Concept explainers

Straight-line

• LO11–2, LO11–5

The property, plant, and equipment section of the Jasper Company’s December 31, 2017,

| Property, plant, and equipment: | ||

| Land | $120,000 | |

| Building | $ 840,000 | |

| Less: |

(200,000) | 640,000 |

| Equipment | 180,000 | |

| Less: Accumulated depreciation | ? | ? |

| Total property, plant, and equipment | ? |

The land and building were purchased at the beginning of 2013. Straight-line depreciation is used and a residual value of $40,000 for the building is anticipated.

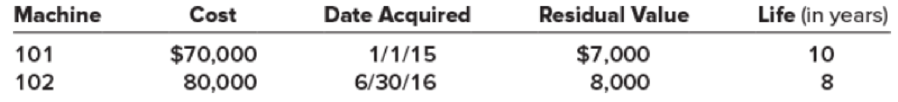

The equipment is comprised of the following three machines:

The straight-line method is used to determine depreciation on the equipment. On March 31, 2018, Machine 102 was sold for $52,500. Early in 2018, the useful life of machine 101 was revised to seven years in total, and the residual value was revised to zero.

Required:

1. Calculate the accumulated depreciation on the equipment at December 31, 2017.

2. Prepare the

3. Prepare a schedule to calculate the gain or loss on the sale of machine 102.

4. Prepare the journal entry for the sale of machine 102.

5. Prepare the 2018 year-end journal entries to record depreciation on the building and equipment.

(1)

Depreciation:

The decrease in the value of fixed tangible assets due to its use is known as depreciation. It is the allocation of the cost of tangible fixed assets over the useful life of the asset.

To calculate: The accumulated depreciation on the equipment at December 31, 2017.

Explanation of Solution

Company J using straight line method of depreciation:

Straight-line method: It is a method of providing depreciation. In this method, depreciation is calculated as the fixed percentage of the original cost of the fixed asset. The amount of depreciation in this method remains same for all the years of the useful life of the asset. Therefore, the following formula is used to calculate depreciation of asset.

To calculate: The accumulated depreciation on the equipment at December 31, 2017.

| Asset | Cost at 2016 ($) |

Estimated residual value | Estimated life of the asset | Number of years used |

Accumulated depreciation ($) |

| (1) | (2) | (2a) |

(3) | (4) | (5) =

|

| 101 | 70 | 7000 | 10years | 36 | 18,900 |

| 102 | 80 | 8000 | 8 years | 18 | 13,500 |

| 103 | 30 | 3000 | 9 years | 4 | 1,000 |

| Accumulated depreciation on 31, December 2017 | 33,400 | ||||

Table (1)

(2)

To prepare: The journal entry to record the depreciation machine 102 up to the date of sale.

Explanation of Solution

Prepare a journal entry to record the depreciation on equipment 102.

| Accounts title and explanation | Post Ref. | Debit ($) |

Credit ($) |

| Depreciation expense (1) | 2,250 | ||

| Accumulated Depreciation | 2,250 | ||

| (To record the depreciation on equipment 102.) |

Table (2)

Working note:

(1) Calculate the depreciation on equipment 102 up to the date of sale.

Therefore depreciation up to the date of sale is $2,250.

(3)

To prepare: A schedule to calculate the gain or loss on the sale of machine 102.

Explanation of Solution

Prepare a schedule to calculate the gain or loss on sale of machine 102.

| Particulars | Amount ($) | Amount ($) | Amount ($) |

| Sales proceeds | 52,500 | ||

| Less: Book value on 31/03/18 | |||

| Cost | 80,000 | ||

| Accumulated depreciation | (15,750) | 64,250 | |

| Loss on sale of equipment 102 | 11,750 |

Table (2)

Calculate the accumulated depreciation

| Particulars | Amount $ |

| Depreciation through 31/12/17 | 13,500 |

| Depreciation from 1/1/18 to 31/3/18 | 2,250 |

| Accumulated depreciation | 15,750 |

Table (3)

(4)

To prepare: The journal entry for the sale of machine 102.

Explanation of Solution

Prepare the journal entry for the sale of machine 102.

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| 31/03/2018 | Cash | 52,500 | ||

| Accumulated depreciation | 15,750 | |||

| Loss on sale of the equipment 102 | 11,750 | |||

| Equipment 102 | 80,000 | |||

| (To record the sale of equipment 102.) |

Table (4)

- Cash is a current asset and increased due to sale of equipment 102. Thus, debit Cash account with $52,500.

- Accumulated depreciation is a contra asset. It increases the value of asset account. Thus, debit Accumulated Depreciation with $15,750.

- Loss on sale of equipment 102 decreases the value of shareholders equity. Thus, debit Loss on sale of equipment 102 with $11,750.

- Equipment 102 is an asset and decreases value of the assets due to sale. Thus, credit Equipment 102 with $80,000.

(5)

To prepare: The 2018 year-end journal entries to record depreciation on the building and equipment.

Explanation of Solution

Prepare a journal entry to record the depreciation on building.

| Date | Accounts title and explanation | Post Ref. | Debit ($) |

Credit ($) |

| 31/12/2018 | Depreciation expense (1) | 40,000 | ||

| Accumulated Depreciation – Building | 40,000 | |||

| (To record the depreciation.) |

Table (5)

- Depreciation is an expense which decreases shareholders equity. Thus, debit Depreciation expense account with $40,000.

- Accumulated depreciation is a contra asset. It decreases the value of asset. Thus, credit accumulated depreciation with $40,000.

Working notes:

Determine the depreciation per year.

The land and building were purchased at the beginning of 2013. Straight-line depreciation is used and a residual value of $40,000 for the building is anticipated.

Therefore annual depreciation on building is $40,000.

Prepare a journal entry to record the depreciation on equipment.

| Date | Accounts title and explanation | Post Ref. | Debit ($) |

Credit ($) |

| Depreciation expense (2) | 15,775 | |||

| Accumulated Depreciation | 15,775 | |||

| (To record the depreciation.) |

Table (6)

- Depreciation expense which decreases shareholders equity. Thus, debit Depreciation expense with $15,775.

- Accumulated depreciation is a contra asset. It decreases the value of asset. Thus, credit accumulated depreciation with $15,775.

Working note:

Compute the deprecation on equipments.

| Particulars | Amount ($) |

Amount ($) |

| Equipment 101 | ||

| Cost | 70,000 | |

| Less: Accumulated depreciation | 18,900 | |

| Book value, 12/31/17 | 51,100 | |

| Revised remaining life (7 years – 3 years) | 12,775 | |

| Equipment 103 (requirement 1) | 3,000 | |

| Depreciation | 15,7775 |

Table (7)

Therefore depreciation on equipment’s is $15,775.

Want to see more full solutions like this?

Chapter 11 Solutions

Intermediate Accounting

- Subject: accountingarrow_forwardP 11-3 Depreciation methods; partial periods Chapters 10 and 11 LO11-2 [This problem is a continuation of P 10-3 in Main content d: Chapter 10 focusing on depreciation.] For each asset classification, prepare a schedule showing depreciation for the year ended December 31, 2024, using the following depreciation methods and useful lives: Land improvements-Straight line; 15 years Building-150% declining balance; 20 years Equipment-Straight line; 10 years Automobiles-Units-of-production; $0.50 per mile Depreciation is computed to the nearest month and whole dollar amount, and no residual values are used. Automobiles were driven 38,000 miles in 2024.arrow_forwardPlease don't provide answer in image format thank youarrow_forward

