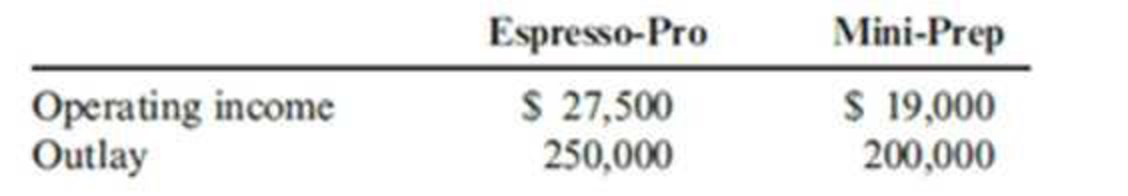

Refer to Exercise 10.7 for data. At the end of Year 2, the manager of the Houseware Division is concerned about the division’s performance. As a result, he is considering the opportunity to invest in two independent projects. The first is called the Espresso-Pro; it is an in-home espresso maker that can brew regular coffee as well as make espresso and latte drinks. While the market for espresso drinkers is small initially, he believes this market can grow, especially around gift-giving occasions. The second is the Mini-Prep appliance that can be used to do small chopping and dicing chores that do not require a full-sized food processor. Without the investments, the division expects that Year 2 data will remain unchanged. The expected operating incomes and the outlay required for each investment are as follows:

Jarriot’s corporate headquarters has made available up to $500,000 of capital for this division. Any funds not invested by the division will be retained by headquarters and invested to earn the company’s minimum required

Required:

- 1. Compute the

ROI for each investment. - 2. Compute the divisional ROI (rounded to four significant digits) for each of the following four alternatives:

- a. The Espresso-Pro is added.

- b. The Mini-Prep is added.

- c. Both investments are added.

- d. Neither investment is made; the status quo is maintained.

Assuming that divisional managers are evaluated and rewarded on the basis of ROI performance, which alternative do you think the divisional manager will choose?

Trending nowThis is a popular solution!

Chapter 10 Solutions

Cornerstones of Cost Management (Cornerstones Series)

- At the beginning of the last quarter of 20x1, Youngston, Inc., a consumer products firm, hired Maria Carrillo to take over one of its divisions. The division manufactured small home appliances and was struggling to survive in a very competitive market. Maria immediately requested a projected income statement for 20x1. In response, the controller provided the following statement: After some investigation, Maria soon realized that the products being produced had a serious problem with quality. She once again requested a special study by the controllers office to supply a report on the level of quality costs. By the middle of November, Maria received the following report from the controller: Maria was surprised at the level of quality costs. They represented 30 percent of sales, which was certainly excessive. She knew that the division had to produce high-quality products to survive. The number of defective units produced needed to be reduced dramatically. Thus, Maria decided to pursue a quality-driven turnaround strategy. Revenue growth and cost reduction could both be achieved if quality could be improved. By growing revenues and decreasing costs, profitability could be increased. After meeting with the managers of production, marketing, purchasing, and human resources, Maria made the following decisions, effective immediately (end of November 20x1): a. More will be invested in employee training. Workers will be trained to detect quality problems and empowered to make improvements. Workers will be allowed a bonus of 10 percent of any cost savings produced by their suggested improvements. b. Two design engineers will be hired immediately, with expectations of hiring one or two more within a year. These engineers will be in charge of redesigning processes and products with the objective of improving quality. They will also be given the responsibility of working with selected suppliers to help improve the quality of their products and processes. Design engineers were considered a strategic necessity. c. Implement a new process: evaluation and selection of suppliers. This new process has the objective of selecting a group of suppliers that are willing and capable of providing nondefective components. d. Effective immediately, the division will begin inspecting purchased components. According to production, many of the quality problems are caused by defective components purchased from outside suppliers. Incoming inspection is viewed as a transitional activity. Once the division has developed a group of suppliers capable of delivering nondefective components, this activity will be eliminated. e. Within three years, the goal is to produce products with a defect rate less than 0.10 percent. By reducing the defect rate to this level, marketing is confident that market share will increase by at least 50 percent (as a consequence of increased customer satisfaction). Products with better quality will help establish an improved product image and reputation, allowing the division to capture new customers and increase market share. f. Accounting will be given the charge to install a quality information reporting system. Daily reports on operational quality data (e.g., percentage of defective units), weekly updates of trend graphs (posted throughout the division), and quarterly cost reports are the types of information required. g. To help direct the improvements in quality activities, kaizen costing is to be implemented. For example, for the year 20x1, a kaizen standard of 6 percent of the selling price per unit was set for rework costs, a 25 percent reduction from the current actual cost. To ensure that the quality improvements were directed and translated into concrete financial outcomes, Maria also began to implement a Balanced Scorecard for the division. By the end of 20x2, progress was being made. Sales had increased to 26,000,000, and the kaizen improvements were meeting or beating expectations. For example, rework costs had dropped to 1,500,000. At the end of 20x3, two years after the turnaround quality strategy was implemented, Maria received the following quality cost report: Maria also received an income statement for 20x3: Maria was pleased with the outcomes. Revenues had grown, and costs had been reduced by at least as much as she had projected for the two-year period. Growth next year should be even greater as she was beginning to observe a favorable effect from the higher-quality products. Also, further quality cost reductions should materialize as incoming inspections were showing much higher-quality purchased components. Required: 1. Identify the strategic objectives, classified by the Balanced Scorecard perspective. Next, suggest measures for each objective. 2. Using the results from Requirement 1, describe Marias strategy using a series of if-then statements. Next, prepare a strategy map. 3. Explain how you would evaluate the success of the quality-driven turnaround strategy. What additional information would you like to have for this evaluation? 4. Explain why Maria felt that the Balanced Scorecard would increase the likelihood that the turnaround strategy would actually produce good financial outcomes. 5. Advise Maria on how to encourage her employees to align their actions and behavior with the turnaround strategy.arrow_forwardHome Builder Supply, a retailer in the home improvement industry, currently operates seven retail outlets in the Maritimes. Management is contemplating building an eighth retail store across town from its most successful retail outlet. The company already owns the land for this store, which currently has an abandoned warehouse located on it. Last month, the marketing department spent $15,000 on market research to determine the extent of customer demand for the new store. Now Home Builder Supply must decide whether to build and open the new store. Which of the following should be included as part of the incremental earnings for the proposed new store? a. The original purchase price of the land where the store will be located. b. The cost of demolishing the abandoned warehouse and clearing the lot. c. The loss of f sales in the existing retail outlet, if customers who previously drove from Dartmouth to Halifax to shop at the existing outlet become customers of the new store instead. d.…arrow_forwardDirection. Read and understand the given situation. Solve the problem using the given methods of evaluation. A man is considering P500,000 to open a semi-automatic auto washing business in a city of 400,000 population. The equipment can wash on the average of 12 cars per hour., using two men to operate it and to do small amount of hand work. The man plans to hire two men, in addition to himself and operate the station on an 8 hour basis, 6 days/week, 50weeks/year. He will pay his employees P25 per hour. He expects to charge P25.00 for a car wah out of pocket miscellaneous cost would be P8500/month. He would pay his employees for 2 weeks for vacation each year. Because of the length of his lease, he must write off his investment with 5 years. His capital now is earning 15% and he is employed at a steady job that pays P25,000/month. he desires a rate of return of at least 20% on his investment. Would you recommend the investment? Use the following method Present Worth Methodarrow_forward

- Direction. Read and understand the given situation. Solve the problem using the given methods of evaluation.A man is considering P500,000 to open a semi-automatic auto washing business in a city of 400,000 population. The equipment can wash on the average of 12 cars per hour., using two men to operate it and to do small amount of hand work. The man plans to hire two men, in addition to himself and operate the station on an 8 hour basis, 6 days/week, 50weeks/year. He will pay his employees P25 per hour. He expects to charge P25.00 for a car wah out of pocket miscellaneous cost would be P8500/month. He would pay his employees for 2 weeks for vacation each year. Because of the length of his lease, he must write off his investment with 5 years. His capital now is earning 15% and he is employed at a steady job that pays P25,000/month. he desires a rate of return of at least 20% on his investment. Would you recommend the investment? Use the following method (Payback Period)arrow_forwardDirection. Read and understand the given situation. Solve the problem using the given methods of evaluation. A man is considering P500,000 to open a semi-automatic auto washing business in a city of 400,000 population. The equipment can wash on the average of 12 cars per hour., using two men to operate it and to do small amount of hand work. The man plans to hire two men, in addition to himself and operate the station on an 8 hour basis, 6 days/week, 50weeks/year. He will pay his employees P25 per hour. He expects to charge P25.00 for a car wah out of pocket miscellaneous cost would be P8500/month. He would pay his employees for 2 weeks for vacation each year. Because of the length of his lease, he must write off his investment with 5 years. His capital now is earning 15% and he is employed at a steady job that pays P25,000/month. he desires a rate of return of at least 20% on his investment. Would you recommend the investment? Use the Present Worth Methodarrow_forwardHome Builder Supply, a retailer in the home improvement industry, currently operates seven retail outlets in Georgia and South Carolina. Management is contemplating building an eighth retail store across town from its most successful retail outlet. The company already owns the land for this store, which currently has an abandoned warehouse located on it. Last month, the marketing department spent $10,000 on market research to determine the extent of customer demand for the new store. Now Home Builder Supply must decide whether to build and open the new store. Which of the following should be included as part of the incremental earnings for the proposed new retail store?arrow_forward

- Direction. Read and understand the given situation. Solve the problem using the given methods of evaluation.A man is considering P500,000 to open a semi-automatic auto washing business in a city of 400,000 population. The equipment can wash on the average of 12 cars per hour., using two men to operate it and to do small amount of hand work. The man plans to hire two men, in addition to himself and operate the station on an 8 hour basis, 6 days/week, 50weeks/year. He will pay his employees P25 per hour. He expects to charge P25.00 for a car wah out of pocket miscellaneous cost would be P8500/month. He would pay his employees for 2 weeks for vacation each year. Because of the length of his lease, he must write off his investment with 5 years. His capital now is earning 15% and he is employed at a steady job that pays P25,000/month. he desires a rate of return of at least 20% on his investment. Would you recommend the investment? Use the Future Worth Methodarrow_forwardSuppose that you have been given a summer job as an intern at Issac Aircams, a company that manufacturessophisticated spy cameras for remote-controlled military reconnaissance aircraft. The company, which isprivately owned, has approached a bank for a loan to help it finance its growth. The bank requires financialstatements before approving such a loan. You have been asked to help prepare the financial statements andwere given the following list of costs:1. Depreciation on salespersons’ cars.2. Rent on equipment used in the factory.3. Lubricants used for machine maintenance.4. Salaries of personnel who work in the finished goods warehouse.5. Soap and paper towels used by factory workers at the end of a shift.6. Factory supervisors’ salaries.7. Heat, water, and power consumed in the factory.8. Materials used for boxing products for shipment overseas. (Units are not normally boxed.)9. Advertising costs.10. Workers’ compensation insurance for factory employees.11. Depreciation on chairs…arrow_forwardSuppose that you have been given a summer job as an intern at Issac Aircams, a company that man- ufactures sophisticated spy cameras for remote-controlled military reconnaissance aircraft. The company, which is privately owned, has approached a bank for a loan to help it finance its growth. The bank requires financial statements before approving such a loan. You have been asked to help prepare the financial statements and were given the following list of costs: Depreciation on salespersons’ cars. Rent on equipment used in the factory. Lubricants used for machine maintenance. Salaries of personnel who work in the finished goods warehouse. Soap and paper towels used by factory workers at the end of a shift. Factory supervisors’ salaries. Heat, water, and power consumed in the factory. Materials used for boxing products for shipment overseas. (Units are not normally boxed.) Advertising costs. Workers’ compensation insurance for factory employees. Depreciation on…arrow_forward

- Home Builder Supply, a retailer in the home improvement industry, currently operates seven retail outlets in Georgia and South Carolina. Management is contemplating building an eighth retail store across town from its most successful retail outlet. The company already owns the land for this store, which currently has an abandoned warehouse located on it. Last month, the marketing department spent $15,000 on market research to determine the extent of customer demand for the new store. Now Home Builder Supply must decide whether to build and open the new store. a. Should the original purchase price of the land where the store will be located be included in the incremental earnings for the proposed new retail store? (Select from the drop-down menu.) b. Should the cost of demolishing the abandoned warehouse and clearing the lot be included in the incremental earnings for the proposed new retail store? (Select from the drop-down menu.) c. Should the loss of sales in the existing retail…arrow_forwardAfter considerable research, a winter products line has been developed. However, Silven's president has decided to introduce only one of the new products for this coming winter. If the product is a success, further expansion in future years will be initiated. The product selected (called Chap-Off) is a lip balm that will be sold in a lipstick-type tube. The product will be sold to wholesalers in boxes of 24 tubes for $9 per box. Because of excess capacity, no additional fixed manufacturing overhead costs will be incurred to produce the product. However, a $105,000 charge for fixed manufacturing overhead will be absorbed by the product under the company's absorptlon costing system. Using the estimated sales and production of 150,000 boxes of Chap-Off, the Accounting Department has developed the following manufacturing cost per box: Direct material Direct labor $ 4.10 2.40 Manufacturing overhead 1.80 Total cost $ 8.30 The costs above relate to making both the lip balm and the tube that…arrow_forwardAfter considerable research, a winter products line has been developed. However, Silven's president has decided to introduce only one of the new products for this coming winter. If the product is a success, further expansion in future years will be initiated. The product selected (called Chap-Off) is a lip balm that will be sold in a lipstick-type tube. The product will be sold to wholesalers in boxes of 24 tubes for $11 per box. Because of excess capacity, no additional fixed manufacturing overhead costs will be incurred to produce the product. However, a $99,000 charge for fixed manufacturing overhead will be absorbed by the product under the company's absorption costing system. Using the estimated sales and production of 110,000 boxes of Chap-Off, the Accounting Department has developed the following manufacturing cost per box: Direct material Direct labor Manufacturing overhead Total cost $ 5.10 3.40 2.30 $ 10.80 The costs above relate to making both the lip balm and the tube that…arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning