1.

Prepare a schedule related to payroll for Company U from the information given.

1.

Explanation of Solution

Payroll: The total payment that a company is required to pay to its employee for the services received is called as payroll.

Payroll withholding deduction: The amounts which the employer withheld from employees’ gross pay to deduct taxes such as federal income tax, state income tax, social security tax, and Medicare tax are called payroll withholding deduction.

Payroll register: A schedule which is maintained by the company to record the earnings, earnings withholdings, and net pay of each employee is referred to as payroll register.

The purpose of payroll register is used to record the following:

- Earnings of each employee.

- Taxes (Social security tax, Medicare tax, and federal income tax) and other withholdings (health insurance, and other) of each employee.

- Net pay of each employee.

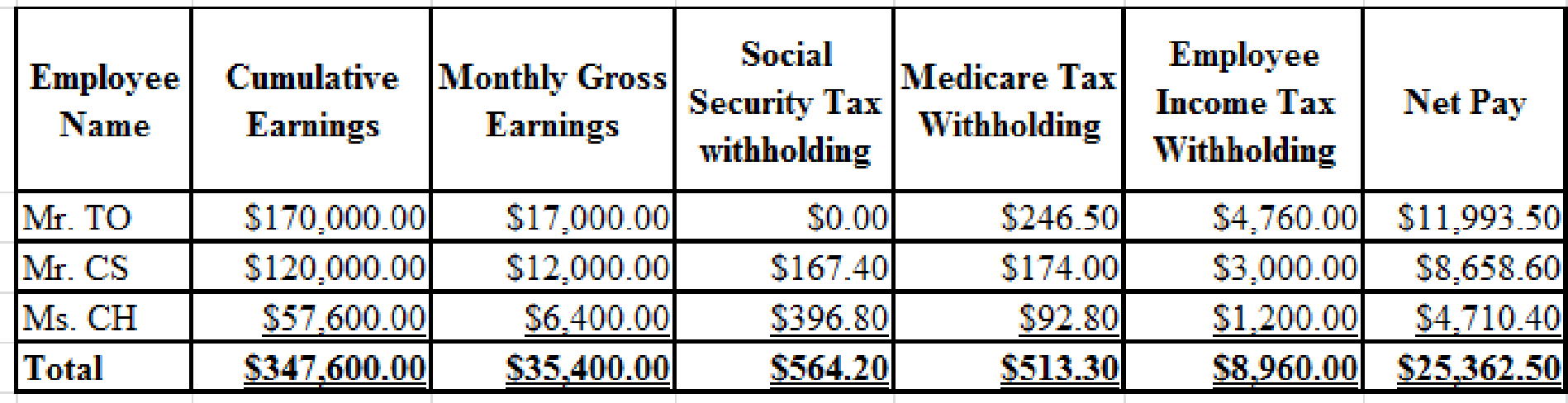

Prepare a schedule related to payroll for Company U as below:

Table (1)

Working notes:

Calculate social security tax withholding for Mr. TO.

The cumulative earnings of Mr. PP are $170,000 which already exceeds the ceiling of $122,700. Hence, the social security tax withholding will be $0.

Calculate social security tax withholding for Mr. CS.

The cumulative earnings of Mr. CW are $120,000 and the earnings ceiling of social security tax $122,700. Hence, the taxable salary of social security tax will be $2,700

Calculate social security tax withholding for Ms. CH.

Calculate Medicare tax withholding for Mr. TO.

Calculate Medicare tax withholding for Mr. CS.

Calculate Medicare tax withholding for Ms. CH.

Note:

- Net pay is calculated by using the following formula:

2.

Journalize the entry to record the payroll on November 30, 2019.

2.

Explanation of Solution

Debit and credit rules:

- Debit an increase in asset account, increase in expense account, decrease in liability account, and decrease in

stockholders’ equity accounts. - Credit decrease in asset account, increase in revenue account, increase in liability account, and increase in stockholders’ equity accounts.

Prepare general journal entry to record the payroll on November 30, 2019.

| General Journal | Page 24 | ||||||||

| Date | Accounts and Explanation | Post Ref | Debit ($) | Credit ($) | |||||

| 2019 | Salaries Expense | 35,400.00 | |||||||

| November | 30 | Social Security Taxes Payable | 564.20 | ||||||

| Medicare Taxes Payable | 513.30 | ||||||||

| Employees Income Taxes Payable | 8,960.00 | ||||||||

| Salaries Payable | 25,362.50 | ||||||||

| (To record salaries expense and payroll withholdings) | |||||||||

Table (2)

- Salaries expense is an expense and it decreases equity value. So, debit it by $35,400.00.

- Social security taxes payable is a liability and it is increased. So, credit it by $564.20.

- Medicare taxes payable is a liability and it is increased. So, credit it by $513.30.

- Employee income taxes payable is a liability and it is increased. So, credit it by $8,960.00.

- Salaries payable is a liability and it is increased. So, credit it by $25,362.50.

3.

Journalize the entry to record the payment to employees on November 30, 2019.

3.

Explanation of Solution

Prepare general journal entry to record payment to employees on November 30, 2019.

| General Journal | Page 24 | ||||||

| Date | Accounts and Explanation | Post Ref | Debit ($) | Credit ($) | |||

| 2019 | Salaries Payable | 25,362.50 | |||||

| November | 30 | Cash | 25,362.50 | ||||

| (To record the payment to employees) | |||||||

Table (3)

- Salaries payable is a liability and it is decreased. So, debit it by $25,362.50.

- Cash is an asset and it is decreased. So, credit it by $25,362.50.

Analyze: Mr. CS reach the withholding limit for social security tax in the month of November 2019.

Want to see more full solutions like this?

Chapter 10 Solutions

LooseLeaf for College Accounting: A Contemporary Approach

- Payroll Accounting Jet Enterprises has the following data available for its April 30, 2019, payroll: *All subject to Social Security and Medicare matching and withholding of 6.2% and 1.45%, respectively. Federal unemployment taxes of 0.70% and state unemployment taxes of 0.90% are payable on $405,700 of the wages earned. Required: 1. Compute the amounts of taxes payable and the amount of wages that will be paid to employees. Then prepare the journal entries to record the wages earned and the payroll taxes. ( Note: Round to the nearest penny.) 2. CONCEPTUAL CONNECTION Jet would like to hire a new employee at a salary of $65,000. Assuming payroll taxes are as described above (with unemployment taxes paid on the first $9,000) and fringe benefits (e.g., health insurance, retirement, etc.) are 25% of gross pay, what will be the total cost of this employee for Jet?arrow_forwardIn the space provided below, prepare the journal entry to record the November payroll for all employees assuming that the payroll is paid on November 30 and that Joness cumulative gross pay (cell I13) is 85,000.arrow_forwardThe information listed below refers to the employees of Lemonica Company for the year ended December 31,2019. The wages are separated into the quarters in which they were paid to the individual employees. For 2019, State D's Contribution rate for lemonica company based on the experience-rating system of the state, WAs 2.8 of firs $7000 of each employees earnings. The state tax returns are due one month after the end of each calender quarter. During 2019 the company paid $2,214.80 of contributions to state D's unemployment fund. Employer's phone number: (613)555-0029. Employer's State D reporting number 00596. Using The forms supplied on pages 5-44 to 5-46 complete the following for 2019 a. Date and amount of the FUTA tax payment for the fourth qurter of 2019( State D is not a credit reduction state) Tax payment: Date____________ Amount $____________ b. Employer's report for Undemployment compensation, State D-4th Quarter only. Item 1 is the number of employees employed in the pay…arrow_forward

- Noura Company offers an annual bonus to employees (to be shared equally) if the company meets certain net income goals. Prepare the journal entry to record a $15,000 bonus owed (but not yet paid) to its workers at calendar year-end.arrow_forwardFor the year ended December 31, Lopez Company implements an employee bonus program based on company net income, which the employees share equally. Lopez’s bonus expense is computed as $14,563. 1. Prepare the journal entry at December 31 to record the bonus due the employees. 2. Prepare the later journal entry at January 19 to record payment of the bonus to employees.arrow_forwardThe payroll records of Brownlee Company provided the following information for the weekly pay period ended March 23, 2021: Required: 1. Enter the relevant information in the proper columns of a payroll register and complete the register, calculate CPP and El deductions. Charge the wages of Kathy Sousa to Office Wages Expense and the wages of the remaining employees to Service Wages Expense. Calculate Income tax deductions at 20% of gross pay. Employees are paid an overtime premium of 50% for all hours in excess of 40 per week. (Round your intermediate calculations and final answers to 2 decimal places.) Payroll Week Ended March 23, 2021 Employees Ray Loran Kathy Sousa Gary Smith Nicole Parton Diana Wood 1 2 3 4 5 Employment Insurance 0.00 Employee No. View transaction list CPP MTWT 11 8 12 0000 O 0.00 7 13 8 14 8 15 0 Daily Time 00 00 00 00 00000 8 8 6 Income Tax Journal entry worksheet 2 LL 8 7 8 8 8 8 8 6 6 0.00 F S S 4 4 SOO || 0 To 0 4 4 0 0 8 8 Hospital Insurance Total Hours 40.00…arrow_forward

- Assume that the payroll records of Bramble Oil Company provided the following information for the weekly payroll ended November 30, 2020. Employee T. King T. Binion N.Cole C. Hennesey Hours Worked 44 46 40 42 Hourly Pay Rate $69 34 39 44 Federal Income Tax $442 97 148 230 Union Dues $9 5 7 Year-to-Date Earnings Through Previous Week $133,900 23,200 5.700 49,500 Additional information: All employees are paid overtime at time and a half for hours worked in excess of 40 per week. The FICA tax rate is 7.65% for the first $132,900 of each employee's annual earnings and 1.45% on any earnings over $132,900. The employer pays unemployment taxes of 6.0% (5.4% for state and .6% for federal) on the first $7,000 of each employee's annual earnings.arrow_forwardb. Provide a June 28 journal entry to record the employer's payroll taxes, which have not yet been paid to the government. Date June 28, 2023 June 28, 2023 June 28, 2023 June 28, 2023 C. Payroll Tax Expense FICA Payable Date Account Debit Provide a June 30 journal entry to show the payment of all amounts owed to employees, government agencies, and a health insurance provider. Account Credit Debit Credit 2 0arrow_forwardSiomai Company salaried employees are paid biweekly. Occasionally, advances made to employees are paid back by payroll deductions. Information relating to salaries for the calendar year 2021 is as follows: • Employee advances, Dec. 31, 2020 - P12,000 • Employee advances, Dec. 31, 2021 - P18,000 • Accrued salaries payable, Dec. 31, 2021- P100,000 • Salaries expense during the year- P815,000 • Salaries paid during the year (gross) 780,000 On December 31, 2020, what amount should Siomai report as accrued salaries payable?arrow_forward

- TFM Enterprises pays its employees every two weeks and has paid its employees P375,000 for work completed in 2019. In addition, the employees earned a week's salary of P 7,200 at the end of December that will be paid as part of the P14,400 payroll at the end of the first week in January of 2020. How much should the company declare for salaries and wages expense for 2019?arrow_forwardThe employees of UMPISA NA NG KALBARYO COMPANY are paid biweekly. Occasionally, advances made to employees are paid back by payroll deductions. Information relating to salaries for the calendar years 2018 and 2019 are as follows. On December 31, 2019, what amount should the company report as accrued salaries payable? a. P100,000 b. P94,000 c. P82,000 d. P35,000arrow_forward3 Assume the year is 2021. On March 15, Juneau Inc. pays each of 15 employees gross wages of $50,000. They withheld $123,300 FIT, $48,000 SIT, applicable FICA, and $200 union dues. FUTA is $140, SUI is $220. Prepare the following journal entries: a. Payment of employee salaries, including deductions. b. Juneau Inc. remits its payroll taxes. c. Juneau Inc. remits employee union dues.arrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning