Concept explainers

The

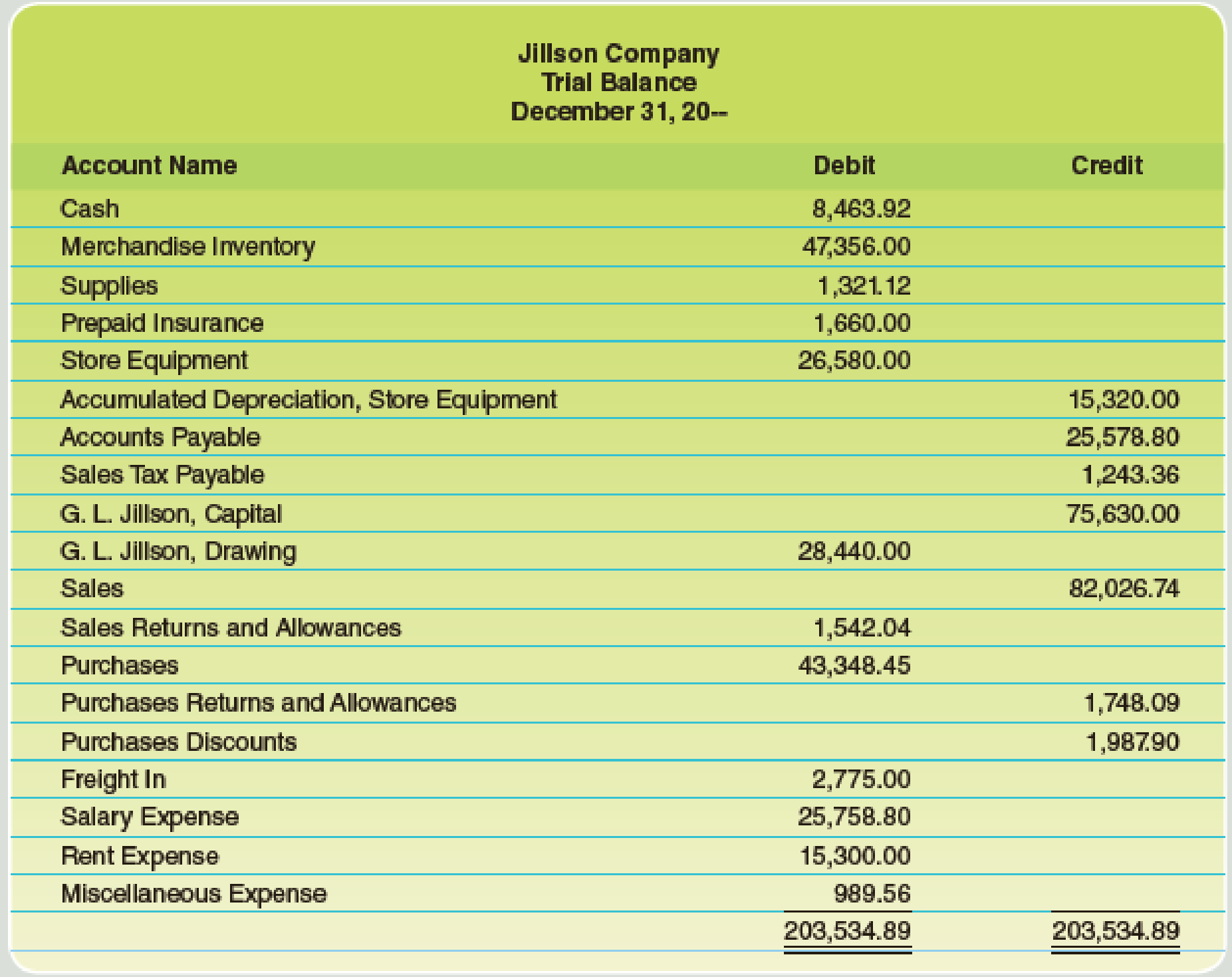

Here are the data for the adjustments.

a–b. Merchandise Inventory at December 31, $54,845.00.

c. Store supplies inventory (on hand), $488.50.

d. Insurance expired, $680.

e. Salaries accrued, $692.

f.

Required

Complete the work sheet after entering the account names and balances onto the work sheet.

Trending nowThis is a popular solution!

Chapter 11 Solutions

College Accounting (Book Only): A Career Approach

Additional Business Textbook Solutions

Foundations Of Finance

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

Macroeconomics

Financial Accounting, Student Value Edition (5th Edition)

Horngren's Accounting (12th Edition)

- The following lots of Commodity Z were available for sale during the year. Beginning inventory First purchase Second purchase Third purchase 10 units at $30 25 units at $32 30 units at $34 10 units at $35 The firm uses the periodic inventory system, and there are 20 units of the commodity on hand at the end of the year. What is the ending inventory balance of Commodity Z using the weighted average cost method? a. $620 b. $659 c. $690 d. $655arrow_forwardAssume that three identical units of merchandise were purchased during October, as follows: Units Cost Oct. 5 Purchase 1 $ 5 12 Purchase 1 13 28 Purchase 1 15 Total 3 $33 One unit is sold on October 31 for $28. Using the table provided, determine the cost of goods sold using the weighted average cost method. a. $11 b. $17 c. $13 d. $22arrow_forwardBoxwood Company sells blankets for $39 each. The following information was taken from the inventory records during May. The company had no beginning inventory on May 1. Boxwood uses a perpetual inventory system.DateBlanketsUnitsCostMay 3Purchase21$1710Sale8 17Purchase36$1920Sale15 23Sale 30Purchase37$20Determine the gross profit for the sale of May 23 using the FIFO inventory costing method.a. $100b. $221c. $95d.$259arrow_forward

- General accounting questionarrow_forwardNonearrow_forwardChapter 18 Homework i Saved 15 Exercise 18-14 (Algo) Contribution margin income statement LO C2 1 points eBook Hint Sunn Company manufactures a single product that sells for $190 per unit and whose variable costs are $133 per unit. The company's annual fixed costs are $628,000. The sales manager predicts that next year's annual sales of the company's product will be 39,800 units at a price of $198 per unit. Variable costs are predicted to increase to $138 per unit, but fixed costs will remain at $628,000. What amount of income can the company expect to earn under these predicted changes? Prepare a contribution margin income statement for the next year. SUNN COMPANY Contribution Margin Income Statement Units $ per unit 39,800 $ 198 Ask Sales Variable costs 39,800 Print Contribution margin 39,800 Fixed costs Income References Mc Graw Hill $ 7,880,400 138 5,492,400 2,388,000 628,000 $ 1,760,000 Help Save & Exit Submit Check my workarrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning