Fundamentals of Financial Management (MindTap Course List)

15th Edition

ISBN: 9781337395250

Author: Eugene F. Brigham, Joel F. Houston

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 11, Problem 10P

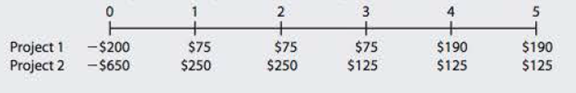

CAPITAL BUDGETING CRITERIA: MUTUALLY EXCLUSIVE PROJECTS A firm with a WACC of 10% is considering the following mutually exclusive projects:

Which project would you recommend? Explain.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

The capital budgeting decision that requires a choice between two decisions is a(n) _______ project.

Independent

Dependent

Mutually exclusive

Inclusive

The actual value that a firm loses when it makes a capital budgeting decision is a(n) ______ cost

Fixed

Opportunity

Sample

Unknown

The number of years required for an investment to return the monies invested is known as a projects

Economic life

Usage rate

Capital decision

Payback period

The future benefits received from investing in a project are the projects

Net cash flows

Net investment

Net cost

Net return

The capital components included in a firms weighted cost of capital are

Common stock

Debt

Retained earnings

All of the above

Weaknesses in using solely the payback method as a measure of a projects risk include

Not accounting for the time value of money

There is no objective criterion for deciding what is an acceptable payback period

Cash flows that occur after the payback period have no impact on the…

Marginal analysis and capital budgeting decisions. A company faces the following schedule of potential

investment projects (all assumed to be equal risk).

Use marginal analysis to decide which projects should NOT be undertaken?

Expected Rate of

Return (%)

Project

alm|0|n|u|u

A

B

с

D

E

F

CH

G

1

Investment

Required ($

million)

25

15

40

35

12

20

18

13

7

OF and G

OH and I

OF, G, H, and I

01

OG, H, I

27

24

21

18

15

14

13

11

8

Cumulative

Investment

The following is the cost of acquiring the funds needed to finance these investment projects.

Cost of Capital (%)

Block of funds ($ million)

First 50

10

Next 25

10.5

11

Next 40

Next 50

12.2

Next 20

14.5

25

40

80

115

127

147

165

178

185

50

75

115

165

185

Cumulative Funds Raised

Q.1. Three mutually exclusive investment alternatives are under consideration. The initial capital outlays and the pattern of the net annual cash benefits (revenues - expenses) for each alternatives are presented in the following table. Based on NPV analysis, if the company’s minimum acceptable rate of return is 10%, which alternative should be the best economic choice? Use appropriate IRR analysis to double-check your selection.

Investment, M$

A

B

C

Initial cost

-$200

-$350

-$500

Net Revenues, year 1 to 3

$80

$105

$85

Net Revenues, year 4

$60

$90

$150

Net Revenues, year 5

$40

$80

$250

Chapter 11 Solutions

Fundamentals of Financial Management (MindTap Course List)

Ch. 11 - How are project classifications used in the...Ch. 11 - Prob. 2QCh. 11 - Why is the NFV of a relatively long-term project...Ch. 11 - Prob. 4QCh. 11 - If two mutually exclusive projects were being...Ch. 11 - Discuss the following statement: If a firm has...Ch. 11 - Why might it be rational for a small firm that...Ch. 11 - Project X is very risky and has an NPV of 3...Ch. 11 - Prob. 9QCh. 11 - A firm has a 100 million capital budget. It is...

Ch. 11 - NPV Project L costs 65,000, its expected cash...Ch. 11 - IRR Refer to problem 11-1. What is the projects...Ch. 11 - MIRR Refer to problem 11-1. What is the projects...Ch. 11 - Prob. 4PCh. 11 - DISCOUNTED PAYBACK Refer to problem 11-1. What is...Ch. 11 - NPV Your division is considering two projects with...Ch. 11 - CAPITAL BUDGETING CRITERIA A firm with a 14% WACC...Ch. 11 - Prob. 8PCh. 11 - CAPITAL BUDGETING CRITERIA: ETHICAL CONSIDERATIONS...Ch. 11 - CAPITAL BUDGETING CRITERIA: MUTUALLY EXCLUSIVE...Ch. 11 - CAPITAL BUDGETING CRITERIA: MUTUALLY EXCLUSIVE...Ch. 11 - Prob. 12PCh. 11 - MIRR A firm is considering two mutually exclusive...Ch. 11 - CHOOSING MANDATORY PROJECTS ON THE BASIS OF LEAST...Ch. 11 - NPV PROFILES: TIMING DIFFERENCES An oil-drilling...Ch. 11 - Prob. 16PCh. 11 - CAPITAL BUDGETING CRITERIA A company has an 11%...Ch. 11 - NPV AND IRR A store has 5 years remaining on its...Ch. 11 - Prob. 19PCh. 11 - NPV A project has annual cash flows of 5,000 for...Ch. 11 - Prob. 21PCh. 11 - MIRR A project has the following cash flows: This...Ch. 11 - CAPITAL BUDGETING CRITERIA Your division is...Ch. 11 - BASICS OF CAPITAL BUDGETING You recently went to...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Capital Budgeting Decision Measurement Methods Prior to deciding on which long-term project/investment is most suitable, a company is going to analyze different options by considering various capital budgeting decision measurement methods. Some of these measurement methods include but not limited to payback period, discounted payment period, net present value, and internal rate of return. If you have a business and would like to invest in equipment that costs $1,000,000, which measurement method would you choose and why?arrow_forwardWhat is the typical discount rate used with the Net Present Value (NPV) when project risk is the same as firm risk? Which capital budgeting methods should managers of firms use to evaluate a project? Why?arrow_forwardCAPITAL BUDGETING CRITERIA Your division is considering two projects. Its WACC is 10%, and the projects’ after-tax cash flows (in millions of dollars) would be as follows: REFER IMAGE a. Calculate the projects’ NPVs, IRRs, MIRRs, regular paybacks, and discounted paybacks.b. If the two projects are independent, which project(s) should be chosen?c. If the two projects are mutually exclusive and the WACC is 10%, which project(s) should be chosen?d. Plot NPV profiles for the two projects. Identify the projects’ IRRs on the graph.e. If the WACC was 5%, would this change your recommendation if the projects were mutually exclusive? If the WACC was 15%, would this change your recommendation? Explain your answers.f. The crossover rate is 13.5252%. Explain what this rate is and how it affects the choice between mutually exclusive projects.g. Is it possible for conflicts to exist between the NPV and the IRR when independent projects are being evaluated? Explain your answer.h. Now look at the…arrow_forward

- Profitability index. Given the discount rate and the future cash flow of each project listed in the following table, , use the PI to determine which projects the company should accept. ..... What is the Pl of project A? (Round to two decimal places.)arrow_forwardConsider the following two investment alternatives: The firm's MARR is known to be 15%.(a) Compute the IRR of Project B.(b) Compute the PW of Project A. (c) Suppose that Projects A and B are mutually exclusive. Using the IRR, whichproject would you select?arrow_forwardWolff Enterprises must consider one investment project using the capital asset pricing model (CAPM). Relevant information is presented in the following table. Item Rate of return Beta, b Risk-free asset 9% 0.00 Market portfolio 14% 1.00 Project 1.74 a. Calculate the required rate of return for the project, given its level of nondiversifiable risk. b. Calculate the risk premium for the project, given its level of nondiverisifiable risk.arrow_forward

- 1. Hardchoice Corp. is a firm considering prospective capital budgeting projects. Selected data on the projects follow: Image attached Consider the following statements. Select the one that is true. 1. The NPV of project D will be much more sensitive to changes in the discount rate than will the NPV of project A. 2. If projects C and D are mutually exclusive, incremental analysis indicates that one should reject project C and accept project D. 3. It is possible for projects A and D to have the same NPV. 4. All of the above are true. 5. None of the above is true.arrow_forward1. Hardchoice Corp. is a firm considering prospective capital budgeting projects. Selected data on the projects follow: Image attached Consider the following statements. Select the one that is true. 1. The NPV of project D will be much more sensitive to changes in the discount rate than will the NPV of project A. 2. If projects C and D are mutually exclusive, incremental analysis indicates that one should reject project C and accept project D. 3. It is possible for projects A and D to have the same NPV. 4. All of the above are true. 5. None of the above is true. Pls show formula used. Final dollar answers should be rounded to two decimal places. Interest rate answers should be rounded to 6 decimal places if expressed as a decimal or 4 decimal places if expressed as a percent. Use timeline if necessary. No excel .Thanks!arrow_forwardThe cost of capital for a new project: Multiple Choice 1.) is determined by the overall risk level of the firm. 2.) is dependent upon the source of the funds obtained to fund that project. 3.) is dependent upon the firm's overall capital structure. 4.) should be applied as the discount rate for all other projects considered by the firm. 5.) depends upon how the funds raised for that project are going to be spent.arrow_forward

- Wolff Enterprises must consider one investment project using the capital asset pricing model (CAPM). Relevant information is presented in the following table. Item Rate of Return Beta, b Risk free asset 8% 0.00 Market Portfolio 13% 1.00 Project 1.12 The required rate of return for the project is? THe risk premium for the price is?arrow_forwardWhat are the internal rates of return (IRR) on the three projects? Does the IRR rule in this case give the same decision as NPV? How do you know? If the opportunity cost of capital is 11%, what is the profitability index for each project? Please analyze if, in general, decisions based on the profitability index are consistent with decisions based on NPV. What is the most generally accepted measure to choose between the projects? Please justify your answer. Project A -5000 +1000 +1000 +3000 0 B -1000 0 +1000 +2000 +3000 C -5000 +1000 +1000 +3000 +5000 I will need full analysis (qualitative examples and references citations and examples of relative current investments of big companies.arrow_forwardLopez Industries has identified the following two mutually exclusive capital investment projects: Year Project A Project B 0 -16000 -15500 1 400 12500 2 800 8000 3 13000 800 4 14000 800 If the required return is 11%, what is the NPV for each of these projects? Which project should the firm accept if they apply the NPV rule?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Capital Budgeting Introduction & Calculations Step-by-Step -PV, FV, NPV, IRR, Payback, Simple R of R; Author: Accounting Step by Step;https://www.youtube.com/watch?v=hyBw-NnAkHY;License: Standard Youtube License