Engineering Economy (17th Edition)

17th Edition

ISBN: 9780134870069

Author: William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 10, Problem 17P

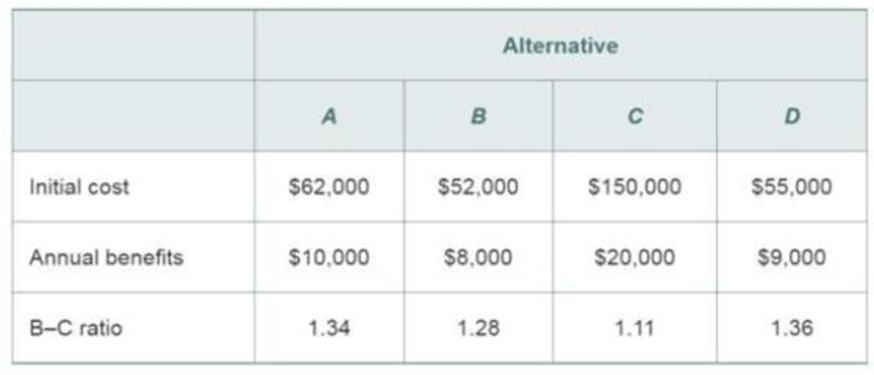

Four mutually exclusive projects are being considered for a new 2-mile jogging track. The life of the track is expected to be 80 years, and the sponsoring agency’s MARR is 12% per year. Annual benefits to the public have been estimated by an advisory committee and are shown below. Use the B–C method (incrementally) to select the best jogging track.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The two alternatives shown are under consideration for improving security at a facility.

Determine which one should be selected, if any, based on a B/C analysis. Consider an

interest rate of 7% per year and a 10-year study period. Additional information is provided

in Table Q 6(b).

Page 4 of 5

Table Q 6(b)

Alternative 1: Extra Cameras | Alternative 2: New Sensors

First cost, $

Annual O&M cost, $

38000

87000

49000

64000

Annual benefits, $

Annual disbenefits, $

110000

160000

26000

A proposal to reduce traffic congestion on Jounieh Highway has a B/C

ratio of 1.4. The annual worth of benefits minus disbenefits is $560,000.

What is the first cost of the project if the interest rate is 5% per year and

the project is expected to be perpetual?*

4,000,000

4,588,208

8,000,000

6,666,667

DRAW THE CASH FLOW DIAGRAM

Two alternatives are being considered for a certain project. Alternative A has an initial cost of $10,000, uniform annual benefits of $3,000 and a useful life of 6 years. Alternative B has an initial cost of $20,000, uniform annual benefits of $5,000 and a useful life of 6 years. If money is worth 12% annually, determine the better alternative using modified B/C analysis.

Chapter 10 Solutions

Engineering Economy (17th Edition)

Ch. 10 - Prob. 1PCh. 10 - Prob. 2PCh. 10 - Prob. 3PCh. 10 - A retrofitted space-heating system is being...Ch. 10 - Prob. 5PCh. 10 - Prob. 6PCh. 10 - Prob. 7PCh. 10 - Prob. 8PCh. 10 - Prob. 9PCh. 10 - Prob. 10P

Ch. 10 - Prob. 11PCh. 10 - Prob. 12PCh. 10 - Prob. 13PCh. 10 - Prob. 14PCh. 10 - Prob. 15PCh. 10 - Prob. 16PCh. 10 - Four mutually exclusive projects are being...Ch. 10 - Two municipal cell tower designs are being...Ch. 10 - Prob. 19PCh. 10 - Prob. 20PCh. 10 - Prob. 21PCh. 10 - Prob. 22PCh. 10 - You have been requested to recommend one of the...Ch. 10 - Prob. 24PCh. 10 - Prob. 25PCh. 10 - Prob. 26FECh. 10 - Prob. 27FECh. 10 - Prob. 28FECh. 10 - Prob. 29FECh. 10 - Prob. 30FECh. 10 - Prob. 31FE

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- For mutually exclusive projects are being considered for a 2 mile jog in track. The life of the track is expected to be 75 years and the sponsoring agency MARR is 13% per year annual benefits to the public. I've been estimated by an advisory committee and are shown below used to be – C method incrementally to select the best jogging track.arrow_forwardA county will invest $4,200,000 to clean up a chemical spill that occurred following a natural disaster. At the end of the 9-year planning horizon, an additional $1,000,000 will be spent in restoring the site to an environmentally acceptable condition. The investment is expected to produce net annual benefits that will decrease by 29% each year. The net annual public benefit in the 1st year is estimated to be $2,300,000. Determine the B/C ratio for the investment using a 4% MARR. Click here to access the TVM Factor Table calculator. B/C= Carry all interim calculations to 5 decimal places and then round your final answer to 3 decimal places. The tolerance is ±0.003.arrow_forwardPerform a Benefit/Cost Analysis on the two project options below for a toll plaza renovation. What is the incremental B/C? Which option should be selected? OPTION Y $5,400,000 $2,350,000 $343,000 OPTION Z $14,240,000 S1,915,000 Initial Cost Annual Cost Annual Disbenefits $196,500 Life 00arrow_forward

- The Texas Department of Transportation is considering in improving accident prevention countermeasures on the state's accident-prone public highways and bridges. The following set of projects has been recommended for evaluation at three different locations and assumes the budget is $20 million. All alternatives are mutually independent projects. Determine the best combination of projects within the budget constraint.(a) II-Band III-B only(b) I-A, II-A, and III-B(c) 1-B, III-A, and III-B(d) 11-B and IIl-Barrow_forwardwhich projects should be considered as the base alternative and the first-choice alternative.arrow_forward5,6,7 search Saved Help S GEarrow_forward

- Six sites have been identified for a parking lot in downtown Blacksburg. Because the sites are plots of land, their salvage value and investment cost are identical. A 10-year study period has been specified, and the MARR is 19% per year. Which site should be chosen based on the IRR criterion? Click the icon to view the alternatives description.arrow_forwardCompany B is considering two alternatives for a certain project. Alternative A has an initial cost of $20,000, uniform annual benefits of $5,000 and a useful life of 6 years. Alternative B has an initial cost of $30,000, uniform annual benefits of $7,000 and a useful life of 6 years. If money is worth 12% annually, determine the better alternative using modified B/C analysis.arrow_forwardLocations under consideration for a border patrol station have their costs estimated by the federal government. Use the B/C ratio method at an Interest rate of 9.00% per year to determine which location to select, if any. (Round the final answer to three decimal places.) Location Initial Cost, $ Annual Cost, $ per Year Disbenefits, $ per Year Life, Years The AB/C ratio is -928888.889 ✪ Select location. N North N 1,360,000 480,000 70,000 South S 2,900,000 400,000 45,000 0arrow_forward

- Four mutually exclusive projects are being considered for a new 2-mile jogging track. The life of the track is expected to ing agency's MARR is 9% per year. Annual benefits to the public have been estimated by e shown below. Use the B-C method (incrementally) to select the best jogging track. Problem 10-17 (algorithmic) Q Initial cost Annual benefits B-C ratio A $50,000 $8,000 1.78 Alternative A Alternative B $145,000 $21,000 1.61 $55,000 $9,000 1.82 D $64,000 $10,500 1.82 Perform the incremental B-C Analysis. Fill-in the table below. (Round to two decimal places.) Inc. B-C ratio Is the alternative acceptable? Yes 1.78 □arrow_forwardWhen comparing multiple alternatives, the DPBP can lead to wrong conclusions regarding the maximum economic worth. True or False?arrow_forwardEvaluate each project with a MARR of 10% using (a) simple payout method, (b) discounted payout method, and (c) incremental benefit-cost analysis. Determine also the (d) future worth and the (e) ERR of each project. Based on the findings, which of the three projects must be prioritized for funding? Draw a cashflow diagramarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education

Valuation Analysis in Project Finance Models - DCF & IRR; Author: Financial modeling;https://www.youtube.com/watch?v=xDlQPJaFtCw;License: Standard Youtube License