- Problem 10-3 (Algo) Acquisition costs [LO10-1, 10-4, 10-6] The plant asset and accumulated depreciation accounts of Pell Corporation had the following balances at December 31, 2020: Accumulated Depreciation $ Land Land improvements Building Equipment Automobiles Plant Asset $ 480,000 245,000 2,150,000 1,184,000 215,000 Transactions during 2021 were as follows: a. On January 2, 2021, equipment were purchased at a total invoice cost of $325,000, which included a $6,800 charge for freight. Installation costs of $40,000 were incurred. b. On March 31, 2021, a small storage building was donated to the company. The person donating the building originally purchased it three years ago for $32,000. The fair value of the building on the day of the donation was $21,000. c. On May 1, 2021, expenditures of $63,000 were made to repave parking lots at Pell's plant location. The work was necessitated by damage caused by severe winter weather. The repair doesn't provide future benefits beyond those…arrow_forwardProblem 11-11 (Algo) Error correction; change in depreciation method [LO11-2, 11-6, 11-7] Collins Corporation purchased office equipment at the beginning of 2022 and capitalized a cost of $2,130,000. This cost figure included the following expenditures: Purchase price Freight charges Installation charges Annual maintenance charge Total The company estimated an eight-year useful life for the equipment. No residual value is anticipated. The double-declining-balance method was used to determine depreciation expense for 2022 and 2023. In 2024, after the 2023 financial statements were issued, the company decided to switch to the straight-line depreciation method for this equipment. At that time, the company's controller discovered that the original cost of the equipment incorrectly included one year of annual maintenance charges for the equipment. Required: 1. Ignoring income taxes, prepare the appropriate correcting entry for the equipment capitalization error discovered in 2024. 2.…arrow_forwardAA3arrow_forward

- Do not give image formatarrow_forwardExercise 11-11 (Algo) Disposal of property, plant, and equipment; partial periods (LO11-2] On July 1, 2016, Farm Fresh Industries purchased a specialized delivery truck for $219,000. At the time, Farm Fresh estimated the truck to have a useful life of eight years and a residual value of $27,000. On March 1, 2021, the truck was sold for $88,000. Farm Fresh uses the straight-line depreciation method for all of its plant and equipment. Partial-year depreciation is calculated based on the number of months the asset is in service. Required: 1. Prepare the journal entry to update depreciation in 2021. 2. Prepare the journal entry to record the sale of the truck. 3. Assuming that the truck was instead sold for $125,000, prepare the journal entry to record the sale. X Answer is not complete. Complete this question by entering your answers in the tabs below. Reg 1 and 2 Reg 3 Prepare the journal entries to update depreciation in 2021 and record the sale of the truck. (If no entry is required…arrow_forwardNonearrow_forward

- Exercise 11-24 (Algo) Change in principle; change in depreciation methods [LO11-2, 11-6] Alteran Corporation purchased office equipment for $2.2 million at the beginning of 2022. The equipment is being depreciated over a 10-year life using the double-declining-balance method. The residual value is expected to be $700,000. At the beginning of 2024 (two years later), Alteran decided to change to the straight-line depreciation method for this equipment. Required: Prepare the journal entry to record depreciation for the year ended December 31, 2024. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round intermediate calculations. Enter your answers in whole dollars. View transaction list View journal entry worksheet Event 1 No 1 General Journal Depreciation expense Accumulated depreciation Debit Credit Tecnalarrow_forwardProblem 10-3 (Algo) Acquisition costs [LO10-1, 10-4, 10-6] The plant asset and accumulated depreciation accounts of Pell Corporation had the following balances at December 31, 2020: Accumulated Plant Asset 540,000 275,000 2,450,000 1,196,000 245,000 Depreciation $ 64,000 369,000 424,000 131,000 Land $ Land improvements Building Equipment Automobiles Transactions during 2021 were as follows: a. On January 2, 2021, equipment were purchased at a total invoice cost of $355,000, which included a $7,400 charge for freight. Installation costs of $46,000 were incurred. b. On March 31, 2021, a small storage building was donated to the company. The person donating the building originally purchased it three years ago for $38,000. The fair value of the building on the day of the donation was $24,000. c. On May 1, 2021, expenditures of $69,000 were made to repave parking lots at Pell's plant location. The work was necessitated by damage caused by severe winter weather. The repair doesn't provide…arrow_forward2Aarrow_forward

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning