Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

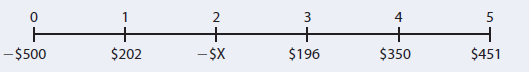

A project has the following cash flows:

This project requires two outflows at Years 0 and 2, but the remaining cash flows are positive.

Its WACC is 10%, and its MIRR is 14.14%. What is the Year 2

Transcribed Image Text:3

$202

$451

-$500

- $X

$196

$350

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 7 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Radha Limited is evaluating a project whose expected cash flows are as follows. Year Cash flow 0 -5,00,000 1 1,00,000 2 2,00,000 3 3,00,000 4 1,00,000 What is the NPV of the project if the cost of capital is 10 percent? ? What is the Modified NPV of the project if the reinvestment rate is 13%?arrow_forwardA project has the following cash flows: as a positive value. Do not round intermediate calculations. Round your answer to the nearest cent. $arrow_forwardA project has the following expected net cash flows associated with it: Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 -R 800 000 R150 000 R200 000 R400 000 R100 000 R100 000 The cash flows are expressed in real terms. Adjust the cash flows to nominal terms assuming constant inflation of 5% and calculate the NPV of the project. The company in question has a WACC of 10%.arrow_forward

- With an initial cost of $100,000, a WACC of 15%, and subsequent cash flows for years 1, 2, 3 of $25,000, $50,000, $75,000, in how many years will break even occur? Use non-discounted cash flows for your calculation. Use the information above and calculate the discounted payback period what is the project’s NPV?arrow_forwardThere is a project with the following cash flows : Year Cash Flow 0 −$ 23,350 1 6,300 2 7,400 3 8,450 4 7,350 5 5,900 What is the payback period?arrow_forwardConsider the following projects, X and Y where the firm can only choose one. Project X costs $1500 and has cash flows of $678, $652, $347, $111, $54, $16 in each of the next 6 years. Project Y also costs $1500, and generates cash flows of $738, $693, $405 for the next 3 years, respectively. WACC=11%.Calculate the projects’ NPVs, IRRs, payback periods.arrow_forward

- A project has the following cashflows. The project's cumulative cashflow turns positive between year 4 and 5, to be precise it is 4.22. Your further analysis indicates that you are too conservative about the cash flows for Year 1 and 2. You expect both cash flows to be at least $1000 higher, if not more :) How will this affect your calculation of the precise time when the cumulative cashflow turns positive? t 0 ON 35 67 2 4 $ Cash flow (250,000) 41,000 48,000 63,000 79,000 88,000 64,000 41,000 Changes. The project's cumulative cashflow turns positive a bit earlier. Changes. The project's cumulative cashflow now turns positive a lot later. Changes. The project's cumulative cashflow now turns positive a bit later. No change. The project's cumulative cashflow still turns positive between year 4 and 5, to be precise it is 4.22.arrow_forward7. The NPV and payback period What information does the payback period provide? Suppose you are evaluating a project with the expected future cash inflows shown in the following table. Your boss has asked you to calculate the project’s net present value (NPV). You don’t know the project’s initial cost, but you do know the project’s regular, or conventional, payback period is 2.50 years. Year Cash Flow Year 1 $375,000 Year 2 $475,000 Year 3 $500,000 Year 4 $400,000 If the project’s weighted average cost of capital (WACC) is 8%, the project’s NPV (rounded to the nearest dollar) is: $345,386 $328,117 $414,463 $362,655arrow_forwardA project has the following cash flows: 0 1 -$400 $195 2 $176 111 4 5 ㅓ $350 $488 This project requires two outflows at Years 0 and 2, but the remaining cash flows are positive. Its WACC is 13%, and its MIRR IS 14.21%. What is the Year 2 cash outflow? Enter your answer as a positive value. Do not round intermediate calculations. Round your answer to the nearest cent.arrow_forward

- For the given cash flows, suppose the firm uses the NPV decision rule. Year Cash Flow 0-$ 150,000 1 66, 000 2 73,000 3 57,000 a. At a required return of 10 percent, what is the NPV of the project? b. At a required return of 20 percent, what is the NPV of the project?arrow_forwardRayver Cruz is considering a project that has the following cash flow and WACC data. What is the project's MIRR? WACC: 11.00% Year 1 Cash flows - $800 $350 $350 $350 9.84% O 10.94% 12.15% 13.50% 8.86%arrow_forwardA project has the following cash flows. It costs $15,000. It briongs in $22,000 after one year, and costs an adittional $6,500 after two years. The Required rate of return is 11%. Calculate the MIRR using the combination approach.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education