Concept explainers

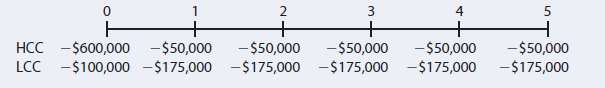

Kim Inc. must install

a new air conditioning unit in its main plant. Kim must install one or the other of the

units; otherwise, the highly profitable plant would have to shut down. Two units are

available, HCC and LCC (for high and low capital costs, respectively). HCC has a high

capital cost but relatively low operating costs, while LCC has a low capital cost but

higher operating costs because it uses more electricity. The costs of the units are shown

here. Kim’s WACC is 7%.

a. Which unit would you recommend? Explain.

b. If Kim’s controller wanted to know the IRRs of the two projects, what would you tell

him?

c. If the WACC rose to 15%, would this affect your recommendation? Explain your answer

and the reason this result occurred.

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

- McPupper Steel has products that cost $10,500 to manufacture. The products can be sold as is for $13,000 or could be processed further for a cost of $2,100 and sold for $14,000. What would be the incremental profit or (loss) of processing the products further and selling them instead of selling them as is?arrow_forward1. Jamuna Group is evaluating the proposal of a new RMG factory called Jamuna Fabrics. Jamuna Group is renting a premise of 50,000 Square feet in Savar and Jamuna Fabrics is planning to use 10,000 Square feet from this facility. The rest of the premise is currently being used by another RMG factory of Jamuna Group called Jamuna Exclusive Fabrics. The Jamuna Exclusive Fabrics has already started its production. For Jamuna Fabrics, the total capital cost is USD 40,000 and is depreciated using the straight-line method over five years to a zero-salvage value. The monthly salary expense will be USD 2500, whereas annual utility and other expense will be USD 2,000. The annual total rent of 50,000 Square feet premise is USD 25,000. Jamuna Fabrics will need to annually pay USD 6000 as staff’s festival bonus. The cash flow from asset for Jamuna Fabrics is USD 28000 in the first year, followed by USD 12000 in the second year. Assume, initially Jamuna Fabrics will require USD 2,000 in working…arrow_forwardmakabhai this problem, given the same data has several different answers for the NPV. Please show in excel with formulas that correct answer. TexMex Food Company is considering a new salsa whose data are shown below. The equipment to be used would be depreciated by the straight-line method over its 3-year life and would have a zero salvage value, and no new working capital would be required. Revenues and other operating costs are expected to be constant over the project's 3-year life. However, this project would compete with other TexMex products and would reduce their pre-tax annual cash flows. What is the project's NPV? WACC 10.0% Pre-tax cash flow reduction for other products (cannibalization) -$5,000 Investment cost (depreciable basis) $80,000 Straight-line deprec. rate 33.333% Sales revenues, each year for 3 years $67,500 Annual operating costs (excl. deprec.) -$25,000 Tax rate 35.0%arrow_forward

- Ruby is looking at the results of a Capital Investment Appraisal. The report shows that, assuming a Cost of Capital of 10%, investing in a plant to manufacture a new clothing line would give a positive NPV and an IRR of 23%. Should the company buy the machine? NPV is positive and IRR is less than the Cost of Capital NPV is positive and IRR exceeds Cost of Capital. NPV does not provide enough information. IRR is higher than the Cost of Capitalarrow_forwardKim Inc. must install a new air-conditioning unit in its main plant. Kim must install one or the other of the units; otherwise, the highly profitable plant would have to shut down. Two units are available, HCC and LCC (for high and low capital costs, respectively). HCC has a high capital cost but relatively low operating costs, while LCC has a low capital cost but higher operating costs because it uses more electricity. The costs of the units are shown here. Kim's WACC is 5%. HCC LCC 0 1 2 3 5 -$590,000 -$110,000 -$45,000 -$170,000 -$45,000 -$45,000 -$170,000 -$170,000 -$45,000 -$170,000 -$45,000 -$170,000 a. Which unit would you recommend? 1. Since all of the cash flows are negative, the NPV's cannot be calculated and an alternative method must be employed. II. Since all of the cash flows are negative, the NPV's will be negative and we do not accept any project that has a negative NPV. III. Since we are examining costs, the unit chosen would be the one that had the lower NPV of costs.…arrow_forwardA firm that manufactures paper is considering a project to set up a logging operation. Wood pulp generated by the project - normally an unwanted by-product of a logging operation - is an input to the paper manufacturing process. This will save the company $340,000 in wood pulp purchases, but it will cost $50,000 more to transport the wood pulp to the paper factory than it would cost to dump it as waste. How would you describe this situation in terms of the NPV analysis for the logging operation? Question 2Answer a. There is a positive externality equal to $290,000 which should be included in the NPV analysis. b. There is a positive externality equal to $340,000 which should be included in the NPV analysis. c. There is a negative externality equal to $290,000 which should be included in the NPV analysis. d. There is a negative externality equal to $340,000 which should be included in the NPV analysis.arrow_forward

- Isaac Industries must choose between a gas-powered and an electric-powered forklift truck for moving materials in its factory. The firm will choose only one because both forklifts perform the same function. (They are mutually exclusive investments.) The electric-powered truck will cost more but will be less expensive to operate; it will cost $22,000, whereas the gas-powered truck will cost $17,500. The cost of capital that applies to both investments is 18%. The life for both types of truck is estimated to be six years, during which time the net cash flows for the electric-powered truck will be $7,290 per year, and those for the gas-powered truck will be $6,000 per year. Annual net cash flows include depreciation expenses. Calculate the NPV and IRR for each type of truck and decide which to recommend. Compute the NPV for each truck. Compute the IRR for each truck. Compute the crossover rate. Compute the payback period for each truck. Compute the profitability index for each truck.arrow_forwardThe investor-developer would not be comfortable with a 7.8 percent return on cost because the margin for error is too risky. If construction costs are higher or rents are lower than anticipated, the project may not be feasible. The asking price of the project is $12,700,000 and the construction cost per unit is $82,200. The current rent to justify the land acqusition is $2.2 per square foot. The weighted average is 900 square feet per unit. Average vacancy and Operating expenses are 5% and 35% of Gross Revenue respectively. Use the following data to rework the calculations in Concept Box 16.2 in order to assess the feasibility of the project: Required: a. Based on the fact that the project appears to have 9,360 square feet of surface area in excess of zoning requirements, the developer could make an argument to the planning department for an additional 10 units, 250 units in total, or 25 units per acre. What is the percentage return on total cost under the revised proposal? Is the…arrow_forwardBlooper Industries must replace its magnoosium purification system. Quick & Dirty Systems sells a relatively cheap purification system for $20 million. The system will last 5 years. Do-It-Right sells a sturdier but more expensive system for $21 million; it will last for 6 years. Both systems entail $1 million in operating costs; both will be depreciated straight- line to a final value of zero over their useful lives; neither will have any salvage value at the end of its life. The firm's tax rate is 30%, and the discount rate is 13%. a. What is the equivalent annual cost of investing in the cheap system? Note: Do not round intermediate calculations. Enter your answer as a positive value. Enter your answer in millions rounded to 2 decimal places. b. What is the equivalent annual cost of investing in the more expensive system? Note: Do not round intermediate calculations. Enter your answer as a positive value. Enter your answer in millions rounded to 2 decimal places. c. Which system…arrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education