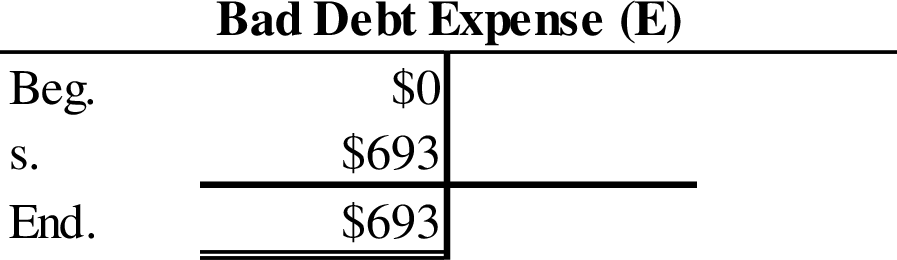

| January 31 | s. | 693 | |||

| Allowance for doubtful accounts | 693 | ||||

| (To record the bad debt expense incurred during the year) | |||||

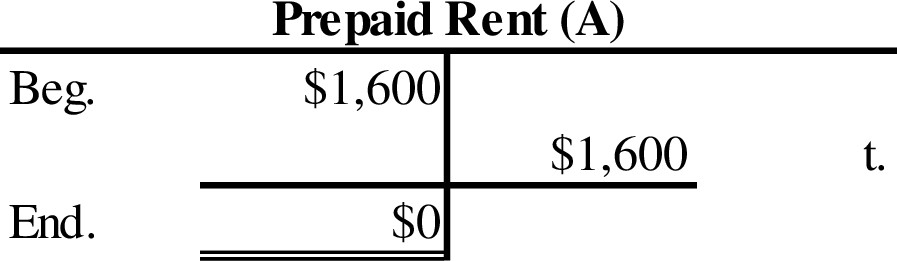

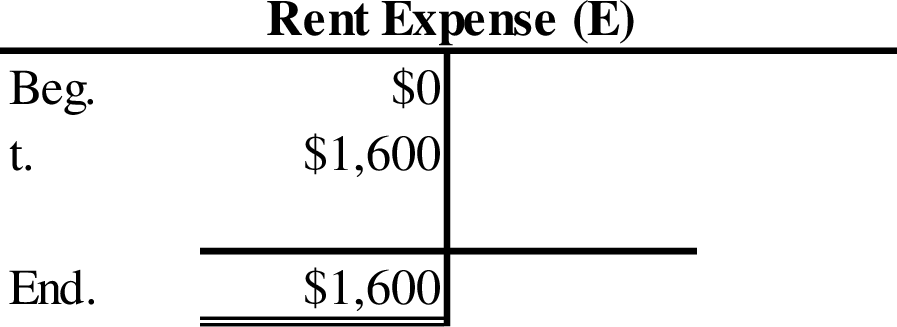

| January 31 | t. | Rent expense | 1,600 | ||

| Prepaid rent | 1,600 | ||||

| (To record the rent expense incurred during the year) | |||||

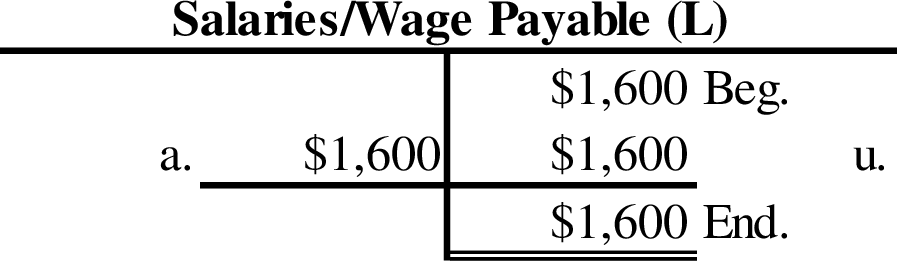

| January 31 | u. | Salaries and wages expense | 2,000 | ||

| Payroll tax expense (10) | 200 | ||||

| Withheld income tax payable | 250 | ||||

| FICA payable (11) | 300 | ||||

| Unemployment tax payable | 50 | ||||

| Salaries and wages payable | 1,600 | ||||

| (To record accrued salaries and wages expense during the year) | |||||

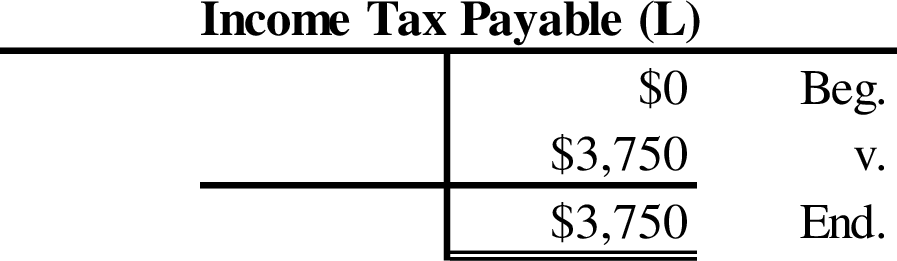

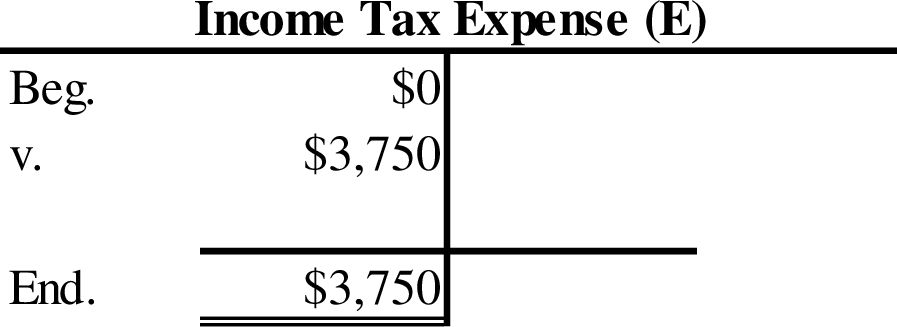

| January 31 | v. | Income tax expense | 3,750 | ||

| Income tax payable | 3,750 | ||||

| (To record the income tax expense incurred during the current year) | |||||

Table (1)

Working note (1):

Calculate the number of outstanding share.

Working note (2):

Calculate the amount of dividends:

Number of outstanding shares is 6,150 shares (1).

Dividends per share are $0.50.

Working note (3):

Calculate the amount of sales revenue:

Working note (4):

Calculate the value of sales tax payable.

Working note (5):

Calculate the cost of goods sold:

Inventory per unit is $67 per unit

Units delivered are 175 units.

Working note (6):

Calculate the value of annual depreciation expense:

Working note (7):

Calculate the depreciation expense during the current year:

Working note (8):

Calculate the value of accumulated depreciation:

Working note (9):

Calculate the gain from sale of equipment:

Working note (10):

Calculate the amount of payroll tax expense:

Working note (11):

Calculate the value of FICA payable:

Working note (12):

Calculate the value of cash paid behalf of salaries and wages expenses:

Working note (13):

Calculate the amount of sales revenue:

Working note (14):

Calculate the value of sales tax payable:

Working note (15):

Calculate the cost of goods sold:

Inventory per unit for first 5 units is $67 per unit

Inventory per unit for last 25 units is $63 per unit

Units delivered are 30 units.

Working note (16):

Calculate the value of deferred revenue:

Working note (17):

Calculate the cost of goods sold:

Inventory per unit for last 25 units is $63 per unit

Units delivered is 25 units

Working note (18):

Calculate the value of annual depreciation expense:

Working note (19):

Calculate the value of bad debt expenses:

2.

2.

Explanation of Solution

T-account: T-account refers to an individual account, where the increases or decreases in the value of specific asset, liability, stockholder’s equity, revenue, and expenditure items are recorded.

This account is referred to as the T-account, because the alignment of the components of the account resembles the capital letter ‘T’.’ An account consists of the three main components which are as follows:

- (a) The title of the account

- (b) The left or debit side

- (c) The right or credit side

Adjusted trial balance: Adjusted trial balance is a summary of all the ledger accounts, and it contains the balances of all the accounts after the adjustment entries are journalized, and posted.

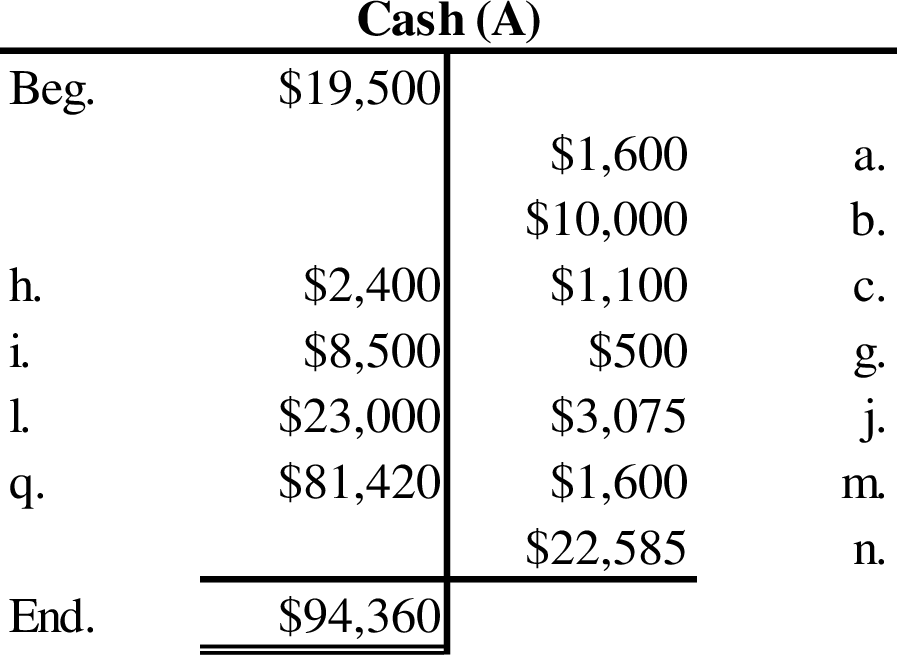

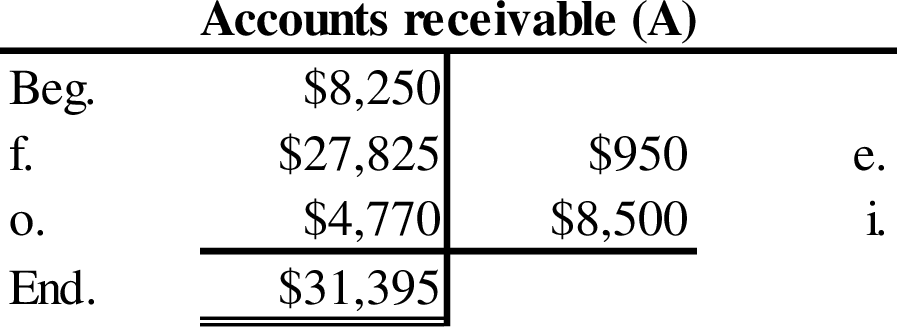

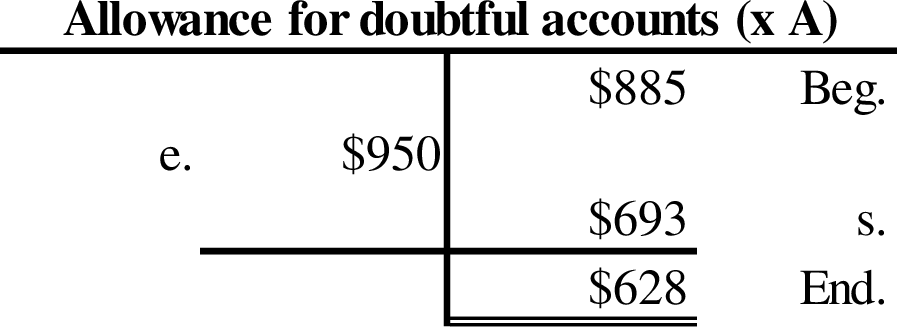

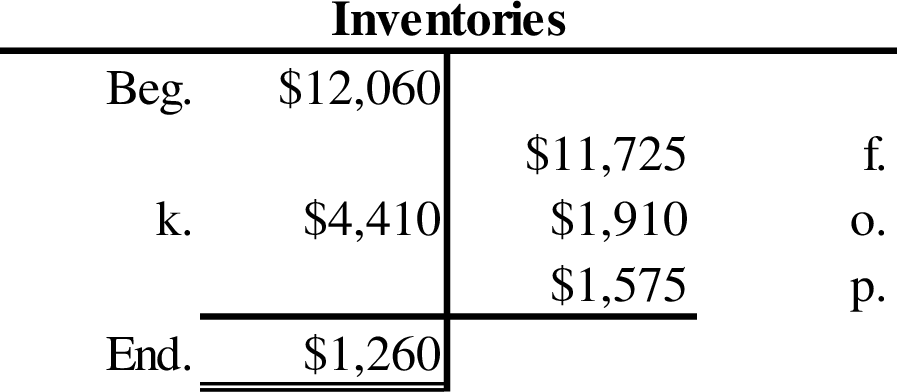

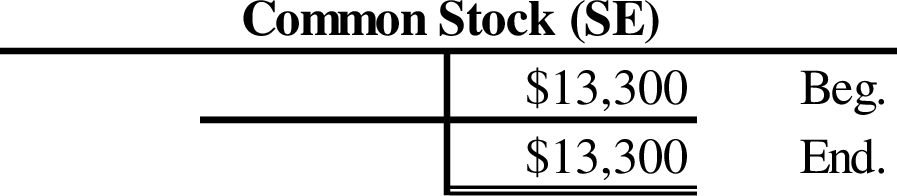

T-accounts of company O are as follows:

Prepare adjusted trial balance of Company O as follows:

| Company O | ||

| Adjusted Trial balance | ||

| January 31 | ||

| Account titles | Debit($) | Credit($) |

| Cash | $94,360 | |

| Accounts Receivable | 31,395 | |

| Allowance for Doubtful Accounts | $628 | |

| Inventory | 1,260 | |

| Prepaid Rent | 0 | |

| Equipment | 0 | |

| Vehicles | 10,000 | |

| Accumulated Depreciation—Equipment | 0 | |

| Accumulated Depreciation—Vehicles | 380 | |

| Accounts Payable | 4,410 | |

| Sales Tax Payable | 1,845 | |

| FICA Payable | 600 | |

| Withheld Income Taxes Payable | 500 | |

| Unemployment Taxes Payable | 400 | |

| Salaries and Wages Payable | 1,600 | |

| Deferred Revenue | 750 | |

| Note Payable | 0 | |

| Interest Payable | 0 | |

| Income Taxes Payable | 3,750 | |

| Dividends Payable | 0 | |

| Bonds Payable | 90,000 | |

| Discount on Bonds Payable | 8,580 | |

| Common Stock | 13,300 | |

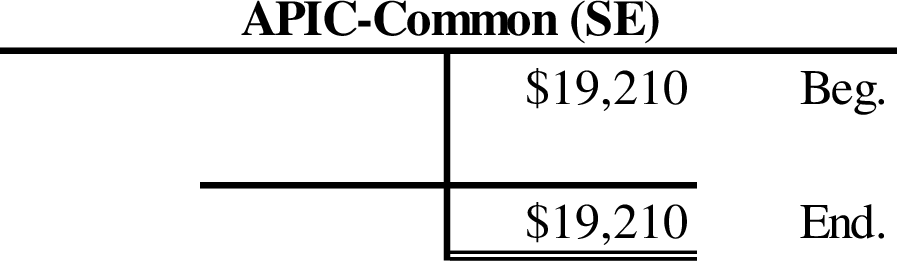

| Additional Paid-In Capital, Common | 19,210 | |

| Treasury Stock | 1,600 | |

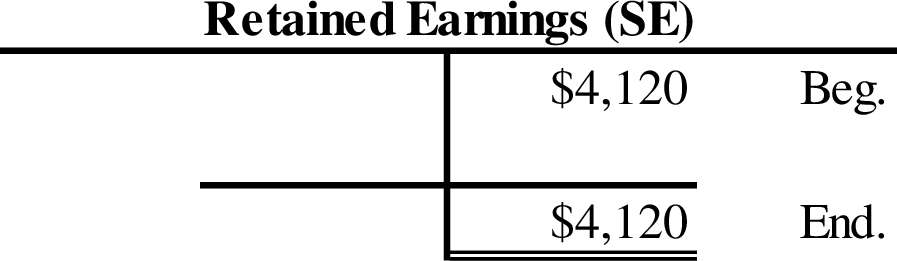

| Retained Earnings | 4,120 | |

| Dividends | 3,075 | |

| Sales Revenue | 34,500 | |

| Cost of Goods Sold | 15,210 | |

| Salaries and Wages Expense | 4,000 | |

| Rent Expense | 1,600 | |

| Bad Debt Expense | 693 | |

| Depreciation Expense | 580 | |

| Payroll Tax Expense | 400 | |

| Interest Expense | 90 | |

| Income Tax Expense | 3,750 | |

| Gain on Disposal | 600 | |

| Totals | $176,593 | $176,593 |

Table (2)

Therefore, the total of debit, and credit columns of adjusted trial balance is $176,593 and agreed.

3.

Prepare an income statement, statement of stockholders’ equity and classified balance sheet at the end of January.

3.

Explanation of Solution

Income statement: This is the financial statement of a company which shows all the revenues earned and expenses incurred by the company over a period of time.

Statement of stockholder's equity: This statement reports the beginning stockholder's equity and all the changes which led to ending stockholder's equity. Additional capital, net income from income statement is added to and drawings or dividends are deducted from beginning stockholder's equity to arrive at the end result, closing balance of stockholder's equity.

Classified balance sheet: This is the financial statement of a company which shows the grouping of similar assets and liabilities under subheadings.

Prepare an income statement of Company O as follows:

| Company O | |

| Income Statement | |

| For the Month Ended January 31 | |

| $ | |

| Sales Revenue | $34,500 |

| Less: Cost of Goods Sold | 15,210 |

| Gross Profit | 19,290 |

| Less: Salaries and Wages Expense | 4,000 |

| Rent Expense | 1,600 |

| Bad Debt Expense | 693 |

| Depreciation Expense | 580 |

| Payroll Tax Expense | 400 |

| Loss (Gain) on Disposal | (600) |

| Income from Operations | 12,617 |

| Less: Interest Expense | 90 |

| Income before Income Tax Expense | 12,527 |

| Less: Income Tax Expense | 3,750 |

| Net Income | $8,777 |

Table (3)

Prepare a statement of stockholder’s equity of Company O as follows:

| Company O | ||||

| Statement of Stockholders’ Equity | ||||

| For the Month Ended January 31 | ||||

| Common Stock | Additional Paid-In Capital, Common | Retained Earnings | Treasurystock | |

| $ | $ | $ | $ | |

| Beginning | 13,300 | 19,210 | 4,120 | 4,000 |

| Stock Issuances | - | - | - | (2,400) |

| Net Income | - | - | 8,777 | - |

| Dividends: Common | - | - | (3,075) | - |

| Ending | 13,300 | 19,210 | 9,822 | 1,600 |

Table (4)

Prepare a classified balance sheet of Company O as follows:

| Company O | |

| Balance Sheet | |

| At January 31 | |

| Assets: | $ |

| Current Assets: | |

| Cash | 94,360 |

| Accounts Receivable | 31,395 |

| Allowance for Doubtful Accounts | (628) |

| Inventory | 1,260 |

| Total Current Assets | 126,387 |

| Vehicles | 10,000 |

| Accumulated Depreciation | (380) |

| Total Assets | 136,007 |

| Liabilities and Stockholders’ Equity : | |

| Liabilities | |

| Current Liabilities: | |

| Accounts Payable | 4,410 |

| Sales Tax Payable | 1,845 |

| Salaries and Wages Payable | 1,600 |

| FICA Payable | 600 |

| Withheld Income Taxes Payable | 500 |

| Unemployment Taxes Payable | 400 |

| Deferred Revenue | 750 |

| Income Taxes Payable | 3,750 |

| Total Current Liabilities (a) | 13,855 |

| Bonds Payable | 90,000 |

| Discount on Bonds Payable | (8,580) |

| Total Liabilities | 95,275 |

| Stockholders’ Equity | |

| Common Stock | 13,300 |

| Additional Paid-In Capital, Common Stock | 19,210 |

| Retained Earnings | 9,822 |

| Treasury Stock | (1,600) |

| Total Stockholders’ Equity (b) | 40,732 |

| Total Liabilities and Stockholders’ Equity | 136,007 |

Table (5)

4.

Calculate the total payroll cost for January of Company O’s.

4.

Explanation of Solution

Payroll tax: The costs incurred by an employer to pay the employee for his labor, including other employee benefits, plus the payroll taxes the employer pays to the government, are called payroll tax.

Company O’s total payroll cost is as follows:

Total payroll cost includes the salaries and wages expense and payroll tax expense.

Therefore, the total payroll cost is $4,400 (20).

Working note (20):

Calculate the value of total payroll cost:

5.

Describe whether the carrying value of bond is increased or decreased after recording the interest in February.

5.

Explanation of Solution

Bonds: Bonds are a kind of interest bearing notes payable, usually issued by companies, universities and governmental organizations. It is a debt instrument used for the purpose of raising fund of the corporations or governmental agencies. If selling price of the bond is equal to its face value, it is called as par on bond. If selling price of the bond is lesser than the face value, it is known as discount on bond. If selling price of the bond is greater than the face value, it is known as premium on bond.

Describe whether the carrying value of bond is increased or decreased after recording the interest in February as follows:

The carrying value of the bond would increase after recording the interest in February because the interest expense of the bond will be greater than the interest payment. The difference between the interest expense and interest payment is recorded as a deduction in the discount on bonds payable and it is contra-liability account. Hence, the decrease in contra-liability account would increase the carrying value of bond reported on the balance sheet.

6.

State the interest payment that the company needs to pay annually on the bond.

6.

Explanation of Solution

Interest: Interest is the amount charged on the principal value, for the privilege of borrowing money. Interest is to be paid by the borrower, and to be received by the lender.

Calculate the amount of interest payment as follows:

Face value of bond is$90,000

Interest rate is 5%

Length of time is 1 year (12monts)

Therefore, the interest payment of bond (annually) is $4,500.

7.

Compute the recognized gain or loss on the issuance of treasury stock on January 8.

7.

Explanation of Solution

Treasury Stock: It refers to the shares that are reacquired by the corporation that are already issued to the stockholders, but reacquisition does not signify retirement.

Compute the recognized gain or loss on the issuance of treasury stock on January 8 as follows:

In this case, no gain or losses are reported on the balance sheet for the treasury stock issued. Usually, the treasury stock is shown under the stockholder’s equity on the balance sheet as a contra entry. The gain or loss from the reissuance of treasury stock is recorded under the additional paid-in capital, and the reissuance is not reported in the income statement because they are not considered as profit-making activities.

8.

Prepare the journal entry for stock dividends.

8.

Explanation of Solution

Stock Dividend: Stock dividend refers to the dividends that are paid in the form of additional shares to stockholders rather than the cash.

Prepare the journal entry for stock dividends as follows:

When a 30% of stock dividends would be considered as a larger stock dividend:

| Date | Accounts title and explanation | Ref. | Debit ($) | Credit ($) |

| Retained earnings (-SE) (21) | 3,690 | |||

| Common stock (+SE) | 3,690 | |||

| (To record the stock dividend paid to stockholder’s) |

Table (6)

- Retained earnings are a component of stockholder’s equity and it decreases the value of stockholder’s equity by $3,690. Hence, debit the retained earnings accounts for $3,690.

- Common stock is component of stockholder’s equity and it increases the value of stockholder’s equity by $3,690. Hence, credit the common stock accounts for $3,690.

Working note (21):

Calculate the amount of stock dividends:

9.

Prepare the journal entry for stock dividends.

9.

Explanation of Solution

Stock Dividend: Stock dividend refers to the dividends that are paid in the form of additional shares to stockholders rather than the cash.

Prepare the journal entry for stock dividends as follows:

When a 10% of stock dividends would be considered as a small stock dividend:

| Date | Accounts title and explanation | Ref. | Debit ($) | Credit ($) |

| Retained earnings (-SE) (22) | 3,075 | |||

| Common stock (+SE)(23) | 1,230 | |||

| Addition paid in capital | 1,845 | |||

| (To record stock dividend paid to stockholder’s) |

Table (7)

- Retained earnings are a component of stockholder’s equity and it decreases the value of stockholder’s equity by $3,075. Hence, debit the retained earnings accounts for $3,075.

- Common stock is component of stockholder’s equity and it increases the value of stockholder’s equity by $1,230. Hence, credit the common stock accounts for $1,230.

- Additional paid in capital is component of stockholder’s equity and it increases the value of stockholder’s equity by $1,845. Hence, credit the additional paid in capital accounts for $1,845.

Working note (22):

Calculate the amount of stock dividends utilized from retained earnings:

Working note (22):

Calculate the amount of stock dividends transfer to common stock:

10.

Show the way in which the total bond issuance proceeds of $81,420 were computed in item (q) by calculating the present value of (a) face value of investment and (b) the annual interest payment.

10.

Explanation of Solution

Present value: Present value refers to the present worth of the money that is received in future in a lump sum or as series of cash flows at a specified interest rate. When these future sums of money are discounted at a higher rate, the present value of the future cash flows gets lower.

(a) Face value of bond:

| Particulars | Amount ($) |

| Face value of bond (a) | $90,000 |

| PV factor at an annual market rate of 7% for 6 periods (b) | 0.66634 |

| Present value of face value of principal | $59,971 |

Table (8)

Therefore, the present value of principle amount of bond is $59,971.

(b) Annual interest payment:

| Particulars | Amount ($) |

| Interest payments amount (a)(24) | $4,500 |

| PV factor at an annual market rate of 7% for 6 periods (b) | 4.76654 |

| Present value of interest payments | $21,449 |

Table (9)

Therefore, the interest payment of bond is $21,449.

Working note (24):

Calculate the amount of annual interest payment:

11.

State the single lump sum amount that the company would have to invest now to reach $98,000 in three years.

11.

Explanation of Solution

Present value: Present value refers to the present worth of the money that is received in future in a lump sum or as series of cash flows at a specified interest rate. When these future sums of money are discounted at a higher rate, the present value of the future cash flows gets lower.

Compute the present value of the given investment as follows:

| Particulars | Amount ($) |

| Face value of investment (a) | $98,000 |

| Present factor of 7% for 3 periods (b) | 0.81630 |

| Present value of investment | $79,997 |

Table (10)

Therefore, the present value of investment is $79,997.

12.

State the amount of cash that the company needs to invest equally at the end of each of the next three years to save $98,000.

12.

Explanation of Solution

Future amount of single sum: The future amount of single sum is the sum of original amount and compound interest earned on the amount till a particular future date.

Future value of given investment is as follows:

| Particulars | Amount ($) |

| Face value of investment (a) | $98,000 |

| Future annuity of 7% for 3 periods (b) | 3.21490 |

| Future value of single sum annually | $30,483 |

Table (11)

Therefore, the future value of single sum of investment annually is $30,483 per year.

Want to see more full solutions like this?

Chapter 11 Solutions

Fundamentals Of Financial Accounting

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education