FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

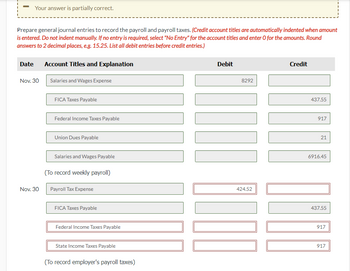

Transcribed Image Text:Your answer is partially correct.

Prepare general journal entries to record the payroll and payroll taxes. (Credit account titles are automatically indented when amount

is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Round

answers to 2 decimal places, e.g. 15.25. List all debit entries before credit entries.)

Date

Nov. 30

Nov. 30

Account Titles and Explanation

Salaries and Wages Expense

FICA Taxes Payable

Federal Income Taxes Payable

Union Dues Payable

Salaries and Wages Payable

(To record weekly payroll)

Payroll Tax Expense

FICA Taxes Payable

Federal Income Taxes Payable

State Income Taxes Payable

(To record employer's payroll taxes)

Debit

8292

424,52

Credit

437.55

917

21

6916.45

437.55

917

917

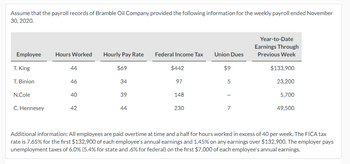

Transcribed Image Text:Assume that the payroll records of Bramble Oil Company provided the following information for the weekly payroll ended November

30, 2020.

Employee

T. King

T. Binion

N.Cole

C. Hennesey

Hours Worked

44

46

40

42

Hourly Pay Rate

$69

34

39

44

Federal Income Tax

$442

97

148

230

Union Dues

$9

5

7

Year-to-Date

Earnings Through

Previous Week

$133,900

23,200

5.700

49,500

Additional information: All employees are paid overtime at time and a half for hours worked in excess of 40 per week. The FICA tax

rate is 7.65% for the first $132,900 of each employee's annual earnings and 1.45% on any earnings over $132,900. The employer pays

unemployment taxes of 6.0% (5.4% for state and .6% for federal) on the first $7,000 of each employee's annual earnings.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- .arrow_forwardExhibit 6-1 The totals from the first payroll of the year are shown below. Total Earnings $36,195.10 FICA OASDI $2,244.10 FICA НІ $524.83 FIT W/H $6,515.00 State Tax $361.95 Refer to Exhibit 6-1. Journalize the entry to record the employer's payroll taxes (assume a SUTA rate of 3.7%). Union Dues $500.00 Net Pay $26,049.22arrow_forwardWorkers' Compensation Insurance and Adjustment Specialty Manufacturing estimated that its total payroll for the coming year would be $462,500. The workers' compensation insurance premium rate is 0.2%.arrow_forward

- Farm has 28 employees who are paid biweekly. The payroll register showed the following payroll deductions for the pay period ending March 23, 2021. Gross Pay 85,950.00 EI Premium Income Taxes 1,426.77 11,855.00 View transaction list Journal entry worksheet < 1 Required: Prepare a journal entry to record payment by the employer to the Receiver General for Canada on April 15. (Do not round intermediate calculations. Round the final answers to 2 decimal places.) Note: Enter debits before credits. Date April 15 CPP 4,067.95 Record the remittance to the Receiver General for Canada. Medical Ins. 1,650.00 General Journal United Way 1,819.00 Debit Creditarrow_forwardAccounting Assume that the payroll record of Riverbed Oil Company provided the following information for the weekly payroll ended November 30,2020. Employee Hours Worked Hourly Pay Rate Federal Income Tax Union Dues Year- to-Date Earnings Through Previous Week T. king 44 58 442 9 133,900 T. Binion 46 23 97 5 23,200 N.Cole 40 28 148 5,700 C. Hennesey 42 33 230 7 49,500 Additional information: All employees are paid overtime at time and a half for hours worked in excess of 40 per week. The FICA tax rate is 7.65% for the first 132,900 of each employee's annual ear earnings and 1.45% on any earnings over 132,900. The employer pays unemployment taxes of 6.0% (5.4% for state and .6% for federal) on the first 7,000 of each employee's annual earnings. Prepare the payroll register for the pay period.(Round answers to 2 decimal places, e.g. 15.25)arrow_forwardCarla Vista Company has the following data for the weekly payroll ending May 31: Hours Worked Employee M Tu W Th F S HourlyRate CPPDeduction Income TaxWithheld HealthInsurance A. Kassam 12 7 8 7 7 5 $16 $35.48 $93.70 $8 H. Faas 9 9 8 8 8 6 11 24.98 72.15 15 G. Labute 12 9 6 10 10 0 16 36.66 108.65 12 Employees are paid 1.5 times the regular hourly rate for all hours worked over 40 hours per week. Carla Vista Company must make payments to the workers’ compensation plan equal to 2% of the gross payroll. In addition, Carla Vista matches the employees’ health insurance contributions and accrues vacation pay at a rate of 4%. Prepare the payroll register for the weekly payroll. Calculate each employee’s EI deduction at a rate of 1.66% of gross pay Record the payroll and Carla Vista Company’s employee benefitsarrow_forward

- Payroll Register The following data for Throwback Industries Inc. relate to the payroll for the week ended December 9, 20Y8: Hours Hourly Employee Worked Rate Weekly Salary Federal Retirements Income Tax Savings Aaron 47 $30 $348.45 $75 Cobb 46 42 442.47 65 Clemente 45 234.65 75 DiMaggio 36 40 302.4 90 Griffey, Jr. 44 38 367.08 75 Mantle $2.170 520.80 90 Robinson 38 34 193.80 80 Williams 2,430 534.60 60 Vaughn 41 46 381.80 100 Employees Mantle and Williams are office staff, and all of the other employees are sales personnel. All sales personnel are paid 1½ times the regular rate for all hours in excess 40 hours per week. The social security tax rate is 6%, and Medicare tax is 1.5% of each employee's annual earnings. The next payroll check to be used is No. 901. Required: 1. Prepare a payroll register for Throwback Industries Inc. for the week ended December 9, 2018. Assume the normal working hours in a week are 40 hours. Enter amounts as positive numbers. Round your Intermediate…arrow_forwardGreensburg Inc. had the following payroll for October 2020: Employee Wages $90,000 Federal income tax withheld 23,000 FICA 5,000 Health premiums deducted 3,000 Salaries (included above) subject federal unemployment taxes 90,000 Salaries (included above) subject to state unemployment taxes 90,000 REQUIRED: Present journal entries on October 31, 2020 to record: Accrual of the monthly payroll. Accrual of the employer's payroll tax. (Assume that the employer matches health premiums and the federal unemployment tax is 0.8%, and the state unemployment tax is 5.4%.)arrow_forwardbh.0arrow_forward

- Assuming no employees are subject to ceilings for their earnings, Harris Company has the following information for the pay period of January 15–31. Gross payroll $18,729 Federal income tax withheld $3,167 Social security rate 6% Federal unemployment tax rate 0.8% Medicare rate 1.5% State unemployment tax rate 5.4% Salaries Payable would be recorded in the amount of a.$12,996.13 b.$14,400.80 c.$14,157.33 d.$18,729.00arrow_forwardXYZ Company is processing payroll for the week ending January 9th. Employee earnings total $5,000. Federal income tax withheld from employee paychecks totaled $1,100. The social security tax rate is 6%, the Medicare tax rate is 1.5%, the state unemployment tax rate is 5.4% and the federal unemployment tax rate is .8%. a) Journalize the payroll entry for the week. DATE Debit Credit X/X b) Journalize the payroll tax entry for the week. DATE Debit Credit X/Xarrow_forwardThe payroll records of Jasper Co. provide the following data for the weekly pay period ended March 7 Employee Gross Pay Gross Pay To Date Income Taxes Medical Insurance Deduction Union Dues United Way A $500 $6,000 $100 $30 $15 $10 B 600 6,500 120 30 15 20 C 700 5,500 202 50 0 30 Assume CPP is 4.95 % and El is 1.66 %. 1) Prepare the general journal entry to accrue the payroll on March 7. 2) Prepare the general journal entry to record the payroll tax expense for March 7.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education