FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

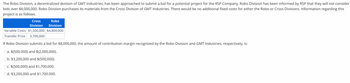

Transcribed Image Text:The Robo Division, a decentralized division of GMT Industries, has been approached to submit a bid for a potential project for the RSP Company. Robo Division has been informed by RSP that they will not consider

bids over $8,000,000. Robo Division purchases its materials from the Cross Division of GMT Industries. There would be no additional fixed costs for either the Robo or Cross Divisions. Information regarding this

project is as follows.

Cross

Robo

Division Division

Variable Costs $1,500,000 $4,800,000

Transfer Price 3,700,000

If Robo Division submits a bid for $8,000,000, the amount of contribution margin recognized by the Robo Division and GMT Industries, respectively, is:

a. $(500,000) and $(2,000,000).

Ob. $3,200,000 and $(500,000).

Oc. $(500,000) and $1,700,000.

Od. $3,200,000 and $1,700.000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 1 steps

Knowledge Booster

Similar questions

- M4 Engineering has two divisions, the Fabrication Division and the Airplane Division. The Airplane Division may purchase engine mounting clamps from the Fabrication Division or from outside suppliers. The Fabrication Division sells engine mounting clamps both internally and externally. The market price for is $5,000 per 100 mounting clamps. The following conversation took place between the controllers of the Fabrication Division and Airplane Division: • Airplane Division: I hear you are having problems selling mounting clamps out of your division. Maybe I can help. • Fabrication Division: You've got that right. We're producing and selling at about 90% of our capacity to outsiders. Last year we were selling 100% of capacity. Would it be possible for your division to pick up some of our excess capacity? After all, we are part of the same company. • Airplane Division: What kind of price could you give me? • Fabrication Division: Well, you know as well as I that we are under strict profit…arrow_forwardGemma Company is a midsize manufacturing company with 120 employees and approximately $45 million in sales. Management has established a set of processes to purchase fixed assets, described in the following paragraphs: When a user department decides to purchase a new fixed asset, the departmental manager prepares an asset request form. When completing the form, the manager must describe the fixed asset, the advantages or efficiencies offered by the asset, and estimates of costs and benefits. The asset request form is forwarded to the director of finance. Personnel in the finance department review estimates of costs and benefits and revise these if necessary. A discounted cash flow analysis is prepared and forwarded to the vice president of operations, who reviews the asset request forms and the discounted cash flow analysis, and then interviews user department managers if he or she feels it is warranted. After this review, she selects assets to purchase until she has exhausted the…arrow_forwardThis-Test-Is-a-Breeze, Inc. owns a warehouse in Wilmington, DE. The company has decided to use the warehouse for the production of plastic polymers. To do so the company will forgo the option of renting the warehouse to a third party, which would have generated $50,000 of annual cash inflow. The $50,000 that the company is forgoing to pursue another investment is: Sunk Cost Opportunity Cost Erosion Cost Variable Costarrow_forward

- hello, please give more emphasis on points a,b,c, and d Spark Ltd has two divisions, assembly and electrical. The assembly division transfers partiallycompleted components to the electrical division at a predetermined transfer price. The assemblydivision’s standard variable production cost per unit is $550. This division has spare capacity, and itcould sell all its components to outside buyers at $680 per unit in a perfectly competitive market.Required:a) Determine a transfer price using the general rule.b) How would the transfer price change if the assembly division had no spare capacity? c) What transfer price would you recommend if there was no outside market for the transferredcomponent and the assembly division had spare capacity? d) Explain how negotiation between the supplying and buying units may be used to set transferprices. How does this relate to the general transfer pricing rule?arrow_forwardSe.119.arrow_forwardAMD is contemplating a decision to either continue producing a unique line of microprocessors, or discontinue production. • The AMD factory manufactures approximately 100,000 of such processors and generates $3,000,000 in revenues and incurs $2,000,000 in variable costs. • AMD estimates that if the product is discontinued ADM would save $ 1,500,000 in fixed manufacturing costs in engineering support and depreciation costs of production equipment. • Should AMD keep or discontinue production of this product line?arrow_forward

- Glide Behind Corporation manufactures and sells small cargo trailers. The Wheel Division creates parts that are both sold externally and transferred internally to the Assembly Division. Variable production costs of wheel set #102 are $80, and each set sells externally for $150. What would you recommend as the internal transfer price from the Wheel Division to the Assembly Division if a competitive external market exists for wheel set #102? Would your answer change if there were no external market this component? Why? What would the transfer price be if upper management required cost plus 25 percent as the transfer price?arrow_forwardKim Inc. must install a new air conditioning unit in its main plant. Kim must install one or the other of the units; otherwise the highly profitable plant would have to shut down. Two units are available, HCC and LCC (for high and low capital costs). HCC has a high capital cost but relatively low operating costs, while LCC has a low capital cost but higher operating costs because it uses more electricity. The costs of the units are shown below. Kim’s WACC is 7%. Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 HCC -$600,000 -$50,000 -$50,000 -$50,000 -$50,000 -$50,000 LCC -$100,000 -$175,000 -$175,000 -$175,000 -$175,000 -$175,000 a) Which unit would you recommend? Explain. b) If Kim’s controller wanted to know the IRRs of the two projects, what would you tell him? c) If the WACC rose to 15% would this affect your recommendation? Explain your answer and the reason this result occurred.arrow_forward"The Midwest Division of the Paibec Corporation manufactures subassemblies that are used in the corpora-tion’s final products. Lynn Hardt of Midwest’s Profit Planning Department has been assigned the task of determining whether a component, MTR–2000, should continue to be manufactured by Midwest or purchased from Marley Company, an outside supplier. MTR–2000 is part of a subassembly manufactured by Midwest.Marley has submitted a bid to manufacture and supply the 32,000 units of MTR–2000 that Paibec will need for 20x1 at a unit price of $17.30. Marley has assured Paibec that the units will be delivered according to Paibec’s production specifications and needs. While the contract price of $17.30 is only applicable in 20x1, Marley is interested in entering into a long-term arrangement beyond 20x1.Hardt has gathered the following information regarding Midwest’s cost to manufacture MTR–2000 in 20x0. These annual costs will be incurred to manufacture 30,000…arrow_forward

- 12-3. Analyzing a company's future plant expansion based on its costing methods. The board of directors of the Williams Corporation is considering the possibility of a plant expansion. After some research and a review of the company's materials costing methods, the president presents the controller with the proposition of using the lifo method instead of the present fifo method because of its apparent tax advantages. A reduction of the company's income tax liability might provide additional capital for the planned expansion. The presidert requests the controller to study the proposal further. The controller's analysis regarding the inventory is based on these transactions for June: June 1. Beginning balance: 200 units @ $3.00 per unit. 2. Purchased 500 units @ $3.20 per unit. 7. Issued 400 units. 11. Purchased 300 units @ $3.30 per unit. 14. Issued 400 units. 17. Purchased 400 units @ $3.20 per unit. 21. Issued 200 units. 24. Purchased 300 units @ $3.40 per unit. 26. Purchased 400…arrow_forwardKim Inc. must install a new air-conditioning unit in its main plant. Kim must install one or the other of the units; otherwise, the highly profitable plant would have to shut down. Two units are available, HCC and LCC (for high and low capital costs, respectively). HCC has a high capital cost but relatively low operating costs, while LCC has a low capital cost but higher operating costs because it uses more electricity. The costs of the units are shown here. Kim's WACC is 5%. HCC LCC 0 1 2 3 5 -$590,000 -$110,000 -$45,000 -$170,000 -$45,000 -$45,000 -$170,000 -$170,000 -$45,000 -$170,000 -$45,000 -$170,000 a. Which unit would you recommend? 1. Since all of the cash flows are negative, the NPV's cannot be calculated and an alternative method must be employed. II. Since all of the cash flows are negative, the NPV's will be negative and we do not accept any project that has a negative NPV. III. Since we are examining costs, the unit chosen would be the one that had the lower NPV of costs.…arrow_forwardRequired: 1. Assume the Quark Division has enough idle capacity to fill the 5,300-unit order. Is the division likely to accept the $405 price or to reject it? 2. Assume both the Screen Division and the Quark Division have idle capacity. Under these conditions, what is the financial advantage (disadvantage) for the company as a whole (on a per unit basis) if the Quark Division rejects the $405 price? 3. Assume the Quark Division has idle capacity but that the Screen Division is operating at capacity and could sell all of its screens to outside manufacturers. Under these conditions, what is the financial advantage (disadvantage) for the company as a whole (on a per unit basis) if the Quark Division accepts the $405 unit price?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education